Global Payments Slims Down with SMB Focus

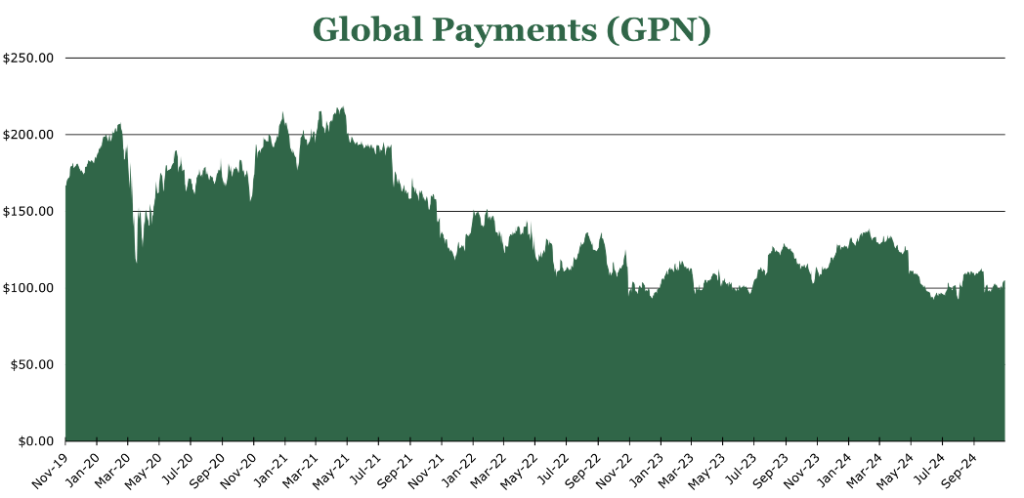

| Price $105.15 | Growth Holding | November 6, 2024 |

- Committed to repurchasing 2.3% of shares within the next quarter, on top of a modest 1.0% dividend.

- Strong presence in the SMB (Small-medium business) space, consolidating its 16 brands into one coherent entity.

- #1 commercial card processor in the US, processing more than 35 billion transactions annually across 830 million accounts.

- 70% attachment rate for new offerings to existing customers.

Investment Thesis

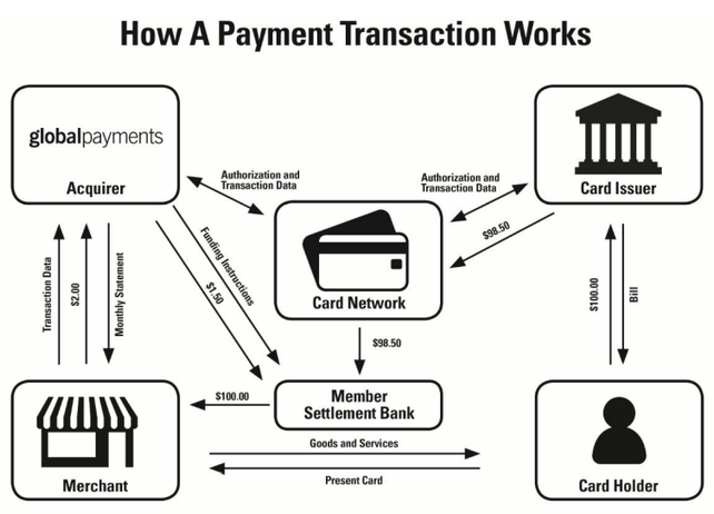

Global Payments (GPN) is one of the largest payment processors in the world, primarily working on the acquirer side. GPN processes more than 75 billion transactions a year with 5 million merchant customers in more than 38 countries.

Compared to its other ‘legacy’ peers, GPN has targeted middle-market enterprise as its growth avenue. In our view, this could be a good niche somewhere between continuing to target massive customers like FIS does, or pivoting toward more small business offerings, such as Fiserv (FI). It has also begun to expand its European and B2B offerings with the acquisition of EVO Payments and has expanded its partnerships with both software vendors and market peers like PayPal. Overall, we feel that improving management transparency regarding metrics, clear guidance on shareholder returns, and overall streamlining of operations makes GPN a good buy in our view.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/Earnings)

EFV = E25 EPS X P/E = $12.90 x 18.9x = $243.81

We feel that GPN is undervalued compared to legacy peers given its relative focus on SMB, which means it generally processes fewer transactions. However, we feel that the focus on SMB allows GPN the opportunity for more value-added and high-margin services that are not typical with other legacy peers.

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 2.9 | 2.8 | 2.6 |

| Price-to-Earnings | 9.0 | 8.1 | 7.2 |

Merchant Solutions

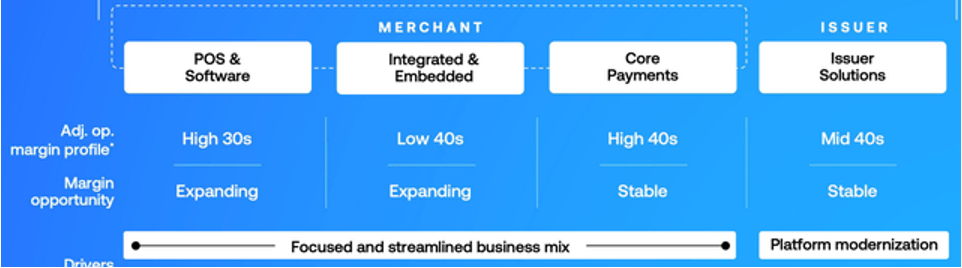

GPN provides several services to merchants. It provides POS (point of sale) terminals, acquiring services for payments, and an increasing number of value-added software solutions like loyalty management and e-commerce. GPN reported 15% growth in POS locations and 30% growth in bookings in the quarter ending September 2024. Overall, this represented 5% volume growth and 7% revenue growth over the same period. The decoupling of revenue from volumes is a good sign that more customers are up taking value-added services rather than sticking to just payments or POS terminals. It also de-risks the business as revenues are not as dependent on volumes, which would be a boon given the currently difficult macroeconomic environment.

As discussed in our Adyen article, merchant providers can experience a significant amount of loyalty, as converting customers to or from another provider can be difficult but adding services to existing customers can be a growth driver. While the number has likely changed, during 2021 investor day GPN stated that it has an average customer tenure of 15 years. During the quarter ending September 2024, GPN stated that it had successfully renegotiated contracts with 15 of the top 20 customers, expecting to convert the rest within the next 12-18 months. Given the reported 70% attachment rate for new embedded offerings such as loyalty engagement tools and previously discussed decoupling of revenue from volume, we feel that GPN does experience at least at-peer loyalty in the merchant space.

During the 2024 investor day, GPN doubled down on its strategy of both international expansion and more software offerings in the merchant area. Additionally, the target of a more streamlined operation can be seen here too. Previously, GPN offered more than 16 different POS brands which is being simplified into a single cohesive offering which will likely tie into more software options for customers. We feel this is a move to make it more competitive to other similar offerings, like FI’s Clover. However, this could generate some churn as it gives ample switching opportunity for even very loyal customers. As of the quarter ending September 2024, POS Bookings were up 30% year over year, which we feel means that any churn would likely be fully offset by growth in the business.

Issuer Solutions

GPN is the #1 issuer-side processor in the US, Canada, and UK, and the #1 commercial card processor in the US. It processes more than 35 billion transactions annually across 830 million accounts on file for 170 financial institutions. For the quarter ending September 2024, GPN reported 9% accounts on file growth, with 3% transaction volume growth and 2% revenue growth.

GPN estimates that the B2B payment opportunity in the US is more than $34 trillion, with B2B volumes still being dominated mostly by wire and ACH transfers. To penetrate more of this market, GPN will be launching a new suite of software in 2025, which will target small and mid sized banks giving them support for new use cases, like ERP (enterprise resource planning) software, as well as new features like accounts payable solutions, virtual cards, and better fraud systems. Management has alluded that this will also be a standalone product, which could potentially help decouple revenue from volumes like the merchant segment. Already, the movement of the issuer business toward technology has expanded adjusted operating margins by 217bps, to 26.6%.

Risk

Typically, GPN would present volume and revenue growth trends on slide 5 of their quarterly deck for the Merchant segment. In adjusting these numbers, GPN would exclude the impact from business dispositions but would include acquisitions, which would be a very aggressive choice and one that they seemed to have stopped doing.

For the quarter ending September 2024, it reported 5% SMB volume growth in total, and 3% transaction growth on the issuer side. While it did not break out Latin-American or developing market growth for the quarter ending September 2024, during the June 2024 investor day it reported 20% LATAM growth. While growth slightly lags bigger legacy peers, we feel this is more due to the target market being more impacted by economic conditions rather than a structural failing.

Equally, GPN has repeatedly used an ‘adjusted’ free cash metric. It claims that the conversion from operating income to adjusted free cash is regularly 100% or higher. Adjusted accounting for a business like payments is not at all unheard of and one that would be completely reasonable, especially in a business with a lot of cash for non-operating items moving around. However, until Investor Day 2024, GPN just never reconciled these due to them requiring “undue effort”. During Investor Day 2024, GPN did reconcile it on a year basis, and during the quarter ending September 2024 it began to do it quarterly. While we feel that the level of adjustment is far too aggressive, working toward transparency is a step in the right direction. Overall, we feel that the previous adjustment choices set the stage for the bad market reaction to the “operational transformation” announced on Investor Day in 2024. If it continues on the path of transparency, we feel it could reinforce our thesis with a potential repricing

Divestitures

As part of Investor Day 2024, GPN announced its intention to begin divesting non-core business units for streamlining purposes. The current plan involves an annual revenue impact of $500-600 million, taking place in the second half of 2024. GPN said that they will only divest assets that will ‘create value’ for GPN shareholders.

Based on GPN’s previous transaction size, $500-600 million revenue impact in a disposition would be around $1 billion in M&A value. However, as of the quarter ending September 2024, they have reached an agreement to sell the AdvancedMD business, for $1 billion in cash and $125 million contingent on return targets. According to GPN, the transaction had a high-teens multiple to EBITDA, which we feel is a good sign that divestitures will create value for shareholders. With the AdvancedMD divestiture, GPN expects a topline impact of around $250-260 million in annual revenue.

Acquisitions and Partnerships

In August 2022 GPN announced it would acquire EVO Payments for $4 billion, a 24% premium at the time. In June 2024 it announced it would be acquiring Takepayments for $250 million. Both providers focus heavily on European markets with EVO having exposure to India and Latin America. With these acquisitions GPN has a jumping off point in Europe, India, and Latin-America, which it expects to be able to gain a market share similar to the US market of 20-30%. Given the current strategy of improving efficiency profitability by reducing costs, we feel that acquisitions are likely to be much smaller than recent history.

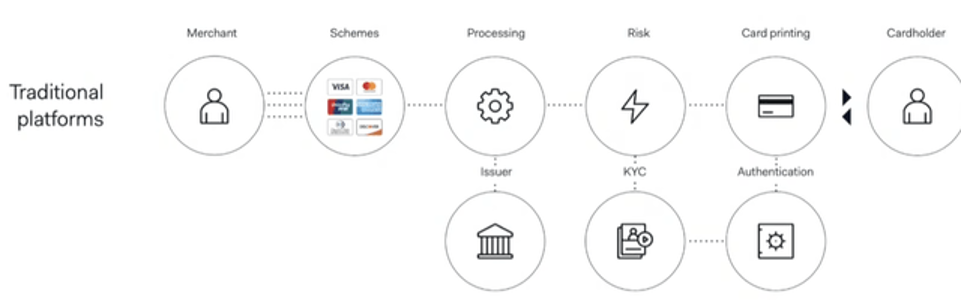

In the partnerships category, GPN has begun to target partnerships with ISVs (Integrated Software Vendors) and other vertical markets. ISVs offer a way to increase offering depth and breadth without nearly as much spend, and without requiring the day-to-day management of niche software offerings. Effectively, it mounts GPN’s offering to an existing product, which are often called PayFacs. The PayFac space has GPN provide varying degrees of backend services to software vendors such as managing the compliance, facilitation, and processing of the payments. This opens up a potential high-margin and high-growth avenue, allowing software vendors to essentially generate customers for GPN. According to Investor Day 2024 materials, GPN has more than 7,000 software partners which have generated 1.2 million merchant accounts and $600 billion in annual payment volume. During the quarter ending June 2024, it reported a 40% increase in active PayFac merchants and a 60% improvement in average merchant volume.

Financials

We do expect to see some cost leverage from moving workloads into the cloud from owned infrastructure. Since 2020, GPN has switched over 17 datacenters — 40% of workload — to the cloud. Additionally, it hopes to substantially slim down management and the technology stack. With more than 40 acquisitions since 2010, we feel its better late than never. This effort will generate an estimated $500 million in annual savings by 2027, which could expand operating margins somewhere in the 30-40bps range by 2025, with a full expected 50-100bps margin expansion by 2027. In the short term, revenues should modestly contract after divestitures, but the company has guided to $14 in earning power by 2026-2027 which would below-teens growth.

During investor day 2024, GPN stated that it has a general deleveraging target of 3x EBITDA by end of 2024 and keeping it there – as of the quarter ending September 2024, the trailing twelve months debt to EBITDA is 3.4x, which is a contraction from 3.8x seen in June 2024.

GPN plans to increase its capex to 8% of revenues, compared to the typical 6-7% target. In our view this will likely be focused on continuing the platform modernization program in the Issuer segment. Additionally, it will target $7.5 billion in returns to shareholders over the next 3 years, which we feel will largely be in the form of buybacks.

The GPN dividend is $0.25 quarterly, around 1.0% yield. We feel that the dividend is one paid for continuity rather than a going priority for management. For the quarter ending September 2024, it was announced that the share repurchase agreement was authorized at up to $2.5 billion, or around 9.4% of outstanding shares. In the short, term it has authorized an ‘accelerated repurchase’ program of $600 million, or around 2.3% of shares.

Conclusion

GPN has begun to reposition itself to focus more fully on the SMB (Small-Medium Business) space and has announced a series of combinations and divestitures which should deliver some cost leverage over time. Additionally, management is now providing more financial transparency with shareholders.

For all of these reasons, we believe that GPN could be due for a repricing. As an added bonus, GPN has committed to returning $7.5 billion in shareholder returns over the next 3 years including an accelerated repurchase program to repurchase 2.3% of shares within the next quarter.