Generac Generates Significant Opportunity with Acquisitions

| Price $126.60 | Growth Holding | June 22, 2023 |

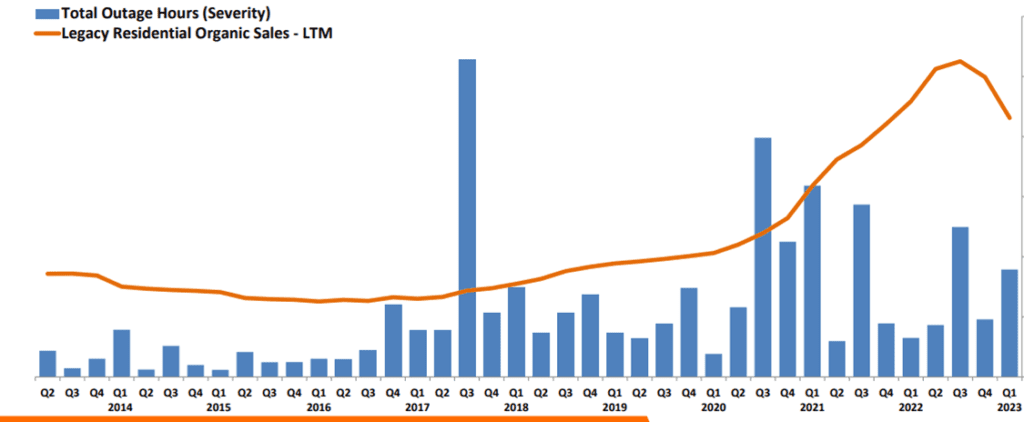

- Increasing demand for uninterrupted power in the industrial space due to data requirements and increase in consumer demand due to the above-average outage hours the US has experienced over the last 3 years.

- 10GWh of currently installed capacity, with addressable market set to expand by 5x by FY25.

- Aggressive M&A to penetrate new markets, with each 100 basis point increase in penetration equating to $3 billion in total addressable market.

- Strong international growth should offset weakness in US domestic consumer market.

Investment Thesis

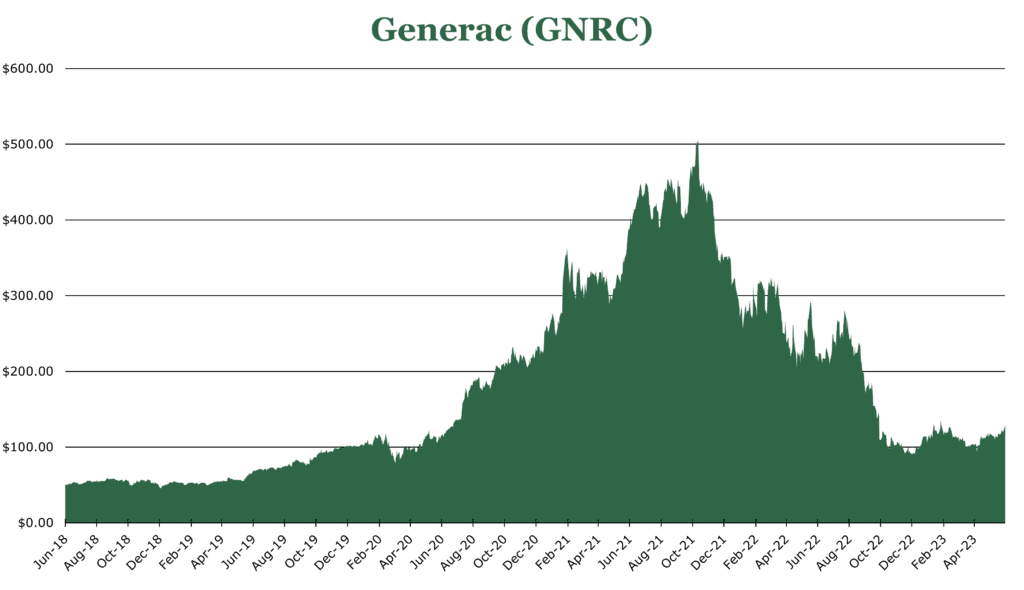

Generac Power Systems (GNRC) is a specialized industrial firm producing uninterrupted power supplies through battery storage and generators. GNRC stock has pulled back from its high of $282 in 2022 and $500 in 2021 as business has slowed after an unsustainable surge in 2022. Generac is well positioned to capitalize on the “Decarbonization, digitization, and decentralization” megatrend. Outage hours are steadily increasing as grid demand keeps up with extreme weather events and an increasingly connected society that requires uninterrupted data connectivity. We give GNRC a buy for the long-term investor hoping to capitalize on megatrends through a market leader.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $7.60 X 18.0 = $138.60.

| E2023 | E2024 | E2025 | |

| Price-to-Sales | 1.9 | 1.9 | 1.6 |

| Price-to-Earnings | 20.5 | 15.5 | 13.7 |

Operations

Generac derives 60% of its income from residential products, 31% from commercial products and 10% from value-added services such as monitoring. 84% of revenue originates from the United States. The total home ecosystem represents a $10 billion domestic opportunity by 2025, with industrials representing $5 billion by 2025.

Current operations include 10GWh of capacity installed worldwide, with significantly more demand for demos compared to previous years. This is likely due to the uptick in major outage events beyond the expected baseline.

The home EV charging station will be the most significant product launch in FY23. Already, the PWERcell system has a 33% increase in usable energy to the next closest competitor.

GNRC plans to fully acquire Pramac, which it already owns a 20% share of. This will help bolster the footprint of GNRC globally, particularly in Europe where Pramac has a significant footprint. Though specifics are not yet announced, India’s consumer and industrial segment is growing quickly. GNRC will likely acquire an Indian firm to enter the market some time in FY23. Internationally, GNRC has seen significant growth in 1Q23, with shipments increasing 17% year over year, with power security concerns in Europe elevating demand.

Catalyst

Since IPO in 2010, GNRC has maintained a 16% revenue CAGR. The market for battery backup systems has grown significantly as grid disruptions and non-continuous power sources like solar have become more common. Additionally, the critical nature of 5G and data center infrastructure has made uninterrupted power supplies a critical part of build-out.

5G has been a significant growth point for the industrial and commercial segments. By FY26 5G tower count will grow by 30%, with only 50% of sites considered “hardened” to resist outages and other interim events. By 2030, this will rise to 75%, representing a $2 billion opportunity. Already, GNRC has a 60% domestic market share for telecom hardening.

“Decarbonization, digitization, and decentralization” are megatrends that GNRC hopes to harness. As many as 25% of Americans will be in an area under “high risk” for sustained power shortfalls during the 2023-2027 period, per NERC.

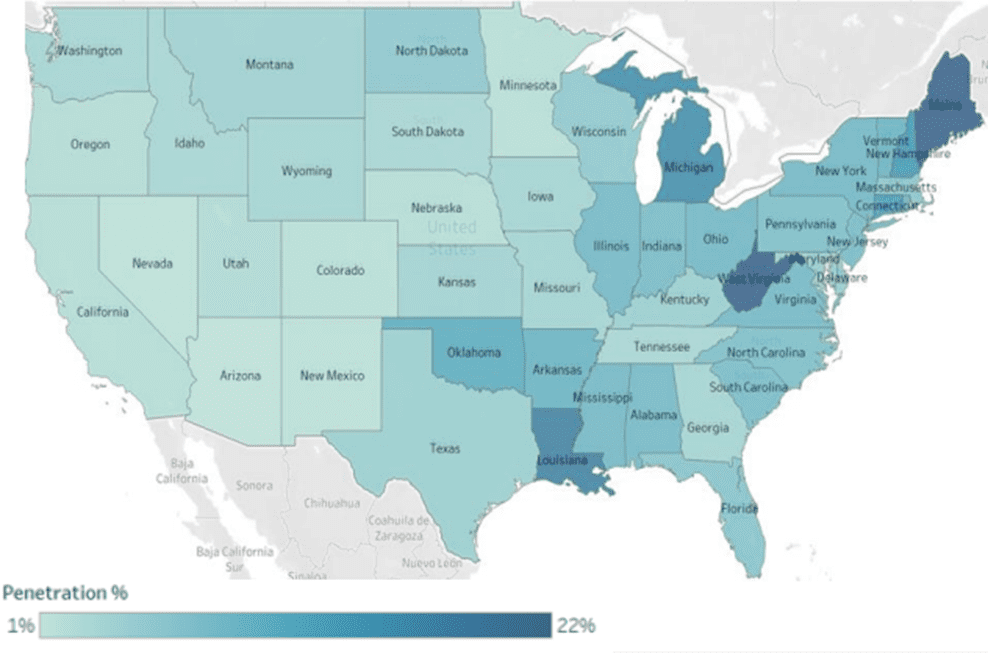

GNRC has continuously built out its business through acquisitions. In 2018 GNRC embarked on a campaign to expand the total addressable market by 5x by 2025. Current market penetration is 5.75%, in the highest geographic areas penetration has reached 15-20%. Severe weather events, grid imbalance, and work from home have all contributed significantly to the uptick in the most penetrated areas. The areas with the largest addressable areas and most grid disruptions (Florida, Texas, and FL) are considered underpenetrated at only about 3.5%.

While speaking in single percentage points seems small, each 100bps of penetration equates to approximately $3 billion in addressable market.

Risk

The largest risk facing GNRC is the large increase in debt. Debt on the balance sheet has doubled since FY21, with free cash flow dropping from $305 million in FY21, to negative $24.1 million in FY22. While much of GNRC’s debt is interest rate swap protected, the average loan interest rate was about 6.27%.

This is slightly concerning, given GNRC intends to repurchase 63 million shares. Management expects a significant recovery in free cash conversion and a slight recovery in EBITDA margin. However, we think this is something to monitor given how heavily acquisition-based GNRC’s growth internationally has been.

Outlook

As GNRC attempts to penetrate more markets, the debt has increased to 2.3x as of 1Q23, which has pushed the EBITDA margin down to 17%. Additionally, as previously discussed, cash flow is down.

The decrease year over year in sales by 22% to $888 million was attributed to residential product sales decreasing by 46%. Largely, management attributes this to clearing the backlog and decreasing consumer demand caused by economic conditions. Offsetting at least part of this, was a record quarter for commercial and industrial customers, increasing 30% year over year – a quarterly record. For FY23, a net revenue decrease of 6-10% is expected. However, the margin is expected to stay stable and free cash flow is expected to recover to have a conversion rate of “well over 100%”.

Though FY23 results are depressed compared to FY22, already in 1Q23 US power interruption activity is well above the long-term average, causing a spike in in-home consultations 4x higher than FY19. Additionally, international sales are still strong in the industrial and consumer sectors. Generac is well positioned to capitalize on the “Decarbonization, digitization, and decentralization” megatrend.

Competitive Comparisons