First Solar Shines Through Cloudy Market

| Price $191.13 | Growth Holding | January 10, 2025 |

- Growing manufacturing base to 25GW by 2026, with 14GW in the US. Fully integrated supply chain independent of Chinese supply mitigates most tariff risks.

- Sell-off driven by fears of loss of IRA tax credits, however, FSLR remains profitable without the credits and its unlikely they will be repealed in their entirety.

- Largest US solar manufacturer and #10 in the world by market share.

- FSLR’s 17 TOPCon patents might yield a third-party sale or royalties, as the U.S. International Trade Commission looks into banning infringing imports and the Chinese government upheld FSLR’s ownership.

- FSLR’s CdTe modules have higher temperature tolerance and lower annual degradation rates compared to Chinese-dominated c-Si modules.

Investment Thesis

First Solar (FSLR) is an American manufacturer of solar panels. FSLR is the only American company in the top 10 list of largest manufacturers, being #10, and the leader in CdTe (cadmium telluride) modules.

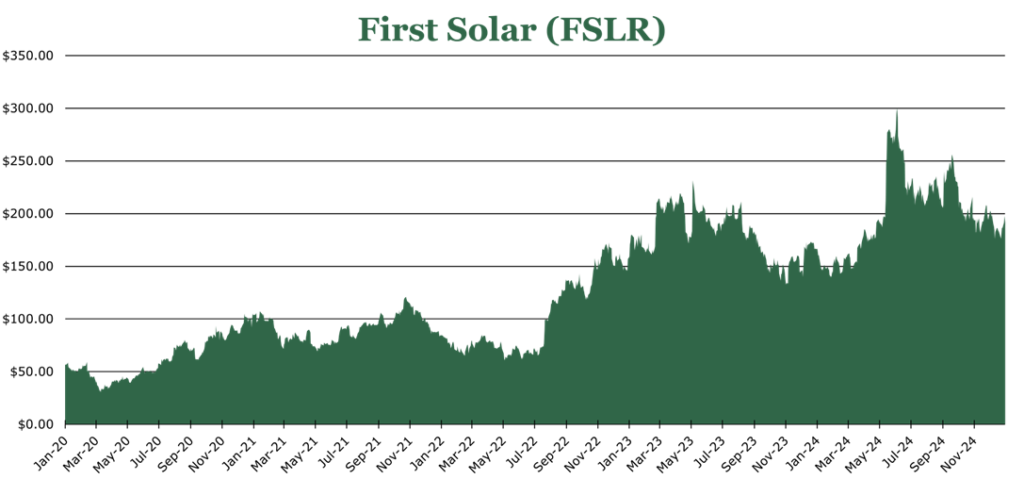

FSLR has been hammered by the market, losing 36.2% since its June 2024 high. The drawdown has been due to fears that the IRA (inflation reduction act) could be repealed on top of oversupply in the solar market from Chinese manufacturers. As we discussed in our Canadian Solar article, we do not think the IRA will be repealed. Additionally, FSLR would be insulated from tariffs on Chinese manufacturers, who control more than 90% of the Solar market.

In the short term, we feel that risk has been overpriced into the stock. Over the long-term there are secular tailwinds in electrification and the push for renewable energy that we believe will provide strong earnings growth.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

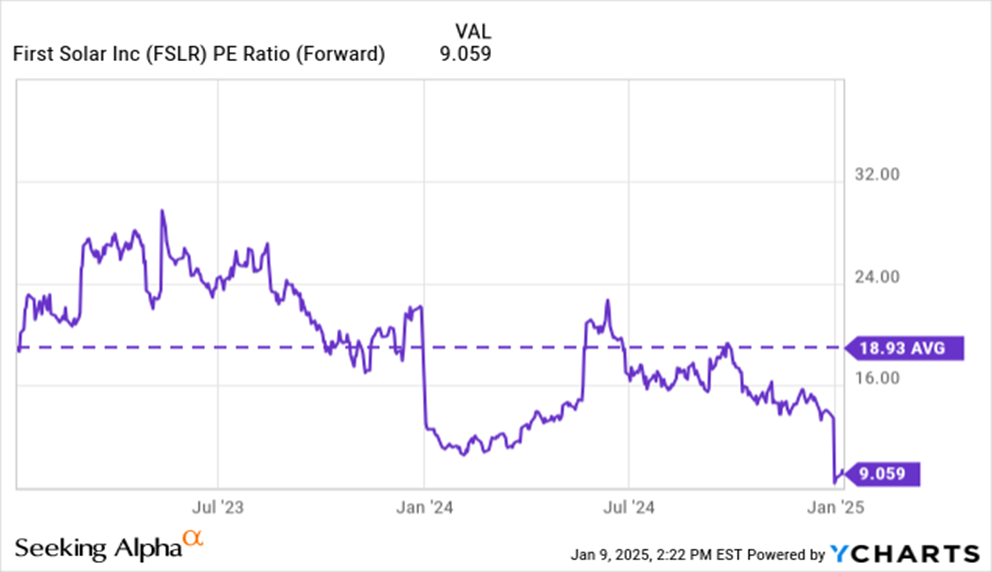

EFV = E26 EPS X P/E = $18.00 X 22.6 = $406.80

A 22.6x P/E would bring the P/E far closer in line with the way FSLR traded before 2024, and price in new developments such as energy demand growth from datacenters and FSLR’s continued manufacturing expansion.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 3.7 | 3.1 | 3.0 |

| Price-to-Earnings | 9.1 | 6.5 | 5.8 |

Development

For more detailed information on global energy demand and the broad cost of renewables, see our article on Canadian Solar. The two most common types of solar cells are c-Si (crystalline silicon) and CdTe (cadmium telluride). At the end of 2023, the IEA (International Energy Agency) estimated that c-Si cells had a global market share of 96%, mostly due to economies of scale and the abundance of input materials. However, in recent years the industry’s close ties to China, who control more than 80% of the supply chain, has begun a wave of alternative manufacturing. The leader outside of c-Si is FSLR’s CdTe.

| Product | Type | Efficiency (module-level) | Nominal Max Power (W) | Annual Degradation of Efficiency | Heat Degradation1 |

| FSLR CdTe Series 7 (TR1) | High-end Utility grade | 19.7% | 550W | -0.3% | -0.28% |

| FSLR CuRe Series 6 | Durable Utility Grade | 19.0% | 480W | -0.2% | -0.24% |

| CSIQ TOPBiHiKu7 | High-end Utility grade | 23.2% | 720W | -0.4% | -0.29% |

| JNKS Tiger Neo N-Type | High-end Utility grade | 23.3% | 650W | -0.4% | -0.29% |

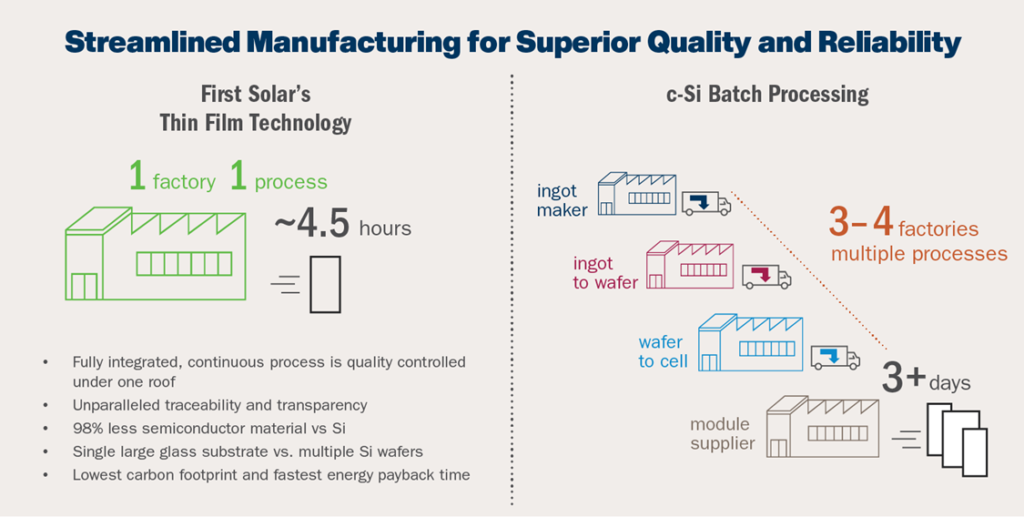

Aside from China controlling much of the supply chain, there are some additional advantages in CdTe cells. The current generation of CdTe cells have higher reliability over a longer period than c-Si cells do. While 0.1% is a minute difference on the face of it, provided the retirement occurs at 90% of original efficiency, CdTe cells have almost 9 more years of useful life. According to FSLR’s datasheets, its CdTe modules also have less efficiency loss to weather (clouds or high temperatures) than competitor c-Si modules. On a cost basis, FSLR reports that it uses 98% less semiconductor material than a typical c-Si module which means that the material input costs are lower.

| Efficiency (cell-level) | |

| CdTe | 20.6% |

| c-Si | 25.0% |

| Perovskite Tandem with c-Si | 33.8% (Early Research) |

| Perovskite Tandem with CdTe | 29.5% (Early Research) |

Single-material solar cells are limited by the laws of thermodynamics, and the accepted limit is the Shockley-Queisser limit of 30-34%. Early-stage development is underway across the spectrum of solar manufacturers to develop the “next generation” of tandem materials to exceed this limit. In May of 2023, FSLR purchased Evolar, a Swedish materials firm experimenting with perovskite. Perovskite captures higher-energy light, like UV light, while the under layer of c-Si or CdTe captures lower-energy light, like infrared light. Combined, efficiencies could be as high as 45%, without meaningful increases to the cost of materials.

Manufacturing

Currently FSLR operates 18.5 GW of solar manufacturing capacity and plans to have 25 GW of global capacity by the end of 2026. FSLR expects to output 14.4 GW for the full year 2024, with around 60% of output being Series 6 modules.

| Facility | Nameplate Capacity | Product Line |

| Ohio I, II, III | 6 GW | 53% Series 6 and 47% Series 7 |

| Expansion (Planned) | 1 GW | Series 7 |

| Alabama | 3.5 GW | Series 7 |

| Louisiana (Planned) | 3.5 GW | Series 7 |

| Malaysia | 3.3 GW | Series 6 |

| Vietnam | 2.4 GW | Series 6 |

| India | 3.3 GW | Series 7 |

| Current Active Capacity | 18.5 GW | |

| Planned Capacity by 2026 | 25 GW |

Series 7 is the newest model of FSLR solar modules with improved efficiency, higher maximum power output, and larger module size which allows for lower total-cost. Series 6 will continue to be made with improvements. The new Series 6 CuRe (copper-replacement) modules use less copper and more ruggedized materials, giving an edge for installations that require longer-life or have high-exposure to adverse climates. It expects to convert full-scale production from older series 6 models to the CuRe through 2025, completing the conversion of the Ohio and Vietnam facility by the end of the year.

As previously discussed, perovskite research with CdTe is still in its initial stages, with FSLR retooling a line at the Ohio facility for experimentation during the quarter ending December 2024. Commercialization of any form of perovskite may still be a ways off, with IEEE (Institute of Electrical and Electronics Engineers) estimating that first commercialization may not begin until 2026.

During 2023, the only customer that made up more than 10% of orders was BP. We expect the variety of customers to increase if a ‘buy-American’ push materializes in the form of further tariffs on c-Si cells from China or a modified IRA. In June 2024, the US government named FSLR as 1 of its 2 primary partners for supplying US government buildings and facilities with solar equipment. While the election of Trump may have discounted this news, Trump has historically been favorable on solar compared to other renewables.

TOPCon Patent Dispute

A potential boon to FSLR could be action regarding long-standing patent disputes on TOPCon technologies. TOPCon (Tunnel Oxide Passivated Contact) technology forms the backbone of current high-end c-Si manufacturing done by top-tier solar firms. While FSLR does not produce any TOPCon modules, it owns approximately 17 patents in the technology. In November 2024 the US International Trade Commission (USITC) announced that it would be stepping in and investigating certain TOPCon patent disputes, with potential action including the banning of importing infringing designs into the US. Additionally, FSLR won a case in early 2024 that established the validity of all 17 patents within China with the Intellectual Property Administration (the patent issuing body in China).

According to management, it is in talks with “multiple interested parties” to buy out FSLR’s TOPCon patent portfolio. Both the confirmed validity of Chinese patents and renewed US government interest in stepping in have certainly raised the price of the patent portfolio, initially acquired in 2013 for an undisclosed price.

Risk

Tellurium is one of the rarest metals on earth, occurring at a frequency 8x less than gold, and the crucial second part of cadmium telluride. Currently, China is the only country in the world that intentionally targets tellurium production and controls around 67% of global output. Data available suggests that FSLR purchases most of its tellurium from Canadian recycling firm 5N Plus, who refines waste products from Rio Tinto’s copper refineries in the US. FSLR’s own study in 2015 concluded that the price and availability of tellurium would not be a factor until the 2030s, though S&P and data from the USGS (US Geological Survey) suggest that price constraints could hit FSLR during this decade. What could potentially delay price impacts is the 90% recovery rate that FSLR reports for its recycling business of old CdTe cells.

As we discussed in more detail in our article on Canadian Solar, the market has hammered solar stocks after pricing in that the IRA’s (Inflation Reduction Act) favorable treatment may end up being repealed with a Republican majority. However, the risk of all subsidies being cut is not our base case, and we do not expect the sweeping elimination of manufacturing credits. Management stated that during the quarter ending September 2024, it expects to realize $1.02 billion in tax credits for the full year 2024, representing $0.17/watt. If the IRA is fully repealed or gutted, other events like tariffs may give FSLR a boost that at least partially offsets the impact of the IRA.

| Current Guidance for Full Year 2024 | Theoretically IRA Repeal | |

| Gross Margin | 47.3% | 22.9% |

| Operating Margin | 36.3% | 11.9% |

| Earnings Per Diluted Share | $13.25 | $3.59 |

Historically, FSLR has sold excess tax credits including a recent sale to Fiserv for $687.2 million in December 2023. FSLR has favorable tax treatment in Malaysia, where it will pay almost no income tax until 2027. It has a similar carve out in Vietnam, where much of its income is untaxed until 2036. Combined for the full year 2024, FSLR expects its effective tax rate to be around 5.6%.

Financials

For the first 9 months of 2024, FSLR reported a 24.6% increase in revenues and a 21% increase in volumes. Operating margin expanded by 1360bps to 34.8%, driven by contract termination charges, higher mix in tax-qualifying modules and higher benefits from scale realized from higher volume. During the quarter ending September 2024, FSLR reported it had hit record quarterly production of 3.8GW, though it did revise its year-end production estimate to 14.3GW due to project cancellations. We expect margins to move back down in 2025 as startup costs associated with production expansion and R&D expenses for perovskite ramp, and as contract cancellation income rolls off.

FSLR reported that it had an average sales price of $0.298/watt company wide. Regionally, price realization is around $0.20/watt in India, and up to $0.32/watt in the US. We expect there to be some upward movement in price realization in India as government measures begin impacting the market during the first half of 2026. Currently, Indian price realizations are artificially depressed by Chinese dumping. In the future, FSLR said that it may still qualify for favorable tax treatment if it ships excess capacity at the Indian facility to the US which could boost both utilization and margins. However, it is unclear if the US market would have the absorption ability without impacting price.

As a result of previously mentioned cancellations, FSLR realized 3 contract termination payments as revenue. The contract termination payments do not cover the full required amount, and FSLR stated during the quarter ending September 2024 it expects to litigate at least 2 of the 3.

FSLR has a strong balance sheet relative to solar peers, carrying a net of cash debt position of around $1.0 billion. Interest expense remains fully offset by investment income, and all $373 million of financial debt is in the form of working capital facilities with a maximum interest of 6.25%. Given the cyclical nature of the solar industry, having a minimal amount of debt is highly advantageous. Management has a history of conservatism when it comes to capacity expansion, so we do not expect a meaningful ramping of leverage within the near future. Given the uncertainty around global solar demand, the future of its domestic US tax treatment, and the pace of technological advancement, this balance sheet strength makes sense.

Conclusion

We believe that management’s conservatism is an advantage in a market as cyclical as solar, and one with geopolitical risks. However, we do not expect the worst case to come to pass and thus FSLR could be repriced over the medium term. Over the long term we believe FSLR will continue to deliver strong earnings growth in line with capacity expansion.

Peer Comparisons