Exxon’s Growing Dividend Supported by Great Assets and Prodigious Free Cashflow

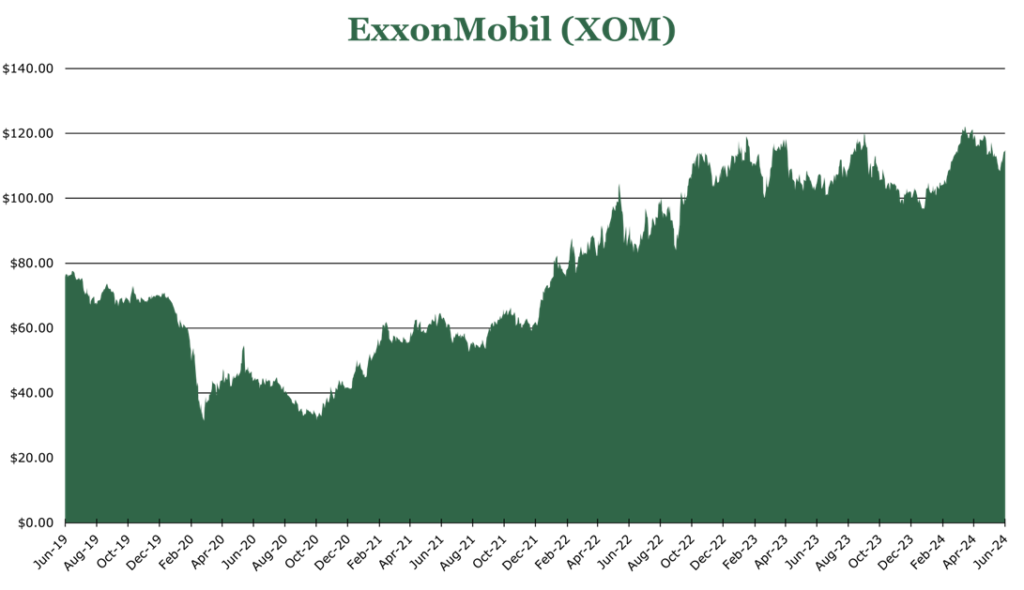

| Price $114.90 | Dividend Holding | June 28, 2024 |

- 3.3% Dividend Yield.

- Free cash flow machine that will repurchase 8.7% of outstanding shares by 2025.

- Permian acquisition will expand US footprint by double, targeting 2 million barrels per day by 2027.

- Large Guyana development plans in one of the lowest cost basins in the world, with more than 1.5 million barrels per day in planned capacity.

- Free cash machine with little debt, Guyanese development could make up as much as 20% of FCF to 2040.

Investment Thesis

ExxonMobil (XOM) has long been a “dividend aristocrat,’ increasing its dividend the last 42 years, and paying dividends for 142 years. However, management is not content with maturity and is instead embarking on aggressive campaign of expansion into low-cost areas like Guyana and expanding in Asian LNGs.

In addition, it trades at a modest forward multiple of 12.3x earnings with incredibly low debt, and a strong dividend yield of 3.3% with a robust repurchase program to 2025 planning to repurchase 8.7% of outstanding shares. With an increasing portion of the liquids profile coming from low-cost areas with high growth potential, XOM will continue to be a free cash machine and strong dividend stock far into the future.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $10.00 X 13.5x = $135.00

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.3 | 1.3 | 1.3 |

| Price-to-Earnings | 12.3 | 11.7 | 11.4 |

Existing Operations

| Oil and Liquids | ||

| Geography | 2023 Full Year Production (Mbbl/d) | 1Q24 Production |

| US | 803 | 216 |

| Canada/Other Americas | 664 | 772 |

| Europe | 4 | 4 |

| Africa | 221 | 224 |

| Asia/Middle East | 721 | 711 |

| Oceania/Australia | 36 | 30 |

XOM’s strongest current operations come from the Permian Basin, where it outputs 650 Mbbl/d (thousands of barrels of oil per day). In Spring 2023 XOM announced its intent to purchase Pioneer Resources in an all stock deal, bringing full production to 1.3 MMboe/d (millions of barrels of oil equivalent per day) in production in the Permian by the end of 2024 and making it the largest player in the Permian. By 2027, XOM could foreseeably breach 2 MMboe/d in the Permian, which would substantially increase the North American concentration of assets.

| Natural Gas | ||

| Geography | 2023 Full Year Production (Mcf/d) | 1Q24 Production |

| US | 2,311 | 2,241 |

| Canada/Other Americas | 96 | 94 |

| Europe | 414 | 377 |

| Africa | 125 | 150 |

| Asia/Middle East | 3,490 | 3,274 |

| Oceania/Australia | 1,298 | 1,226 |

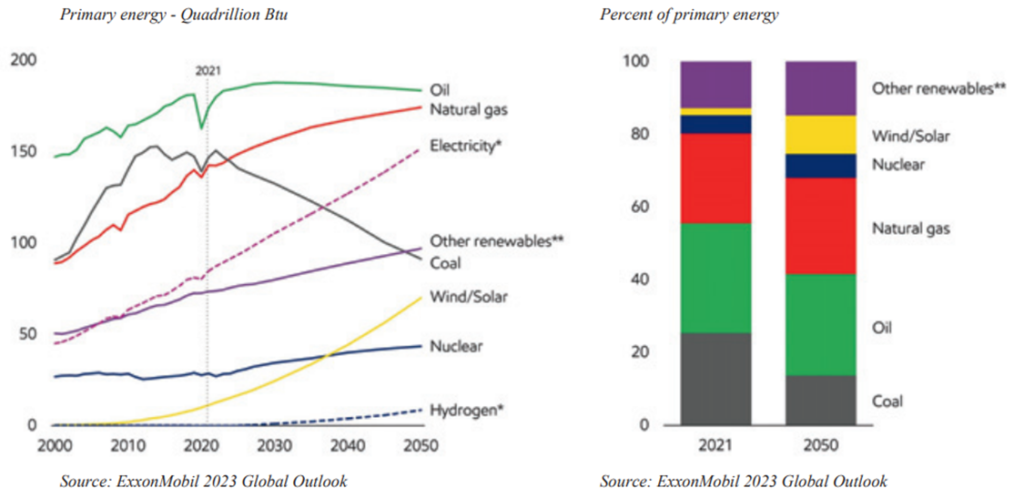

Much of XOM’s natural gas operations are byproducts of its liquids operations, though there has been some investment in LNG projects in Oceania and Asia.

While XOM does see natural gas production as a focus in the latter half of the decade, seeking to ‘double’ its LNG footprint by 2030, it would not comment on a timeline for moving the mix more firmly away from oil.

In our view, it’s likely that much of LNG expansion will come organically, as 80% of global LNG trade is still done via long-term contracts, rather than the spot market. This means there is far more value in a fully integrated LNG supply chain rather than conducting business piecemeal.

| Long-Term Expansion Plans | |||

| Geography | Average Working Interest | Liquids Output, includes LNGs (Mbbl/d) | Gas Output (Mcf/d) |

| US | 65% | 450 | 3,450 |

| Other Americas (Less Guyana) | 25% | 250 | 0 |

| Europe | None Planned | ||

| Africa | 25% | 10 | 2,400 |

| Asia/Middle East | 22% | 2,315 | 1,200 |

| Oceania/Australia | 25% | 30 | 2,700 |

Guyana

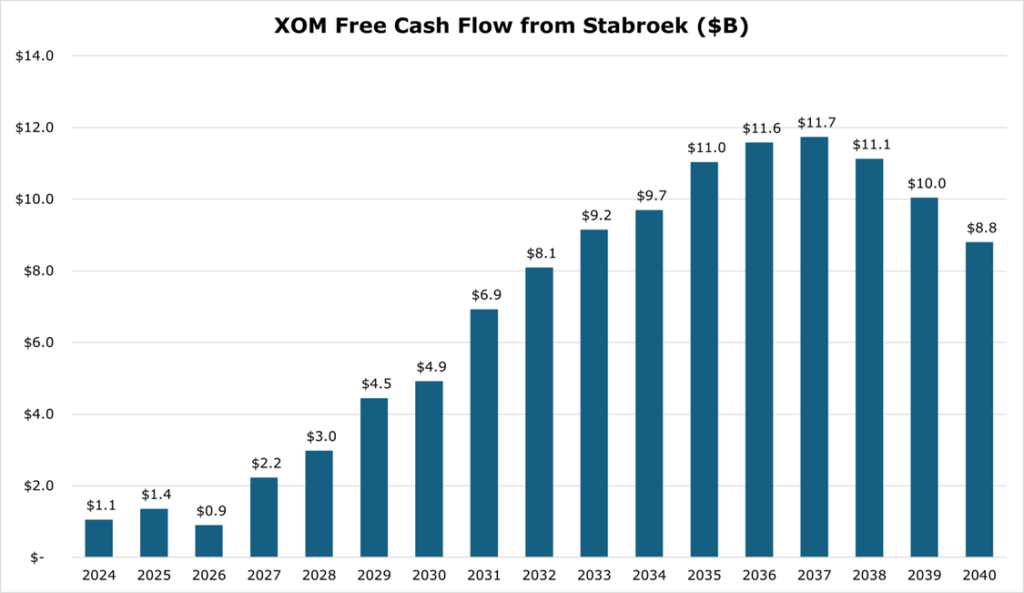

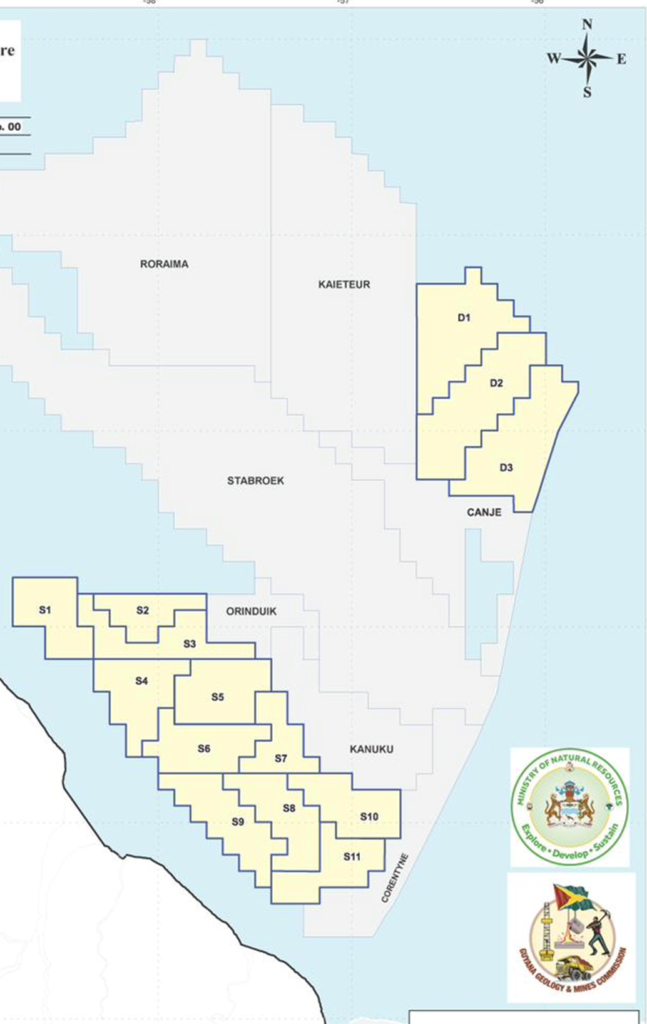

The Guyana-Suriname basin was discovered in the 60s, with first limited production beginning in the 80s. In 2015, in the Stabroek section of the basin, XOM discovered 11 billion barrels of commercially viable oil. This discovery represents nearly 75% of discovery volume since 2010.

The structure of the deal is a consortium, between Exxon (XOM, 45%, operator), Hess (HES, 30%), Chinese National Offshore Oil Corporation (CNOOC, 25%) and the Guyanese government. Existing terms are the lion’s share of the profits going to the corporate partners until 75% of costs are recouped, then a 50-50 profit split. Outside of this, there is a 2% royalty on all revenue in the Stabroek block, with 10% outside of Stabroek. Though, in our view, it is likely that the Guyanese government will continue its efforts to claw-back a full 10% royalty in the Stabroek field.

The Guyana project has a huge boon for XOM and partner firms, with Rystad Energy forecasting XOM will generate $116.1 billion in free cash flow over the first 16 years of life at current planned capacity. At current firm-wide quarterly free cash levels, Stabroek will represent 18.1% of XOM’s free cash to 2040.

| Site | Breakeven Price | Output (thousands of barrels per day) | Estimated Cost ($B) |

| Liza-1 | $35/bbl | 150 | $3.6 |

| Liza-2 | $25/bbl | 250 | $6.0 |

| Payara | $32/bbl | 220 | $9.0 |

| Yellowtail (2025) | $29/bbl | 250 | $10.0 |

| Uaru (2026) | $25-35/bbl | 250 | $12.7 |

| Whiptail (2028) | $25-35/bbl | 250 | $12.7 |

| Hammerhead (2029) | $25-35/bbl | 180 | Awaiting Determination |

| Median New Guyana | $35/bbl | ||

| Median New US | $57/bbl | ||

| Median New Middle East | $30/bbl |

The venture has posted a net margin of 56%, with the EIA estimating 850 Mbbl/d in production by the end of 2025 with an estimated 1.3 MMbbl/d by 2027.

Within the Stabroek there are also substantial natural gas reserves, with an estimated 17 Tcf of recoverable gas. According to Reuters, the Guyanese government has been pressing for more diversified production from the oil-rich basin. XOM selected Fulcrum LNG to pilot the estimated $10-15 billion natural gas drill, with commercial strategy to be released in early 2025 with first production starting in 2029.

Guyana has become the lowest cost non-OPEC oil producer in the world and jumped to the third largest non-OPEC producer in the world. XOM has embarked on this project at breakneck speed, with a new drill coming online every 18 months to the end of the 2020s. XOM has continued to explore within the Stabroek, embarking on a further 10 exploratory drills.

Previously XOM held interest in Kaieteur and Canje, but initial exploratory drilling did not find commercially viable deposits. Seeking to expand its footprint, the XOM-lead partnership was awarded shallow-water block S-8 in the September 2023 auction, though at this time it is unclear when first S-8 exploratory drills would take place.

Risk

Initial negotiations in Guyana had XOM substantially better off than other historical deals of similar sizes. However, the Guyanese government has been seeking to claw back some provisions and broaden partners in development outside of the HES-XOM-CNOOC consortium. While we don’t feel that the consortium will lose any of its existing land, the Guyanese government has alluded to allowing other companies to drill in the Stabroek for natural gas earlier than XOM’s initial 2029 target.

Venezuela has recently renewed a territorial dispute in Guyana. This territorial dispute is certainly stemming from oil rights, and Venezuelan military forces have threatened war as late as May 2024. While the broader international community is on the side of Guyana, armed conflict between Venezuela and Guyana is within the realm of possibility.

Chevron is seeking to buy Hess in a $53 billion all-stock deal. XOM and CNOOC have both claimed preemption rights over Hess’s 30% stake in Stabroek. This means if arbitration rules that Chevron’s deal with Hess is an acquisition, not a merger, then XOM and CNOOC would be able to purchase Hess’s 30% stake in the Stabroek block, and any other HES assets held under the consortium of HES-XOM-CNOOC. This could provide additional upside to the Guyanese footprint, and arbitration will conclude by the end of 2024. Although a ruling against Chevron would probably result in cancellation of the merger.

Financial Outlook

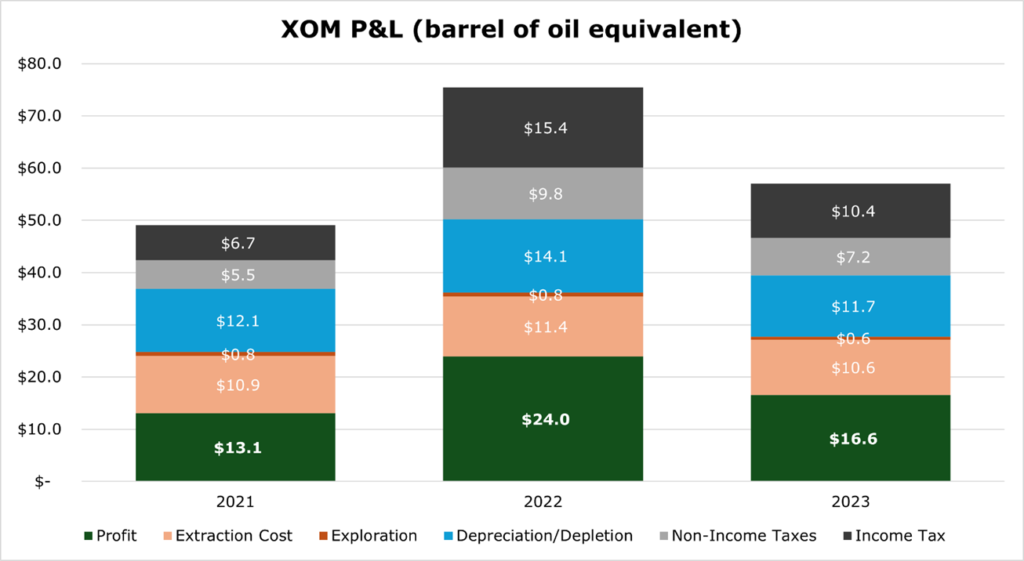

XOM is expecting production to be 4.2 MMboe/d by 2027, representing a production CAGR of 3.4% to 2027. While production growth is certainly smaller than it has been in the past, we expect most of the production growth over this period to be from far lower operating cost assets in Guyana, increasing earnings.

To 2027, XOM expects a companywide breakeven price of $35/bbl. With cost saving measures and an assumed price of $60/bbl, XOM expects to see an over 10% CAGR in earnings growth to 2027.

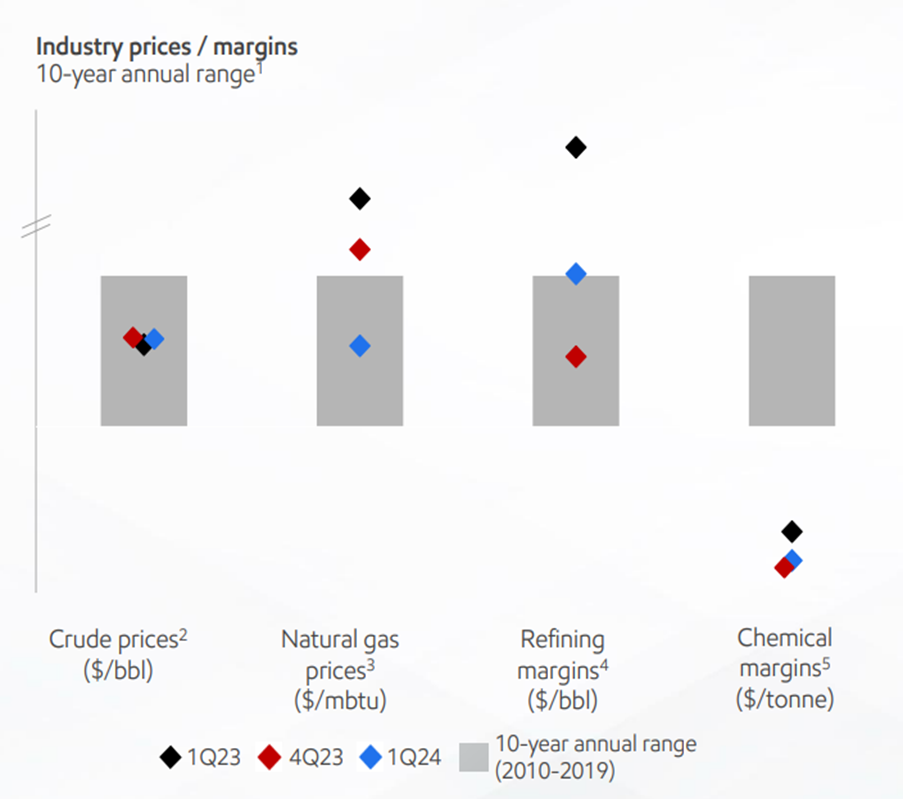

Outside of the liquids segment, refining margins are increasing above the 10-year range driven by lower downtime and strong refining demand. Natural gas margins are moving back upward after the severe 2023 price slump. Chemical margins are at bottom-of-cycle conditions, with recovery expected to begin during 2024.

XOM expects 2024 capex of $23-25 billion. In our view, this capex figure will inch up to $25-27 billion per year range in the latter half of the decade, as Guyana operations ramp up and Asia LNG operations begin on a larger scale.

XOM is a free cash machine, outpacing peers with $10.1 billion in quarterly FCF and $33.3 billion in cash on hand. Additionally, XOM has very low leverage, with a 3% net debt to capital ratio, or a debt to EBITDA of 0.6x. XOM has renewed its share repurchase agreement, expecting $20 billion per year through 2025, which represents a market cap shrink of approximately 8.7%. XOM currently yields 3.3%, with an annual payout of $3.80/share – representing a payout ratio of 42.5%.

Conclusion

XOM is not content with sitting on its current portfolio of assets, or pouring money into moonshot renewables, but instead is seeking to maximize cash flow and minimize costs with new investments in low-cost production.

With Guyanese development moving forward with 1 MMbbl/d in planned additions, a doubled Permian footprint, and strong Asian LNG demand in the back half of the decade, we believe that XOM is an excellent buy for dividend investors.

Competitive Comparisons