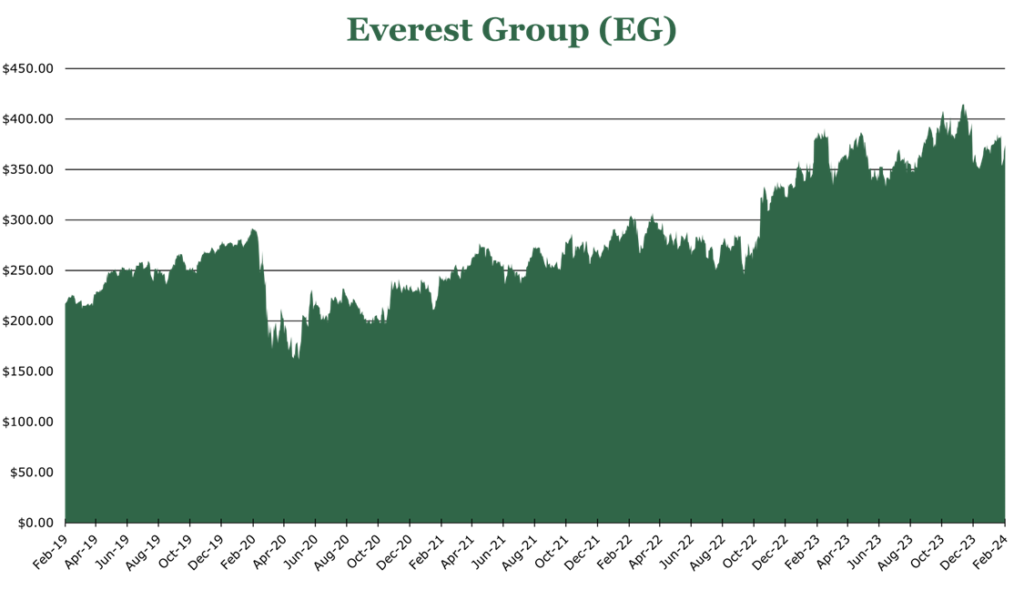

Everest Reaches Peak Performance with Rising Premiums and Business Expansion

| Price $374.38 | Core Holding | February 23, 2024 |

- 1.9% dividend yield, EG is targeting >17% shareholder return.

- Gross written premium growth of 20.9% year over year, with a combined ratio of 90.9%.

- EG expects to invest more in reinsurance underwriting opportunities in 2024, aiming for a combined ratio target of 89-91%.

- Strong earnings growth, with a continued hard market in reinsurance and new specialty lines in the primary insurance business.

- Sustaining catastrophe reinsurance share at 7% of business, realizing 45% increase in catastrophe reinsurance rates.

Investment Thesis

Everest Group (EG) is a reinsurance and primary insurance provider. EG is embarking on global expansion in the primary insurance market, attempting to capture the nearly $1 trillion in total addressable market. Additionally, the strong reinsurance market will continue to provide significant tailwinds until at least fiscal year 2025.

Across the whole business, EG grew its gross written premiums by 20.9% year over year, with a company-wide combined ratio of 90.9%. Continued growth in reinsurance premiums and EG’s international expansion strategy in the primary insurance business provide a clear growth path and make EG an attractive total return opportunity, in our opinion.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $69.00 X 8.6 = $586.5

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.1 | 1.0 | 0.94 |

| Price-to-Earnings | 9.7 | 8.6 | 7.9 |

Downstream Conditions

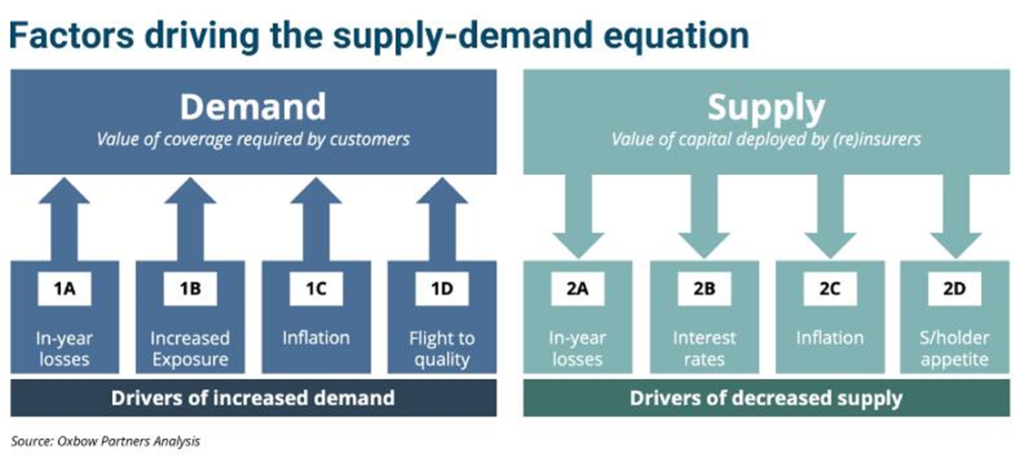

For a more detailed overlook of the downstream conditions in the insurance market, see our previous article on EG. Reinsurance has entered into a “hard market” that is expected to stay until at least 2025. The “hard market” in reinsurance means insurance companies have become price takers, and reinsurance companies can ask for higher prices and stricter terms. The “hard market” was precipitated by stagnant premiums and higher-than-usual losses by primary insurers.

AON projects that the global reinsurance market has decreased the capital available since the peak in 2021 by 5%. Despite the changes in premiums and better risk profiles, a smaller amount of new money has entered the market. Investors still worry about how climate change, rising prices, and increased political risks might affect future losses.

Reserves

An ongoing concern cited by many investors is the allocation of additional money in the reserves of EG’s general liability segment of the primary insurance business. In the December quarter, EG announced that it would be increasing its reserves in this area by $392 million. EG states that the majority (70-90%) of the claims from the 2016-2019 periods are now mature, and this additional allocation is merely ‘closing the door’ on those claims.

On average, the time to pay a claim in general liability is 3.7 years, while EG maintains an investment profile that yields 6%, with an average duration of 2.7 years.

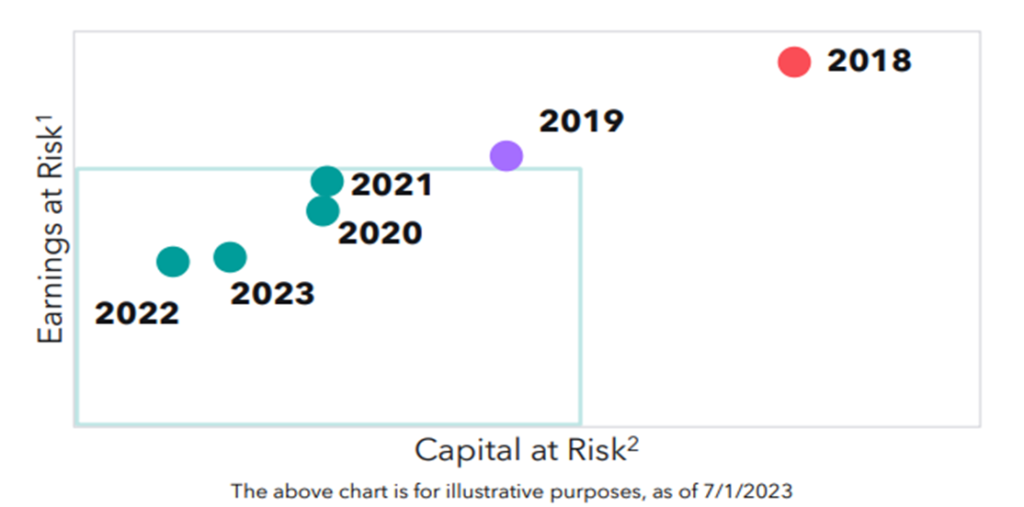

On a go-forward basis, we believe that EG has appropriate reserves and a large amount of liquidity to back up excess loss. EG started the 2020-2023 period with significantly higher loss expectations than the 2016-2019 period. Additionally, over the 2020-2023 period, EG significantly repositioned the business mix to include higher deductibles, lower coverage limits, and exiting litigious industries – reducing total general liability exposure by 23%.

Reinsurance Business

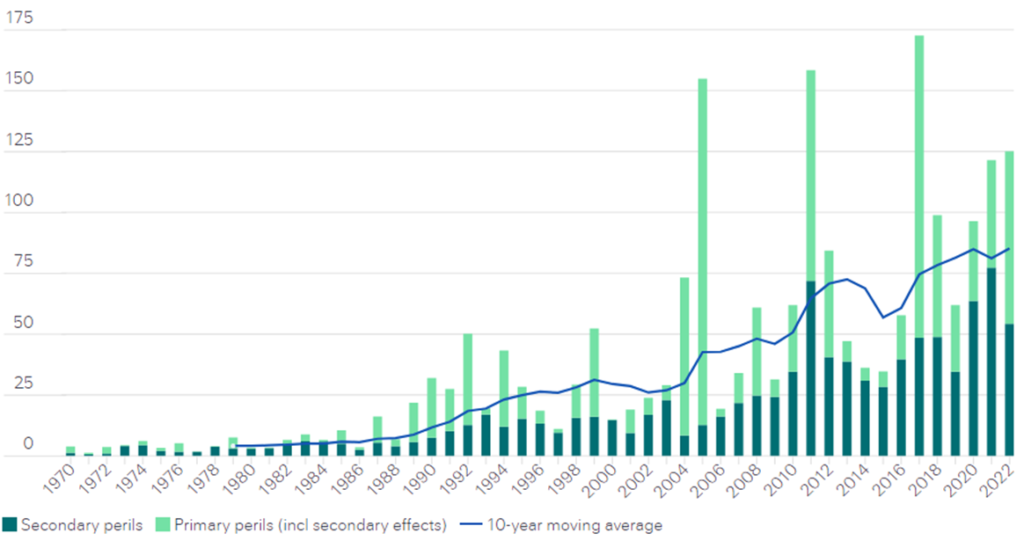

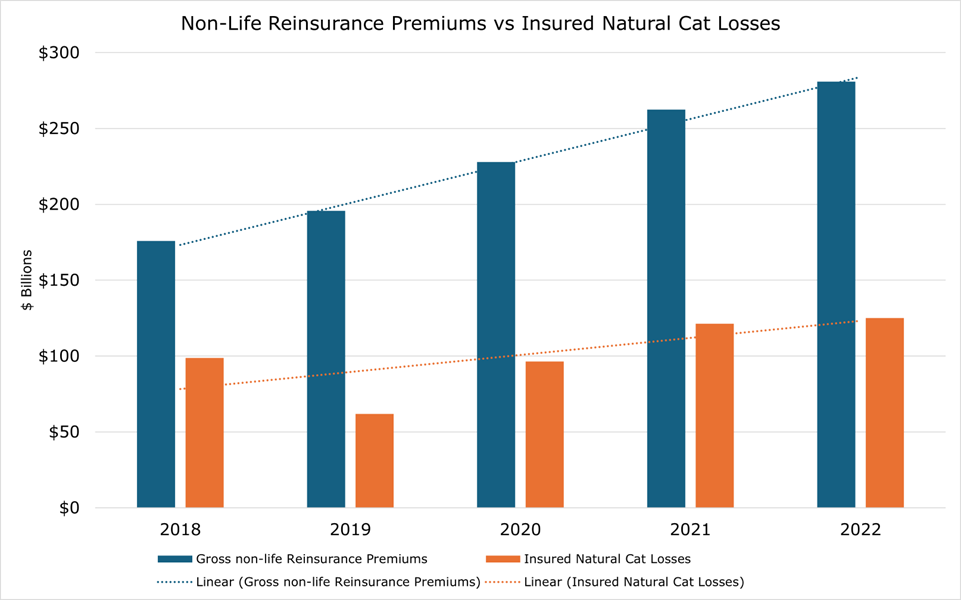

Swissre estimates insured Natural Cat losses have fallen 25% year over year to $100 billion in 2023. The $100 billion figure is still above the 10-year moving average of $89 billion, with the makeup notably changing.

Secondary perils like severe thunderstorms have become a substantially higher portion of losses. Losses from severe thunderstorms have had a 7% CAGR over the last 30 years, meaning large portions of Cat losses are now coming from more frequent smaller events rather than singular large events. EG expects this to continue as climate change grows in scope.

However, premium increases have consistently offset losses, which has allowed EG to improve the combined ratio by 100bps to 85.1% in 2023. The hard market has continued, with EG increasing gross written reinsurance premiums by 26.4% to $11.5 billion in 2023. In the Cat segment, more specifically, reinsurance premiums were up 45%.

For the 2024-2026 timeframe, EG expects to hold 6-7% of reinsurance premiums in the Cat category. While large Cat claims can hurt the combined ratio, EG is expecting a 2024 combined ratio target of 89-91% for the reinsurance segment versus the current combined ratio of 85.1%.

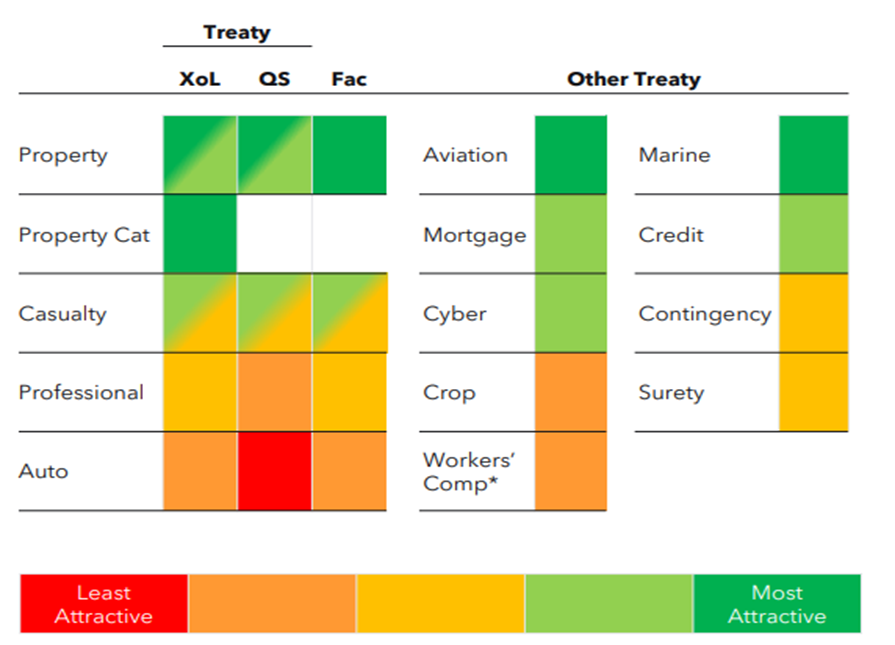

EG still plans to remain in the property catastrophe market so long as it provides them with ample risk-adjusted return. Property and Property Cat remain two of the more attractive reinsurance categories for total return.

Outside of additional premium increases, growth in the reinsurance segment will likely come from further geographic expansion and expansion into more specialized lines of reinsurance, like cyber liability. Primary cyber insurance premiums reached $12 billion in 2022. According to S&P, this number will grow to $23 billion by 2025, with the cyber insurance industry being currently underrepresented in reinsurance.

Primary Insurance and International

For the full year 2023, gross written premiums in the primary insurance segment grew at 10.3% to $5.2 billion. Primary insurance issuance now makes up 45% of the book of business and continues to grow. EG estimates that its total addressable market in the North American primary insurance business is $280 billion, with a total global addressable market of just shy of $1 trillion.

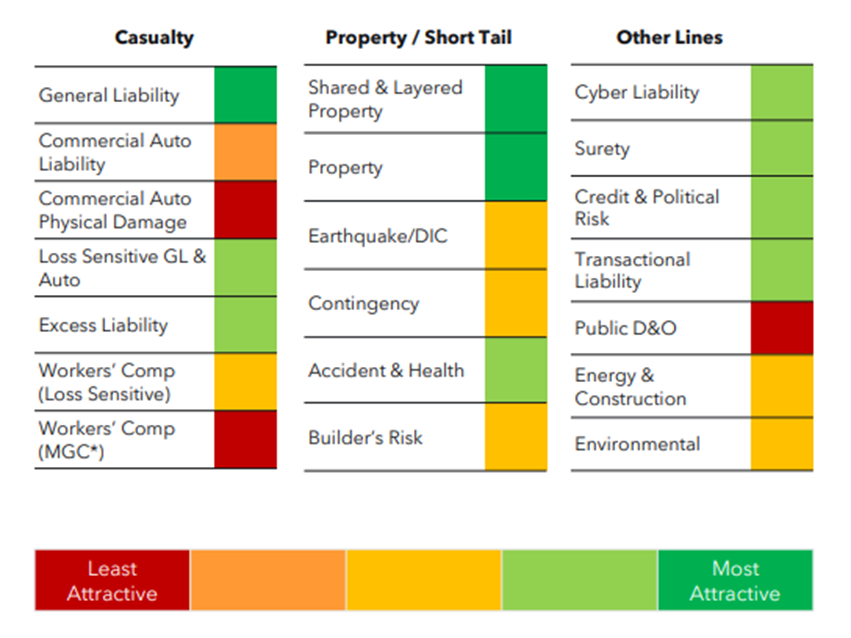

A particular area of growth for EG has been the entry into specialty markets, such as specialty casualty and specialty liability (specialty liability is reported as “Other Lines”). Combined, these have grown to be 57% of the primary insurance business, compared to 48% in 2019. The extension into more proprietary insurance products has helped bring the combined ratio down to ~92%. The specialty insurance market is expected to grow at a 10-year CAGR of 10.5%, reaching $282 billion by 2032. The combined ratio of the primary insurance segment could see measurable improvement over the decade as the specialty insurance market begins to see more direct purchase penetration, currently estimated to be 60% brokers and 40% direct purchases.

Over the short term, EG is targeting further international expansion for the primary insurance segment. For the first 9 months of 2023, the gross written premiums on the books in the international area were $697 million, or about 13% of segment revenue. The current focus for the international primary insurance business is the business upper market, with the ideal customer having at least $250 million in revenue. Geographically, 45% of gross international premiums are currently in the UK and Ireland, with robust demand from upper-market customers.

Risk and Changes to Modeling

In November of 2023, S&P released its new criteria for modeling insurance companies – a key part in how the rating agencies assign ratings to insurance companies. Additionally, it conducted a significant review of non-operating holding companies headquartered in Bermuda and how they are regulated, including EG. As a result, EG’s non-operating holding company in Bermuda was downgraded to BBB+ from A- based on both legal considerations in Bermuda and the new modeling criteria. However, the operating company ratings were maintained.

Insurance and Reinsurance companies invest their premiums to generate income until they need to pay out claims. In a low-interest rate environment, the returns on these investments, particularly in fixed-income securities like bonds, are lower. This reduction in investment income can lead to higher reserves required and lower profitability.

Climate change will continue to change the dynamics of the property insurance business. In the last decade, both primary and secondary perils have increased in intensity and volume, with losses being consistently higher. While we believe that premium increases will continue to offset this, profitability could be affected over the long term once the hard-market in reinsurance rolls over.

Outlook

For the period 2024-2026, EG has an estimated total combined ratio of 89-91%. On a more granular level, the target ratio in the primary insurance business is expected to remain at 90-92%. In reinsurance, EG expects a combined ratio of 89-91%. The current strategic plan has a 3-year CAGR of 10-15% for gross written premium growth. We feel both of these are achievable given the sustained hard market in reinsurance and business expansion in both segments.

For the 2024-2026 period, total shareholder returns are targeted at >17% through both capital appreciation and dividend yield. The current dividend yield is 1.89%, with a yearly payout of $7.0. Underwriting opportunities in reinsurance continue to be very attractive. Thus, we expect more capital deployment in this area rather than share repurchases in 2024.

We believe that EG presents a compelling investment opportunity with its strategic positioning, growth prospects, and commitment to shareholder returns. Especially considering the share price has contracted 3% in the past week, we believe that EG is a good buy.

Competitive Comparisons