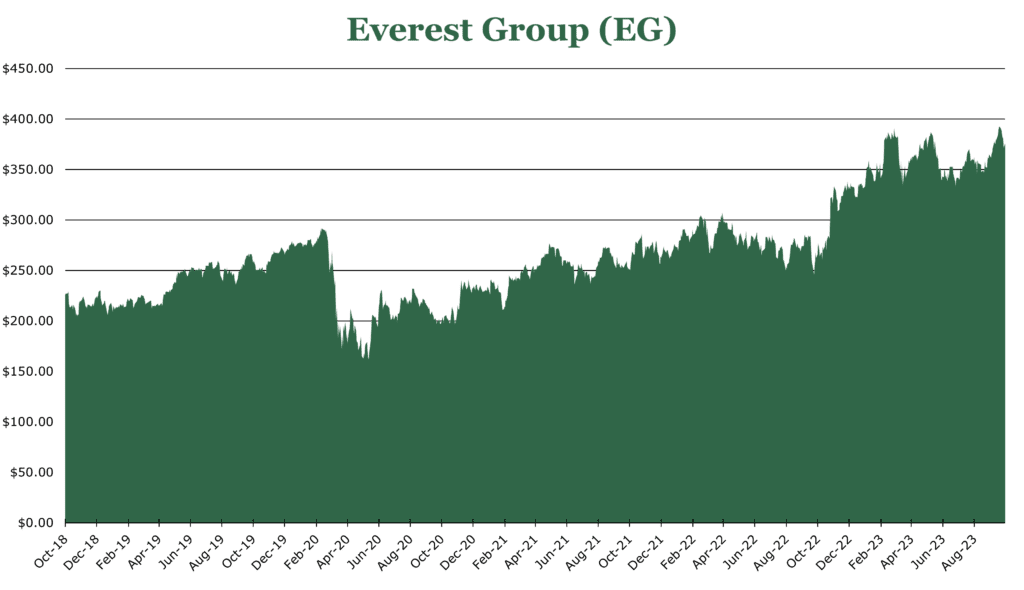

Everest Reaches Peak Performance with Rising Premiums and Business Expansion

| Price $372.19 | Core Holding | October 4, 2023 |

- 1.9% dividend yield, EG is targeting >13% shareholder return.

- Natural disasters are becoming more frequent and more intense, with primary insurers facing restrictions on premium hikes.

- Reinsurance rates have sustained tailwinds, with Everest realizing a 26.9% increase in premiums.

- Even in the face of increased catastrophe claims, the combined ratio in all segments of the company has improved. Reinsurance combined ratio dropped 340 bps to 88.2%, and primary insurance dropped 120 bps to 91.5%.

- International expansion effort in the primary insurance area resulting in premium growth of 13.5% year over year.

Investment Thesis

Everest Group (EG) is a reinsurance and primary insurance provider. Everest has 66% of its underwritten premiums in reinsurance and 33% in primary insurance. Everest is embarking on a global expansion in the primary insurance market, attempting to gain a global foothold. Additionally, the strong reinsurance market will continue to provide significant tailwinds until at least FY25.

Robust growth in reinsurance volumes and pricing and Everest’s international expansion strategy provide a clear growth path and make Everest an attractive total return opportunity, in our opinion.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $57.0 X 10.8 = $615.60

| E2023 | E2024 | E2025 | |

| Price-to-Sales | 1.3 | 1.2 | 1.1 |

| Price-to-Earnings | 7.8 | 6.4 | 5.6 |

Downstream Conditions

Natural disasters are becoming more frequent and more powerful. Since 1980, the amount of disasters per year with over $1 billion in damages has increased 600%. Most insurance companies are regulated with regard to raising premium prices, with the average rate increase in 2022 being 12%. However, reinsurance companies are generally not and can reprice quickly as risks evolve. The slow price change for insurance companies creates the need to offload more risk.

Underwriting losses (non-life) have increased massively over the primary insurance sector, with the average combined ratio in 2022 being 102.7% – the highest losses since 2011. This has driven wide-ranging consumer effects, with many in disaster-prone states paying 89% more than the average in premiums. This combination of high losses and risk aversion is leading to solid premium growth in the face of higher industry losses. Everest reports that property catastrophe premiums went up 30% year over year, with casualty going up 16%.

Reinsurance has entered into a “hard market” expecting to stay until FY25. The “hard market” means insurance companies have become price takers, and reinsurance companies can ask for higher prices and stricter terms.

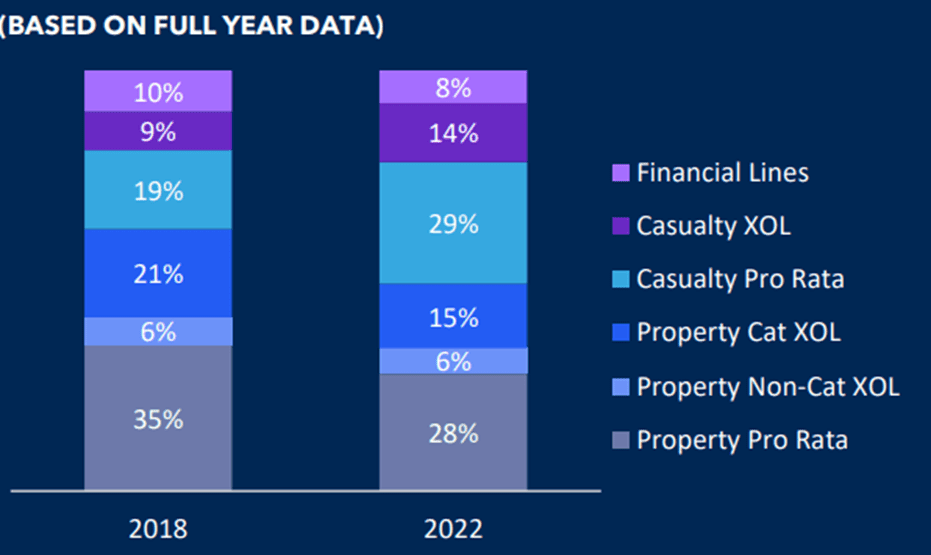

Reinsurance

Everest is the 4th largest reinsurance firm in the world. Gross written premiums have grown 26.9% year over year, a new quarterly record. For the January 2024 renewal cycle, Everest expects to push increased rates once again.

Everest reports significant pricing momentum, with catastrophe reinsurance pricing up 48% in North America and up 29% internationally. Despite the increase in claims in pockets like Florida and California, Everest reports its combined ratio (the ratio of claims and expenses to premium income) has decreased by 340 bps to 88.2%. In order to continue this downward trend, Everest is undergoing “deliberate efforts” to reduce catastrophe exposure or increase prices.

Everest raised $1.5 billion in equity for both buildout and resilience in the reinsurance division. In the short term, Everest will deploy roughly 90% of the capital to the reinsurance division. This extra capital will help Everest capture the significant pricing tailwinds expected during the next renewal cycle in January of 2024.

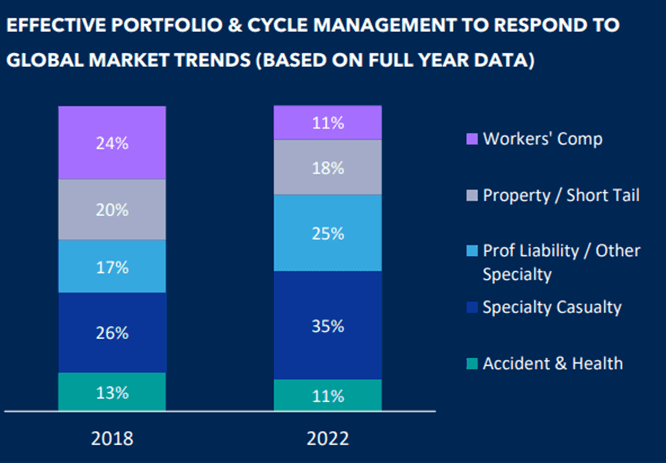

Insurance

The primary insurance area entails workplace insurance, such as liability and health, as well as property insurance. Much of the primary insurance business is concentrated in North America. The primary insurance business is planning an aggressive international growth in property and specialty lines (marine, aviation).

Gross written premiums increased 13.5% year over year. The combined ratio decreased by 120 bps to 91.5%. This figure is within the expected 91-93% range, with Everest adjusting guidance to the low 90s after obtaining price increases.

Risk

Despite only making up 9% of all insurance claims, Florida makes up 79% of insurance litigation. Florida passed insurance reform that improves the regulatory environment by eliminating the burden on insurance companies of having to pay for legal fees even on cases in which it wins and allowing for mandatory arbitration clauses in contracts. This also created the FOR-AP (Florida Optional Reinsurance Assistance Program) for insurance companies, offering competitive rates.

While pricing actions have thus far maintained profitability from reinsurance and primary insurance, there is still substantial underwriting risk taken on by Everest.

The fixed-income portfolio does have $1.6 billion in unrealized losses. This is primarily due to non-issuer and non-industry specific credit environment coupled with interest rate increases. As interest rates increase, the value of bonds decreases. Everest reports it does not intend to realize any losses from the portfolio and that it expects to recover the cost basis as the securities mature.

Outlook

In the reinsurance area, there are significant tailwinds in pricing and client base. Deloitte estimates that there will be a 15% volume growth in reinsurance in 2024 alone. Reinsurance gross written premiums are expected to have an 8-12% 3-year CAGR.

Insurance gross written premiums are expected to have an 18-22% 3-year-CAGR. Over the next 3 years, Everest will expand offerings internationally, significantly increasing the client base. This expansion effort has caused an increase in operating expenses of around 20%, which Everest believes is now primarily behind them.

Everest has $33.6 billion invested, primarily in fixed income, with an average timeframe of 2.9 years at an A+ rating. Roughly 22% of the portfolio is comprised of adjustable-rate securities. The investment mix is expected to remain similar, with an expected return on investment of 3%.

Overall, there are significant tailwinds for Everest. With the >13% targeted shareholder return, competent management, and robust market conditions, we believe that Everest is well positioned to grow its business, earnings, free cash flow, and dividend.

Competitive Comparisons