Ecopetrol Pays Out 18% Yield with Successful Permian Play And Gas Exploration

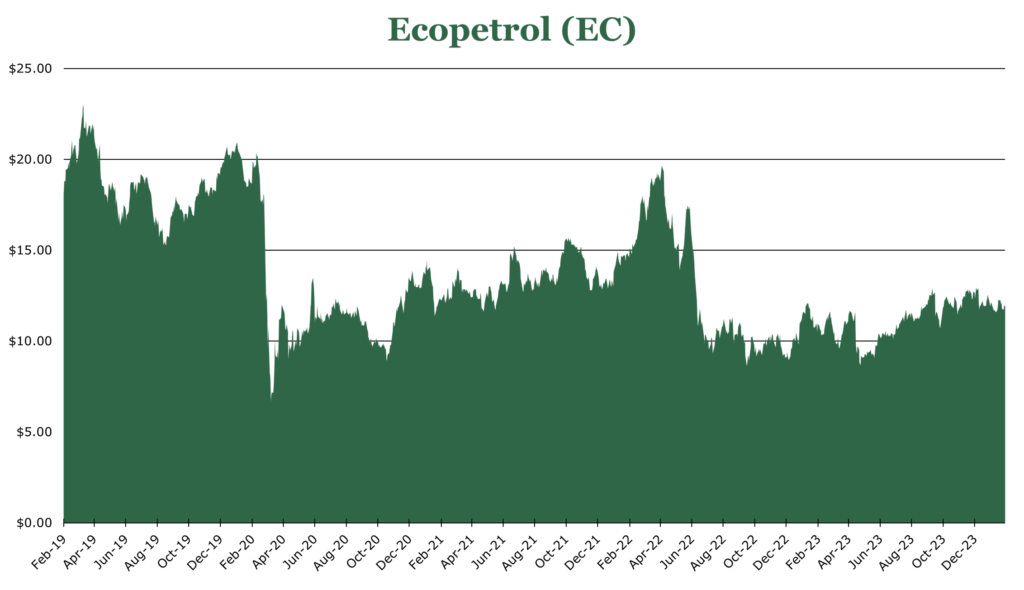

| Price $10.73 | Dividend Holding | March 5, 2024 |

- Dividend Yield estimated at 17.7% for 2024.

- A 3.3% increase in production to an 8-year high of 737 mboe/d and a strong production profile.

- Successful Permian basin development program, outputting 66.3 mboe/d. We expect a secular increase to 100 mboe/d through 2025.

- Strong gas development profile, significant domestic supply shortfall over the next decade.

- Political considerations will likely be resolved during the next Colombian election in 2026.

Investment Thesis

Ecopetrol (EC) is an exploration and production company controlled by the Colombian government, which owns 88% of the company. EC’s strategic expansion into the US’s Permian Basin for oil and domestic gas production provides a compelling short-term growth narrative. While we doubt the company’s broader strategy to wean off oil production, the political considerations surrounding this will likely be fully resolved by the next Colombian election in 2026.

Assuming stagnant oil prices, EC has a strong path forward through natural gas development and Permian basin expansion. Focusing on replacing reserves and expanding outside Colombian oil assets provides a solid foundation for an attractive yield and revenue base that will grow over the decade.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/EPS (Price/EPS)

EFV = E26 EPS X P/E = $2.20 X 7 = $15.40

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 0.67 | 0.69 | 0.69 |

| Price-to-Earnings | 5.4 | 5.4 | 5.0 |

Oil Operations

EC operates primarily domestically in Colombia, but recent government regulation preventing new exploration has pushed them to expand into the US’s Permian Basin and offshore development in the Caribbean. EC had a crude output of 560.2 mbbl/d (thousands of barrels per day) of oil production in 2023 and integrated into its own refining and transportation.

The expansion into the Permian basin has beaten expectations, outputting an average of 66.4 mboe/d in production at 60-70% crude oil. In December of 2023, the Permian field hit a new production record, outputting 113 mboe/d. We believe that EC will likely hit the peak of production with its existing footprint in the Permian in 2025, with around 100 mboe/d on average.

However, we believe that this number will increase beyond this as an expansion of Permian operations is a stated priority of hydrocarbon operations. Most of the short-term expansion in oil will likely be focused in the Permian basin as the current political situation does not allow additional domestic development.

Domestic midstream throughput was 1,112.9 mbbl/d for 2023. Total transportation costs have increased 8.8% year over year, largely due to an increase in utilization. Segment revenue was up 11.1% year over year, though EBITDA margins were relatively flat at 76%. While exploration and production activities have been limited, the Colombian government clarified in December 2023 that the midstream capacity of EC is not limited and that expansion may continue to increase transportation throughput.

Refining throughput is 420 mbbl/d (thousands of barrels per day) across two refining facilities. Gross margin was down to $17.6/bbl due to lower realized sale price for refined products, particularly gasoline and jet fuel. Margins seen in 2023 are more in line with historical averages, with utilization staying stable at around 85% over the last 10 years.

Gas Operations

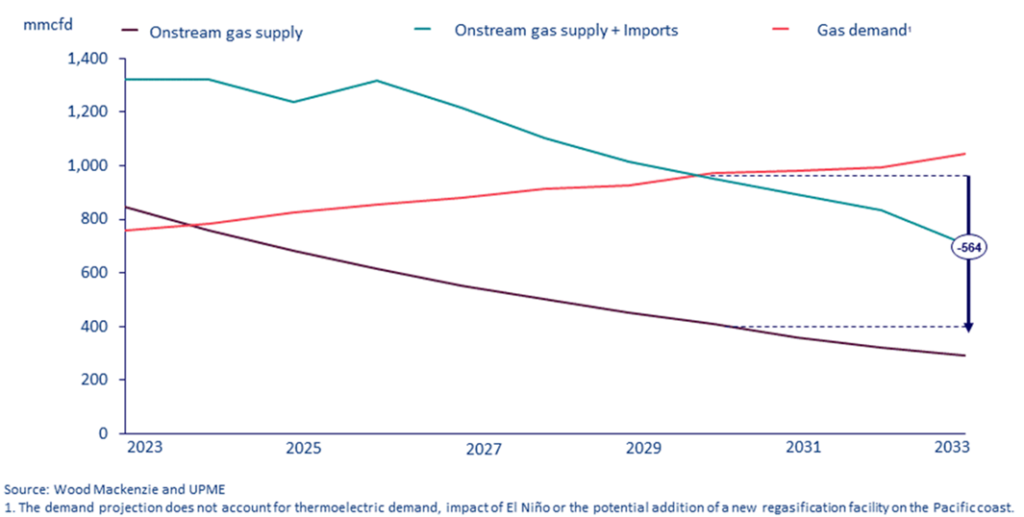

EC makes up 55% of Colombia’s domestic natural gas production at 129 mboe/d. Of the total natural gas sales, domestic sales make up 90%. Colombia imports 14 Bcf of natural gas per year, with production unable to outpace consumption in the long term. According to the EIA, the average lead time from feasibility established to first production is 4.4 years, giving EC a very narrow time frame to establish economic viability for projects.

Capex in natural gas during 2024 will heavily focus on domestic gas self-sufficiency to compensate for shortfalls, a trend that will continue through the decade.

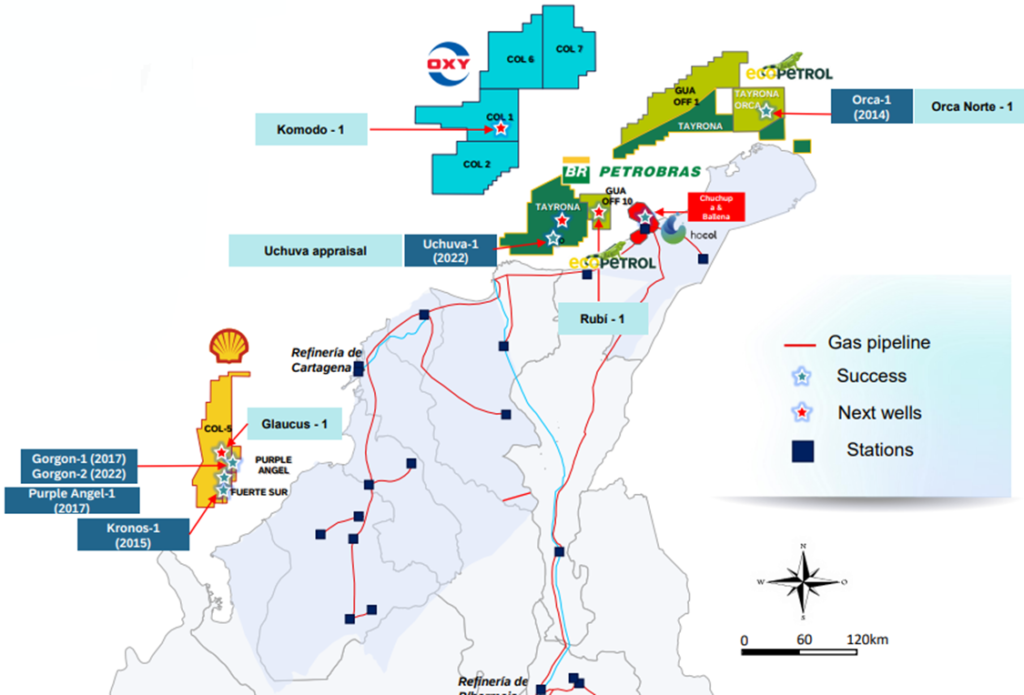

Previous discoveries in the Uchuva and COL-5 areas were promising but proved to be uneconomical for development despite peak output numbers being estimated to be ~100 mboe/d.

However, this has not deterred EC, which has continued to license exploration rights and conduct its own exploration in the offshore area. Orca Norte-1 is the most substantial EC-owned and operated exploration operation, confirming the existence of two previously undiscovered gas deposits in late February. However, the development of these deposits remains in limbo, with EC unable to affirmatively state if it would be economically viable. Other EC exploratory drills are expected in the 2024-2025 timeframe, with the Uchuva block undergoing further exploration in the quarter ending June 2024.

EC has stated that the Glaucus-1 in the COL-5 block, a 50-50 JV with Shell, has shown promising development results. Additionally, EC has given Petrobras a significant license in the North East offshore blocks, with the first drills expected sometime in mid-2024.

EC expects at least some of these projects to be commercially viable, and the first gas is expected to be in the 2027-2029 range. Gas output in 2024 is expected to bring total natural gas production to 135 mboe/d (thousands of barrels of oil equivalent) annually, or a 5% increase. Over the medium term, output may grow faster as more deep-water deposits are discovered in economically viable areas or if natural gas prices see a sustained increase.

Future Operations

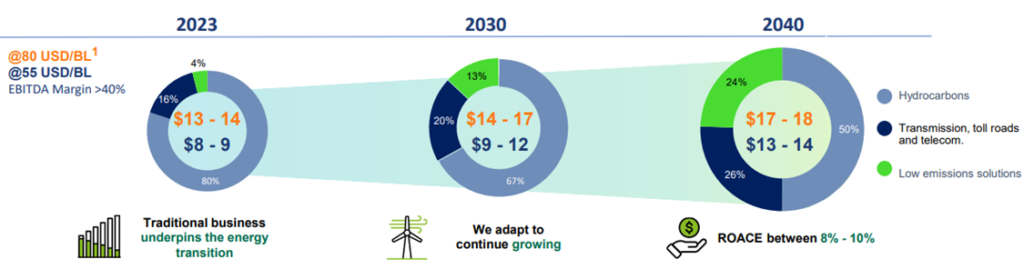

EC is targeting 50% hydrocarbons and 50% diversification by 2040. EC already derives 20% of its revenue through transmission, toll roads, and non-hydrocarbon energy sources like solar. The intent of this is to replace lost revenue from depleting oil assets and prevent stranded assets.

Some of this will shift toward a domestic and regional-looking business, with EC buying the majority-government-owned transmission business ISA for $3.6 billion. EC will expand its domestic transmission footprint by around 16% by 2026. Additionally, EC will target >1,000 MW of clean energy production by 2030 to help meet Colombia’s previously mentioned energy gap.

Export-hydrogen production is part of the diversification outside domestic power production, targeting 1 million metric tons per year by 2040 and already producing 130kt (thousands of metric tons) annually. The shift to 1 million tons annually could generate $400 million in additional EBITDA annually. Whether or not the “hydrogen Economy” will ever take off is still up in the air. Still, EC already has several large partners, including Mitsui and Siemens, for purchasing and production.

Combined, EC doesn’t expect a meaningful change in EBITDA growth as a result of the change to renewables and move away from its core business.

However, we feel that this is an untenable strategy in the long term, given diversifying away from your core revenue generator adds significant uncertainty about continuing operations. Considering that neighboring Venezuela’s PDVSA and Brazil’s Petrobras are projecting significant production expansion over the decade, EC’s aggressively diversifying feels too soon. A comparison made by the LATAM Energy Institute at Rice University topically likened South American oil to cocaine in the war on drugs. Just as reducing cocaine supply didn’t lessen demand, stopping Colombian oil production won’t reduce global oil demand—it will just shift production to other countries and cause EC to lose out on a significant amount of revenue.

Risk and Political Considerations

The largest risk is that the Colombian government owns 88% of EC, meaning the domestic political situation affects operational directives.

Politically, Colombia has made progress with its new constitution but still faces challenges with extremism and populism. President Gustavo Petro, a former socialist guerilla, has opposed oil and gas exploration. During his 2022 presidential campaign, he emphasized ending new oil projects to reduce the country’s oil dependency. Though specifics have not been released, he plans to shift the economy from relying on oil and coal to focusing on agriculture and tourism. However, in an interview with Le Monde, he later clarified that his issue was more with using oil revenue to fund government programs rather than solely as a stance against oil for environmental reasons. This makes him significantly different from other regional socialists like Brazil’s Lula or Venezuela’s Maduro, who heavily endorse oil.

Despite this, many in Colombia, including Petro’s supporters who draw a large base from the Petroleum Workers Union and the Columbian Treasury Secretary, are not outspoken critics. The risks of a quick transition are a hot-button issue in the country, which has likely moderated the early extremism of Petro’s future decisions. Additionally, midterm elections in Columbia were sobering for Petro and his party, losing a significant number of local seats in October 2023.

Since Petro’s presidency, no new oil exploration licenses have been issued in Colombia, although existing operations continue, and no laws have been passed preventing new permits in the future. EC is adapting by focusing on offshore development in the Caribbean and joint ventures in the US.

The government’s sale of its stake in the ISA transmission business to EC suggests they see EC as key to the energy transition, not something to eliminate. In our view, the political risks are priced in, and it’s unlikely that Petro’s government will drastically change its strategy of slowly weaning oil dependency during his term. This strategy will likely change with future leaders. The next election in 2026 will likely be the turning point for the strategy, whether it will be maintained or reversed.

Recently, Exxon was required to provide the Guyanese government an ‘unlimited guarantee’ that its operations would not meaningfully damage the local environment. Exxon is fighting this in court, and it has been stayed in favor of a large insurance policy pending appeal to a higher court. If the Caribbean community’s high court rules that the unlimited guarantee policy was legal, then it could put a lot of pressure on oil exploration in the region, including EC’s own development projects with Shell.

Much of EC revenue is realized in USD, with all costs being in pesos. At the present moment, the strong USD is advantageous for costs. However, dividends are paid in Pesos.

Outlook

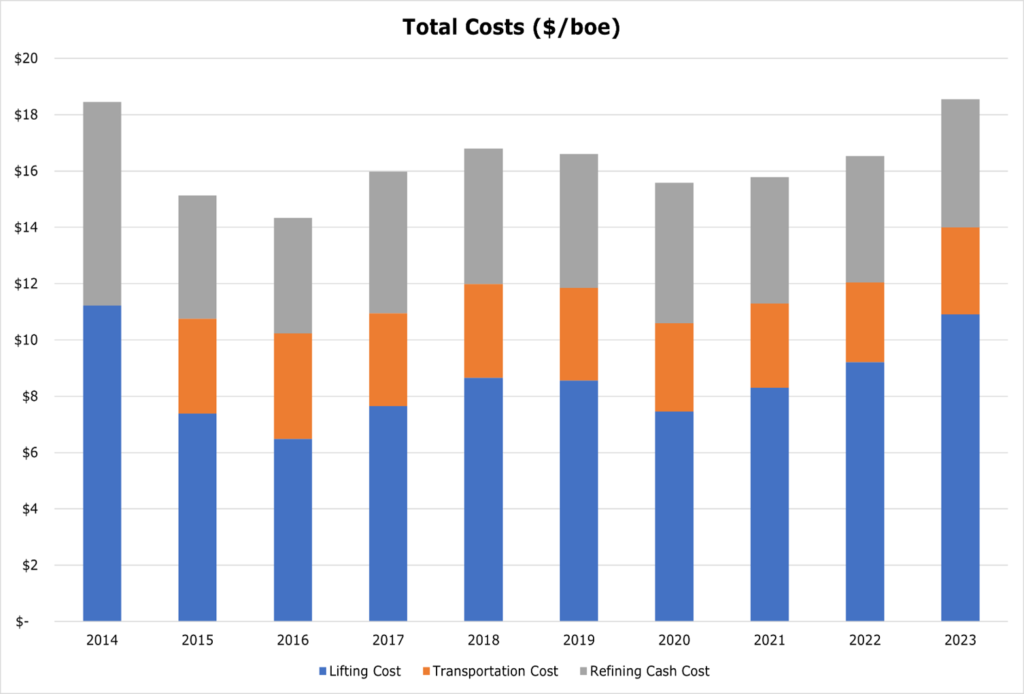

Despite the block on new exploration in Colombia, EC saw its highest level of production in 8 years, with a 3.3% increase in oil equivalent production or 737 mboe/d on average in 2023. Despite a significant depression in oil prices, EC maintained a solid EBITDA margin of 40.7%, which was above peers. Lifting costs increased by 18% compared to 2022, though this can be partially attributed to further Permian drilling changing the economics.

As oil production becomes more weighted to the Permian area, lifting costs will likely increase, though realized price may be higher as assets are closer to the point of sale.

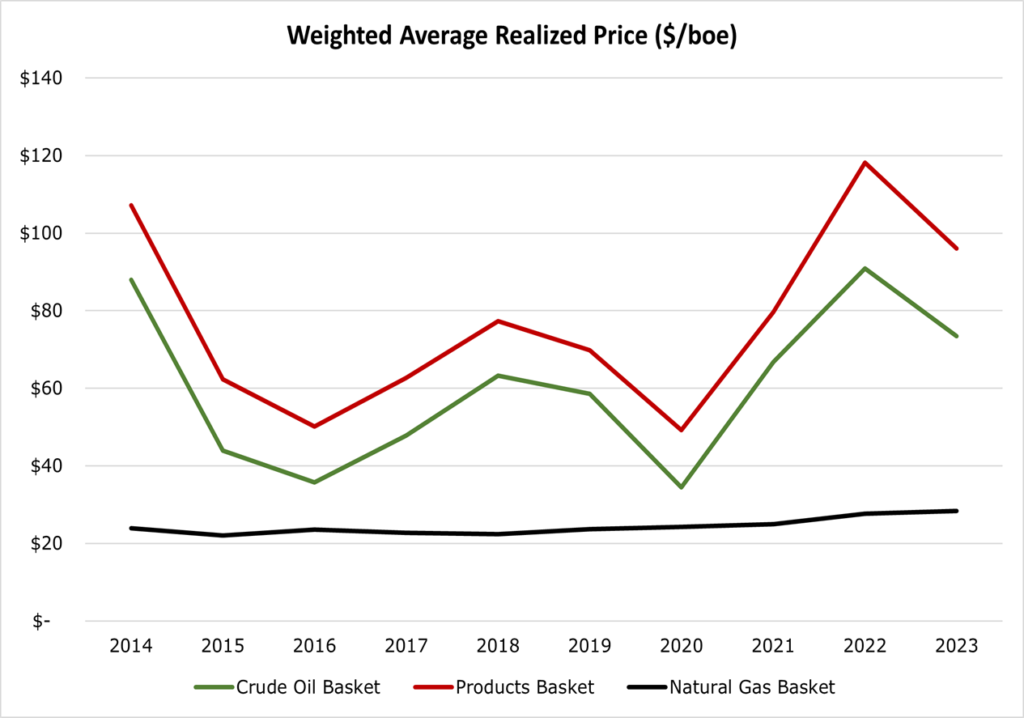

The realized export price for processed products was $96.08/bbl in 2023; for crude oil, it was $73.43/bbl. EC expects average Brent crude oil prices to be around $75/bbl for 2024. At this price level, the EBITDA margin will be pushed down to the ~38% neighborhood.

EC is expecting to spend $3.5-4 billion on exploration and production budget for 2024, with 360 development wells and 15 exploration wells across Brazil, the US, and the Caribbean offshore. Over the past 3 years, the exploration focus has been a 60-40 split between gas and oil. EC expects to put 37% of its capex budget toward projects in the United States, which should continue to maintain oil production levels. In addition to the typical E&P budget, EC will invest around $2.5 billion in transmission, infrastructure, and decarbonization projects in 2024.

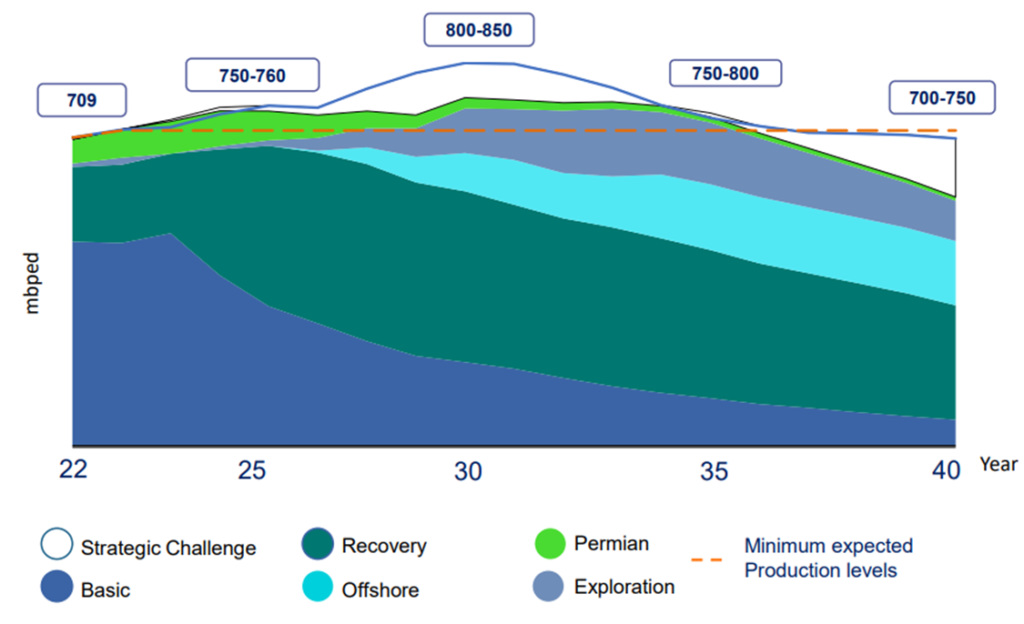

EC effectively has a production floor in place of 700 mboe/d, with a significant exploration profile of around 6 billion barrels in reserves and a reserve replacement ratio of 117%. Overall, aggregate production over the next decade will peak at 800-850 mboe/d (thousands of barrels of oil equivalent per day) by 2030 once natural gas operations reach full stride and fall to 700 mboe/d by 2040 as domestic wells begin to ramp down production and global oil demand is expected to begin to move down from its peak. EC expects production to be 725-730 mboe/d in 2024, which will likely improve over the medium term as more Permian expansion is conducted and if more offshore gas reaches economic viability.

The long-term debt-to-EBITDA target is to stay under 2.5x, of which EC is currently at 1.7x for the year ending December 2023. Over the last 5 years, EC has averaged a 78% payout ratio, with dividends being directly tied to operational results. With decreasing oil prices and significant amounts of capex pushed toward lower return assets in decarbonization, we expect the dividend, excluding special dividends, to be in the $1.90/share neighborhood or around 17.7% yield for fiscal 2024. The dividend could increase if offshore gas production turns out to be profitable or if the Permian footprint is significantly expanded.

EC’s strategic initiatives, marked by its expansion into non-domestic oil production and efforts to achieve gas self-sufficiency in Colombia, set a strong foundation for sustained growth in the short term. While the strategy to diversify from the core business does add some uncertainty, EC’s ability to leverage its existing infrastructure and revenue base to pursue opportunities in the medium term aggressively underscores its ability to sustain dividend yield and moderate capital appreciation.

Competitive Comparisons