Despite Neuroscience Setback AbbVie has Strong Recovery Ahead

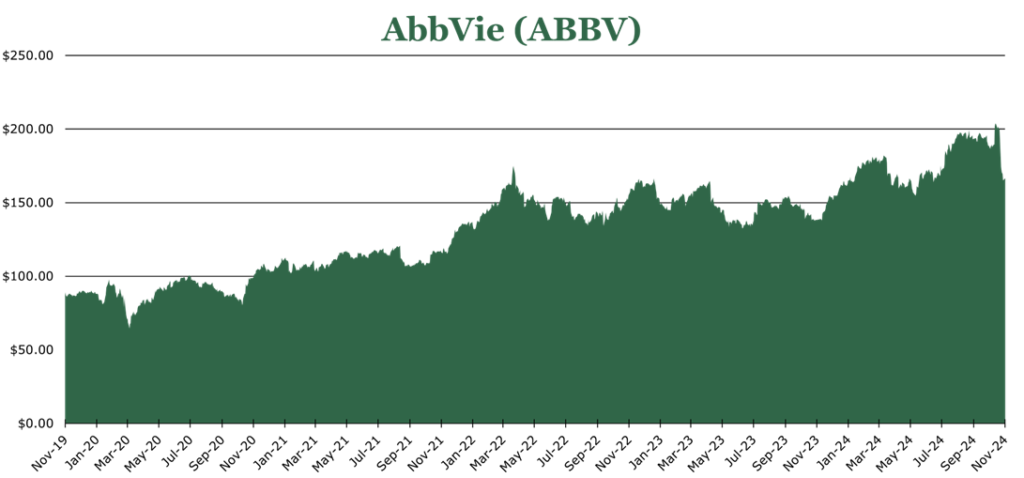

| Price $171.73 | Dividend Holding | November 22, 2024 |

- 3.95% Dividend Yield.

- Stock dropped 17.3% on the failure of Emraclidine in Phase 2 Trials, a drug only projected to make up ~7% of revenues.

- Aggressively expanding oncology offerings, acquiring ADC (antibody drug conjugates, non-chemo cancer drugs) expert ImmunoGen.

- Expects to replace Humira revenue in 2025 with two new immunology drugs and grow to be more than $27 billion in annual revenues.

- Shifting focus in neuroscience to Alzheimer’s and Parkinson’s, areas with few effective on-market treatments.

Investment Thesis

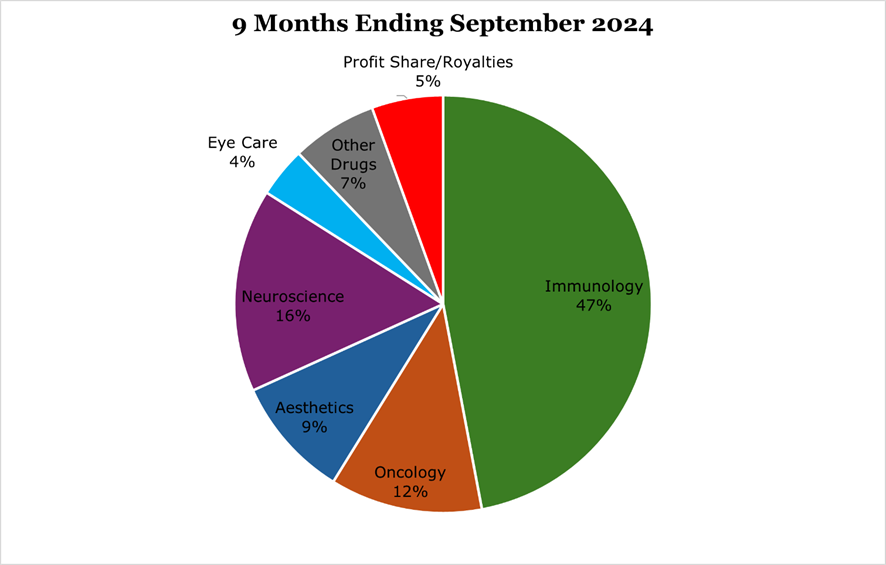

AbbVie (ABBV) is a biopharma company, made famous by its blockbusting Humira, at one point the best-selling drug in the world. As biosimilars have eroded Humira ABBV has gone on an acquisition spree to replace lost Humira revenues while also bolstering the future pipeline of the company.

Despite the positive outlook for a replacement pipeline, ABBV’s stock price has dropped 17.3%. The primary reason for this was the announcement that both formulations of the Schizophrenia drug Emraclidine failed to produce meaningful patient improvements during phase 2 trials. The drug was the original keystone to the $8.7 billion Cerevel acquisition in August 2024. Based on projections for peer drug Cobenfy (formerly known as KarXT), peak sales would’ve been between $3-4 billion per year, less than 7.0% of ABBV’s 2024 projected revenues.

Overall, the move to a diversity of drugs rather than focusing on blockbusting therapies reduces the risk to ABBV in the future. We are confident that management will be able to make up the Humira shortfall and continue to grow the top line. In the meantime, ABBV pays out a strong 3.95% yield or around 60% of earnings.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/Earnings)

EFV = E25 EPS X P/E = $12.00 x 18.0 = $216.00

An 18.0 P/E would put ABBV back to its long-term average.

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 5.3 | 5.0 | 4.6 |

| Price-to-Earnings | 19.6 | 18.0 | 16.6 |

Double Drug Bet – Immunology

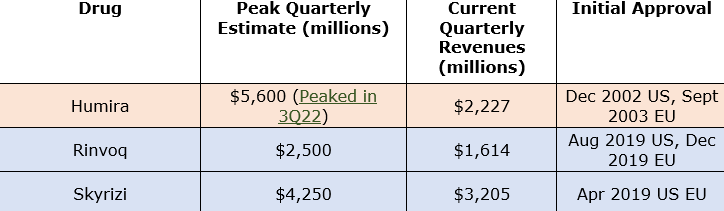

Since the February 2024 expiry of ABBV’s exclusivity rights, 10 biosimilars have been taken to market. While some analysts have pointed to the roll off being slower than expected, evidence points to existing PBM (pharmacy benefit manager) agreements. The largest of these, United Health and Cigna, will begin removing Humira starting in January 2025. ABBV now expects to end the year with Humira at $7.4 billion in sales, or approximately 13.2% of total revenues.

Skyrizi and Rinvoq are considered the revenue-replacements for Humira, combined they have already surpassed Humira’s current revenues, and are expected to surpass peak Humira revenues ($21.2 billion) in around 2025, and peak at a combined $27 billion in 2027. This is more than $6 billion ahead of previous estimates, and drug uptake has been far quicker than expected. In our view it is possible that the revenue peak comes later and higher than estimated given the wide breadth of clinical applications. For the 9 months ending September 2024, Skyrizi saw $7.9 billion in sales, a 47.9% year over year change. As of the 9 months ended September 203, Rinvoq saw $4.1 billion in sales, a 52.4% year-over-year increase.

Compared to other areas, the pipeline in immunology is slightly smaller with much of the development work still focused on applying Rinvoq and Skyrizi to new pathologies. We feel that this will likely remain the case for the near-term.

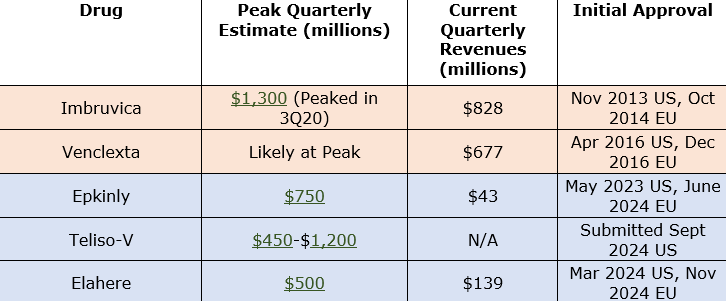

Oncology

ABBV is starting to focus heavily on Oncology ADCs (antibody drug conjugates, non-chemo cancer drugs). ABBV closed on a $10 billion acquisition of ImmunoGen who has more than 40 years of experience in the ADC space.

On the near-term approval pipeline from the ImmunoGen acquisition is Teliso-V, an ADC lung cancer drug which already has breakthrough therapy approval. The more conservative Wells Fargo estimate put peak Teliso-V revenues at around $1.8 billion annually, but AstraZeneca’s own estimates for its ADC-peer-drug Dato-DXd are peak sales of $5 billion annually. We feel the higher end of this estimate could be more accurate, with ABBV stating that it will seek to expand the therapeutic applications of Teliso-V with a new payload under the name ABBV-400.

Overall, we expect the oncology segment to grow as a percentage of revenue, especially if ABBV continues to invest heavily into the segment. For the 9 months ending September 2024, the oncology segment saw 10.4% revenue growth year over year.

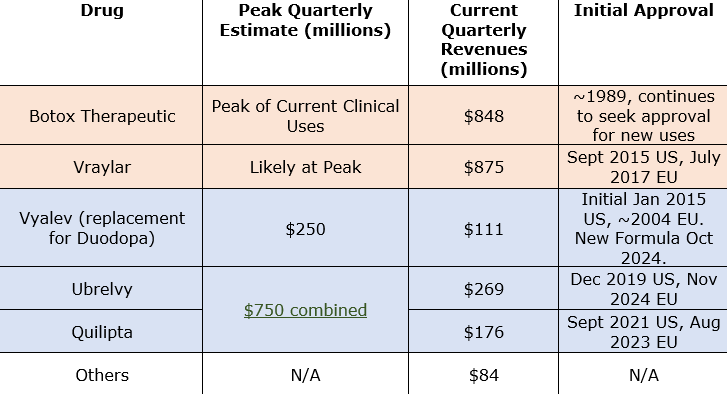

Neuroscience

As previously discussed, ABBV’s previously promising Schizophrenia drug Emraclidine failed phase 2 testing. While it is possible that in a higher dose the drug could work, or have another therapeutic use like for Alzheimer’s psychosis, our view is that ABBV will likely shelve the drug.

ABBV has been moving its way into Alzheimer’s therapy, including a recent $1.4 billion acquisition of Aliada. We expect a similar trend over the medium term as Alzheimer’s still does not have a strong on-market treatment for prevention or symptom mitigation.

Other Segments

As previously stated, ABBV purchased Allergan in 2020 for $63 billion – a 45% premium at the time. Allergan has leadership in aesthetic medicine, including being the primary global producer for Botulinum Toxin A, commonly marketed as Botox.

Botox has led the aesthetic medicine market since its introduction in the late 80s and holds substantial brand recognition and a long product cycle with aesthetic medicine requiring several injections over a long period.

For this reason, our view is that Botox offers a large sales funnel for other aesthetic products over a much longer period than in non-aesthetic medicine and should provide a strong baseline for ABBV. For the 9 months ending September 2024, aesthetics saw a 1.2% decline in sales fully due to new competition and headwinds in China for Juvederm, a dermal filler.

Risk

The largest risk facing ABBV is drug failure. Typically, internally developed drugs take around $1 billion to bring to trial and acquiring trial drugs trade at 3-5x peak sales. In the case of Cerevel, the failure of Emraclidine brought down peak revenues from the acquisition from around $3.5-$4.5 billion per year down to just $500 million – $1 billion.

Financials

Overall, we expect revenues in 2027 to be between $65-70 billion, recovering to pre-Humira biosimilar levels by 2025. The main short-term headwind is margin and earnings pressure from Humira rolling off PBMs before Skyrizi and Rinvoq reach peak-Humira replacement levels in the latter part of 2025. For the full year 2024, ABBV expects the impact to earnings to be a 1.5% decrease compared to the full year 2023, ending the year at around $10.94/share.

We expect free cash to recover quickly in 2025 with uptakes of new approvals and the end of rebating. Early in a drug’s lifecycle there is often aggressive rebating to encourage adoption and secure a PBM deal, which can lower margins and free cash generation.

ABBV has a net debt to EBITDA of 2.5x for the trailing twelve months, which is in line with peers. We do not see substantial risk on the balance sheet, with ABBV holding more than $7.2 billion in cash and generating $5.2 billion in free cash for the quarter ending September 2024.

Conclusion

Despite the positive outlook for a replacement pipeline, ABBV’s stock price has dropped 17.3% on the heels of a drug trial failure. ABBV now trades at a 2024 low, and at just 15.2x earnings.

We are confident in management’s ability to replace Humira revenues in the immunology segment while also continually targeting growth opportunities elsewhere. In the meantime, investors can take advantage of the 3.95% dividend yield backed by strong quarterly free cash generation.