Camping World Ready for Strong Upcycle

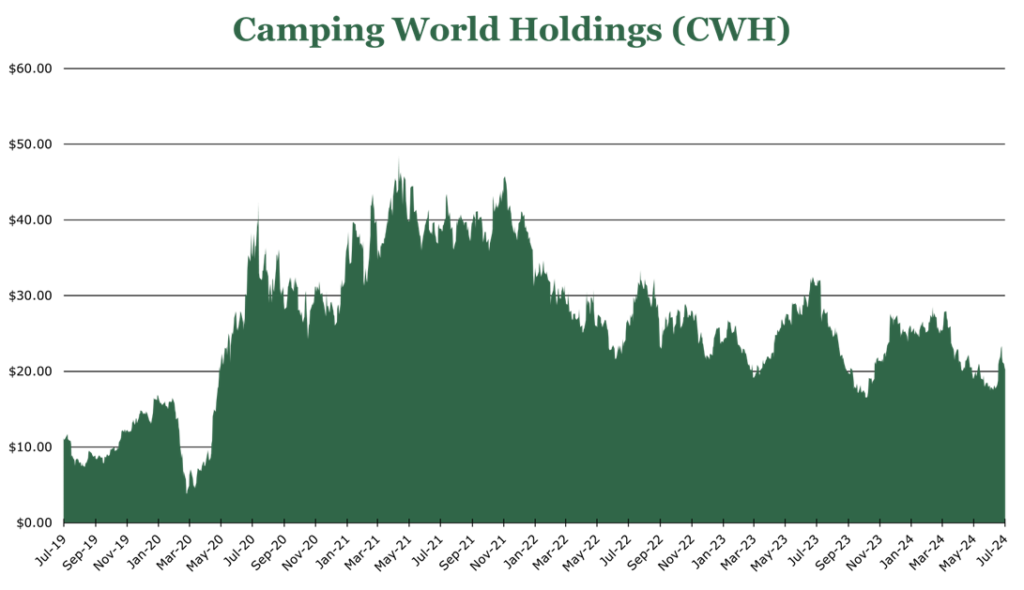

| Price $20.22 | Core Holding | July 25, 2024 |

- 2.44% Yield.

- Strong market share growth, moving from 18% to 25% in a single quarter.

- Aggressive expansion campaign, hoping to add just over 100 locations by 2028, largely through acquisitions.

- Largely finished with inventory management ahead of the market, with 90% of inventory now containing the cheaper 2024 models.

- Internal actions to move SG&A expenses back from 80% of gross profit back down to 70%, which should provide incremental net income margin gains.

Investment Thesis

Camping World Holdings (CWH) is the world’s largest RV dealer, including both its Camping World mainline brand, and its Good Sam service brand. New units make up around 50% of sales, used units make up 25.6%, ancillary retail sales make up 13.5%, with the remaining being the Good Sam RV club membership and insurance/financing broker.

CWH is engaging in a massive expansion, hoping to add more than 100 locations by 2028. Already, it has increased its market share to 25% from its historical 15-18% with macroeconomic conditions providing very favorable M&A valuations. Additionally, consumers tend to purchase RVs for the monthly payment rather than the outright cost, meaning that if interest rates begin to fall the incoming upcycle will have substantial tailwinds. In the meantime, CWH pays out a 2.44% dividend yield.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $2.00 X 17.2 = $34.35

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.0 | 0.9 | 0.8 |

| Price-to-FFO | 16.3 | 15.0 | 13.5 |

Market Conditions

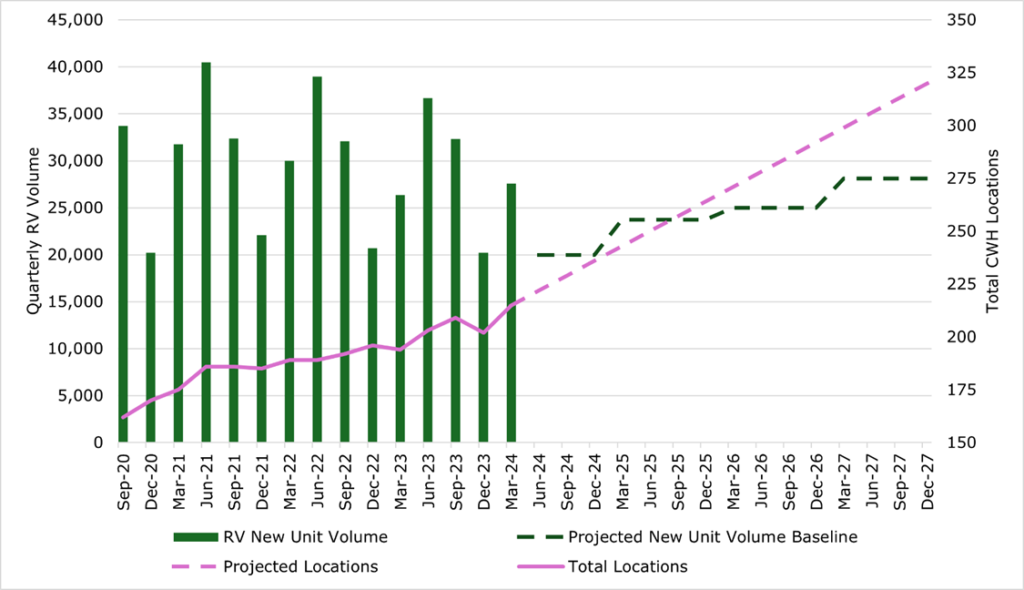

| Previous Peak (FY17) | Current (TTM as of September 2023) | CWH 2028 Estimates | |

| CWH Dealer Count | 124 | 205 | 320 |

| New RVs Sold (industry-wide) | 472,000 | 385,000 | 450,0000 |

| Used RVs Sold (industry-wide) | 689,000 | 803,000 | 800,000 |

| CWH EBTIDA Margin | 9.2% | 4.9% | 8.0% |

A major component of the RV business that separates it from the automotive industry is that people do not buy based on price but buy for the monthly payment. With interest rates high, CWH has reported the retail lending desk sees rates around 9% for the average customer, which put many consumers out of the affordability range.

Broad pricing deflation in the RV market has been seen for the 2024 models, with 2023 models and even 2022 models still sitting unpurchased, expensive, and quickly going out of date. In the quarter ending March 2024, CWH reported that its manufacturers are pricing new models at about 10% less than 2023’s models.

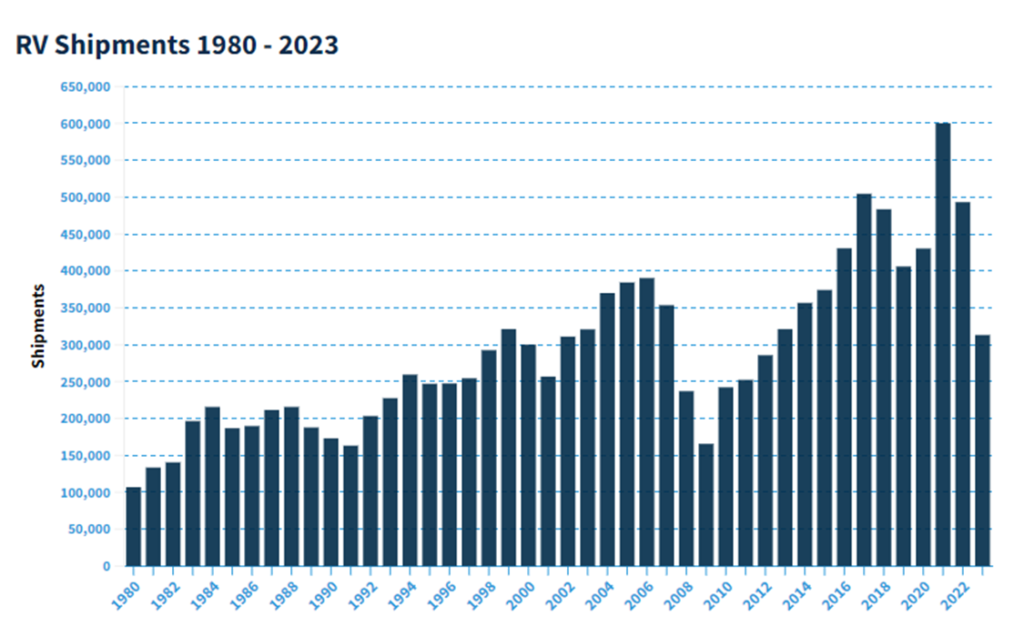

The entire RV industry shipped around 313,000 new units in 2023. The drop was attributable to both a drop in consumer spending on durable goods, and a contraction in the number of RV dealers. The first half of 2024 is expected to stay depressed, with broad acceleration in the second half of the year. CWH expects industry-wide sales to be around 330-350,000 units. As rates drop though, CWH expects sales to increase at a pace similar to rate cuts, assuming a return to around 380,000 units once rates drop by 200bps. Overall, the slump seen in the market is one of the harshest downcycles since the 2008 financial crisis.

Primary Business

The primary business of CWH is owning and operating RV dealerships, along with retail locations that sell related products and services

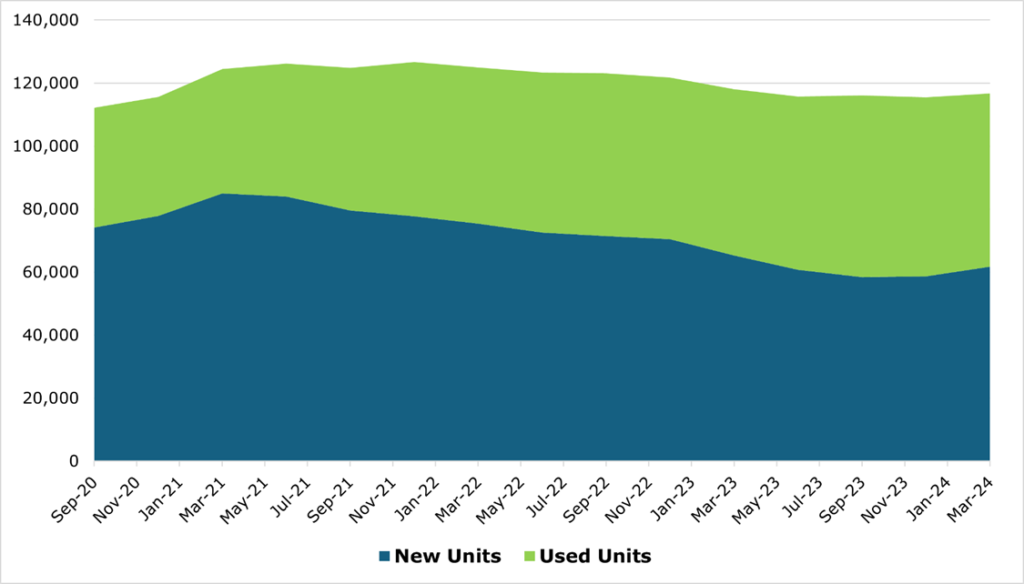

As previously mentioned, new inventory pricing has seen deflation for new 2024 models, which has provided a huge bump in new sales. Volumes were up 21.3% and revenue up 1.4% in the quarter ending March 2024. On a same-store basis, new unit volumes were up 15.5% year over year, but revenue was down 3.7%. The smaller revenue increase relative to the massive increase in volume is due to the average selling price falling 16.5% across the business both as a function of deflation in new model pricing and continued inventory management action. In our view, revenue growth will likely track closer to volume growth in the latter half of the year.

In the used business volumes have seen a decrease of 14%, with revenues falling 24.1%. On a same store basis, volumes fell 17.3% with revenues falling 28.1%. Despite this fall, it is still on track to be the second largest year for used sales for CWH, with the second half of the year seeing people trade up to new 2024 models.

CWH executed a campaign of offloading old inventory over the trailing six months at a substantial discount. During the quarter ending March 2024, CWH reported the average selling price for a new unit fell 16.4%, with used prices falling 11.7%. This offloading is mostly complete with CWH reporting only around 3,800 2023 models still in inventory, with more than 90% of new inventory models being 2024s, with historically low used inventory levels and a buying pace 60% lower than March 2023. In the used area, CWH is planning to keep substantial cash on hand, as it expects an excess of used inventory in the fall to winter of 2024, that they can acquire for cheap.

The retail product and service segment sales saw revenue fall 14.3% year over year, though on a same-store basis it was slightly lower at a decrease of 8.9%. CWH reports that this was due to overall lower industry volume muting ancillary service and product growth. We believe that as the industry recovers in the second half of 2024 this segment will follow the industry’s growth.

Good Sam

The RV industry is highly cyclical, with all parts of the business impacted by the broader industry trend. CWH hopes to offset some of this cyclicality with financing, insurance, and club membership revenues.

Good Sam is the largest RV club in the US, operating like AAA but for RVs. Good Sam, in exchange for a membership fee, offers roadside assistance, discounts on insurance rates, and rebates for service offerings. Overall, Good Sam’s membership fees represents just under 1% of revenues for CWH but do provide a sales funnel to CWH for its ~2.1 million members. Finance and insurance revenues grew at 4.4% year over year in the quarter ending March 2024. Advantageously, CWH is an agent in insurance and financing transactions, receiving commission and assuming no risk.

During the 1Q24 earnings call, management alluded to expanding the Good Sam business outside of just RVs into other recreational businesses such as marine or aviation. This will be done at the discretion of the Good Sam management team, who has been granted high autonomy in the process of expanding its business. This could cast a broader net to capture the upside of the entire recreational market, rather than just RVs.

Expansion

CWH has been embarking on a massive campaign of expansion, increasing store count to 215, or up 10.3% year over year, representing a net growth of 13 since the end of 2023. This expansion has caused a substantial increase in market share. During the quarter ending March 2024 CWH reported it grew its market share from its typical 15-18% to 25%.

CWH intends to continue this campaign as M&A valuations are becoming increasingly attractive, intending to continue at a pace close to 7 locations per quarter to 2028 when it is targeting a total of 320 stores. CWH states that as older inventory has become comparably more expensive to new models, a backwardation occurs that could allow for favorable valuations for purchasing independent dealers.

For the remainder of the year, it only plans to organically expand into 2 locations meaning much of the growth will continue to come from an aggressive expansion footing. We expect market share to continue to climb through the expansion plan to 2028.

Same-store expansion includes more digital offerings, and auctions. Overall, the used market share for CWH is still in the “single digits”. The used RV market size is nearly double that of new RVs but is dominated by party-to-party private sales. While also providing a new outlet for inventory management, the new auctions initiative will hopefully capture more of this used market share with CWH giving non-wholesale buyers the option to finance their winning bids and helping orchestrate transportation/delivery to those who bid online.

Another potential effect of the auctions market is providing enhanced inventory cycle time. In the RV market a broad wholesale and auction market does not exist like it does for heavy machinery or automobiles, meaning old inventory has been historically harder to offload to a more limited number of customers. In the first 5 auctions run since December 2023, CWH reported “hundreds” of sales, and 2.2 million unique views.

Risk

CWH’s core businesses is highly cyclical, and as people purchase based on payment rather than price, it is also very beholden to interest rates. We continue to believe that the Federal Reserve will be unable to move rates more than 50bps for 2024, which would put downward pressure on the industry-wide sales estimates of 350,000 for 2024 and the more optimistic 380,000 by 2028.

CWH was able to get ahead of price deflation in 2024 by conducting steep discounting of new units and offloading used inventory to prepare for an influx of used inventory during the latter half of 2024. If pricing deflation continues over the medium term, it could hurt margins even if volume continues to increase.

Conclusion

Gross margins for new units were 13.9% in the quarter ending March 2024, which is an increase from the pre-pandemic trend. We expect new margins to remain in the 10-15% neighborhood. In used, however, margins have contracted to 17.5%, compared to 20.6% in the quarter ending March 2019. As new 2024 model pricing deflation hits consumers, we expect a movement back to the 20% range in used units over the medium term. Additionally, CWH is conducting some cuts in SG&A spending to keep it at around 70% of gross profit. For the full year 2023, it was 80%. Thus, we feel like 2024 will also yield some net income margin expansion back toward the 5% neighborhood, where it was 0.1% for full year 2023.

Currently, CWH yields 2.44%. Typically, free cash flow is weakest in the final and first quarter of the year as sales slump in the last quarter of the year and inventory is rebuilt during the first quarter of the year. This year, we do expect timing differences as CWH is currently purchasing 60% less used inventory than last year in preparation for an expected influx of cheap used RVs in the latter half of the year. For the full year 2023, free cash flow was $179.7 million.

Currently CWH has a net debt to EBITDA around 13.4x, which could inch higher if interest rates do not induce more consumer spending and CWH continues its current expansion pace. CWH does hold substantial real assets, with around $220 million in used inventory, $219 million in parts, and $116 million in other real assets. While CWH only holds about $29.7 million in cash, it has around $148 million in floorplan financing accounts. All together, we feel that the risk associated with increasing debt to EBITDA is at least partially offset by a strong holding of real assets on the balance sheet.

Currently, the RV market is in the beginning stages of the upcycle, which we believe will accelerate significantly once interest rates begin to come down. At the same time, CWH is in an excellent position to continue to grow its market share with aggressive M&A. Despite some headwinds from continued inventory management actions, CWH still yields 2.44% and has cast a wide net to capture the upcoming upcycle.

Competitive Comparisons