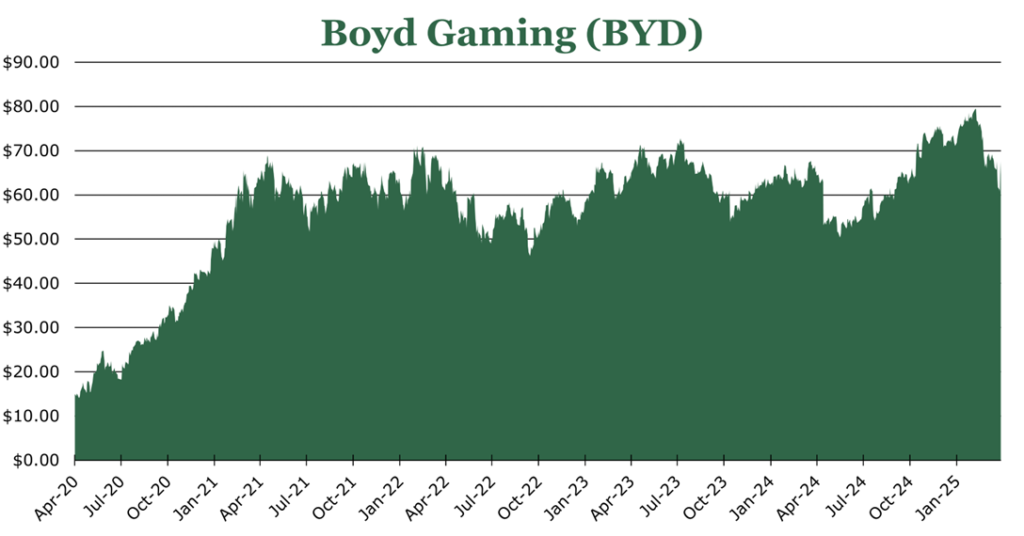

Boyd is Betting on High Shareholder Returns and Long Term Growth

| Price $64.07 | Dividend Holding | April 16, 2025 |

- 1.12% Dividend yield, committed to repurchasing at least 7.5% of outstanding shares in 2025.

- Despite some economic uncertainty, Boyd estimates 2025 will be overall flat outside of the online segment, where it still expects 8.6% bottom line growth.

- Boyd has a $317.5 million cash position and currently generates $556.7 million in annual free cash.

- $200-250 million in annual maintenance capex required, with $200 million additional slated for renovation and $100 million for breaking ground on a new Casino in Virginia.

- Fast growing online segment, with online revenue growing 43.6% on top of a 5% equity stake in FanDuel.

Investment Thesis

Boyd Gambling (BYD) is a US gambling company that operates casino-resorts across the US. It owns 28 properties and operates 27 and has a rapidly growing online footprint boosted by a 5% equity stake with FanDuel.

Boyd has prioritized shareholder returns, raising the dividend to $0.18 per share quarterly or a 1.12% dividend yield. Additionally, 2024 saw an aggressive repurchases of $685.9 million in shares which represented 7.9% of outstanding shares. For 2025, Boyd has committed to at least $100 million in repurchases per quarter another 7.5% of outstanding shares for the full year 2025.

Despite further economic uncertainty on the horizon, we believe that Boyd is well-positioned to weather it due to its strong geographic diversity and continued investment in future projects. It is important to note that consumer spending data has remained strong, and a soft landing may still be possible. If economic conditions hold up, we believe that Boyd is a strong addition to a portfolio seeking a modest dividend yield with the potential for capital appreciation.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $7.20 X 15.2 = $109.00

We believe that the online segment has a substantial growth avenue as legislation bends toward legalization. Boyd also owns a 5% equity stake in FanDuel, which represents significant value. FanDuel’s parent company, Flutter, is guiding toward a 176% increase in FanDuel EBITDA in 2025, with a 33% increase in revenues. Based on competitor DraftKings, a high EBITDA multiple would mean the 5% FanDuel stake could be worth as much as $1.4 billion or 26% of Boyd’s market cap.

| Method | FanDuel Figure | 5% Stake Value |

| Revenue Multiple (Based on DraftKings) | 2.5x forward revenue, $7.66 billion estimated 2025 revenue | $958 million |

| EBITDA Multiple (Based on DraftKings) | 20x forward EBITDA, $1.4 billion estimated 2025 EBITDA | $1.4 billion |

| Revenue Multiple (same as Boyd) | 1.7x forward revenue, $7.66 billion estimated 2025 revenue | $651 million |

| EBITDA Multiple (same as Boyd) | 16.0x forward EBITDA, $1.4 billion estimated 2025 EBITDA | $1.1 billion |

Typically, operators who own casinos on the Strip trade at a premium to non-Strip peers. However over the long-term, we believe that the market will price in Boyd’s earnings power through geographic diversity and bring its P/E more in line with peers.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 1.4 | 1.4 | 1.3 |

| Price-to-Earnings | 9.7 | 8.9 | 8.9 |

SeekingAlpha Analyst Consensus

Operations

Boyd operates 28 properties and an online gambling operation. In a typical year, between 65-70% of revenues are generated from gambling operations, with reimbursements from third party agreements such as market access and revenues from online gambling make up between 10-15%, and the remaining under 10% is typically lodging services and food and beverage.

Companywide, Boyd saw revenues grow by 5.1% in 2024, with operating margins at 24.1%. Operating margins decreased by 240bps due to increases in labor costs and insurance associated with new renovations. For 2025, Boyd expects margins on partnered and operated properties to be flat. Though, with the expected EBITDA increase in the online area, discussed later, we expect a marginal topline increase provided economic impacts of tariffs are limited.

| Las Vegas (non-Strip) | ||

| Year Ending December 2024 | Change from 2023 | |

| Occupancy Rate Rooms | 65.3% | +335 bps |

| Average Daily Rate Rooms | $78.87 | -0.3% |

| EBITDA Margin | 47.9% | -286 bps |

| Revenue Per Square Foot | $1,324 | -3.6% |

Per unit per day assumes a 360-day operating year

Total revenues for the non-Strip and non-downtown casinos in Las Vegas were down 3.6% year over year during 2024. While Boyd does not publish hold rates or win rates, it did say competitive pressures from a new local casino in December 2023 did impact two properties. These two properties dragged down the table game hold by 7.8% and slot play by 3.7%. Aside from those two, management stated that the rest of the non-downtown casinos all performed in-line. Costs did increase as Boyd increased the wages of all staff to the new minimum rate of $15/hr along with increases in property insurance costs.

| Las Vegas (Downtown) | ||

| Year Ending December 2024 | Change from 2023 | |

| Occupancy Rate Rooms | 70.5% | +150 bps |

| Average Daily Rate Rooms | $54.83 | -0.1% |

| EBITDA Margin | 36.2% | -220 bps |

| Revenue Per Square Foot | $2,197 | +3.5% |

Total revenues increased 3.5% on downtown casinos, which Boyd reported is due to a broad increase of revenue across categories and record Las Vegas tourism numbers. Hotel occupancy increased by 150 bps to 70.5%, which increased average guest spend by 4.6%. Increases in gambling revenue were led by an increase in slot play of 3.2%. By property, the broad increase was led by the newly renovated Fremont and Main Street Station properties, both of which completed renovations in late 2023.

Similar to the rest of Las Vegas, higher labor costs decreased margins with increased insurance costs from the renovation also impacting the bottom line.

| Midwest & South | ||

| Year Ending December 2024 | Change from 2023 | |

| Occupancy Rate Rooms | 49.4% | -114 bps |

| Average Daily Rate Rooms | $88.84 | -1.9% |

| EBITDA Margin | 37.1% | -117 bps |

| Revenue Per Square Foot | $2,097 | +1.0% |

Midwest and South saw revenues increase 1.1% year over year. The largest portion of the increase was due to average guest spend increasing by 7.2%, though it was largely offset by increase in promotions and comps. Gambling revenues increased by a small amount, driven by an increased table hold of 1.4%. As with the rest of the properties, the broad increase in minimum wage drove down margins. In June 2024, the segment added a new casino and entertainment venues at the Treasure Chest in Louisiana, which we expect will provide a boost to the top line provided economic conditions hold steady.

Online

Through Boyd Interactive, Boyd offers both direct to consumer online gambling in several states as well as a B2B backend for other providers to offer branded services in exchange for a fee. Additionally, Boyd has a 5% equity stake in FanDuel, which is one of the largest sports betting operators in the US and Canada.

We believe that this is the breakout segment for Boyd and has strong prospects. Online grew its revenues 43.6% year over year. EBITDA margins grew by 299 bps to 17.7%, though it should be noted that Boyd did realize a one-time market access fee during 2024 which boosted both margins and revenues above recurring levels. Excluding the impact of one-time fees on 2024, Boyd expects to realize an increase to EBITDA in 2025 of 8.6%

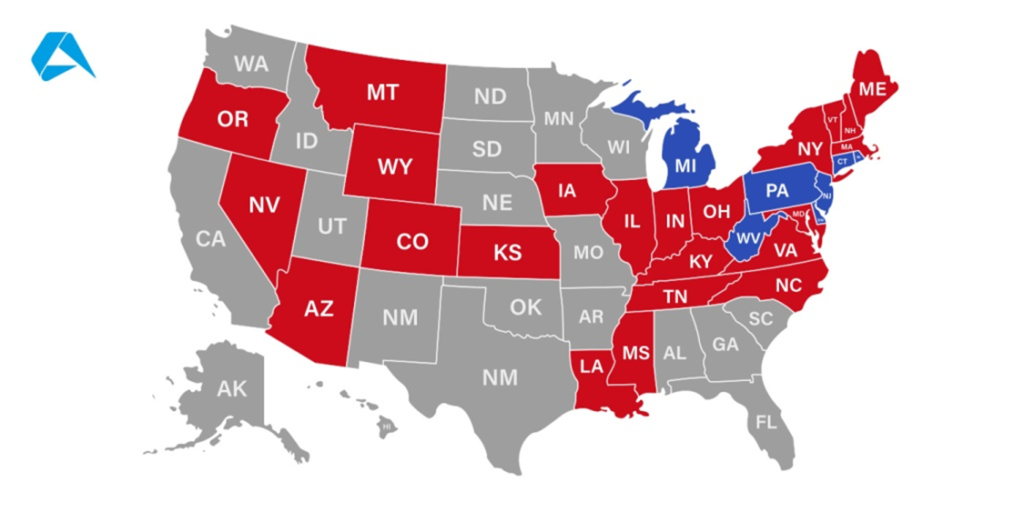

Online gambling in the US is still in its infancy. In 2024, total online-gambling revenue was only around $16.5 billion, with expectations of growth exceeding a CAGR of 12% to 2030. FanDuel’s parent company, Flutter, forecasts sports betting alone could reach $39 billion by 2030. We believe that this is a conservative estimate. While only New Jersey, Pennsylvania, Michigan, West Virginia, Delaware, Connecticut and Rhode Island have fully legalized online gambling, several others have legalized online sports betting.

Additionally, it allows Boyd an avenue into the Canadian market which has shown strong growth since Ontario legalized online gambling in 2022. Other provinces have not yet fully legalized it in a competitive way, with most opting for a province-run system. However, we believe this still offers opportunity for back end B2B contracts.

Risk

Historically, casinos perform like the consumer discretionary sector. However, as they are heavily dependent on travel and high levels of discretionary spending, they are impacted more than most consumer discretionary companies during intense downturns or recessions. In economic slowdowns that do not precipitate a recession, casinos can hold up as long as spending doesn’t collapse – as is presently the case. In a deeper slowdown, depending on how deep the contraction is, Boyd will likely strategically close locations. It should be noted that Boyd typically puts these into mothballs, rather than writing them off as is the case with the Eastside Cannery property since 2020.

Potential competition was identified in the Illinois area, where Boyd will be engaging in some expansion operations to replace an older casino in 2026. Management commented that it expects specific impacts to be minimal, though Illinois is moving toward a laxer legislative environment which may reduce the number of casino-based gambling customers.

Financials and Outlook

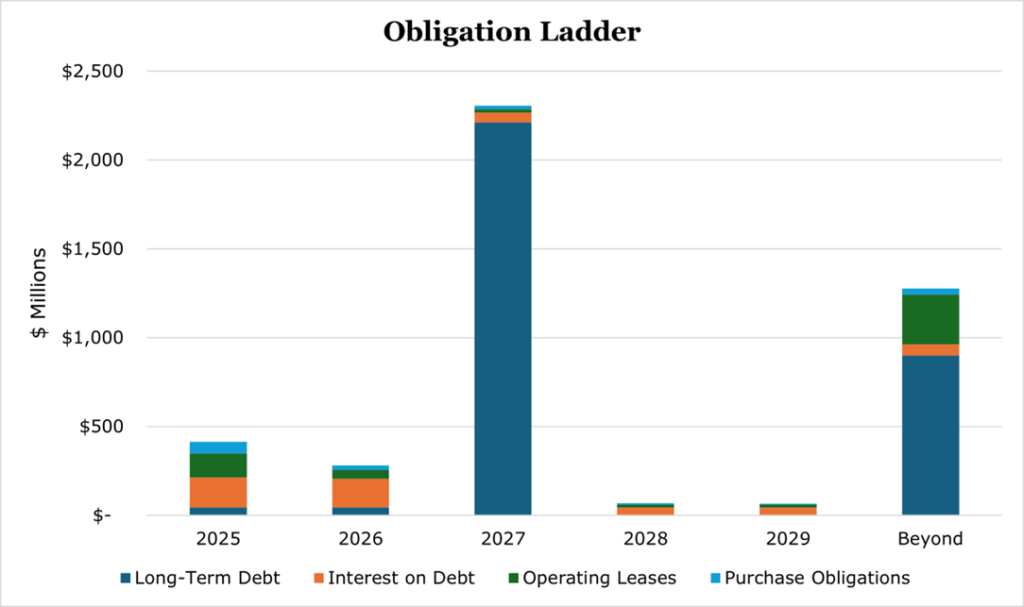

Boyd ended 2024 with a 2.5x leverage ratio, 2.9x when including mandatory lease obligations. This is not out of line with peers considering the capital-intensive nature of opening casinos. For 2025, Boyd has a total of $413.3 million in obligations due, and $284.2 million in 2026. Boyd ended the year with a $317.5 million cash position, and $556.7 million in free cash. Even if operations take a substantial hit due to a downturn, we believe that Boyd is not in a position that threatens the long-term prospects of the company. By the time the most substantial portion of debt comes due in 2027, we believe that any economic downturn will have softened or at least rates will be lower to allow for more attractive refinancing.

During 2024 Boyd aggressively repurchased its own shares, conducting $685.9 million in repurchases. For 2025 $640.5 million remains authorized – though we expect a top up – with Boyd committing to at least $100 million per quarter or at least 7.5% of outstanding shares. Boyd currently pays a small dividend yield of 1.12% or $0.68 annually. Since reinstating the dividend in 2022, Boyd has increased the dividend at about $0.04 per year. We believe this is more conservative than they could reasonably afford, though given the high prioritization on repurchases and uncertain macroeconomic environment it is understandable.

We do not expect there to be a capital-intensive M&A conducted during 2025. During the earnings call for the year ending December 2024 some analysts did probe about expanding the online area, though management seemed apprehensive about saying definitively where, or if, it would focus M&A activity. Likely, expansions in the online area would be internally sourced as scaling its existing platform is likely to be less capital intensive than acquiring a company with a different stack. Thus, we expect any M&A conducted to reflect legislative-related requirements, such as for the sake of licensure.

For 2025, management expects to spend between $600-650 million on capex. Boyd has reaffirmed that its annual baseline cash requirement for renovations and maintenance is $200-250 million per year. Given conditions have still held up, it expects to continue its $100 million annual additional spend for bringing hotel rooms up to date, completing 3 more hotels by the end of 2025.

For smaller scale expansion, Boyd will spend $100 million in expanding the convention and event areas at the Ameristar St. Charles in St. Louis. The new plan will add 43,000 sqft of convention space, on top of the existing 20,000 sqft convention center. Additionally, some of the money will go toward the construction of Cadence Crossing which will replace the aging Jokers Wild. Initially the new casino is expected in mid-2026 and will have more entertainment options than the current facility. Over the long-term, Boyd has stated it will eventually allocate capex toward adding hotel and more entertainment facilities to the area though no specific commitments were made. The new Cadence Crossing Casino will be surrounded by the 12,000 home planned community of the same name, of which around half of the planned homes have been constructed.

The largest single project is a $750 million casino resort in Norfolk, with a planned 200 room hotel with 1,500 slots and 50 table games by late 2027. For 2025, Boyd expects to spend $150-200 million to set up a transitional casino opening by November 2025. The transitional casino will only be breakeven. Boyd’s management says the transitional casino is part of the development deal, so not much advertising or promotional dollars will be utilized to target profitability. While not allocated for 2025, Boyd has stated that it will be replacing its riverboat casino in Illinois with a brick-and-mortar facility after some laxing in Illinois gambling laws. Initial construction is likely to begin in 2026, and management hopes it will bring back loyal players. The existing riverboat is dated, and has seen its gross gambling revenue fall by 23% since 2017. A similar $100 million spend on a modern on-land facility at the Treasure Chest in Louisiana was successful, doubling foot traffic and increasing gross revenue by 81.6%.

Conclusion

Over the long term, Boyd will likely scale its online offerings as legislation shakes out and is planning on a $750 million greenfield casino project in Norfolk which will reach more than 1.8 million people. While the gambling industry experiences heightened sensitivity to consumer spending trends, consumer spending is currently still resilient. In the short-term, Boyd has continued its commitment to shareholder returns with a strong repurchase program and an increase to its dividend. We believe that it represents a strong case for long-term capital appreciation.

Peer Comparisons