Big 7.7% Dividend Yield for Undervalued Stellantis

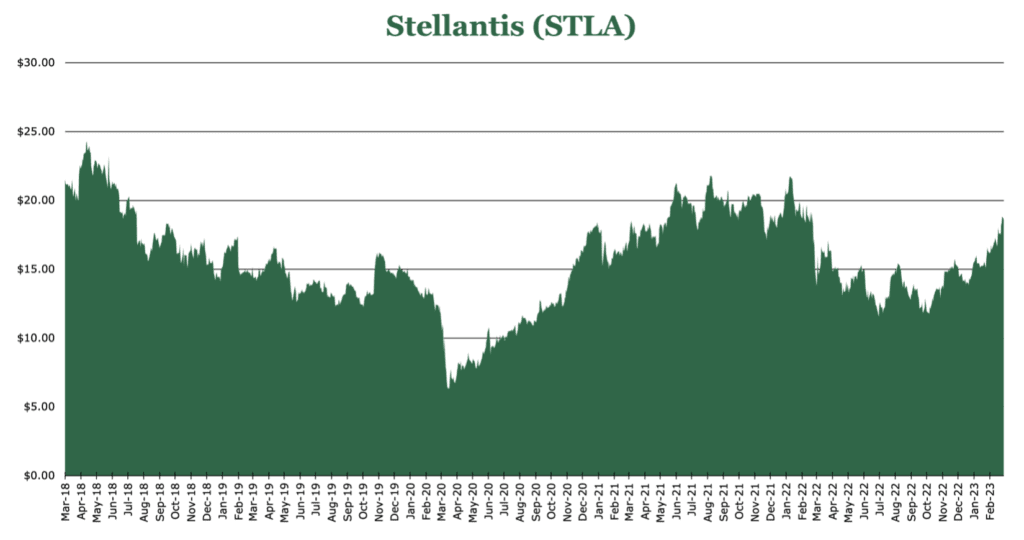

Price $18.47 Dividend Holding March 7, 2023

- Strong Auto Brands include Chrysler, Jeep, Dodge, Peugeot, Fiat.

- 7.7% Dividend Yield is the highest among peers.

- Compelling valuation with a 4.3x P/E compared to sector median of 15.0x.

- 2030 Strategic plan emphasizes global EV (Electrical Vehicles) capacity huge global base to pull from.

- Realizing consumer gains from IRA (Inflation Reduction Act) in North America, focusing on larger utility vehicles in the United States.

Most of the reportable segments of STLA are reported in Euros. We have converted these to USD at a EUR/USD of $1.06.

Investment Thesis

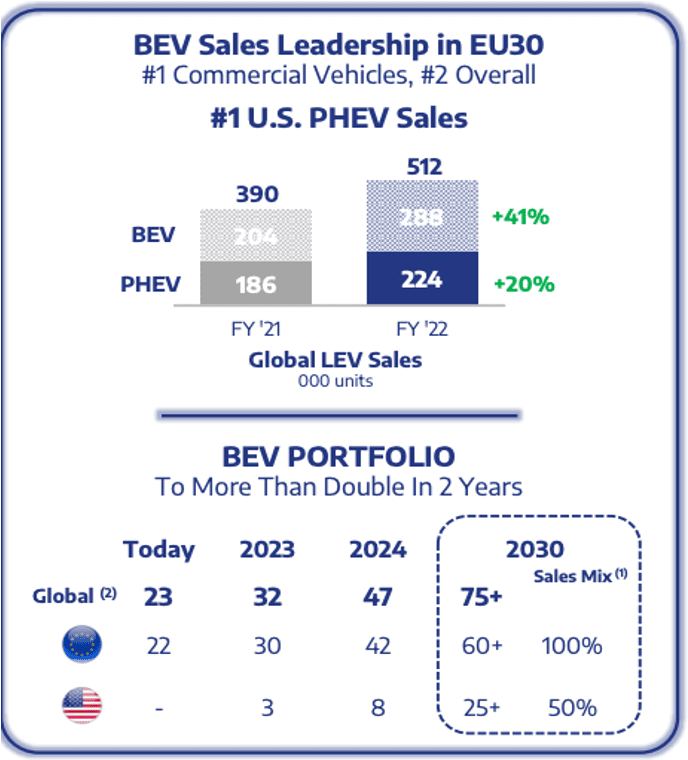

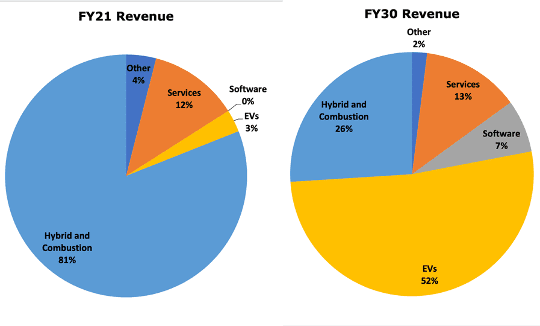

Stellantis (STLA) is a global automobile manufacturer formed on a 50-50 merger with Fiat-Chrysler and PSA Group. Across its 16 brands, it has a global sales footprint in 130 countries and a manufacturing footprint in 30 countries. STLA is focused on moving away from the standard combustion engine and launching more green vehicles. These include, EVs (Electric Vehicles) PHEVs (Plug-in hybrid), LEV (low-emissions vehicles), and Hydrogen. Through its 2030 initiative, STLA is targeting >$20 billion in free cash flow, 400 GWh of battery production, and a significant product mix shift toward EVs. Global EV sales for STLA are up 41% year over year.

Despite the strength of STLA’s portfolio and brands, the current price does not reflect this positioning in our opinion. STLA has an incredible valuation for its expected expansion in revenue of 65% by 2030. STLA has an actionable plan to shift its mix to EVs while also taking into account consumer and commercial demand. It has also significantly bolstered its OEM supply chain through battery and hydrogen production JVs. We believe that STLA is too profitable and too cheap to ignore.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $4.2 X 7.2 = $30.24

We have assumed P/E in the middle range of the typical 6.0-9.0x P/E range for large automakers.

| Stellantis (STLA) | E2023 | E2024 | E2025 |

|---|---|---|---|

| Price-to-Sales | 0.3 | 0.3 | 0.3 |

| Price-to-Earnings | 4.2 | 4.5 | 4.3 |

Operations

The highlight of American operations is STLA’s #1 market share for PHEV (Plug-in Hybrid Electric Vehicle), with a 26% year over year increase in orders. Despite being only #4 in total for American operations, Stellantis has highest average transaction price in the United States, at an average of $53,000 per unit. From 2024 onward, all new launches in North America will include an EV version to gain a foothold through consumer familiarity. As of the end of year FY22, STLA did not offer any EVs in North America. By the end of FY23, it will begin to market 3, increasing to 8 in FY24.

STLA is the #2 market participant in Europe with a 20% market share. Low Emissions Vehicles (LEVs) and EVs are an increasing part of the sales mix. LEVs have seen an increase of 620bps in mix to 17% of STLA sales and pushing STLA up to 16% market share in European LEVs. By 2030 STLA estimates 100% of sales will be EVs in Europe, offering 75 models. However, we are pessimistic on this number as procuring copper and lithium will become increasingly difficult and expensive.

Operating margin has seen huge expansion globally, with the South American segment seeing a 132% expansion and the Asian segment seeing 48% expansion. STLA is attempting to take advantage of the growing middle class in the Middle East and Africa through mobilizing new regional production. Currently 30% of cars sold by STLA in the MENA (Middle East-North Africa) region are locally produced. The target is 70% or higher by 2030.

Despite semiconductor shortages, STLA had a record 13% operating margin company wide. This is a 120bps increase year over year and has exceeded the 2030 target. Combined shipments are up 4% year over year to just under 3 million units in 2H22. Full year results are down 2%, at just over 6 million units. STLA attributes the drop toward the 8% decrease in European deliveries due to shortfalls in logistics and semiconductor deliveries.

Monetization Opportunities

With the Inflation Reduction Act reducing cost barriers for electrification, many businesses and consumers will be seeking to upgrade their combustion engine fleets. We discussed the granular details in our EnerSys report. While most will elect for EVs, there is increased exploration in alternative fuels including hydrogen. Particularly, hydrogen is seen as a viable alternative for semi-trucks and heavy-duty pickups where batteries would be too heavy or take too long to charge. The Inflation Reduction Act does have provisions for similar grants for hydrogen infrastructure. Currently STLA buys its hydrogen cells from OEM Symbio (EPD.PA). Stellantis will purchase a stake in Symbio in 1H23 to accelerate plans for mass-market hydrogen pickups by 2026. The size of the investment has not yet been announced.

LG (LGES) has a joint venture to open a 45 GWh in production capacity facility in 2024. For $4.1 billion USD in establishment costs, it will be the only battery cell manufacturing plant in Canada at open. Additionally, a smaller $2.5-3.1 billion joint venture with Samsung SDI to produce up to 33 GWh of production capacity. Production is targeted to begin production in 2025.

Data and software as a service is a high-margin business model that has not been captured in automotive sector as it has been in other sectors. This may take the form of fleet management as a service, analyzing delivery data, and other software-enabled services. STLA estimates this could hold $20 billion USD at 40% gross margin. We are pessimistic about introducing SaaS (software as a service) elements on the consumer side, as consumers have begun to push back against the model. However, there is still room for such services on the fleet vehicles and B2B side.

Risk

The primary concern facing STLA is battery production and procurement. STLA expects to produce 400 GWh annually in 2030. This would be enough to power 4,000,000 EVs, though the target is 5,000,000. However, our main concern with capacity is the acquisition of copper, lithium, and other rare earth metals required for large gigawatt scale battery production. The USGS (United States Geological Survey) projections place it on the ”supply constrained” list starting in 2H22. Similarly, by 2030, global lithium production will need to increase 600% from the 600,000 tons mined in 2022. We remain pessimistic on the 100% EV adoption in Europe and 50% adoption in the US by 2030 for this reason.

Demand for EVs is strong, and competition is fierce and well-funded. In an effort to gain market share Stellantis is targeting larger utility vehicles in the United States, as it is only the 4th in the US at 11% market share. This is a decrease from 2020, where it had 12.2%. According to Stellantis, “Vehicle sales and profitability in the North America segment were generally weighted towards larger vehicles such as utility vehicles, trucks and vans, consistent with overall industry sales trends in the North America segment, which have become increasingly weighted towards utility vehicles and trucks in recent years.”

Competitive Comparisons

| Stellantis (STLA) | General Motors (GM) | Ford Motors (F) | Honda Motors (HMC) | Hyundai Motors (HYMLF) | Toyota (TM) | |

|---|---|---|---|---|---|---|

| Price-to-Earnings (FWD) | 4.26 | 6.55 | 8.06 | 8.39 | 5.60 | 9.90 |

| Price-to-Sales (TTM) | 0.31 | 0.37 | 0.33 | 0.36 | 0.31 | 0.71 |

| Price-to-Book (TTM) | 0.77 | 0.84 | 1.20 | 0.53 | 0.49 | 0.91 |

| EV-to-EBITDA (FWD) | 1.28 | 7.02 | 10.34 | 7.44 | 8.85 | 12.07 |

| Dividend Yield | 7.64% | 0.89% | 4.62% | - | - | 2.51% |