Bath and Body Works Has Long Term Earnings Potential

| Price $39.19 | Dividend Holding | December 13, 2024 |

- 2.2% Dividend Yield

- Loyal customer base, with loyalty members making up 80% of sales.

- 85% of the supply chain originated in North America, mitigating tariff risk.

- Produces 55% of its end products in-house, with 40% of products on offer being seasonal only.

- Peer leader in sales per square foot with $1,074/sqft in sales.

- Expanding into ‘adjacent’ markets like products marketed at men and products marketed to Gen Z to boost new-customer growth.

Investment Thesis

Bath and Body Works (BBWI) is a North American chain of home-good stores specializing in scented products and self-care. BBWI was formed after L Brands spun off Victoria’s secret into its own publicly traded entity (VSCO), with L Brands changing its name to Bath and Body Works. In recent years BBWI has begun to target running leaner, focusing on expanding its demographic reach and off-mall sales.

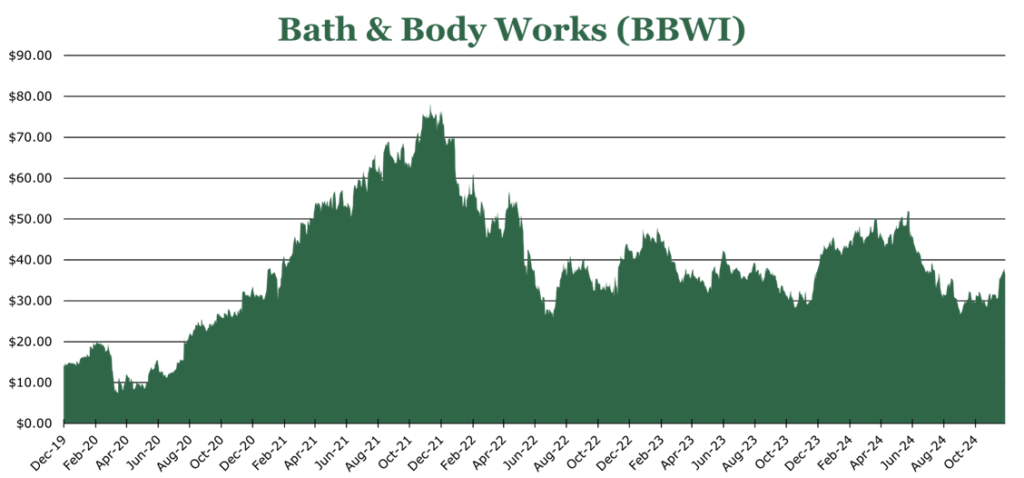

With macroeconomic uncertainty and dissipating tailwinds in soaps and sanitizers post-COVID, the stock has dipped 10.3% on a year-to-date basis and now trades at just 12x January 2025 earnings.

Over the long term the targeted expansion into products like haircare and the emphasis on repeat customer loyalty give BBWI long-term strength. Coupled with cost-saving actions to reduce debt and boost margins, we believe that BBWI has long-term earnings potential it has yet to unlock. In the meantime, investors can take advantage of its 2.2% yield.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $3.60 X 13.4 = $48.24

A P/E of 13.4x would bring BBWI in line with discretionary retail peers, as well as more in line with its long-term average P/E of 13.7x.

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.1 | 1.1 | 1.0 |

| Price-to-Earnings | 12.0 | 10.8 | 10.0 |

Core Operations

BBWI operates 1850 corporate-owned stores in North America, and franchises 510 locations internationally. Stores are typically small footprint, and the core of sales are made up of home fragrance products, soaps and sanitizers, and body care.

On a per-segment basis, all segments grew low single digits year over year, maintaining high market share. Sales dynamics have begun to shift, with buy-online pick-up-in-store growing by 40% year over year, now representing 25% of digital sales. Digital sales grew 1.5% year over year, with in-store sales growing 4.4%.

The international segment currently makes up under 5% of sales, but management has stated that there is many opportunities internationally with low penetration in target markets. The quarter ending November 2024 saw international sales decline 11.1% year over year decline due to middle eastern conflicts, with middle eastern franchises making up 50% of the international segment. Excluding the middle east, management stated that the international area grew by double digits.

Over the long-term, it is likely that BBWI will expand into high conviction markets like the United Kingdom with corporate-owned stores. However, we don’t expect this to occur until the company reaches its longer-term deleveraging and operating margin goals, and until global macroeconomic conditions improve, which could take until the latter part of the decade. The pace of international openings, 13 for the quarter ending November 2024, is approaching that of North America at 16.

BBWI has top-tier customer loyalty which should continue to boost seasonal and promotional offerings. Typically, BBWI releases new seasonal offerings every 6 weeks and creates more than 7,000 new products per year. The pace of new products drives sales both through FOMO (fear-of-missing-out’) and novelty, with seasonal offerings representing around 40% of products. As of the quarter ending November 2024, BBWI had 38 million active loyalty members, growing 4% year over year. Loyalty members contribute 80% of sales.

To maintain its high pace of new products, it operates a single manufacturing facility called ‘Beauty Park’ in Virginia, responsible for 55% of finished goods and 30% of components. This concentration has allowed a high level of inventory optimization, with the typical goal being 60-70% of seasonal store demand being pre-ordered.

The overarching theme of the in-store retail side of the business over the last 5 years has been transitioning to less on-mall foot-traffic dependent locations. As of the quarter ending November 2024, off-mall locations represent 55% of the corporate-owned North American footprint.

Overall, we see little reason to be concerned over the slow pace of on-mall dispositions, as BBWI delivers retail-leading sales per square foot. For the quarter ending November 2024, of corporate owned-stores, BBWI closed 19 on-mall locations and replaced them with 35 off-mall locations.

| Store | Sales per Square Foot in 2023($/sqft) |

| Bath and Body Works | $1,074 |

| Macy’s | $210 |

| Sally’s Beauty Holdings | $~366 |

| Victoria’s Secret | $588 |

| Ulta | $772 |

’Adjacencies’ and Novel Offerings

A specific priority area for BBWI has been the ‘adjacency’ market. Products for consumers that are not typically associated with their core demographic or still drive sales due to their novel nature and physical proximity to core products. These adjacencies include men’s care, hair care, lip care, and laundry; combined representing 10% of quarterly revenues.

On the non-core customer side, new customer growth has been driven by lip care which tends to target Gen Z. For the quarter ending November 2024, BBWI reported sales in the lip-care area doubled. While specifics are not public, management stated that men’s products represent the largest part of the adjacency space. Additionally, men’s products alone represent an estimated $10 billion addressable market.

On the product adjacent side, hair and laundry products have drawn more new-to-brand customers than other products, with hair care products seeing a 13% new-to-brand customers rate.

Management stated that adjacency categories have low awareness, and the bulk of sales are still driven by core customers. However, marketing spend was boosted by 100bps to 3.5% of revenues to increase awareness. Given Gen Z consumption preferences skewing online we expect that the lip care line, or other Gen Z targeted products, will be driven by online sales. In other areas, our view is that the sales dynamics will not be materially different from existing product lines.

Risk

Overall, the risk of trade-down dynamics in a recessionary environment would put pressure on the entire business. Management emphasized that parts of the business are more recession resistant than most believe, stating that its typical consumer seeks ‘bang for buck’ rather than simply low prices – similar to the lipstick effect. In a more pressured environment, the lipstick effect alone would not be able to offset traffic decreases.

On the tariff side, 85% of the BBWI supply chain is US-originated. Therefore, the risk while still present for the international footprint, is better than that of peers.

Financials

Overall quarterly sales were up 3% year over year, which was above expectations, though it is important to note that the quarter included an extra week which BBWI says accounted for around 200bps of the increase.

Better mix coupled with lowering input costs, drove revenue per unit up 1%. We believe that BBWI is uniquely positioned to take advantage of favorable mix dynamics. On the non-seasonal side, mature products have better margins at scale, with seasonal offerings and partnerships like Netflix’s Stranger Things driving both new-to-brand customers and repeat-customers.

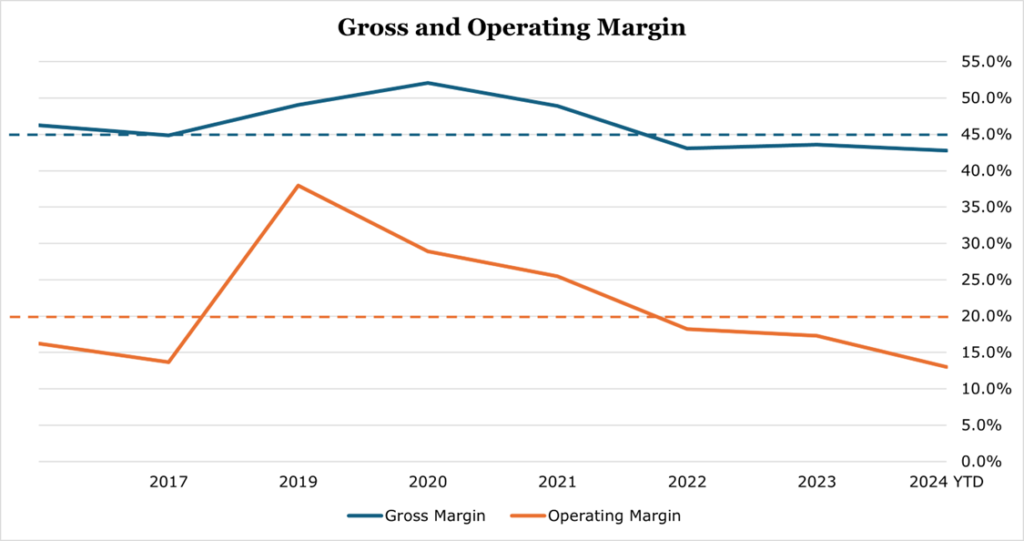

Over the long term, BBWI is targeting gross margin of 45%, which will be achieved by a combination of mix improvements and lower input costs. For operating margin there have been some minor short-term pressures from upping the marketing spend and continued tapering of covid-related tailwinds in soaps and sanitizers. However, the long-term goal of 20% operating margin will come from the goal of dropping SG&A (selling general, and admin) expenses to 25% of revenues from 30% currently.

As of the trailing twelve months ending November 2024, BBWI had a net debt to EBITDA of 3.3x, which is still above the 2.5x target. However, BBWI is on the path to reach its 2.5x target by the end of 2027. Year to date in 2024, it has retired $200 million in debt, with the average interest rate on debt decreasing after 2025.

For the full year 2024, BBWI expects to generate free cash flow of $675–$775 million. Currently, BBWI has $191 million in repurchase authorization remaining or about 2.2% of outstanding shares. BBWI pays out a dividend of 2.2%, or $0.80 per year, which management expects to increase in line with earnings over the long term.

Conclusion

BBWI has increased its guidance for the full fiscal year January 2025 and now expects sales to decline just 2.5% (versus an earlier 4%) with the EPS floor being raised $0.10 to $3.15. This could be revised higher, with consumers spending more than anticipated during the early months of the holiday season. Overall, we believe that BBWI offers the potential for long-term earnings growth from cost savings and customer loyalty, along with a safe 2.2% dividend in the short term.

Peer Comparisons