APTV’s Car Parts Valuation Contrasts its High-Tech Reality

| Price $67.71 | Growth Holding | May 29, 2025 |

- APTV is spinning off its lower-margin electronic distribution business, retaining high-margin technology segments.

- Spin-off structured as tax-free distribution to shareholders, with new APTV retaining investment grade rating while separated EDS business expected to be sub-investment grade.

- 1.6x book-to-bill, expecting around $31 billion in gross new bookings during 2025.

- $1.1 billion in cash on hand, and more than $1.6 billion in annual free cash generated during 2024.

- Operating margins improved 150bps to 10.7% in 2024 through workforce reductions and automation, with guidance for 12.1% operating margins in 2025 and automation targets of 30% by 2026.

- Non-automotive revenues providing buffer during automotive production decline (estimated 5-7% contraction in 2025), with defense/aerospace higher-margin business offsetting cyclical headwinds

Investment Thesis

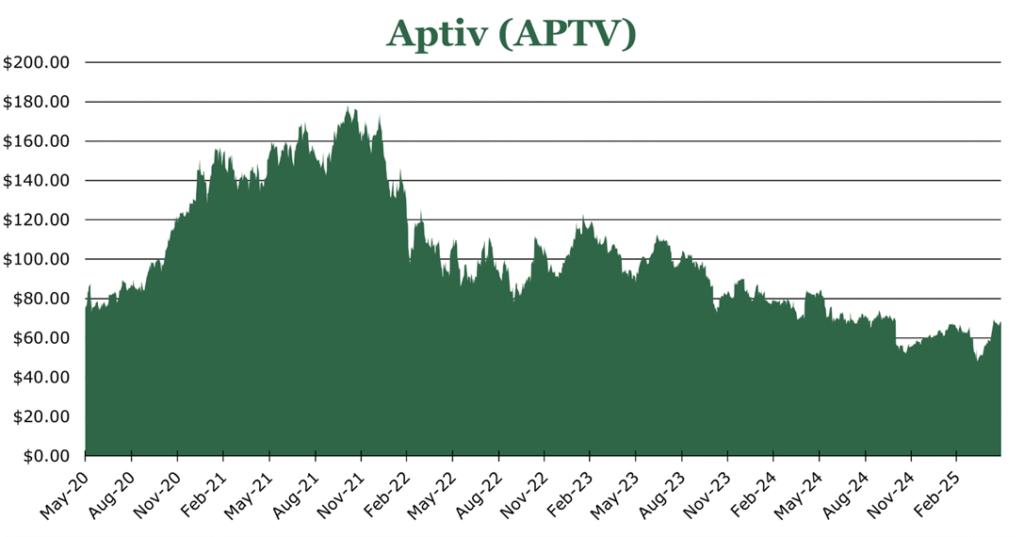

Aptiv (APTV) is an component and software supplier traditionally for auto OEMs. In January 2025 APTV announced it would be spinning off the more mature EDS (electronic distribution system) business, while retaining the higher-growth user experience and engineered components segments, with an expected closing date of March 2026. While the spin-off announcement did result in some rebound, the stock still has a trailing twelve month return of -18.6%.

APTV has expanded its footprint into non-automotive sectors as well as securing a record $31 billion in gross bookings at a 1.6x book-to-bill ratio. Despite the announced transformative (tax free) spin-out, the market is still pricing APTV like it is a typical automotive supplier.

The spin-off represents a catalyst that we believe will unlock significant earnings power by separating APTV’s high-growth, high-margin technology and specialized component businesses from the mature and largely commoditized EDS operations. While automotive headwinds are present in the short-term, we believe that APTV’s strong free cash generation will be able to support the continued repurchase of shares as well as investments in further growth.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY27 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E27 EPS X P/E = $7.0 X 15.9x = $111.23

We believe that the current P/E of 9.6x undervalues the growth avenues that are avaliable to APTV. While the current company gains only around 30% of its revenues from non automotive sectors, the post-spin off APTV entity will likely make a concentrated effort on diversification in the medium term.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 0.8 | 0.7 | 0.7 |

| Price-to-Earnings | 9.5 | 8.5 | 7.5 |

SeekingAlpha Analyst Consensus

Spin Out of EDS

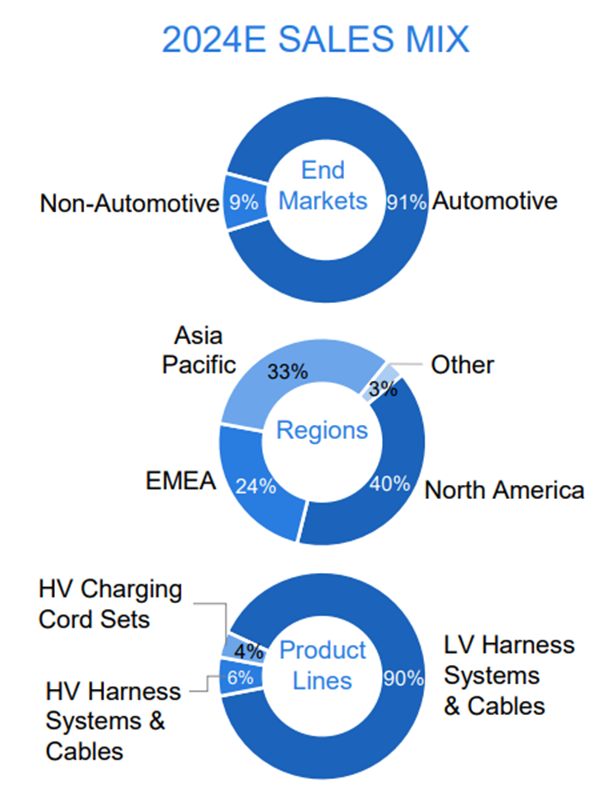

In January 2025, APTV announced that it was spinning out the Electronic Distribution System business, which contains the power connection cable business, and the EV charging cord business. For the full year ending December 2024, EDS represented 41.8% of revenues, or $8.3 billion, with revenues falling 6% compared to 2023.

The EDS segment is facing headwinds related to lower vehicle production schedules globally, though particularly China. The downstream impact was high-voltage revenues specifically being down “just shy of 20%” according to management. However, the EDS segment did secure a major North American OEM for commercial truck platforms during the quarter ending March 2025.

The EDS business is much lower margin, historically having a high single digit to low double-digit EBITDA, ending 2024 with a 9.5% EBITDA margin (less restructuring and one-off charges). In the short term, we expect EBITDA to be weighed down by footprint ‘rotations’, with APTV closing two facilities in China and moving them to Central America and North Africa.

Over the long term, the growth prospects of the segment are a bit tighter, with a flatter addressable market and value chain linked entirely to automotive production numbers. However, it is important to note that the EDS segment had $18.4 billion in new bookings during 2024, a company record. Despite being more mature than the other segments in growth prospects, the EDS segment still has strong results. For the quarter ending March 2025, the segment saw $1.5 billion in bookings, with $1 billion being EVs.

For 2025, APTV expects the EDS segment’s revenue growth to be flat, increasing to mid-single digit growth over the long term provided electrification trends continue in Europe and the US. While we believe that consumer electrification will begin to slow with the expected removal of EV credits in the US, commercial electrification and further effort to diversify revenues beyond automotive would likely meet the mid-single digit target.

How many shares existing APTV shareholders will receive has not yet been announced, and the pro-forma indicates that the new company’s debt will sub-investment grade.

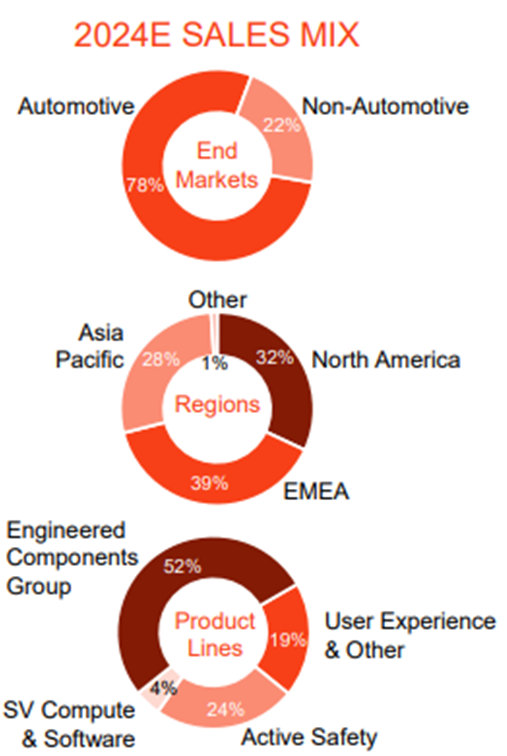

“New” Aptiv

Following the spin-out, APTV will retain the EC (engineered components) segment and the UX (user experience) segment, with a combined $12.1 billion in revenue during 2024. The EC segment will represent 52% of pro-forma revenues and includes products like ruggedized connectors, high voltage connectors, airbag components, and data transmission cables. The UX segment contains safety-critical features like driver assistance technology, autonomous technology features such as vision-processing, as well as non-automotive focused businesses like Wind River embedded software.

Despite EC’s core largely being the same OEMs as EDS, we believe that there are substantial opportunities for growth, especially in ruggedized components. For example, the newly acquired Winchester Interconnect provides highly specialized and ruggedized data and electronic components for use in space, offshore drilling, and medicine. The EC segment had new bookings of $8 billion during 2024, and $2.1 billion during the quarter ending March 2025.

Even within the automotive space, we believe that the UX segment is likely to have above-market pace prospects given the increasing implementation of software in engines and ADAS (advanced driver assistance systems). We believe that the value proposition for APTV’s ADAS versus competitors is cost and resource usage, winning multiple European and Japanese OEMs during 2024.

On the software side, Wind River embedded Linux has made inroads outside of automotive, especially in the automation and embedded AI space. The total book of business for the UX segment rose to $4.4 billion, driven by $2.7 billion in safety bookings in APTV’s Gen 6 ADAS and Radar. During the quarter ending March 2025, bookings were $1.3 billion, driven by $800 million in safety.

Combined, the new APTV had an EBITDA margin of 18.8% for the year ending December 2024 (less restructuring and one-off charges). For 2025, APTV expects the EC segment revenue to be up low single digits with growth outside the automotive sector outpacing the slowdown in auto orders. APTV expects the UX segment to be up mid-single digit driven by continued wins on its ADAS platform.

Risk

Auto OEMs were already at a crossroads, many still reeling from rapid cost inflations, shifting consumer preferences and fierce competition from software focused startups and Chinese firms. Tariffs are the latest threat to the automotive industry, making it very challenging to forecast specific production numbers. For the quarter ending March 2025, global production volumes were down 2%, with China’s 10% growth unable to fully offset North America’s 6% contraction or Europe’s 7% contraction. Including the impact of tariffs, IHS estimates a manufacturing contraction of 3% for the full year 2025. We believe that this is likely a still optimistic figure, with APTV estimating a 5% decline in the first half of 2025, and a 7% decline in the back half.

Much of EDS’s manufacturing footprint is in Mexico, though manufacturing is 99% USMCA complaint. APTV has closed 2 facilities in China and will be shifting them to Central America and North Africa, as previously discussed. Despite some allusions by management to moving production to within the United States we find this highly unlikely due to the economics of a move to the United States being unfavorable, even with high automation.

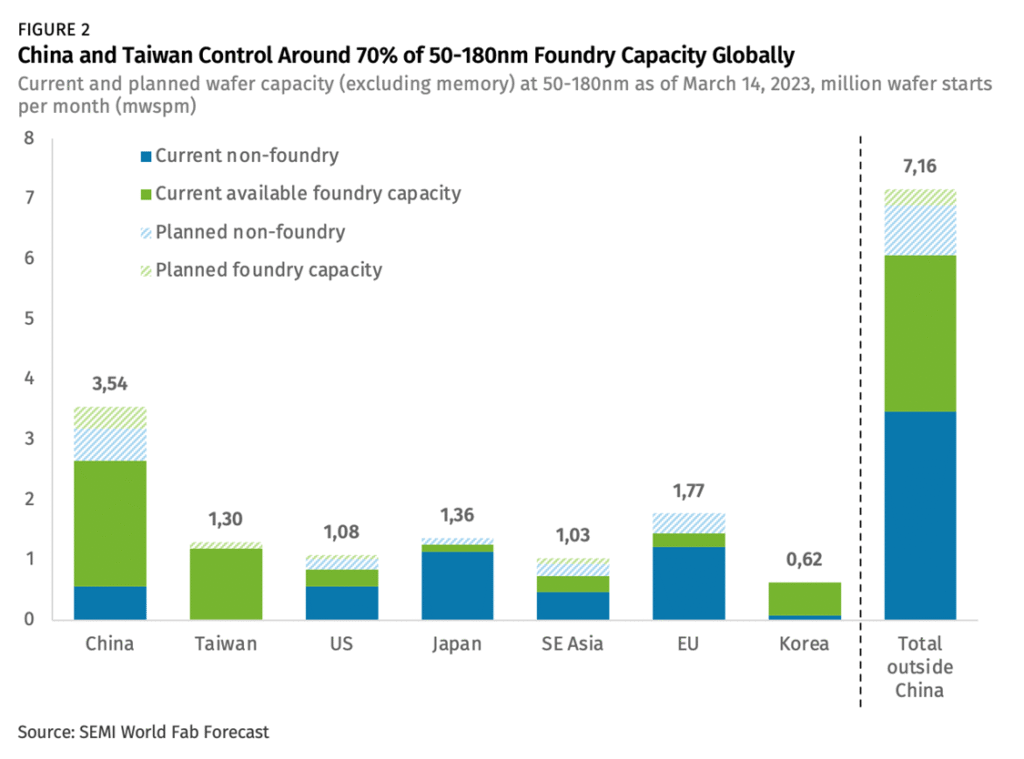

As reported by S&P Mobility, legacy nodes (>40nm) still used in automotive and industrial engineering may run into bottlenecks. These bottlenecks will result in a shortage during 2026. Since 2022, manufacturers have heavily focused on the development of sub-5nm processes for both AI applications and to catch up to the COVID-induced shortage. This has left supply of legacy nodes relatively flat or even down as the number of legacy-chips-per-vehicle has increased 23%. This may be compounded by the fact that legacy chips are overwhelmingly produced in China.

Financials

Across the company APTV is targeting $31 billion in gross bookings, or approximately a 1.6x book-to-bill ratio. For the full year 2025, APTV expects revenues to increase by 1.5% year over year at the midpoint to approximately $20 billion. During the quarter ending March 2025, it reaffirmed this guidance, though it did say that it will not be updating guidance until the second half of the year due to uncertainty surrounding OEM schedules. As a result, we expect the gross bookings to be backloaded toward the end of the year. Excluding structuring charges and one-time items, APTV expects an adjusted EBITDA margin of 15.0% at the midpoint or a 70bps contraction compared to 2024.

During 2024 operating margins were 10.7%, an increase of 150bps compared to 2023. Margins expanded during 2024 primarily due to a 10% reduction in workforce, which current guidance is another 5% as a baseline during 2025. Given 2025’s operating margin guidance is 12.1%, we expect further workforce reductions beyond the 5% target are likely. While it is not specifically disclosed the percentage of factory work that is presently automated, APTV is targeting 30% by 2026, and 50% by 2030 which would unlock further margin expansion.

During 2024, APTV generated $1.6 billion in free cash flow, which we expect to decline marginally due to increased expansion spending. On top of a return to growth for the UX and EC businesses, management pointed out it would be strategically building semiconductor inventories anticipating a shortage in the second half of 2025 and early 2026 as previously discussed.

For the quarter ending March 2025, APTV had $1.1 billion in cash on hand even after paying down $530 million in debt. Between January and May 2025 APTV paid down $700 million in debt or 3 quarters ahead of the deleveraging plan to the 2.0x range, now sitting at 2.2x net debt to EBITDA (excluding structuring and one-offs). We believe this is setting up for M&A in the latter half of the year. An area that we believe APTV will focus on is defense and aerospace, with around $400 million of annual revenues already coming from the area, with existing working relationships with “all of the primes”. Defense and aerospace are also typically higher-margin, given the more specific mission requirements – though the tradeoff is a longer sales cycle.

As of the quarter ending March 2025, $2.5 billion remained available for repurchasing shares, or approximately 17.0% of shares. During 2024, APTV repurchased 13.2% of its shares, and given it does not pay a dividend, we believe it will likely repurchase a similar amount during 2025 depending on the size of any potential M&A.

Conclusion

For the pro-forma information about the new companies, management expects that the new APTV without the EDS segment will have low-to-mid teens operating income, and as previously mentioned an EBITDA margin of high teens to low 20s.

The cash flow from the more mature and larger EC segment will continue to fund both organic and ‘inorganic’ investments. While we believe that shareholder return through repurchases will take a back burner post-completion, APTV will retain its investment grade status. However, as previously discussed, the EDS business will likely be sub-investment grade.

Despite near-term automotive headwinds due to tariffs and lagging production, APTV has made substantial inroads outside of the automotive sector which should offset some of the headwinds before the spin-off completes in early 2026. Post-spin off, we believe that the new APTV entity represents a highly attractive growth company with both exposure to the increasing digitization of industry and automotive, while also having the manufacturing expertise to penetrate specialized markets like defense.

Peer Comparisons