ADYEY Continues to Ride Secular Payments Growth with Land-and-Expand Strategy

| July 31, 2024 |

- Adyen is increasing market share through new customers and greater wallet share per customer.

- Expected sales growth of 22% to 26% and earnings growth of 20% to 25% over the medium term.

- Long-term revenue growth driven by increased wallet share on existing customers, enhanced by very low 1% quarterly churn.

- 10% buyback authorized of outstanding stock by the end of November 2025.

- $1.7 billion in free cash flow in 2023 and $9 billion of cash on hand with no debt.

Overview

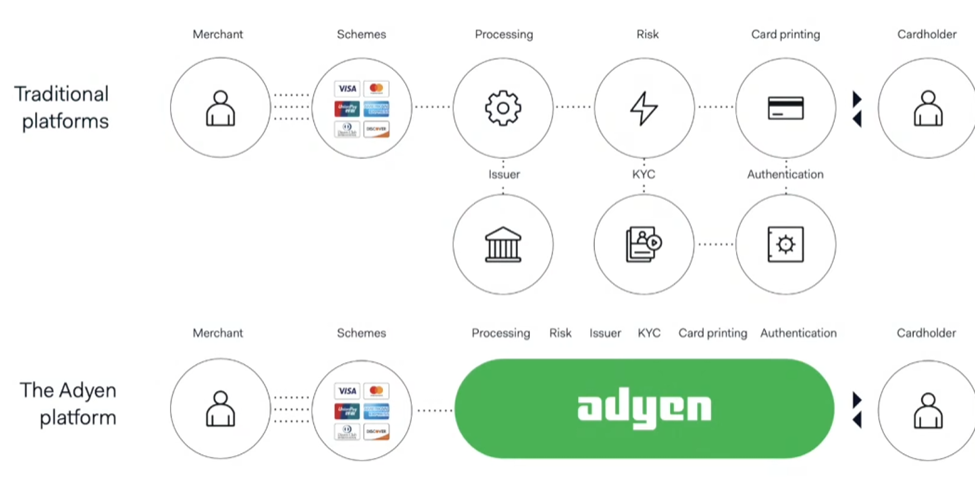

Adyen (ADYEY, 1-to-100 ADR) is the heavy-weight champion of payment service providers as it lists the following multinationals as customers: H&M, McDonalds, LVMH Retailers, Spotify, Uber, and even eBay. The value proposition for Adyen is simple for large enterprise; Adyen reduces complexity. Adyen provides a top-down solution for payment processing, risk management, payment gateways, and accounts receivable services, consolidating as many as 8 vendors into a single point solution.

Adyen has seen a substantial price slump, losing around 30% of its stock price over the trailing twelve months due to mounting competitive pressures in the United States and broader macroeconomic contractions around the world forcing businesses and consumers into a defensive footing. However, the world continues to digitize and the demand for a unified consumer experience between in-store and online will continue to grow. Historically, Adyen has grown in tandem with processed volume, and we see no reason that would not remain to be true. In the first quarter of 2024, Adyen again grew its payment volume by 45.9% year over year despite macroeconomic pressures. Additionally, Adyen saw less than 1% churn, and grew net revenue by 21% year over year. Over the long term, we expect Adyen to grow faster than the payment industry as its superior value proposition allows it to gain share in the US market. BCG expects to industry annualized growth of 6.2% to 2027.

| Adyen (ADYEY) | Block, formerly Square (SQ) | Fidelity National Information Services (FIS) | |

| Closing Price | $11.35 | $61.71 | $75.33 |

| EPS (2024E) | $0.30 | $3.43 | $4.99 |

| EPS (2025E) | $0.40 | $4.37 | $5.53 |

| EPS (2026E) | $0.50 | $5.36 | $6.11 |

| Gross Buyback Authorized (%) | 10% | 2.5% | 9.8% |

| Gross Buyback Authorized ($B) | $3.9 | $1.0 | $4.0 |

| Market Cap. ($B) | $38.56 | $44.53 | $42.34 |

| Dividend Yield (2024E) | 0.0% | 0.0% | 1.91% |

| Net Income Margin | 43.0% | 1.7% | -61.4% |

| EV/EBITDA | 26.4 | 13.3 | 12.1 |

| FCF ($B) | $1.70 | $0.39 | $2.80 |

| PEG (2024E) | 1.81 | 0.52 | 1.16 |

| P/E (2024E) | 37.8 | 21.1 | 15.3 |

| P/E (2025E) | 28.4 | 16.5 | 13.8 |

| P/E (2026E) | 22.7 | 13.4 | 12.5 |

| P/S (2024E) | 16.9 | 1.5 | 4.13 |

| P/S (2025E) | 13.7 | 1.4 | 4.0 |

| P/S (2026E) | 11.0 | 1.3 | 3.8 |

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $0.50 X 34.0 = $17.00

Strong Existing Customer Relationships: “Land-and-Expand”

Adyen’s approach is best described as “land-and-expand”. The idea behind this strategy is you acquire large enterprise customers as an initially small part of their wallet, covering only a portion of their operations or being one of the many processors that the customer may route payments through. The typical enterprise-level customer is a migrator – meaning the customer is switching to Adyen from another competitor.

Land-and-expand typically manifests itself with a 1–2-year tail on new customers, with full revenue potential realized in the 12–18-month period – with wallet share growing gradually over time. Typically, 80% of processed growth in any given quarter comes from existing customers either expanding offerings or organically expanding themselves. More impressively, land-and-expand has incredibly low churn, with Adyen reporting less than 1% customer loss in the first quarter of 2024.

Pushing into SME

Adyen provides an all-in-one solution for enterprise customers, but the Platforms and Unified Commerce offer hope to appeal to more developed SMEs. Existing SME digitization is high, 80% utilize some form of software by firms like Intuit to manage their operations. However, only 34% have their payments digitized, still relying on legacy systems at POS (Point of sale). Consumer experience can make or break an SME, with 64% of consumers stating they simply no longer carry cash with 76% saying they prefer to pay by card even if they do carry cash. Adyen hopes to slowly chip away at the SME space organically by offering better data tools, automatic reconciliation and other features typically reserved for enterprise-only customers.

Digital: Payment Architecture

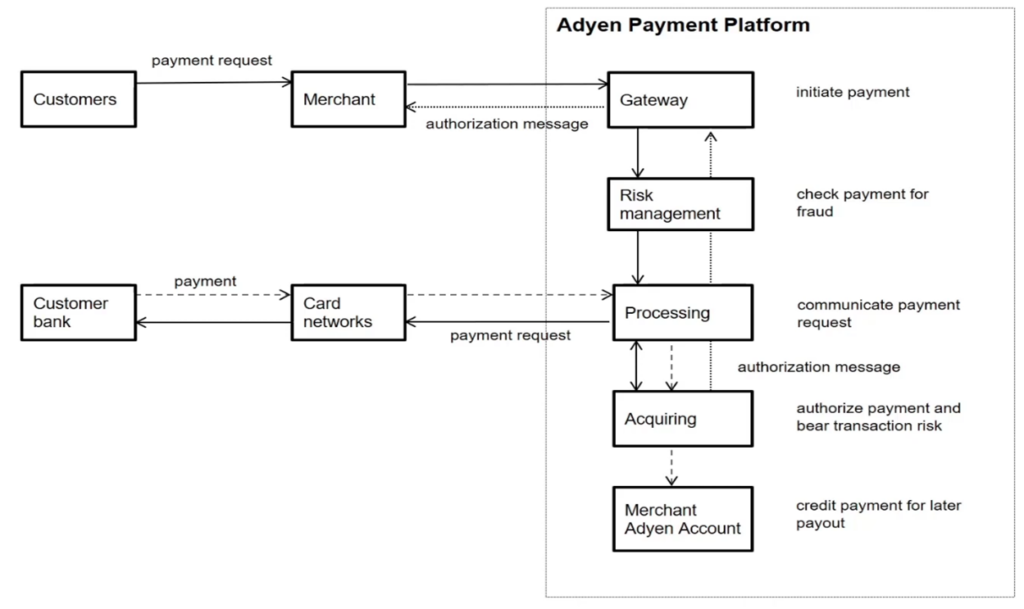

Taking payments has become a complicated process, and it is only getting more complicated. Now processing of payments can involve up to 8 companies, all who want a fee, and if any of those 8 companies different and complex processes fail during the 5 seconds processing takes, the transaction fails.

According to Adyen, 15% of transactions online fail and around 7% of in-person transactions fail. 42% of surveyed retailers with more than $100 million in sales say that false declines have impacted customers satisfaction. This results in more than €20 billion in lost revenue in Europe, and an estimated $120 billion in the US. Approval rate uplift is one of the top reasons customers choose Adyen, including most recently Klarna.

There is still a substantial opportunity on the enterprise side, with large businesses heavily dependent on legacy architecture, often provided by multiple companies. The downsides to this are obvious, including increased transaction costs, and a reliance on batch processing (often called ACH) which often only runs during business hours and can take up to 5 days to fully settle. Legacy architecture like ACH greatly increases fraud risk, failure rates, and increases reconciliation and cash management costs for businesses.

Secular Growth: Substantial Safety Net

Macroeconomically, high rates have caused drastic shifts in the way businesses spend money. Adyen’s customers have shifted from a growth-oriented mindset to one of efficiency and cost savings. Over the short term, this could cause some pressure on new customer acquisition. On a secular basis though, a substantial portion of Adyen’s growth in the payments side of the business will come from continued growth in global payments.

The digital segment’s revenue growth has always mirrored processed volume. In the first quarter of 2024, Adyen saw Digital processed volumes up 50% year over year. Adyen takes a flat $0.12 fee on every transaction that passes through its system, which even if it stays at the same customer base it has now, would mean a 6.2% revenue CAGR to 2028.

Local Appeal: The Fastest and Largest Payment Methods

When discussing payments the largest schemes and networks get most of the attention: MasterCard, Visa, American Express. However, LPMs (local payment methods) now represent nearly 70% of all online transactions, compared to just 25% 10 years ago. LPMs are some of the strongest growing payment methods merchants are presented with, often taking the form of digital wallets, BNPL (buy-now-pay-later), or bank transfers.

| Type | Scope | Example | Estimated Volume |

| Digital Wallets | LPM | CashApp, Apple Pay, Venmo, PayPal | $9 Trillion |

| Credit Cards | Global Issuers | American Express, MasterCard, Discover, Visa | $40 Trillion |

| Debit Cards | Global Issuers/LPM | Many US cards are issued by Visa, however, those in Canada utilize the LPM network Interac. | |

| BNPL (Buy now, pay later) | LPM | Klarna, Affirm, AfterPay | $543.8 Billion |

| Account-to-Account | LPM | Zelle, Interac e-transfer | $850 Billion (2026E) |

| Direct Carrier billing | LPM | Charge payments to mobile phone bill, popular in Africa. | $42 Billion |

Advantageously for merchants not only do LPMs offer customers more ways to pay, but local payment methods also have higher acceptance rates for typically lower transactions costs. More than 90% of Adyen’s customers now utilize LPMs, and Adyen boasts taking the most LPMs out of any other payment platform.

Unified Commerce: Data Insights from SME to Enterprise

Unified Commerce is Adyen’s hardware and associated business management software suite, designed to unify all channels of a business and be used in tandem with its payment processing technology. While smaller than competitors, Unified Commerce has 308 merchants that process more than $50 million USD per year and has more than 250,000 POS terminals live across customers like GAP, Burberry, Subway. The land-and-expand strategy is particularly present here, with Adyen estimating that initial wallet share starts at just 30% in Unified Commerce and slowly grows to 60% over the 18-month sales cycle.

To appeal to SME’s, Adyen does not charge any monthly fees or set-up fees, but rather requires them to make a minimum of 1,000 transactions a month, which it collects its flat fee on. SMEs gain access to Adyen’s massive payment network, which as previously discussed, contains the largest collection of LPMs of any competitor along with free foreign exchange services. Additionally, as of the quarter ending March 2024, SME’s can utilize a smartphone or tablet to collect payments rather than investing in POS architecture.

Data Driven Customer Engagement

While payments and e-commerce have become more data-driven, in-person retail and payments are still dominated by “anonymous” customers. Customers are only known, and therefore can be marketed to, if they are a loyalty offering member and volunteer to tell the cashier. Even if retailers continue to utilize multiple payment service providers and multiple back of house contracts, Adyen has been able to link those “anonymous” customers by payment method, patterns, and other proprietary methods. Together these data insights will also be able to assist in reconciliation services, which was the top operational challenge for 60% of European SMEs in 2022.

Platforms: Bringing Everything Together

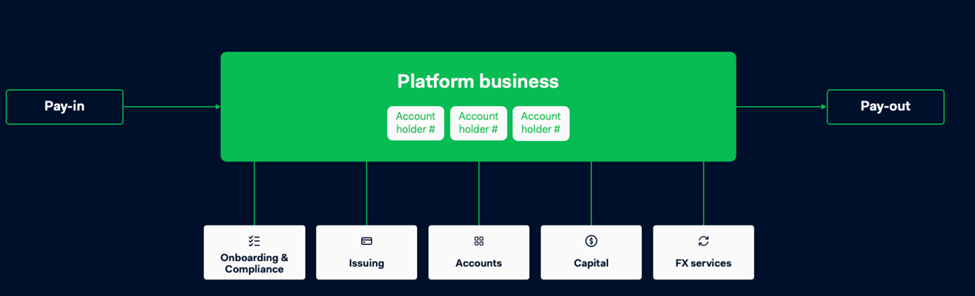

Platforms represent the most modular Adyen offering, targeted as a B2B solution to augment existing Adyen, or competitor, infrastructure. Its purpose is to allow merchants substantial control over user experience design and payment flows without the massive spend and relationship building required.

According to the 2023 investor day presentation, Adyen estimates that these simple bolt-on offerings have a $110 billion revenue total addressable market across managing deposits, payments, issuing cards, and lending. Adyen already has 17 customers that process more than $1 billion annually, and more than 70,000 total platform customers including digital wallets like CashApp.

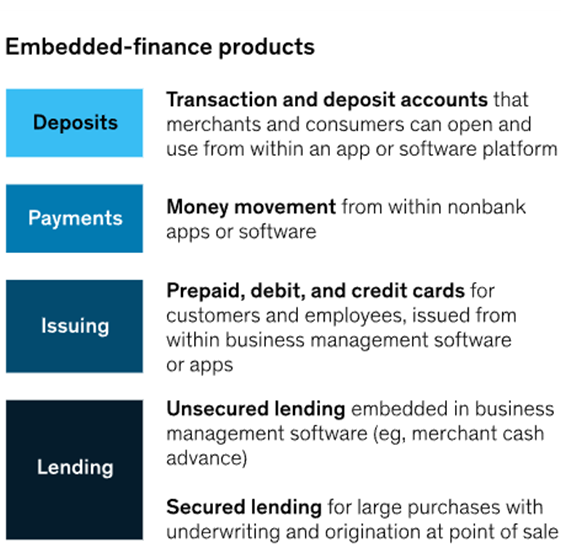

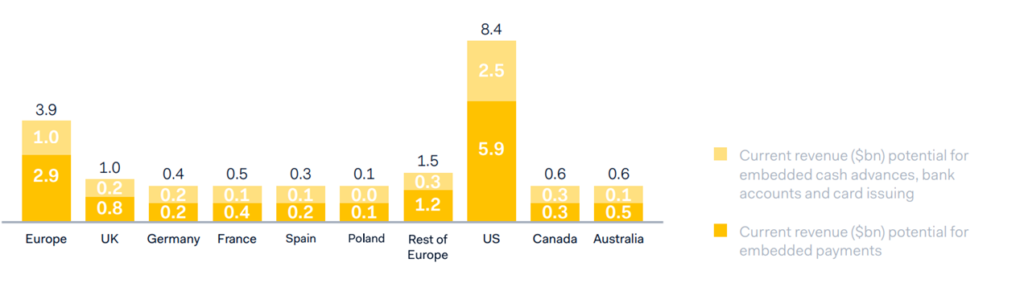

The Rise of Embedded Finance

Embedded finance is the process of offering financial products and services to customers of non-financial businesses. For example, private-label store credit cards or airline rewards cards, or a car dealer offering a branded loan to customers. With more than 33% of global card spending now spent online, the massive spike in demand for BNPL, and the rise of digital wallets like CashApp and Venmo, more consumers are willing to get access to financial services from non-financial businesses than ever before. Embedded finance in the US is estimated to have a 23% CAGR by 2027, with 32% in Europe.

The typical ecosystem in embedded finance is still fragmented, due to there being 3 tiers involved in service. A distributor, who provides a financial service in a non-financial service setting like BNPL companies, FinTech’s who facilitate the transaction like Plaid or PayPal, and finally a traditional bank to provide settlement and balance sheet services like Morgan Stanley with Apple Card.

Adyen hopes to become all three, for all levels SME to enterprise. As previously mentioned Adyen has banking licenses in the EU, UK, and US – allowing it to function as both a balance sheet provider, transaction processor, and a technology provider with its existing tech-stack. Finally, acting as a distributor, Adyen can function as a card issuer or potentially funnel traffic to a BNPL partner or offer other white-label financial products.

For Marketplace Owners

Marketplace offerings provide the same end-to-end solution in the Digital offering, but for peer-to-peer marketplaces, e-commerce SaaS, or for facilitating pay-in pay-out architecture for digital wallets. This allows substantial control to the business while still drastically simplifying the facilitation of cards that can access account balance, offer instant foreign exchange, offer loans to customers, and even account management tools like those in the Unified Commerce Offering.

For Marketplace Owners

The average SME in the US only has 27 days of cash reserves on hand, with a loan approval rate of under 20%. In industries with frequent input costs like restaurants, an issued card directly connected to platform accounts would allow SMEs to spend funds that may not have settled, been paid out yet, or translated to the local currency. As previously discussed with ACH transactions, often transactions are not fully settled until 24 hours or more after the payment has been completed.

For industries with many suppliers and variable costs like logistics, settling accounts payable matching receivable automatically would save substantial cost for payroll and cashflow management processes.

Risks

Visibility is a problem. Previously Adyen only reported in half years and reported the business in a way best described as opaque for investors. The CEO during investor day 2023 entered a commitment to increase shareholder visibility and increase the volume of business updates throughout the year, including committing to quarterly business updates.

While Adyen’s land-and-expand approach has landed it large customers such as H&M, eBay, Etsy and CashApp, there are a limited number of wins available in the market. Moreover, the large customer acquisition cycle is long and costly. Adyen has stated that the typical sales cycle is between 12-18 months for revenue conversion. This is higher than its competitors who focus on SMEs, where in the small business segment a customer can be onboarded in a single afternoon.

To settle instant transfers, Adyen does assume some credit risk. When a firm utilizes instant settlement, Adyen essentially ‘forwards’ them the money to their merchant account where they can spend it on the linked card. Once the transaction clears in the ACH timeframe, Adyen takes off whatever was spent. We believe that the overall risk to the company and its balance sheet is de minimis.

As previously discussed, there is mounting take-rate pressure on Adyen, which was a large reason the stock recently declined in early 2024. In the quarter ending March 2024, the take rate was 14.7 bps, which is down from 17.3bps in 2022 (take rate is net revenue divided by processed volume). With credit card processors increasing their own take-rates, it has put downward pressure on the take-rate of Adyen and other processing competitors to maintain customers.

Recently to grow its market share further, Adyen signed a partnership with Shopify – which makes it a supplier to a supplier – inherently putting pressure on take rate. However, we feel that this downward pressure is a temporary headwind that is part of the land-and-expand strategy. Adyen’s management alluded to being willing to take lower take-rates if it means longer-term incremental gains on net revenue. Additionally, large enterprise targeting results in lower take-rates for processors than a firm which targets SMEs.

Financials

The US has grown from 10% of revenues to 25% in 6 years, but Adyen still only garnered a high-single-digit market share. We believe that given Adyen’s existing enterprise customer base, expanding into the double digits in the United States will come naturally over time. Additionally, we feel that the United States will be the key market for Adyen’s continued growth in the enterprise space, and its breech into the SME space. Capturing more of the SME market organically could cause selling expenses to increase before the sales come thorough. Adyen has stated that CapEx is targeted at no more than 5% of net revenue, and management has been opposed to acquisitions.

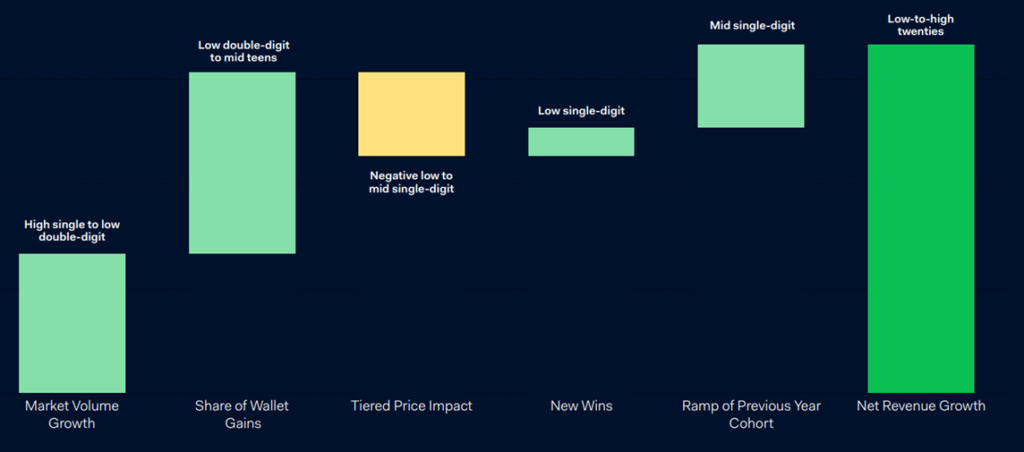

Globally, Adyen expects net revenue growth to continue to be in the 20s range, which would roughly mirror growth in global payments and its existing customer wallet share growth. Typically, Adyen’s wallet share expands from 20-30% to around 60% as the customer relationship matures. This does still leave room for further expansion above 60%. As previously discussed during 2023, Adyen reported that 80% of its growth typically comes from its existing customer relationships.

Bottom Line

We do not expect stock-based compensation to meaningfully increase from its current position. Adyen has stated that its hiring surge, which increased headcount by just over 30%, has concluded. Overall, Adyen typically weights compensation cash-heavy even in the United States where stock-based compensation is more popular. The overall effect has been a 1.6% increase in diluted shares, with a repurchase program allowing up to 10% of outstanding shares to be repurchased by November of 2025.

Overall cost increases for Adyen have begun to move ahead of overall growth, which has caused some margin compression, down 910bps to 45.7%. This compression was due to both new and existing employee wage growth, which grew by 56% year over year in 2023. As previously mentioned, Adyen has concluded its ‘hiring blitz’ and should slowly move its EBITDA margin back to the 50-55% range over the long term.

Despite some EBITDA margin compression seen due to headcount increases, interest and investment income more than offset this increase, growing by 145.9% year over year. This increase was due to cash on hand at central banks and other partner institutions, due to favorable interest rates, and regulations required by Adyen’s banking licenses. This large increase did result in an increased tax burden as income from financial activities like investment and interest are not eligible for several tax credits available to Adyen in both the EU and United States.

Overall, free cash flow conversion was 86% for the full year 2022, up 400bps, amounting to $1.7 billion in free cash.

Balance Sheet

Adyen has a rock-solid balance sheet with zero net debt, and more than $9 billion in cash on hand. Of this cash on hand, under 1.0% is restricted, with about 70.5% of it held at central banking institutions. During 2023, due to global interest rate increases and strong equity performance Adyen earned about $266.7 million in investment/interest income, or about 13.2% of total revenue.

S&P assigns an investment grade A- ranking to Adyen corporate debt. Couple high grade debt, should it be issued, and a strong cash position Adyen is in an excellent position to embark on acquisitions within the United States. In the past, though, Adyen has been strongly opposed to acquisitions to expand its business and has traditionally stuck to strategic partnerships. Additionally Adyen does not pay a dividend, and currently has no plans to. It is possible that Adyen is positioning itself to have the reserves on hand required to enter a more direct BNPL role or offer more substantial embedded finance products to partners which would legally require more reserves.

Overall, balance sheet risks are limited to foreign exchange derivatives held and counterparty risk for customers with large receivables accounts, though the assessed impact of these items is under $50 million.

Conclusion

We believe that secular growth in payment volumes will provide substantial tailwinds to Adyen. We expect an earnings growth rate at a multiple of that of the industry which is around 6.2% annually. Couple this with its land-and-expand strategy for a high-quality client base, we also foresee it capturing more market share in the United States and taking a larger wallet share amongst its existing customers.

Outside of its processing operations for large retail customers, Adyen will have an uphill battle to take share from established SME players like Square and Stripe. Adyen has proven it is able to take market share and wallet share from competitors in the large retail space with its higher-than-industry average transaction approval rate. Emerging features in the Platforms offering like same-day payouts, card issuing, and strong technical features in data analysis will also bring a strong value-added proposition to SME customers.

Adyen has a rock-solid balance sheet and strong free cash flow which will allow the company to continue to grow organically. We believe it is a good buy for growth investors seeking to take advantage of the continuing digitization of the global economy.