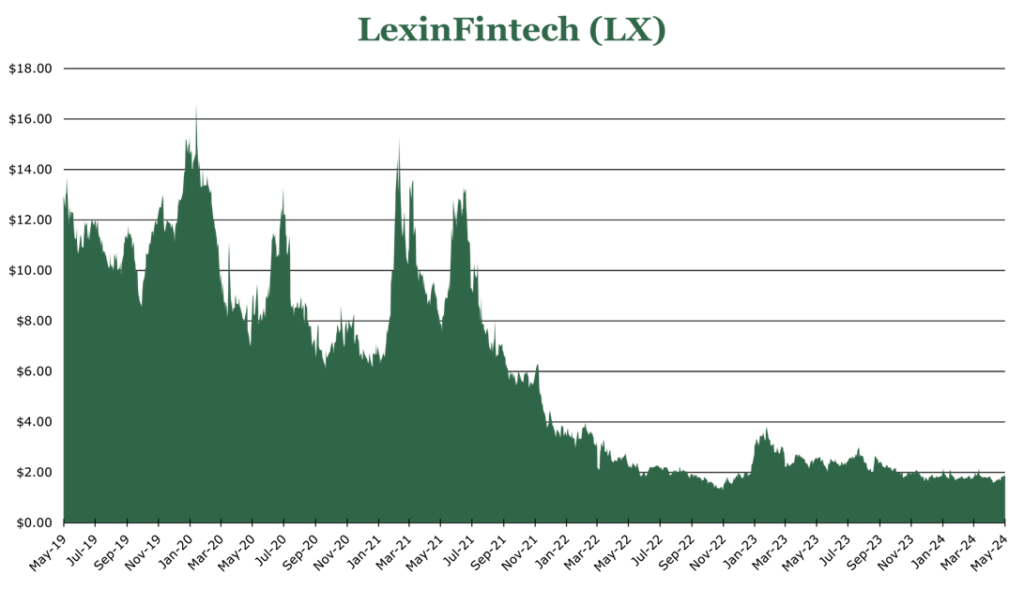

9% Dividend Yield for LexinFintech Value Opportunity

| Price $1.87 | Dividend Holding | May 14, 2024 |

- 9% expected dividend yield.

- New risk officer implementing improved pricing and credit metrics.

- 8.5 million active borrowers and 42 million with an open credit line serving the rapid growth of the Chinese consumer market.

- LX expects cheaper origination and funding costs to remain low, falling below 6% in February 2024, and enhancing profitability.

- Expect continued cost leverage, with expected cost per originated loan decreasing at a faster rate than volume growth over the long term.

Investment Thesis

LexinFintech (LX) is a consumer finance company providing consumer credit products to more than 8.5 million users with an outstanding balance and 42 million users with an available credit line. The Chinese overall consumer credit market is quickly growing, with $130 billion provided to more than 300 million borrowers in 2023.

Despite Chinese economic challenges, LX has embarked on a substantial de-risking campaign for new and existing loans with initiatives to address new markets with high-quality borrowers. These initiatives include AI-based marketing and risk assessment co-developed with ByteDance, more aggressive collection procedures, and more personalized offerings.

With the Chinese economic contraction likely bottoming out in late 2023, we believe that the Chinese consumer upswing, especially among youth, and a consolidating lending market could provide substantial tailwinds for LX. Additionally, LX has begun a dividend amounting to 20% of net income, which brings the yield to approximately 9%. In our view, while speculative, LX trades at a significant discount compared to our calculation of fair value and provides a solid dividend yield.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $1.25 * 3.7x = $4.60

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 0.2 | 0.2 | 0.1 |

| Price-to-Earnings | 1.7 | 1.5 | 1.4 |

Market Conditions

China has been grappling with slower growth of both its economy and its population since COVID-19. At the latest party congress, the government projected a GDP growth rate of 5% for 2024, which is historically low for China. The latest GDP figures for the quarter ending March 2024 were 5.3% year over year, outpacing estimates. The latest Chinese PMI data indicates that manufacturing, a leading indicator, has shifted back into growth at a stronger pace than expected. In our view, the Chinese economic slowdown has likely bottomed out and will accelerate – albeit to a lower rate than the past 3 decades.

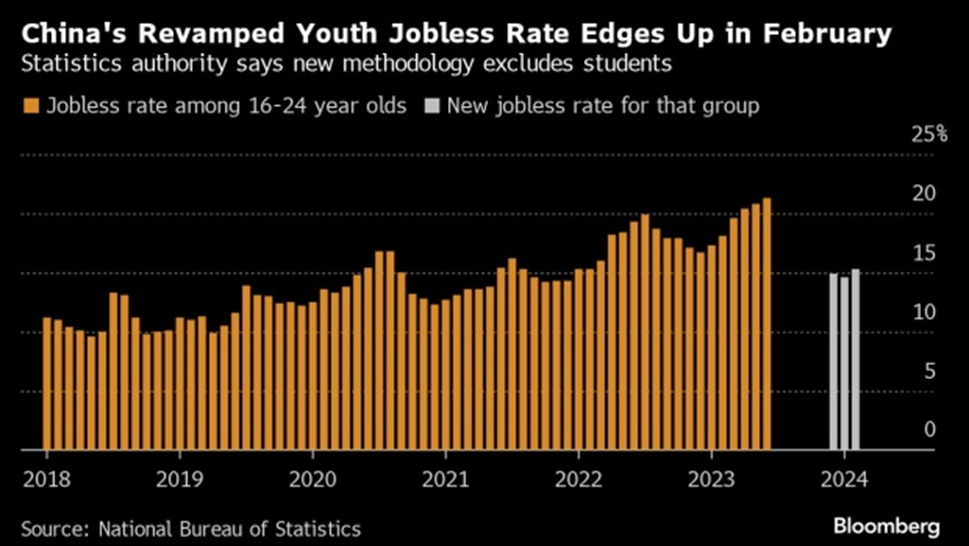

More apt for LX’s consumer demographic, youth unemployment has shown signs of decreasing. The Chinese government ceased reporting on youth (16-24) unemployment after it had risen to a record high of 21%, with rural regions reaching 40%. However, these numbers did include students. The newly revised figures less students paint a less dismal picture, with youth unemployment sitting at 15.3%, though still far above the overall Chinese rate of 5.1% and worse than the OECD youth unemployment average of 10.5%. While more granular data is unavailable, the Chinese Statistics Bureau stated the unemployment rate drops off to 6.1% among the 25-29-year-old bracket.

In our view, these problems are structural in the Chinese economy. Since 2004, the under-30 population with a university education has increased by 400%, far outpacing any other country on Earth. The sharp increase has created a massive skills mismatch between highly educated graduates competing for an increasingly narrow number of tightly regulated white-collar jobs. Even still, this issue has risen to the forefront of domestic Chinese issues, which has pushed the Chinese government into supporting various initiatives like credit extension for new small businesses and job expansion targets targeting urban youth. S&P expects the total unemployment rate to fall to 4.9% in 2024.

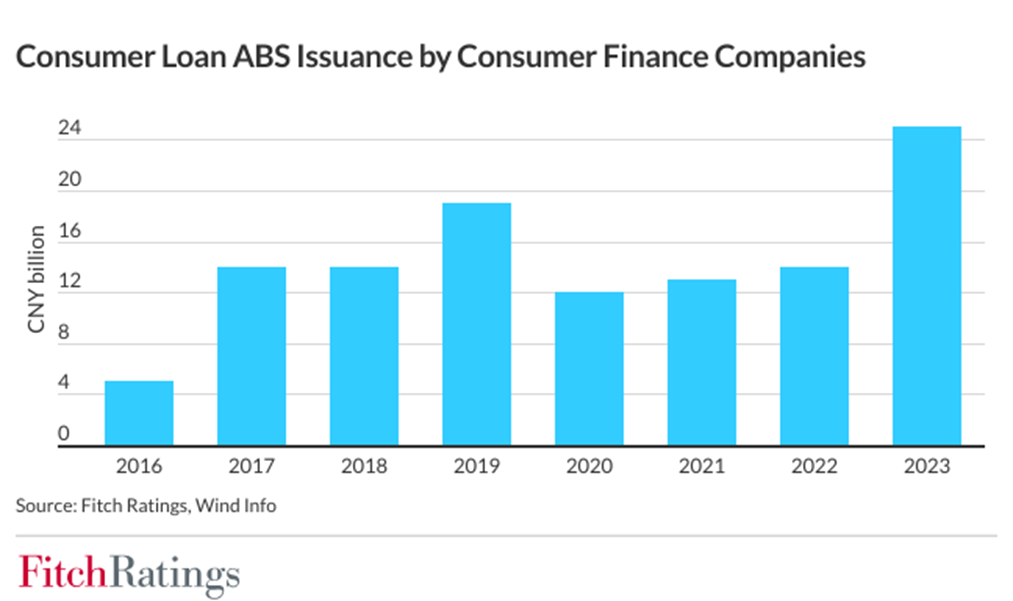

China’s consumer finance companies provide around $130 billion to around 300 million borrowers. Generally speaking, similar to US microcredit, these companies overwhelmingly provide high-interest loans to people shut out of the traditional credit sector for one reason or another. These loans are financed by institutional partners and by consumer ABS (asset-backed securities). While traditional ABS backed by car loans or mortgages has seen contraction in China, the consumer ABS market has seen substantial growth in both issuance and demand. S&P estimates that consumer ABS issuance will have mild-to-high growth in 2024 due to an estimated 4.2% growth in Chinese retail sales and a favorable regulatory environment. In our view, these factors should put downward pressure on LX’s financing cost, allowing it to fund its lending operations at substantially lower rates. Already, LX reported that its financing costs fell below 6% for the first time in February 2024.

Consumer Products

LX offers various financial products to consumers, similar to microcredit options in the US and credit card offerings. The boilerplate offering is lines of credit for consumers or SMEs (small-to-medium enterprises) amounting to $500 to $30,000, with terms generally not exceeding 36 months and an interest floor of 10%. This line of credit can be utilized in the following ways:

LX offers a Fenqile e-commerce platform, with partnered brand goods like smartphones or shoes listed on the platform. Users can either pay upfront or use their line of credit as an installment loan. LX also offers a card in the form of a Lehua Card, operating the same as US-based cards, which allows users to use their credit line for offline purchases or purchases at other e-commerce sites. For quick financial turnovers, the Le Zhouzhuan program offers cash from the line of credit, though the interest rates are generally higher, starting at 18%.

Users may have multiple purchases and installment loans open on their line of credit. The system operates analogously to buy-now-pay-later features common on modern Western credit cards or through companies like Affirm (AFRM).

Secondary Revenue

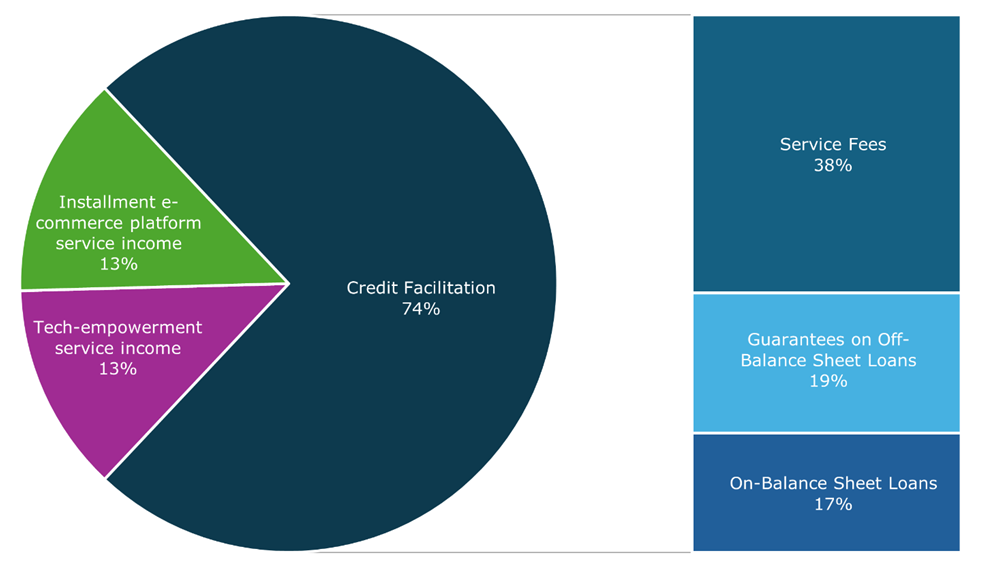

Sales on the Fenqile e-commerce platform and fees associated with certain lending originations from the platform generate a commission for LX, and this makes up 13.4% of revenue.

In a similar vein, LX’s tech-empowerment service caters to the needs of financial institutions and retail partners. Generally speaking, LX provides initial credit screening, payment services, and customer acquisition to financial institutions or funnels customers to its own lending options. These options represent 12.6% of LX’s revenue and 24% of loan originations, which are realized through 3 separate business models for the same service.

The first is a profit-sharing model where LX assumes no credit risk for the borrowers’ principal or interest and instead charges a percentage fee based on the transaction size.

The second is a SaaS-style model, where LX charges a service fee to co-build and co-manage the lifecycle of certain credit products for banks or other credit providers, which may include offline products.

The final model is a customer acquisition model in which LX refers users to its institutional funding partners in a direct placement and provides everything from initial servicing to collection for these institutional funding partners.

Core Revenue

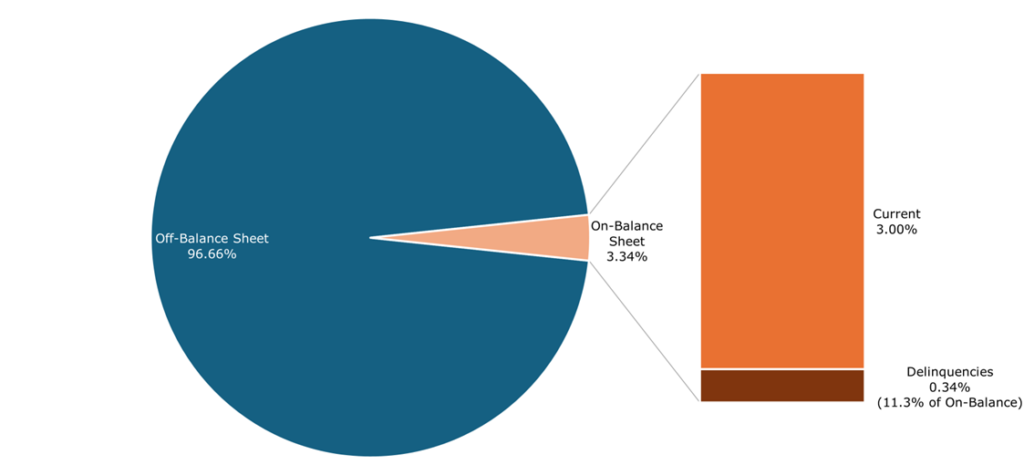

Finally, the core of LX’s revenue is the credit facilitation service, which accounts for 74% of revenue and the bulk of loan origination. LX primarily funds its operations by institutional investment, issuing ABS, and investments from trusts. Loans funded by ABS or trusts are generally held on the balance sheet, while those funded by institutional investors or partners are off-balance sheet.

LX’s credit facilitation service generates revenue primarily through origination service fees and account maintenance and collection service fees. The loans facilitated may be on-balance sheet or off-balance sheet.

The loans held on-balance sheet generate revenue through the difference between the cost of financing the loan and the interest earned during repayment. Currently, LX is experiencing historically low funding costs, averaging 6.18%, compared to an APY of 23.7%.

Loans not held on the balance sheet may be required to be at least partially guaranteed by LX. Guarantee revenue is realized through the underlying guarantees rolling off the liability section of the balance sheet. As borrowers repay loans or if compensation is received following a borrower’s default through insurance agreements, the associated guarantee liabilities decrease. This reduction in liabilities is recorded as guarantee revenue.

Strategy

Late in 2023, LX appointed a new Chief Risk Officer, Qiao Zhanwen. Qiao was the former senior director at Ant Group (BABA consumer-credit arm, the largest in China). He is lauded as the architect of BABA’s consumer-credit risk management system, which substantially de-risked Ant Group’s operations.

The company plans to focus on reducing the overall risk level of assets over the medium term, improving the precision of customer credit profiling for more precise rejections, and increasing market reach among prime and super-prime borrowers. This will be achieved through three initiatives targeting new customers, existing customers, and the collections process.

New customer targeting involves targeting traditionally underserved but creditworthy borrowers like white-collar newcomers to China, urban blue-collar workers, and small business owners. Improvements for the 200 million existing Fenqile or the 43 million with an active line of credit come in the form of micro-marketing. With the stated goal of capturing more of the consumer wallet, LX plans to implement flexible pricing strategies for a wider range of audiences. For example, high-quality customers may be provided with more competitive offers to encourage them to purchase more products on Fenqile.

Finally, the collections process will strengthen ties with financial partners and take a more aggressive stance regarding collection through civil means like legal action or localized collection activities for more efficiency across regions with different regulatory requirements.

LX has begun to expand its offline business origination by partnering with smaller urban and rural commercial banks in the Chinese industrial belt. As previously discussed, SME customers in these areas are generally underserved by the banking system. Additionally, the Chinese government has continued to provide broad support for these banks to provide SMEs across industries with access to credit. The NFRA (Chinese SEC and FDIC rolled into one) has stated that its goals are at least 10% growth in outstanding loans to qualifying SMEs, with the growth rate in 2023 at 23.27%. In our view, the expansion into offline and rural services could substantially increase the scale of the business and open the door for new offerings to customers unaddressed by the Fenqile or Lehua offerings.

Finally, LX expects to expand into markets outside of China in 2024. While specifics have not been disclosed, this expansion will likely involve an acquisition or a partnership with a financial institution. At the present moment, LX does see some long-term value in its business outside of China but stated that the addressable market for its services outside of China remains small.

Balance Sheet and Origination

Balances grew by 24.5% for the full year 2023. Although active users decreased by 12.7% year over year, on a quarter-over-quarter basis, the final quarter of 2023 saw 17% active user growth. For the full year 2023, origination volume increased by 21.9%, with the average term of the loan decreasing to around 12 months, compared to 14 months in 2022.

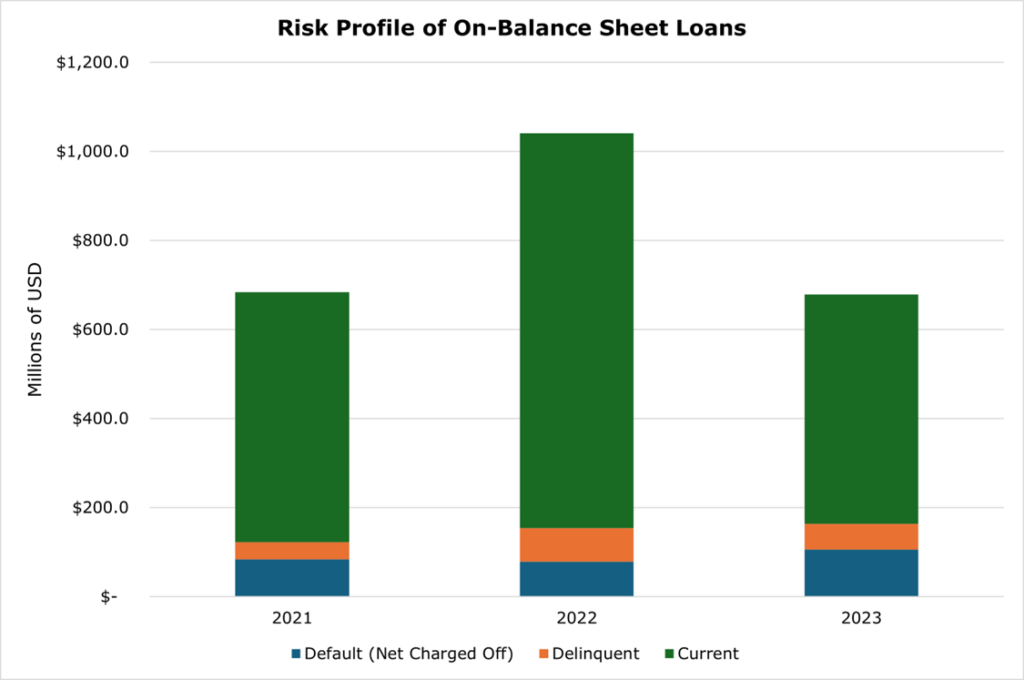

The increase in risk concentration is notable, and this is reflected in the higher-than-normal loss rates. Tight economic conditions in China primarily caused the increase in user credit risk. LX believes that the peak of FDP (first payment default, where the borrower goes into delinquency during the first payment period) occurred early in the quarter ending December 2023 and decreased by 10% by January 2024.

To lower FDP, LX targeted higher conversions with users with super-prime and prime ratings who had not used LX credit products before. The volume of loans issued to these groups increased 12% quarter over quarter. LX reports that moderating conditions coupled with these actions decreased risk on new loans and existing loans by 15% in total. As a final measure, LX has collaborated with large firms like ByteDance to maximize growth while minimizing risk. LX has “expedited” internal risk measures like expanding the risk management team, improving the models utilized, and other data-driven mitigation techniques.

While charge-offs and delinquencies are not out of trend, the decrease in the overall volume of originations held on balance sheets during 2023 did increase the risk held on the books. Equally, macroeconomic pressure caused increases in the fair value of LX’s guarantees by 7.1%, which pushed revenue to be flat on a quarter-over-quarter basis in December.

However, the overall default risk for all LX products, including guarantees provided to holders of ABS or other institutional partners, has not increased beyond what is reasonable for periods of economic contraction. Of loans over 90 days delinquent, including charge-offs, LX has a coverage ratio of 317%. This amounts to $369.8 million in cash on hand for the year ending December 2023. In our view, even a further increase in defaults on the balance sheet would not pose a substantial risk to continuing operations.

Risk

NFRA (Chinese SEC and FDIC rolled into one) has begun to crack down on consumer credit companies in China. This has resulted in a reorganization of the consumer credit sector, which has thus far consolidated the industry. New regulations limit lines of credit to a maximum of 200,000 RMB (~$30k USD) at an APR of 24%. Additionally, Paid-in capital held within China must be at least 1 Billion RMB (~$138 million). These regulations have consolidated the market, with Fitch reporting that 14 of 31 licensed consumer credit firms in China failed to meet these requirements.

Generally speaking, Chinese regulators have been friendly to structure financial products like ABS as they increase foreign investor inflows without sacrificing domestic control. New regulations on ABS issuances now put an upper limit on credit enhancements, with credit-enhanced loans not being able to make up more than 50% of total outstanding loans. On the upside of new ABS regulations, LX will be required to issue more detailed data, including delinquencies, on loans considered off-balance sheet.

We believe LX already abides by the new regulations. At this time, LX does not believe it is in any regulatory danger with the NFRA or any other regulatory body in China.

However, in the past, the Chinese government has often utilized arbitrary enforcement of intentionally opaque regulations to its political ends. The typical risks associated with Chinese equities are present, including forced delisting either by American regulators or Chinese regulators.

Financial Outlook

Despite the previously discussed increase in risk over the short term, revenue grew by 32% year over year in 2023. However, there was a minor net income margin contraction, largely due to increased risk-management costs in the last quarter of 2023.

| Full Year 2023 | Revenue Growth (year over year) | Operating Income (year over year) | Net Income Growth (year over year) |

| Credit Facilitation Service | 62.1% | 14.4% | 8.2% |

| Tech-Empowerment Service | -11.1% | ||

| Installment e-Commerce Platform | -14.9% |

LX expects a “substantially optimized” cost structure on a go-forward basis, decreasing the G&A and R&D cost per loan by 63bps to 3.88% in 2023, even amidst slightly lower volume. Sales and marketing as a percentage did increase slightly with more aggressive marketing toward targeted user groups, to 4.6%. On the origination side, LX expects a continued downward trend in funding costs, with funding rates pushing below 6% in February 2024.

Overall, despite decreases in funding costs, we expect increases in the G&A and R&D spending categories in 2024 as LX embarks on risk-management projects, which include growing headcount and investments in AI. LX expects origination volume and revenue to be at least as much as 2023, though we expect short-term revenue growth in the mid-single digits. Over the long term, we believe that LX will continue on the trend of decreasing cost faster than it grows volume, leading to substantial economies of scale and cost leverage across its offerings.

LX declared a dividend in the second half of 2023, amounting to around 20% of net income for the second half of the year. This amounted to a payout of around $0.18/share semiannually, with a current yield of 9.73%. At present, LX states that it will continue to pay out a similar ratio to shareholders. As the market improves in China, we expect the dividend payout ratio will increase, and we do expect a renewal of the share repurchase program, which shrunk outstanding shares by 10.8% since 2021.

Conclusion

In conclusion, LexinFintech (LX) is positioned to capitalize on the recovering Chinese consumer finance market. Strategic initiatives focus on a de-risked loan portfolio and new customer generation through AI-driven marketing and risk assessment. LX’s costs have decreased faster than origination volume has increased, which we expect to continue over the long term despite some short-term pressures from de-risking costs.

As China’s economy stabilizes, particularly among youth and SMEs, LX is poised to benefit. With a robust dividend yield and a commitment to continued shareholder returns, LX provides great value at current prices.

Competitive Comparisons