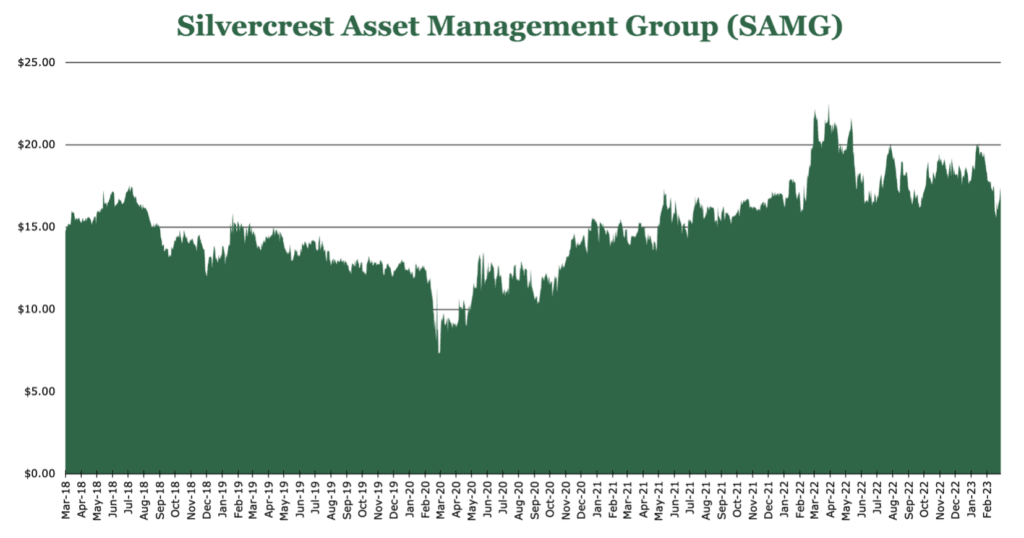

4.3% Yield and Strong Business Momentum Despite Market Headwinds for SAMG

Price $16.77 Dividend Holding March 27, 2023

- 4.3% forward yield, paying out $0.72 per year. Expecting EPS growth of around 12%.

- Expanding offerings to include OCIO (Outsourced Chief Investment Officer).

- Strong free cash conversion, converting 57% of EBITDA to free cash flow.

- Despite downturn in market, SAMG still has strong AUM growth of 28% since its inception in 2003.

Investment Thesis

Silvercrest Asset Management (SAMG) is a full-service investment advisor providing family office services targeting high-net-worth individuals and select institutional investors. SAMG’s relationships are 68% individuals and families and 32% institutional.

We expect SAMG to increase its EPS in FY23 to be at or above $1.50. SAMG has a leading return on equity and cash flow among its peers, and a long history of consistent AUM growth over the long term.

SAMG is a stable company with a solid business model in a difficult industry. Its focus on ultra-high net worth is the best area of the industry. OCIO, Institutional and International give SAMG some nice runways for growth. We believe in management and that SAMG provides a stable dividend distribution that will grow over time. We believe the stock is undervalued.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $1.80 X 12.0 = $21.60

Our earnings estimates are based on continued strong AUM growth.

| Silvercrest Asset Management Group (SAMG) | E2023 | E2024 | E2025 |

|---|---|---|---|

| Price-to-Sales | 1.3 | 1.2 | 1.1 |

| Price-to-Earnings | 11.1 | 9.5 | 8.1 |

Market Size and Profile

The family office market size is primarily catered to by boutique investment firms and held a value of $18.7 billion in 2022. This is expected to have a 5.6% CAGR to 2029, when the market will reach $28 billion.

Currently SAMG has $28.9 billion in assets under management, with a decade CAGR of 28%. SAMG targets those with $10 million in investible assets, with the top 50 clients averaging $349 million in size. SAMG has a client retention rate of 98% over the previous decade, which SAMG believes is due to their non-investment family office services charging flat prenegotiated fees rather than based on assets. Most income is derived from fees resulting from assets under management.

According to management on the 4Q22 Call, there is an intent to expand the addressable market to international clients.

Services and Results

One of the newer services that SAMG offers is OCIO. The OCIO service operates like a family office but typically is a manager assigned for multi-asset tax-exempt entities. Currently, this service is in its infancy and has $1.45 billion in AUM. It also differs from the traditional family office in fee structure, with 0.4% on the first $50 million on a stepping-down basis.

Staff expenditures increased by 6% year over year for 4Q22, primarily attributed to new staff hired across the company. Over the same period, however, SG&A decreased by 54%, attributable to the closing of the acquisition of small-cap growth asset manager Cortina.

Downturns in the market have obviously negatively affected the earnings of SAMG. Total AUM declined 10.5%, which caused revenue to decline 6.4% year over year. Despite this, the EBITDA margin contracted 600bps to 19%, which is still within the historical range for SAMG.

Cash flow remains strong, with SAMG generating $23 million in operating cash flow for FY22. While this is weaker than what was seen in FY21, it is in line with FY20. Free cash flow for FY22 was $18 million, representing 57% FCF conversion. Yearly dividend yield is at 4.27% and pays out $0.72 per year. Even in a worst-case market scenario there is significant buffer room and we do not expect the dividend to fall. The dividend has a trailing 5-year CAGR of 7.26% driven by AUM growth. Longer term we expect this 7-8% CAGR dividend growth to continue.

SAMG repurchased $3.5 million shares in FY22, with $5.7 million remaining in the authorization. SAMG is intent on keeping more cash in shorter term instruments or on hand given market conditions. Additionally, as previously discussed, expanding internationally and expanding the OCIO business will likely require the deployment in capital of either additional experienced staff or M&A.

Risk

Market risk and its impact of AUM under management is a noncontrollable risk. While this will likely not change the composition of the client base, SAMG may not realize as high AUM growth as previous years as organic new business growth is offset by declines in the overall equity market.

As previously stated, income is derived from fees resulting from assets under management. If the AUM falls in the case of market downturn, fee income will also fall but will fall less as some fees are fixed price fees not AUM based.

Competitive Comparisons

| Silvercrest Asset Management Group (SAMG) | Gladstone Capital (GLAD) | Artisan Partners Asset Management (APAM) | T. Rowe Price Group (TROW) | |

|---|---|---|---|---|

| Price-to-Earnings (FWD) | 11.02 | 8.59 | 11.38 | 15.98 |

| Price-to-Sales (TTM) | 1.33 | 4.7 | 1.92 | 3.79 |

| Price-to-Book (TTM) | 1.89 | 0.99 | 7.92 | 2.76 |

| Return on Equity | 25.38% | 4.17% | 60.46% | 14.54% |

| Dividend Yield | 4.31% | 10.00% | 7.20% | 4.48% |