3.25% Yield and Healthcare Repositioning for CVS Health

Price $74.37 Core Holding March 18, 2023

- 3.25% dividend yield, strong free cash generation.

- Oak Street acquisition projected to add $2 billion in EBITDA by 2026.

- Expects significant volume growth at pharmacies with the introduction of several biosimilar and generic drugs in FY23.

- Modest FY23 guidance targeting 7% EPS growth despite some sustained headwinds in retail.

Investment Thesis

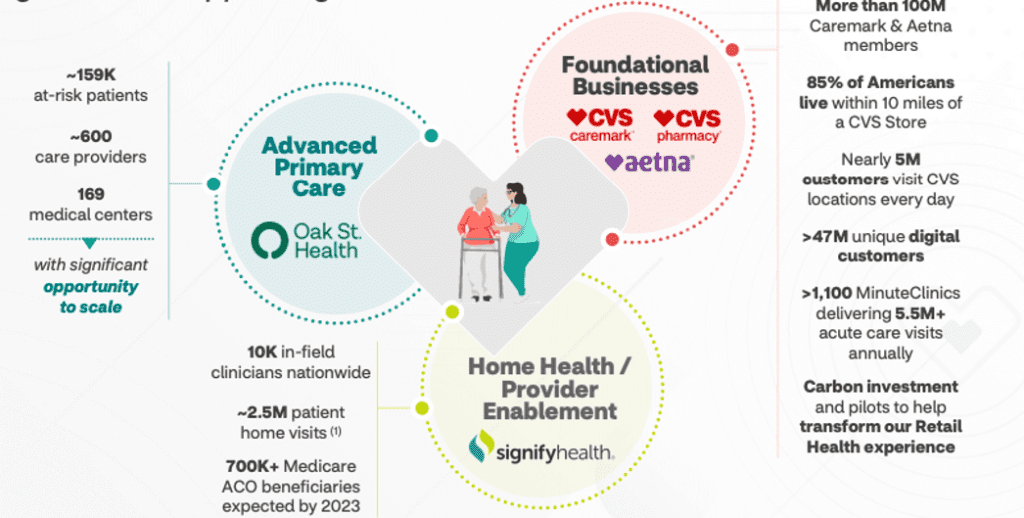

CVS Health (CVS) is a well-known retail pharmacy chain in the United States that has expanded into healthcare services with Aetna and is targeting Medicare Advantage and Medicaid recipients. In a recent acquisition in the form of Oak Street, CVS will continue this trend.

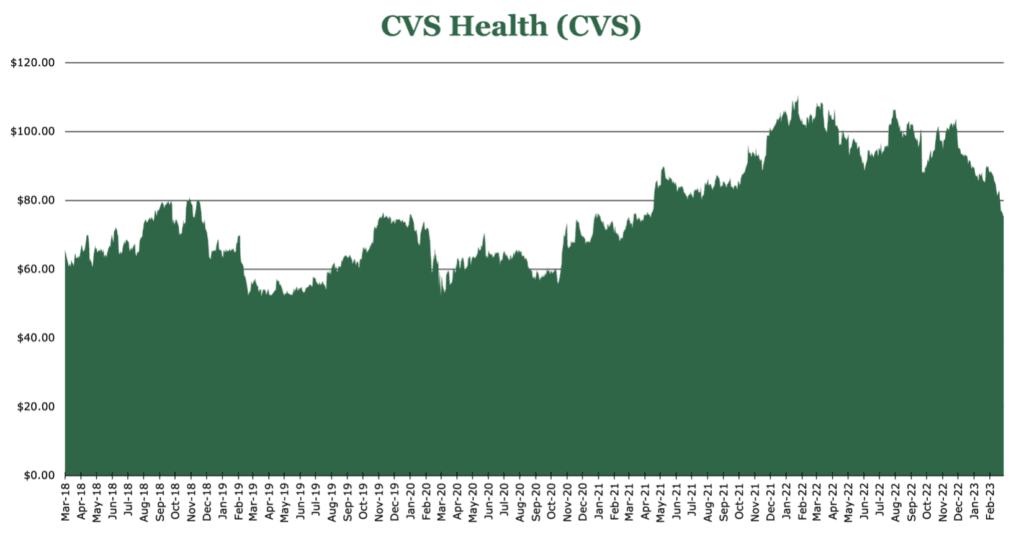

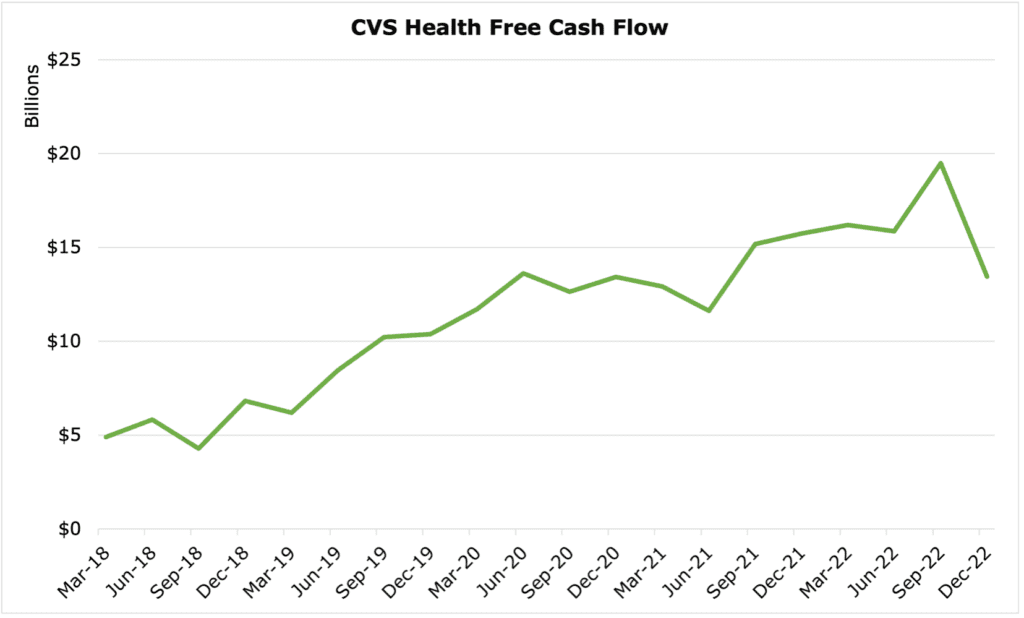

85% of the US population lives within 10 miles of a CVS, and the number of digital customers getting care under CVS Health has increased by 16% to 47 million. CVS is closing 900 retail locations to adjust mix toward healthcare and pharmacy services rather than retail. Despite our concerns about its debt level, it maintains a high free cash flow and consistent 3.2% yield dividend payout. CVS is both a deep value stock and a dividend growth stock. The current valuation combined with anticipated growth make CVS a compelling investment in our opinion.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $9.80 X 13 = $127

Given the retail, PBM and HMO businesses, we felt a combination of those industry multiples of 13x is conservative especially given our view of 8-10% EPS CAGR.

| CVS Health (CVS) | E2023 | E2024 | E2025 |

|---|---|---|---|

| Price-to-Sales | 0.3 | 0.3 | 0.3 |

| Price-to-Earnings | 8.5 | 8.2 | 10.0 |

Operations

The healthcare segment has seen explosive growth in recent years, surging customer counts to over 100 million. Growth in the segment for FY23 is expected to have mid to high single digit growth. Aetna is divesting from portions of its international business and certain services which do not fit the strategic profile. The healthcare segment has historically expanded toward providing “minute clinic” models. The “minute clinic” model is a payor-agnostic provision style that provide acute care. The Payor agnostic model of healthcare provision is providing care to anyone irrespective of health insurance network. However, with the Oak Street acquisition announced in 4Q22 and the Signify Health acquisition announced in 3Q22, CVS Health is targeting expansion into primary care. Roughly 85% of Americans live within 10 miles of a CVS, and the population’s average age is increasing quickly. CVS has an opportunity as a Medicare value-based care platform, offering clinic visits, home visits, and now advanced primary care centers.

While primary care is only about 10% of total US healthcare spend, it significantly influences patient outcomes and utilization of services. For example, if CVS can acquire patients through primary care services, it is likely then that those patients will choose CVS to fill prescriptions or for follow-up medical services.

Total revenues for the healthcare segment were up 11.3% year over year. COVID-19 related morbidity has been decreasing, with a 100bps decrease in the MLR (Medical Loss Ratio, claims divided by premiums). Segment guidance for healthcare is expected to be the highest of the reportable segments, with a 12% revenue increase, 2-4% customer

growth, and further contraction of the MLR in the neighborhood of 70bps. The healthcare segment has had good exposure to the increase in Medicare advantage holders, which handily offsets Medicaid losses.

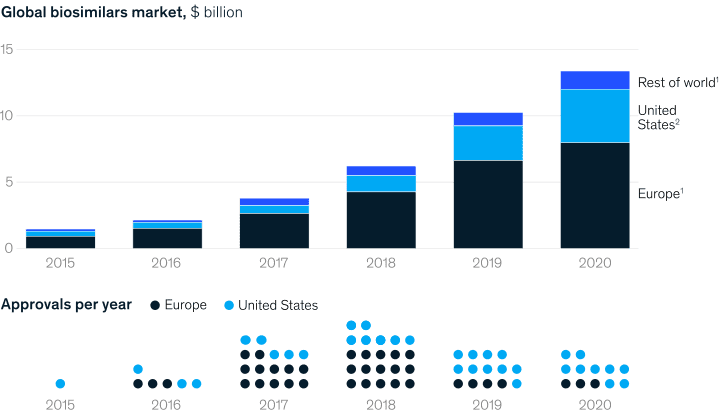

Pharmacy services are continuing to adjust mix and pricing for inflationary impacts. The most notable change is the expansion of generic and biosimilar markets, significantly improving volume. FY23 will see further growth in biosimilars including one for the widely prescribed HUMIRA arthritis drug. Volumes are up 3.1% year over year, with revenues up 11.2%. Guidance for FY23 expects to see an increase in the bottom line with the cheaper to acquire biosimilars, with flat revenue and volume.

Retail services segment is continuing to reduce its footprint in a cost saving measure. 600 of 900 planned closures will be completed by FY23. As a result, adjusted operating income has fallen by 25.1% year over year. While pharmacy same store volume has increased by 7%, decreasing uptake of COVID-19 vaccinations and pharmacy pricing pressure have resulted in down revenues and profits. Retail is expected to contract again in FY23; however, this is mostly due to continued costs associated with enhancing patient retention and investments toward modernizing store operations.

Total company wide revenues are up 10.4% year over year for FY22, and full year normalized EPS came in at $6.58.

Forward Plan

For FY23 CVS expects to see high single digit growth in revenues with a $8.70 earnings per share target. By FY25 CVS expects to be on the upper side of $10 per share. Foundational and organic growth is expected to contribute 7% growth, share repurchases, and health care expansion is expected to make up 2-3%. FY23 guidance is expected to be at least $333 billion in revenue and $9 billion in free cash flow.

In FY22 the dividend was increased by 10%, and we expect a similar announcement regarding FY23. From FY22-FY24 CVS expects to have a cumulative $50 billion in cash for deployment in growth areas. At least 25% will go toward expanding Capex, 20% toward growing the dividend, and the remainder will remain on hand. On hand uses of cash could include M&A and retiring debt. We expect it to be used to repurchase shares to increase EPS or reduce the debt load from M&A.

Oak Street Acquisition

CVS announced its intent to acquire Oak Street Health for $10.6 billion intent on closing in FY23. Oak Street will become a payor-agnostic healthcare provider bolted onto the existing CVS Health entity. Oak Street provides healthcare to 160,000 people across 21 states, primarily engaged with low-income high-age patients. Over time, Oak Street is expected to add $2 billion to EBITDA by FY26 with an additional 500 million possible through expansion in the addressable market. Elective areas of healthcare, like the $500 billion “wellness” market, continue to see expansion. In a post-COVID healthcare environment McKinsey estimates that the traditional model of high-cost acute care will continue to contract.

Payer pools are expected to “shift substantially” toward those with a Medicare Advantage plan. Additionally, the COVID-19 pandemic drastically shifted the healthcare landscape in the places patients seek care. Acute care revenue in hospitals and traditional medical networks is expected to fall 4%, while home care or separate facility care is expected to grow 2% over the same period. Oak Street will contribute to the existing Aetna and Signify Health network provided by CVS health and capture this shift.

Risk

Our main concern with CVS is how much debt they hold. They have been aggressively expanding the healthcare segment in recent years and interest expense has hit $2.3 billion per year. While we don’t feel that this is an imminent problem given its cash flow, its M&A could outrun itself. It will spend at least an additional $10.6 billion to acquire Oak Street.

CVS has seen significant impairment due to ongoing claims related to opioid dispensing, which has caused a measurable hit to earnings per share. Over 10 years CVS will be expected to pay $5 billion in claims to state and local governments.

Competitive Comparisons

| CVS Health (CVS) | Walgreens Boots Alliance (WBA) | Laboratory Corp Of America (LH) | Quest Diagnostics (DGX) | Humana (HUM) | Centene Corporation (CNC) | |

|---|---|---|---|---|---|---|

| Price-to-Earnings (FWD) | 8.53 | 7.45 | 12.61 | 15.26 | 17.58 | 9.90 |

| Price-to-Sales (TTM) | 0.31 | 0.22 | 1.34 | 1.56 | 0.67 | 0.27 |

| Price-to-Book (TTM) | 1.39 | 1.4 | 1.91 | 2.52 | 4.04 | 1.45 |

| EV-to-EBITDA (FWD) | 7.51 | 10.65 | 9.79 | 10.73 | 11.93 | 8.27 |

| Dividend Yield | 3.25% | 5.75% | 1.31% | 2.12% | 0.72% | 0.00% |