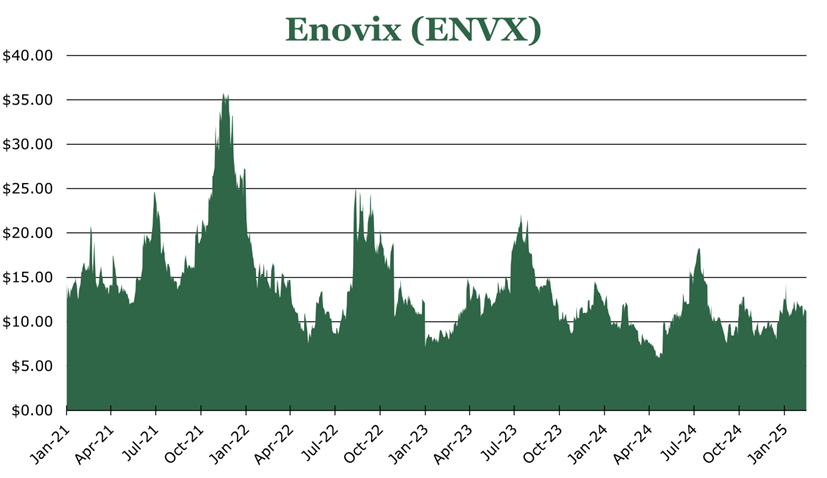

2025 Is ENVX’s Inflection Point With First Commercial Production

| Price $11.01 | Growth Holding | February 22, 2025 |

- First to market 100% silicon anode lithium-ion battery, with 30% better energy density and faster charging than graphite anode batteries.

- Fab2 Production ramp in Malaysia, expecting first customer samples by mid-2025 and full serialized production by the end of September 2025.

- OEM agreements secured with 2 of the top 8 global smartphone manufacturers, a major IoT company, and 2 wearables customers.

- Automotive potential with a non-binding agreement to co-develop larger-scale battery cells for EV (Electric Vehicle) applications.

- Raised $100M in 2024, has enough funding to operate until at least September 2025.

Investment Thesis

Enovix (ENVX) is a Silicon Valley based battery design and manufacturing firm, specializing in the first 100% silicon anode lithium-ion batteries for consumer electronics. The primary fabrication line, Malaysia-based Fab2, exited testing in January 2025 and is now ready for large-scale order fulfillment. We expect first customer demos to be delivered in the quarter ending June 2025 with first serialized production in the quarter ending September 2025.

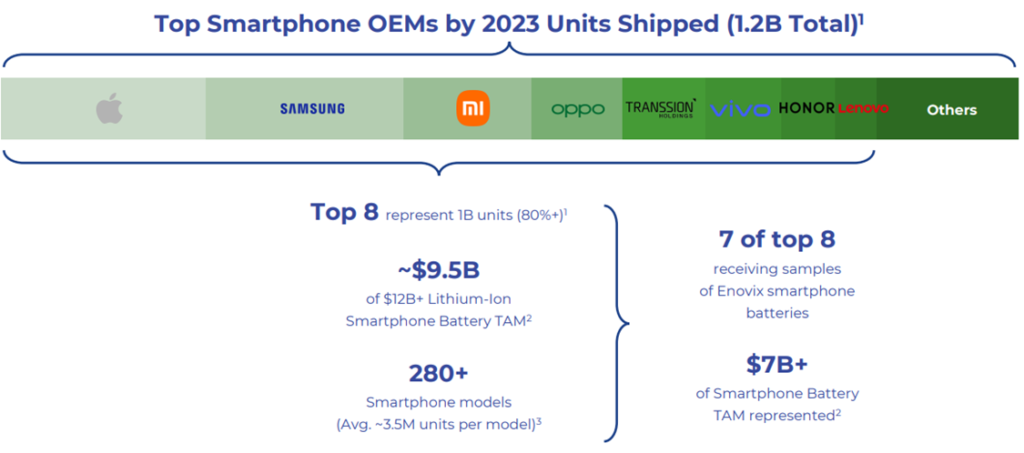

For the 2025 production ramp, ENVX has announced it has supply agreements with 2 of the top 8 global smartphone OEMs, a ‘leading’ IoT (internet of things) customer, and 2 wearables customers. Additionally, it has signed an agreement with an auto OEM to co-develop a larger-scale version of its cells for automotive uses.

On the consumer side, 100% silicon anode batteries offer improved density which will be critical for artificial intelligence enabled smartphones and IoT devices. Over the longer-term, licensing its technology to automotive OEMs could provide additional revenues with minimal capital expenditure requirements. While we do not expect ENVX to enter profitability in 2025, we believe that the stock represents a long-term opportunity.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E29 EPS X P/E = $1.35 X 15.5 = $21.00

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 94.8 | 50.8 | 11.4 |

| Price-to-Earnings | Neg | Neg | 115.0 |

Operations

Currently, the only scaled production comes from Routejade, which ENVX acquired in November 2023. Routejade is a South Korean manufacturer of graphite-silicon hybrid anode lithium-ion cells and packs. The acquisition’s purpose was to bring electrode and packaging capabilities in-house which were previously outsourced.

The existing Routejade production line is the largest and most significant of ENVX’s operations. We expect Routejade to continue to make up the majority of revenue through the middle of 2025 when ENVX begins billing sample runs of batteries for OEMs.

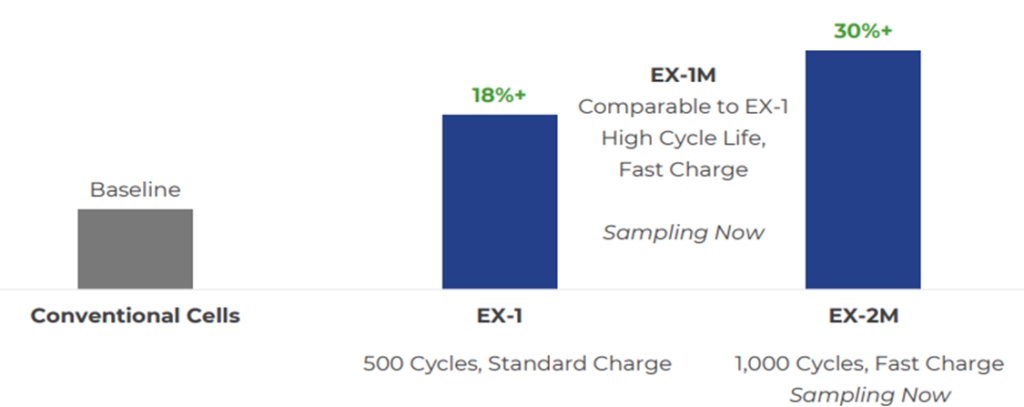

ENVX is the first to bring a 100% active silicon anode consumer-grade battery to market. Theoretically, silicon anodes allow for much higher capacity and better charge time – though they do sacrifice the maximum number of charge cycles before performance degradation compared to mainstream graphite anode batteries. While technical specifications are not directly available, a technical paper published by ENVX asserts that their flagship silicon anode EX-1 offers 18% more energy density and a much faster charge time with minimal degradation in long-term life, with the EX-1M and EX-2M offering around 30% higher density. The EX-1M is in the 5,000-5,500 mAh (milliampere hours) range compared to the normal 2,500-4,000 mAh range in most phone graphite anode batteries.

Management indicated that some OEMs it had demoed the EX-1M to are already inquiring about 7,000 mAh battery capability for artificial intelligence enabled phones. If artificial intelligence becomes more prolific in everyday life, including in smart phones and IoT devices, the power draw will increase requiring higher mAh batteries. While no technical data has been provided, management stated that it shipped some EX-2M samples in the final quarter of 2024, which we expect will be in the 6,000+ mAh range.

Economics

ENVX estimates that its present run rate for the EX-1M are likely to be around $13/unit in ASP (average sales price). Typical graphite anode batteries are in the $7-$9/unit range, with ENVX reporting Routejade’s graphite-silicon hybrid batteries have an ASP of $10-12/unit. For future production runs, ENVX is targeting $150 million in annual revenue per line with $60 million in startup costs which would align with the $13/unit ASP based on published throughput data. In the future, we do expect ENVX to be able to break out of this pricing if it is able to bring 6,000+ mAh batteries to market at high yields.

The key metric to watch over the long term will be battery yields. The typical lithium-ion batteries at scale should have a production yield of over 90%, meaning less than 10% of produced batteries are recycled for not meeting quality standards. Currently, ENVX reports around 80% yield at the new EX-1M Agility line, with the HVM (High-volume manufacturing) line expecting to exit factory tests at similar 80% yields. As ENVX is the first 100% active silicon in the consumer market, lower initial yields are not concerning. However, if there are not meaningful yield improvements by the middle of 2026 ENVX may struggle to gain long-term supply agreements.

While silicon is more available than graphite, much of the battery-grade silicon supply chain is not as mature and still dominated by China. Over the long-term, the adoption of silicon anodes will drive costs down and expand the supply chain which could allow some long-term margin tailwinds. Over the medium-term ENVX is guiding toward a gross margin at 50% in current market conditions.

2025 Will be an Inflection Point

ENVX has stated that it had provided demo units to 7 of the top 8 global smartphone OEMs, with 2 signing supply agreements. Additionally, one of the OEMs signed a development deal for a premium launch in the latter half of 2025. While ENVX has not given up who the premium launch customer is, they did state they are in the top 5 in market share in China, and top 8 globally, which limits the potential options to Vivo, Huawei, Xiaomi or Honor.

A ‘leading’ IoT customer has also signed a deal for a large-scale production order to begin delivery in 2025. Over the longer-term, defense-focused IoT is an area that has had some OEM interest. During the quarter ending December 2024 ENVX engaged with a defense contractor in the drone-space, looking to comply with US laws regarding allied country supply chain requirements.

In January 2025 ENVX announced it had received a pre-paid purchase order from a Silicon Valley-based “global tech leader in AI and immersive technologies” for batteries in wearables, with initial deliveries slated for mid-2025. During the earnings call for the quarter ending December 2024 it also stated that it had signed an agreement to provide units to another company planning to launch wearables sometime in the future, though management did not give specifics.

While there is very little detail available on the orders or the customers, a blurb in the earning release for the quarter ending December 2024 indicates that it is for glasses with augmented reality and AI capability. Additionally, ENVX has identified the pre-paid customer as a “marquee customer”, meaning it has large influence in their industry and one that could provide a high-growth and captive sales avenue. This leads us to believe the primary customer is possibly Meta who has invested into a partnership with Ray-Ban.

All of the deals will supply customer-spec versions of the EX-1 and EX-1M, with first samples delivered during the quarter ending June 2025. As a result, we do not expect capex to be meaningfully above $30 million for 2025 with the year focusing heavily on relationship building and executing the first customer orders. Any manufacturing hangups that could occur should be expected during the quarter ending June 2025 when ENVX begins shipping to OEMs. If there are no major issues, we expect to see revenue substantially increase going into the quarter ending September 2025.

Over the long-term we expect ENVX to expand its silicon technology to a broader scale of applications including automotive. In July 2024 ENVX signed a non-binding agreement to work with an automotive OEM on scaling cell designs into the EV scale. During the earnings call for the quarter ending September 2024, management indicated that it was not going to target opening a fab for EV components or tool an existing one but rather target joint ventures focused on licensing agreements.

Financials

In late 2024, ENVX raised $100 million through issuing more shares, which should provide a runway until large-scale production begins in 2025. In filings, ENVX stated that it has enough funding to continue until at least the quarter ending September 2025. Therefor we anticipate more capital to be raised in the second half of 2025. As previously stated, by that point ENVX should have some serialized production which should allow it to raise more money along with providing it a source of positive cash flows.

Much of the current cash expenditure is allocated to Capex. As previously discussed, we expect capex to fall to the $30 million neighborhood from 2024’s $80-90 million buildout. This should allow for tooling and maintenance of existing lines as well as small capacity expansions for new customers. ENVX has a large component of share-based compensation, and while it is concerning considering the weakness of the balance sheet, retaining talent is going to be critical to execution of the EX-1M scaling and development of EX-2M.

Currently ENVX has $169 million in long-term financial debt, though much of the debt is convertible due in 2028, with the first floating rate note not having a maturity until the middle of 2027. Currently ENVX has very favorable rates on its debt, under 6%.

Conclusion

We believe that 2025 will be the inflection year for ENVX. Based on its rapid securing of relationships with major OEMs, we are confident in the technical specifications of their product. With serialized production revenues expected by the end of 2025 coupled with holding enough cash to operate over that time period we are confident in management’s ability to execute.

Peer Comparisons