Economic and Market Review

October 31, 2023

| Equity Indices | YTD Return |

| Dow Jones | -0.28% |

| S&P500 | 9.23% |

| NASDAQ | 22.78% |

| MSCI – Europe | 1.38% |

| MSCI–Emerging | -4.31% |

| Bonds | Yield |

| 2yr Treasury | 5.07% |

| 10yr Treasury | 4.88% |

| 10yr Municipal | 3.64% |

| U.S. Corporate | 6.08% |

| Commodities | Price |

| Gold | $1992/oz |

| Silver | $22.96/oz |

| Crude Oil | $81.36/barrel |

| Currencies | Rate |

| CAD/USD | $0.73 |

| GBP/USD | $1.22 |

| USD/JPY | ¥148.77 |

| EUR/USD | $1.05 |

Overview

Global financial markets reacted to the conflict in the Middle East war with caution, concerned that the hostility could erupt into a broader situation engulfing other countries and territories. A flight to the U.S. dollar and U.S. government bonds took hold as equity volatility rose in response to the conflict.

The Federal Reserve opted to leave rates unchanged during their most recent meeting, with Fed Chair Jerome Powell hinting that no further rate increases might be needed. The Federal Reserve bases its decisions on economic data that can vary dramatically from month to month, so some analysts doubt that the Fed has formally completed its rate hike strategy.

The Treasury Department announced that it plans to issue less longer-term debt, as the cost of interest payments for the government has increased tremendously as rates have risen. This led to a decrease in long-term Treasury bond yields as investors opted for higher-yielding short-term bonds. Some economists view this dynamic as an indicator that rates may be approaching a pinnacle.

The Treasury bond market experienced volatility in October that resembled the stock market. Hedge fund manager bets against U.S. government debt, flight to government bonds due to the conflict in the Middle East, and a flood of new debt issuance to fund swelling U.S. budget deficits contributed to the volatility. The yield on the 10-year Treasury bond reached 5%, a 16-year high before retreating back to below 5%.

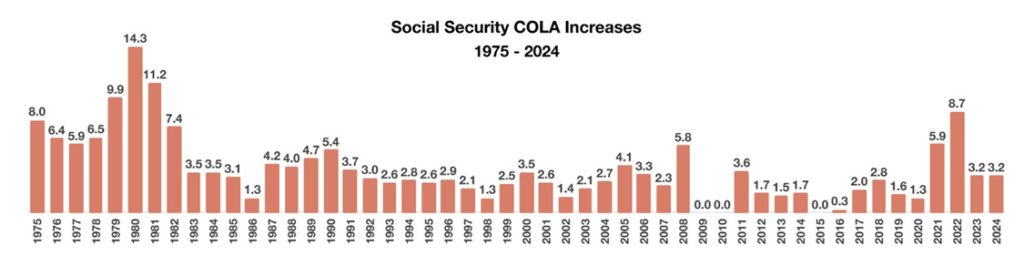

Social Security benefit payments are slated to increase 3.2% effective January 2024, following the same increase as in 2023. The increase, based on the Cost of Living Adjustment (COLA) is designed to keep pace with inflation. Medicare premiums, however, are expected to increase 5.9% in 2024, more than the increase in Social Security.

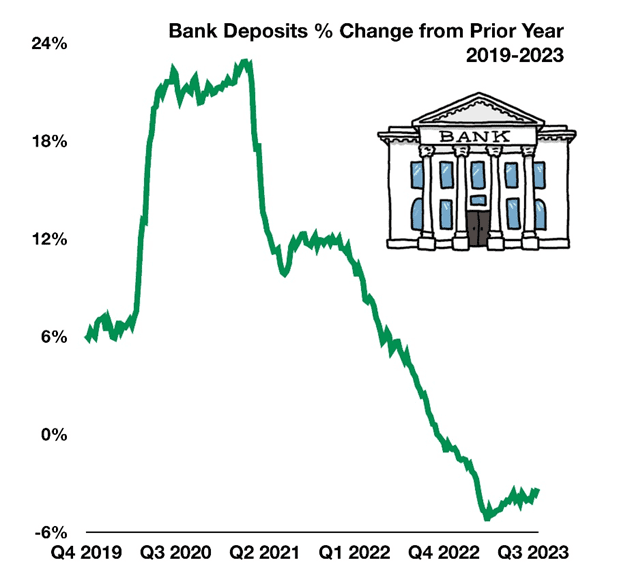

Bank Deposits Heading Downwards

Consumers have been slowly depositing less money into their bank accounts over the past three years. As the pandemic shuttered restaurants and retail stores in 2020, bank deposits increased as consumers spent less and instead saved their cash. Generous government stimulus programs also led to consumers saving more as unused cash landed in bank deposits.

As businesses reopened and consumers began spending again in 2021, bank deposits fell as consumers decided to spend rather than save. Inflation also contributed to less savings and falling bank deposits as consumers found themselves spending more as the post-pandemic recovery drove prices higher.

Recent higher interest rates offered by banks did entice some to deposit more, yet deposits remain much lower than they were even before the pandemic. Banks struggled for years to capture deposits as rates stood at multi-decade lows up until 2022 when the Fed commenced its rate hike strategy. Some bond analysts believe that rates may start to decline as the Fed reacts to slowing economic data signaling dissipating inflation and consumer confidence.

How Deflation Develops and What It Does

A gradual devaluation or decline in overall asset prices is known as deflation, which leads to lower prices on most goods and services. This eventually creates an unfavorable environment for companies to raise prices and maintain already elevated profit margins. Ironically, what has led to this environment are the lingering effects of inflation. As the pandemic diminished and consumers spent more, companies raised prices as demand increased, eventually bringing about inflation. Now, as demand dissipates and consumers spend less, prices head lower.

Economists suggest that long-term yields can directly portray deflation. As the 10-year Treasury bond yield has fallen since its peak in October, nominal GDP along with inflation has slowly fallen. Real wages have also contracted, leading consumers to refuse to pay higher prices but demand more lower-priced goods. Retail stores have resorted to discounting in order to increase sales and reduce unwanted inventories.

Commodities across the globe are also reflecting deflationary characteristics as prices have pulled back from the highs of 2021 and 2022, including lumber, natural gas, aluminum, copper, and wheat. The International Energy Association (IEA) for the first time predicted that global demand for oil will reach a peak this decade, indicative of possibly lower oil and gasoline prices in the future.

Fed Chair Jerome Powell mentioned that elevated long-term bond yields lessen the pressure for tighter monetary policy, meaning that the Fed may not need to raise rates further, thus allowing rising bond yields to slow economic activity.

Social Security Gets a Cost of Living Adjustment

Social Security recipients are due to receive an increase of 3.2% in 2024, the same as last year’s increase. For many recipients, the increase in payments will go towards higher living expenses as well as increased Medicare premiums. The increase in benefit payments is effective in late December 2023 for SSI (Supplemental Security Income) recipients and in January 2024 for Social Security recipients.

Many are concerned that the Social Security benefit increase may not cover expenses that are rising at a faster pace, including essential items such as food, housing, and energy. Medicare Part B premiums are expected to increase 5.9% at the beginning of 2024, nearly double of the 3.2% COLA increase for Social Security. The establishment of Social Security occurred on August 14, 1935, when President Roosevelt signed the Social Security Act into law. Since then, Social Security has provided millions of Americans with benefit payments. The payments are subject to automatic increases based on inflation, also known as cost-of-living adjustment (COLA) which has been in effect since 1975. Over the years, recipients have received varying increases depending on the inflation rate.

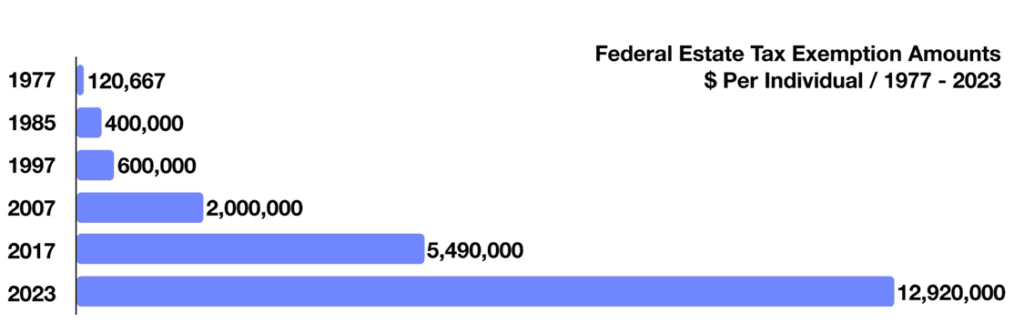

Estate Tax Exemption on Track to Decrease in 2026

Estate tax exemptions began with the Revenue Act of 1916, which imposed a transfer of wealth tax on the estate of any deceased U.S. citizen valued above a certain amount at the time of death. In 1916, the exemption amount was $50,000, today that amount is $12.92 million. Over the decades, however, the exemption amount has varied, driven primarily by lawmakers and inflation indices. In 1977, the exemption amount was $120,667, then gradually increased over the years to $5.49 million in 2017. The current exemption is expected to revert to $5 million on January 1, 2026, yet may be higher depending on where inflation is at that time. Some estimate the revised exemption amount to reach between $6 to $7 million after adjusting for inflation.

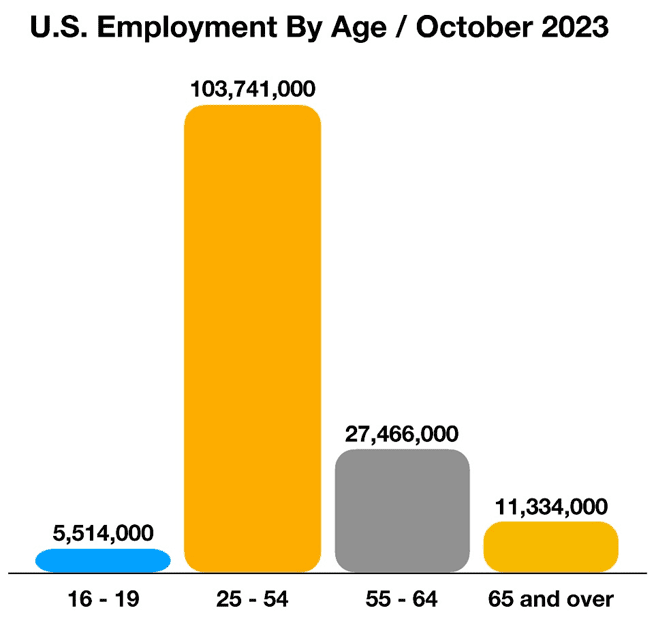

Baby Boomers Working Past Retirement

This year the youngest baby boomers are now 59 and the oldest are 77, according to the Bureau of Labor Statistics. As more baby boomers reach retirement, good health and financial obligations are driving more to work longer or find a new job.

As baby boomers retire, some are finding it necessary to return to work even in their retirement years. Data released by the Labor Department show that many baby boomers may have worked for the same employer for years, then retired, yet find themselves seeking work thereafter. There hasn’t been a growing trend of retirees doing this yet, but there has been a consistent number.

As of this past month, there are over 11.3 million workers age 65 and older which account for 18.8% of the total population, relative to 25 to 54-year-olds which represent over 103.7 million workers making up 81.0% of the employed civilian labor force.