Economic and Market Review

November 30, 2024

| Equity Indices | YTD Return |

| Dow Jones | 19.08% |

| S&P500 | 27.19% |

| NASDAQ | 30.15% |

| MSCI – Europe | 6.75% |

| MSCI–Emerging | 11.66% |

| Bonds (Yield) | |

| 2yr Treasury | 4.16% |

| 10yr Treasury | 4.17% |

| 10yr Municipal | 2.83% |

| U.S. Corporate | 4.68% |

| Commodities | |

| Gold | $2,649.87/oz |

| Silver | $30.62/oz |

| Crude Oil (WTI) | $68.15/bbl |

| Natural Gas | $3.368/MMBtu |

| Currencies | |

| CAD/USD | $0.71 |

| GBP/USD | $1.27 |

| USD/JPY | ¥149.75 |

| EUR/USD | $1.06 |

Overview

Equity markets closed at another record high on the last trading day of November. November was the best month of the year for the S&P 500 and Dow Jones, with the S&P 500 having its best YTD performances since 2013. Largely gains came from renewed market optimism following a Trump victory and strong preliminary economic data.

With the government fiscal year at a close, the federal government spent more than $6.75 trillion, compared to receipts of just $4.92 trillion – ending the year at a massive $1.83 trillion deficit, the third largest on record.

Gold experienced a brief sell-off post-election, ending the month down 3%. Gold is still up a strong 28.65% YTD, driven by gold ETF demand and continued central bank diversification.

The US Dollar saw its best day in a year after the election, with currency markets pricing in the continuation of tax cuts and deregulation. However, the threat of a broad-based tariff across all imports did cut upward momentum against most currencies.

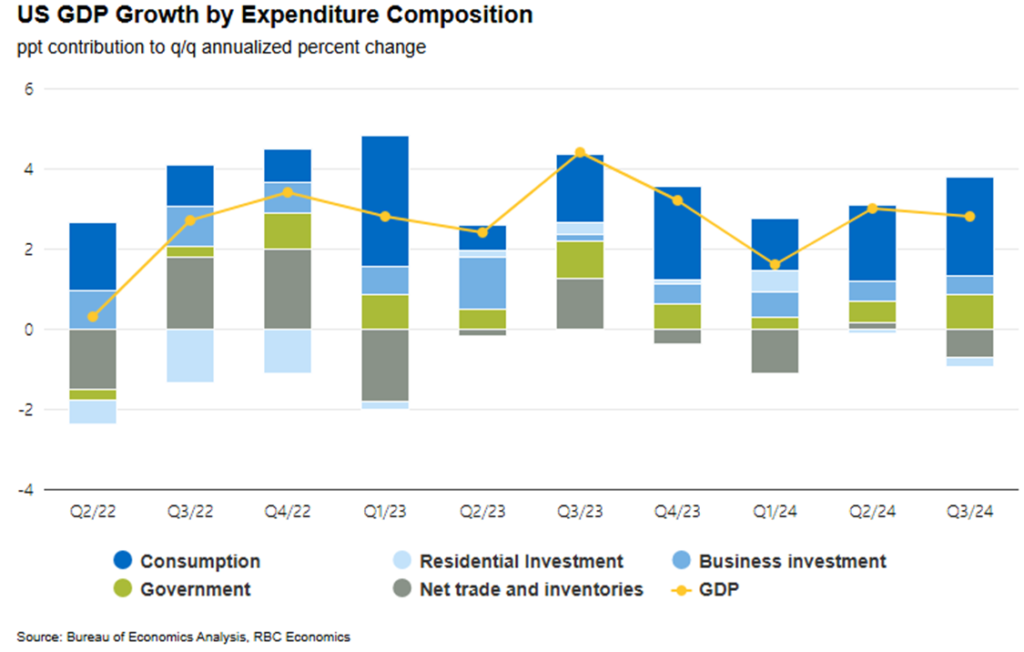

GDP Growth Above Expectations, but so Was Inflation

The US real GDP grew by 2.8% in the third quarter of 2024, driven primarily by higher-than-expected personal consumption. Business investment came in as expected, though Q2 did see an upward revision in research and development spending indicating increasing strength in the business environment.

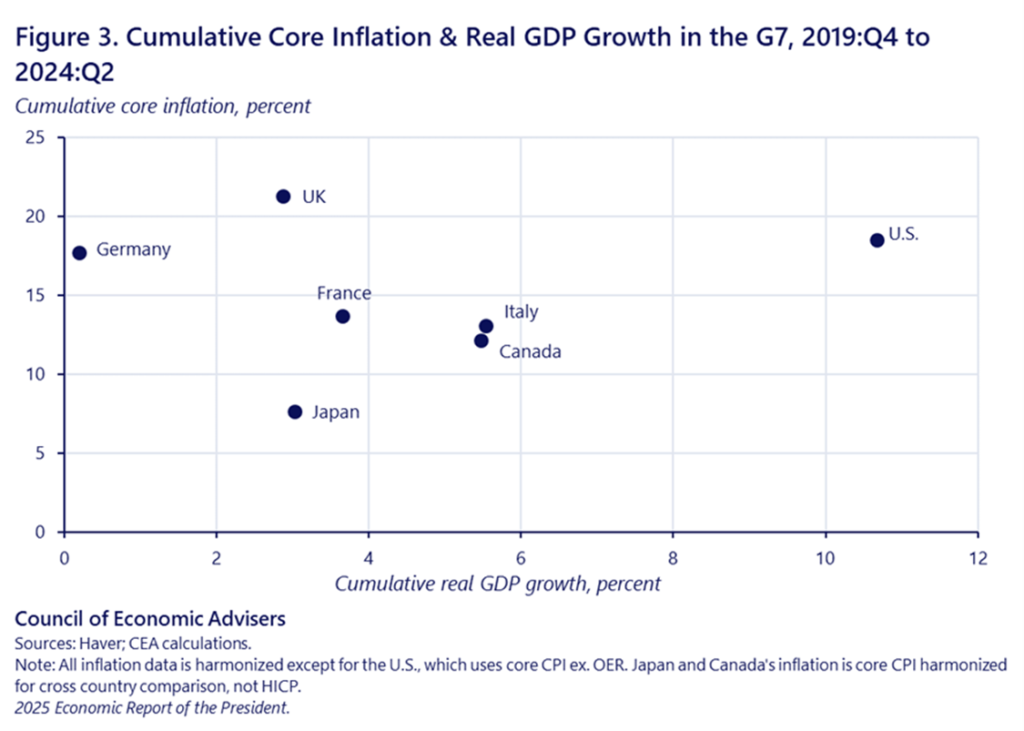

Compared to peer nations, the United States has undoubtably recovered much faster, and much stronger; however, it does sit on the higher end of experienced inflation.

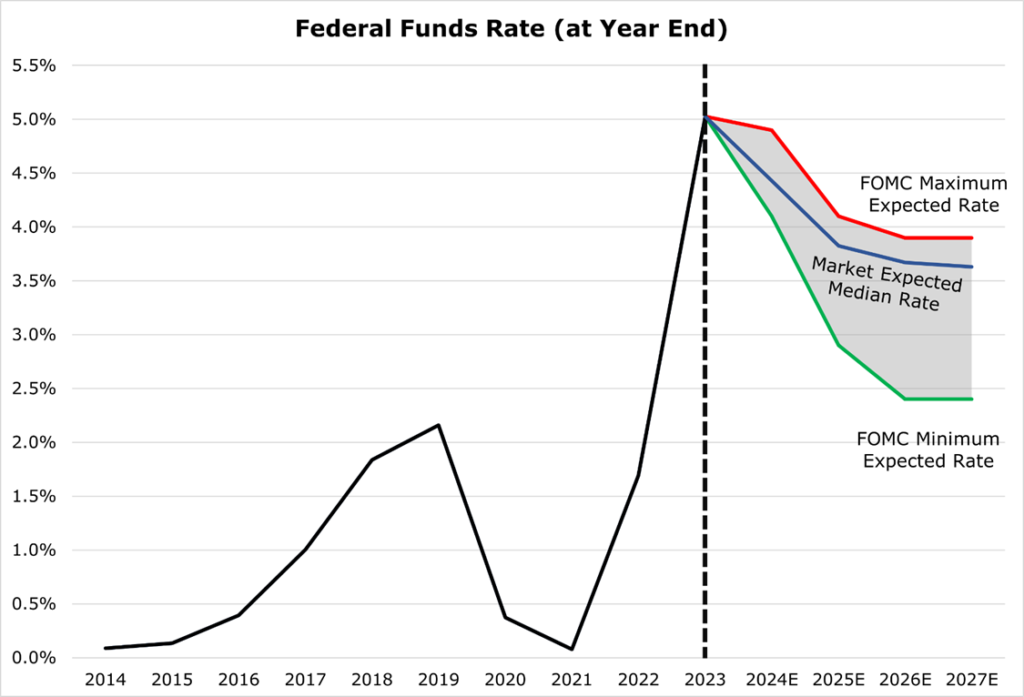

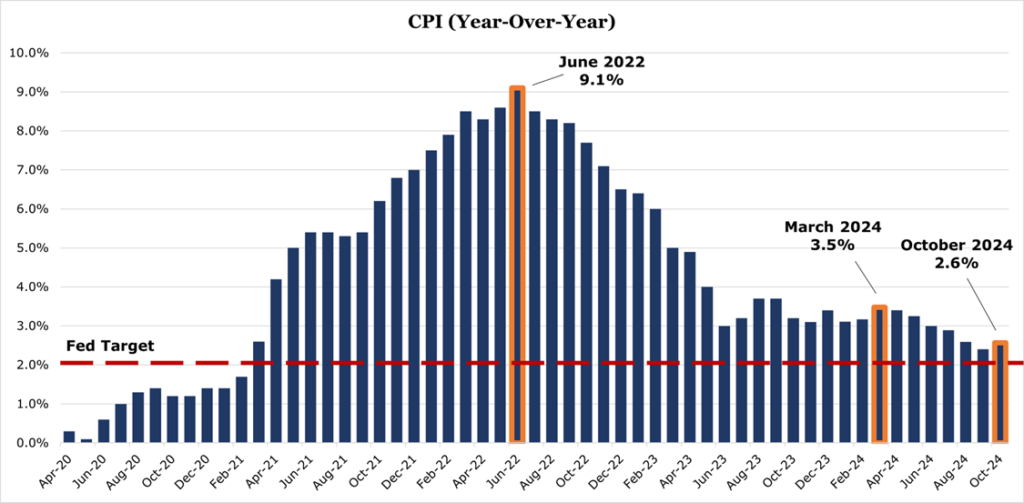

Inflation remains above target, even re-accelerating compared to when the Fed first started cutting rates in September. Thus, the market has seen a quick revision on the expected federal funds rate, now expecting to end 2024 at 4.25% — 25bps higher than at the end of October.

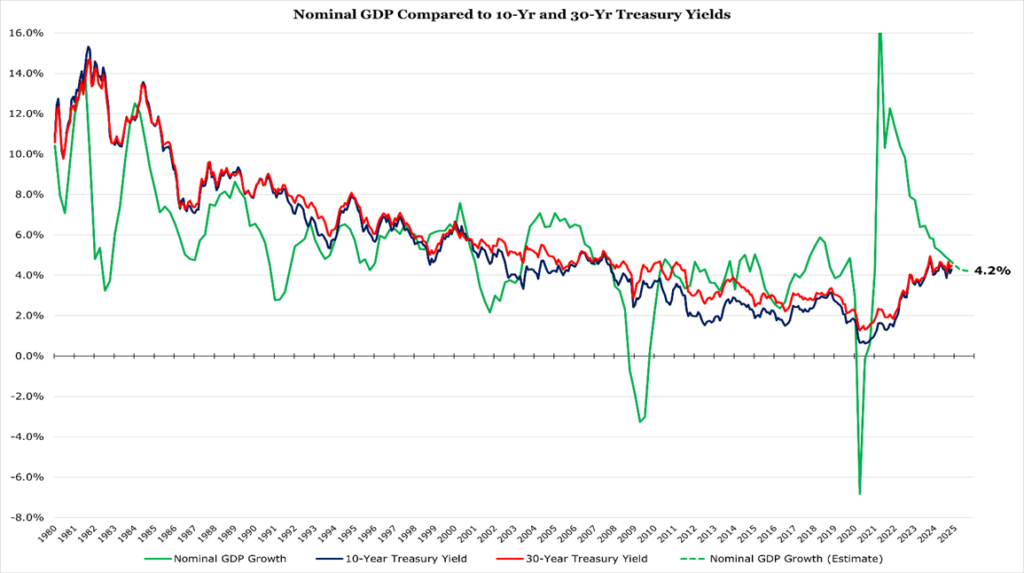

As we discussed in our video on the deficit, the long-term part of the curve tends to mirror nominal GDP growth.

With nominal GDP growth expected to end 2024 at 4.2%, it is likely that the long part of the curve will stay higher longer, while the short end of the curve has some room to contract.

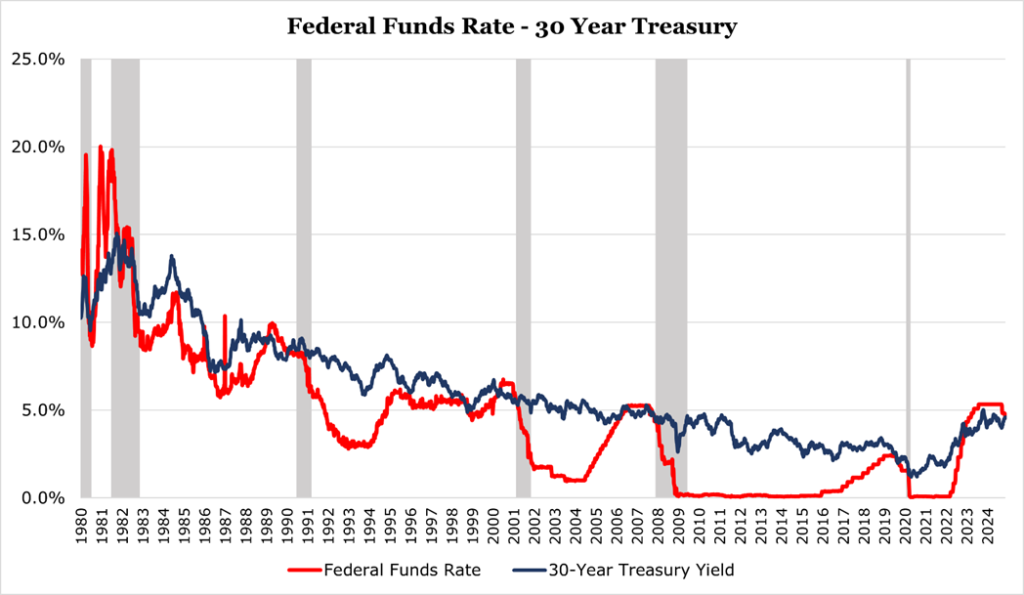

As the Fed lowers short term interest rates, it increases the money supply – which accelerates economic activity but also accelerates inflation. As the market prices in higher GDP growth and higher inflation over the long term, the long part of the curve begins to rise. When the Fed began to cut interest rates, the 30-year Treasury ended up increasing its yield by 60bps.

Will the Fed Blink

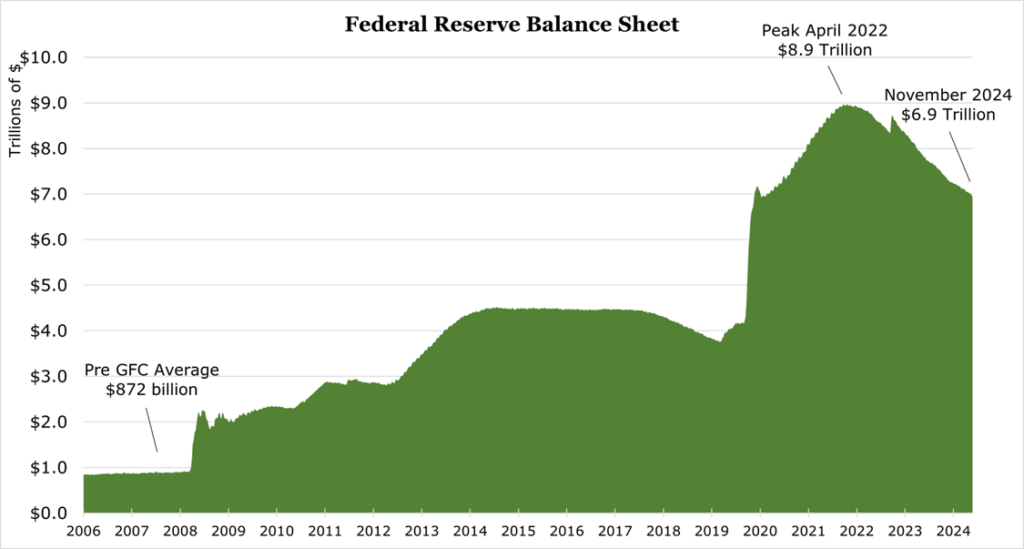

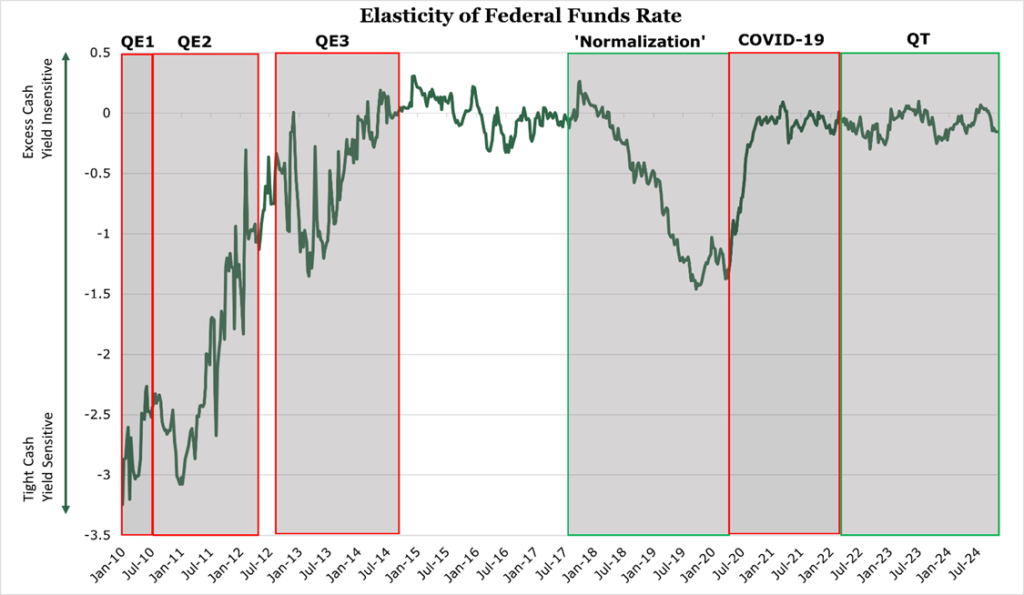

Since the peak of the Fed’s balance sheet in 2022 of almost $9 trillion, it has begun to make a dent through quantitative tightening. It still has a long way down to reach the pre-Global Financial Crisis level of $800 billion.

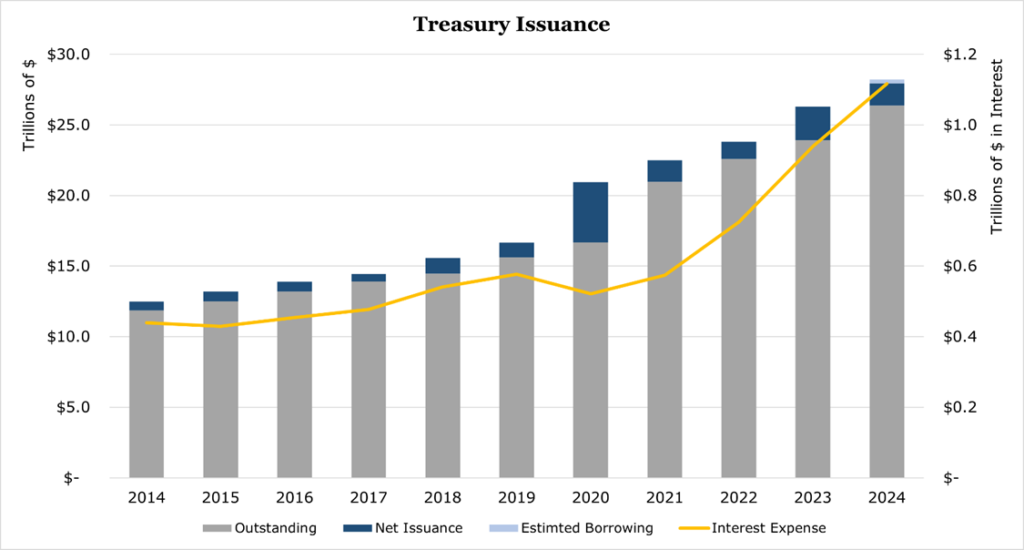

The average interest rate on debt held by the US government is projected to increase to 3.4% over the medium term, which will keep interest expense higher for longer, as low-interest issuances begin to roll off and the government issues new higher-interest debt to pay for it.

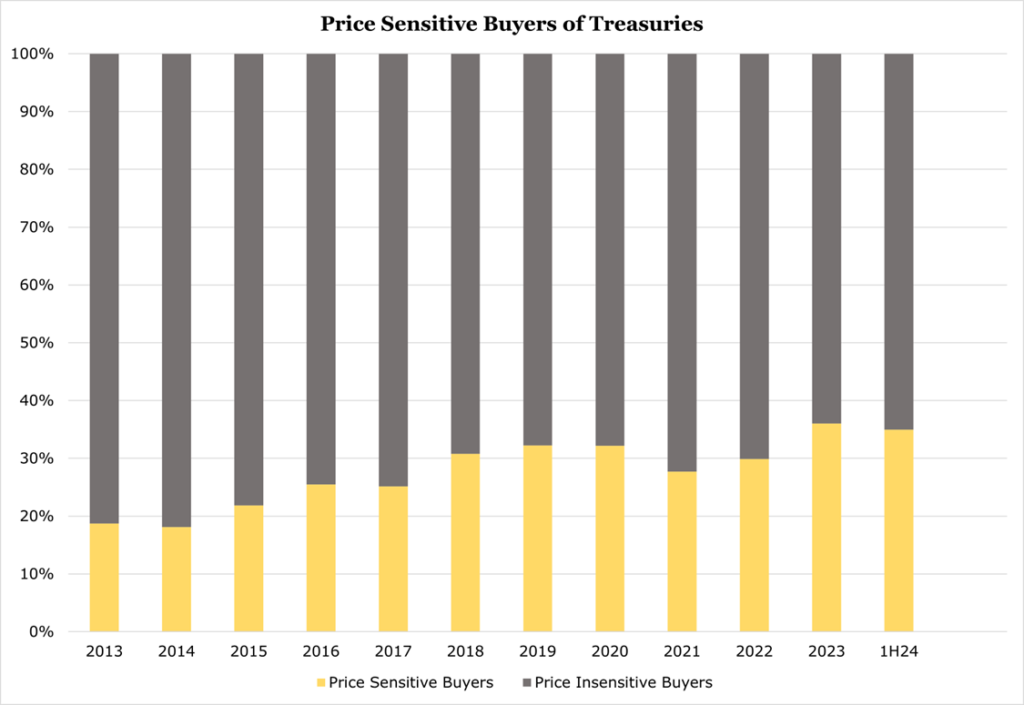

As we have discussed before, additional high-interest issuances have been absorbed by price-sensitive buyers, like hedge funds, investment advisers, investment banks, and other yield-seeking institutions.

Price-sensitive buyers tend to react to policy changes or economic conditions, which can introduce volatility into the traditionally stable Treasury market. As volatility increases, the rate demanded by investors does too, which would drive down the price of the bonds further. This would significantly increase the interest rate on new Treasury issuances and require a higher volume of issuances to keep pace with future interest payments.

The increase in volatility would also have effects on price-insensitive buyers. Despite price-insensitive buyers being yield- and price-agnostic, at higher yields and higher volatilities, other asset classes may provide better risk-adjusted returns which could cause a liquidity crunch.

The Fed has released a new dataset to abate market fears about how much demand there is for more Treasuries. The Fed’s offloading its balance sheet directly impacts Reserve Demand Elasticity (RDE), a measure of how sensitive the federal funds rate is to changes in bank reserves. When reserves are abundant (RDE above zero), banks don’t compete, and reductions in reserves through purchasing Treasuries have negligible effect on interest rates. However, as the Fed continues reducing its balance sheet, reserves can become scarce (RDE below zero), causing banks to demand higher yields, driving up rates, and making monetary policy less effective.

Treasury Secretary Nominee’s Deficit Plan

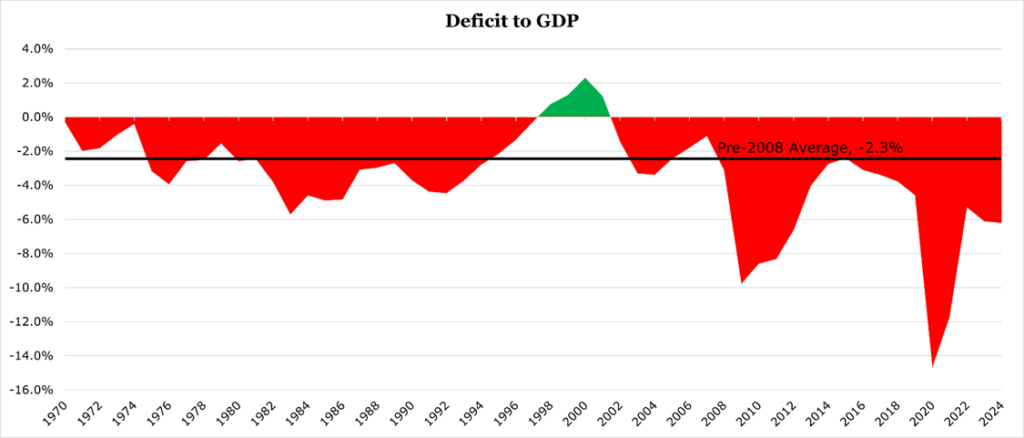

President Elect Donald Trump has proposed Scott Bessent for his Treasury secretary. One of the key points he has emphasized in past interviews is to reduce the US deficit to below 3% of nominal GDP. Before the 2008 Global Financial Crisis, the United States government averaged a deficit to GDP of -2.3% over the last 50 years. The United States had -6.2% deficit to GDP for the quarter ending September 2024.

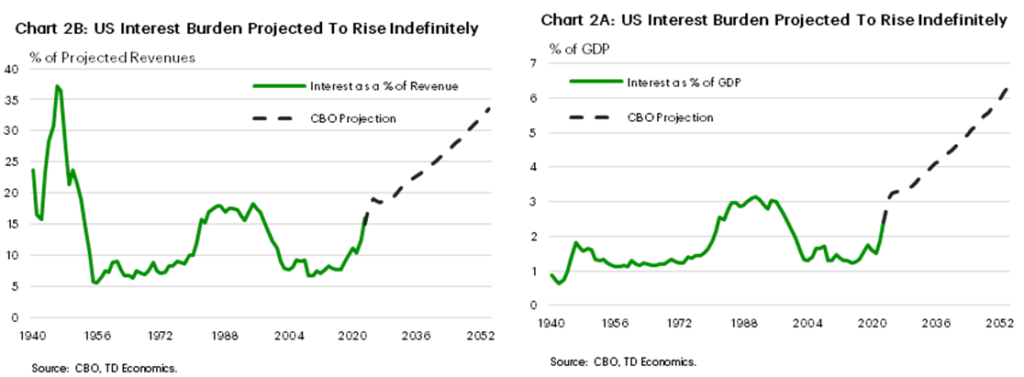

Determining a sustainable level of deficit spending is a problem that has stumped economists for a generation. Most agree that a sustainable level of deficit spending is a level in which net interest payments do not increase as a percentage of GDP.

Historically, the US has paid interest on its issued debt of less than 3.0%, even in a serious economic crisis. Artificially low interest rates have delayed the impact of the massive levels of deficit spending experienced in the wake of the 2008 financial crisis. As previously discussed, the average interest rate on debt held by the US government is projected to increase to 3.4% over the medium term. At this level the Congressional Budget Office projects more than 6% of GDP will be eaten by interest on US government debt by 2050.

According to TD Economics, for net interest payments to remain stable and under 3.0% of GDP by 2035, the US government would need to run a surplus of at least 2% of GDP for 6 out of the next 10 years. As discussed in our video, there is a political unfeasibility for touching non-discretionary spending like Social Security and Medicare. Therefore to return to a more sustainable path, the US would need to cut around 30% of its spending. Currently, Bessent has only stated his support for a pause on non-defense discretionary spending, which makes up 13% of the federal budget.

Energy Producers See Price Uncertainty Going into 2025

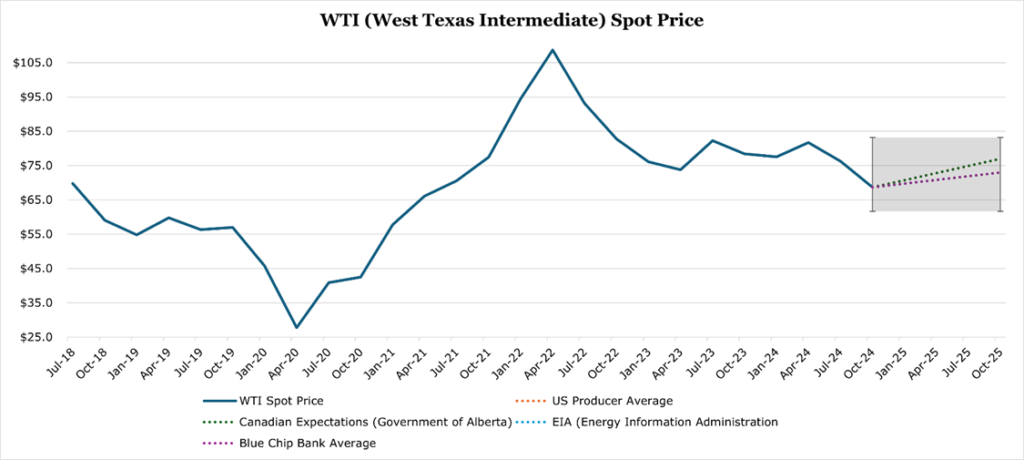

The Kansas City Fed has released its survey of domestic US oil producers. International organizations like OPEC+ and the IEA (International Energy Agency) have lowered demand forecasts for 2025, causing oil prices to dip at the end of November. Additional concerns about OPEC+ removing voluntary output cuts have been temporarily abated, but it is widely believed that the output cuts will begin to be phased out at the OEPC+ meeting on December 5th.

The average breakeven price for US producers is $65/bbl, with the consensus forecast showing an average expected price of $76.25 by the end of 2025. Consensus sell side analysts expect marginally lower price levels of $73, while the Canadian, EIA, and KS Fed are in tandem expecting a higher $77.

The vast majority of US producers, 87%, reported that hiring levels are not

expected to change, and 42% reported Capex plans have not changed. However, 68% reported more uncertainty about economic conditions than at the beginning of the year.

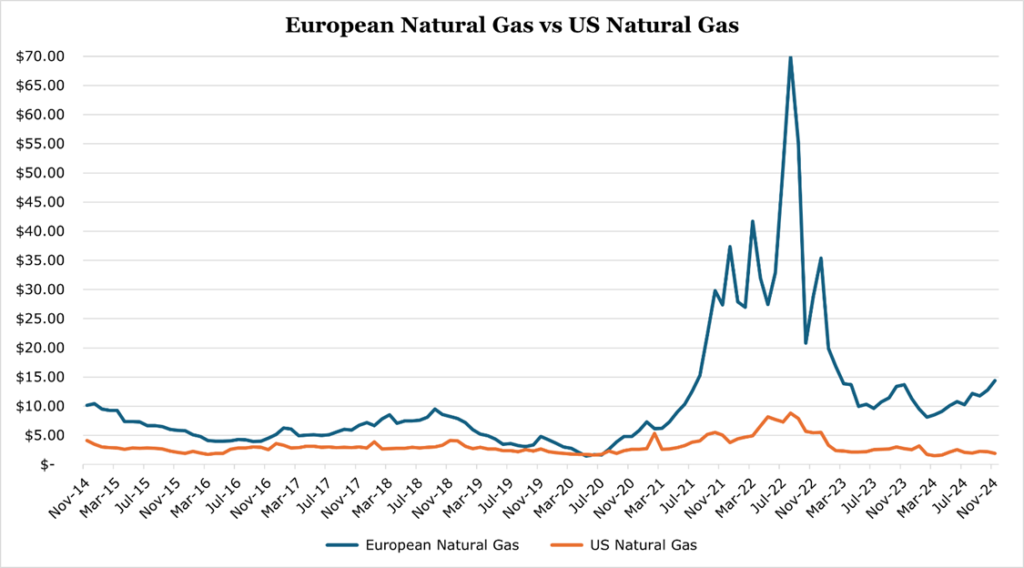

On the natural gas side, cheap natural gas flowing from Permian oil has depressed domestic US natural gas prices down, ending November at $3.37/mmbtu (millions of British thermal units) and 2025 price expectations of $2.73/mmbtu. Both are below average break evens, now reported to be $3.43/mmbtu.

However, with European natural gas prices being consistently elevated since the Russian invasion of Ukraine in 2022, US producers have found new markets with the increases in LNG capacity. With additional sanctions against Gazprombank making what additional trade with Russia remains in Europe more challenging, we expect there to be upward pressure on natural gas prices.

Consumers Showed Resilience on Black Friday, is BNPL to Thank?

Black Friday spending saw a 3.4% year over year increase, while in-store sales grew an anemic 0.7%, online saw a huge boost of 14.6% year over year. Adjusted for the still elevated level of inflation, in-store growth saw an 8% decline, and online sales saw 8.5% growth.

BNPL (Buy-now-pay-later) volumes spiked by 23% year over year, reaching record levels. More than 70% of consumers who utilize a BNPL agreement also carry balances on other credit revolvers like credit cards. According to Harvard Business Review, those same customers are spending around 10% more per purchase, and are far more likely to pull the trigger on an impulse buy.

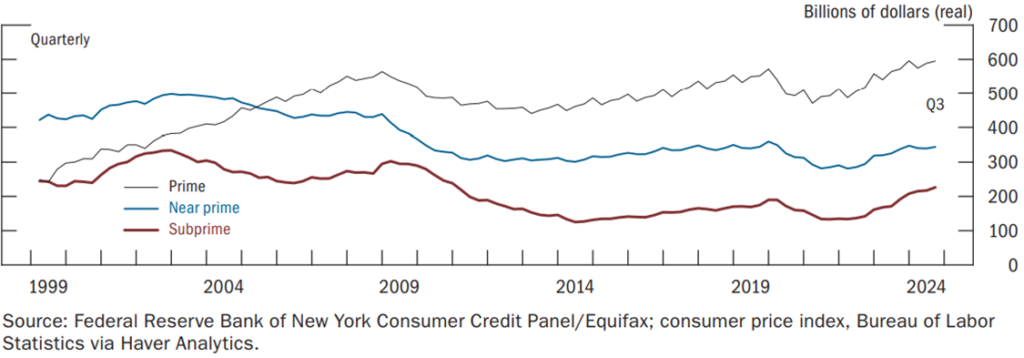

Inflation adjusted credit card balances are still below their 2008 financial crisis peaks for near prime and subprime borrowers, but prime borrowers’ balances have increased above their previous peak as credit access has increased.

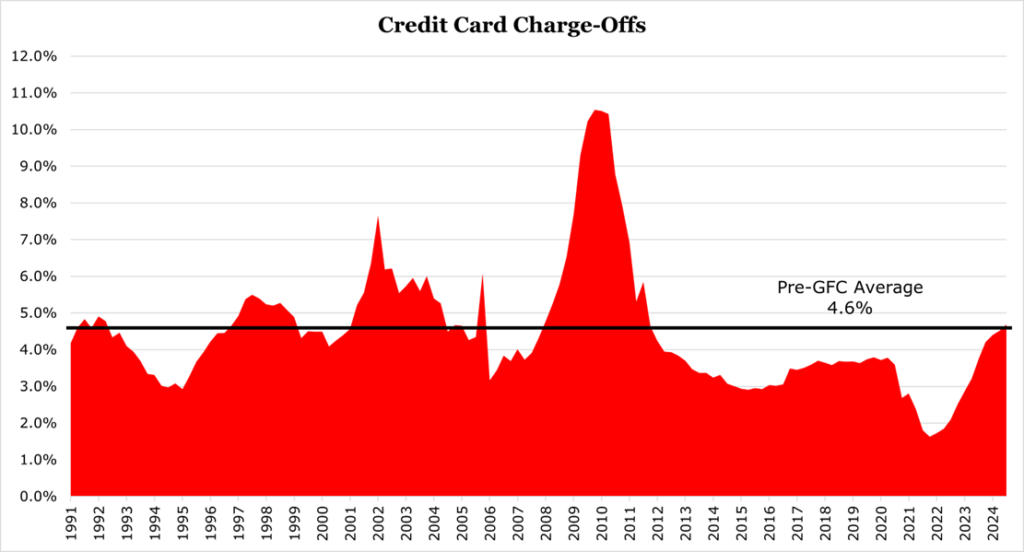

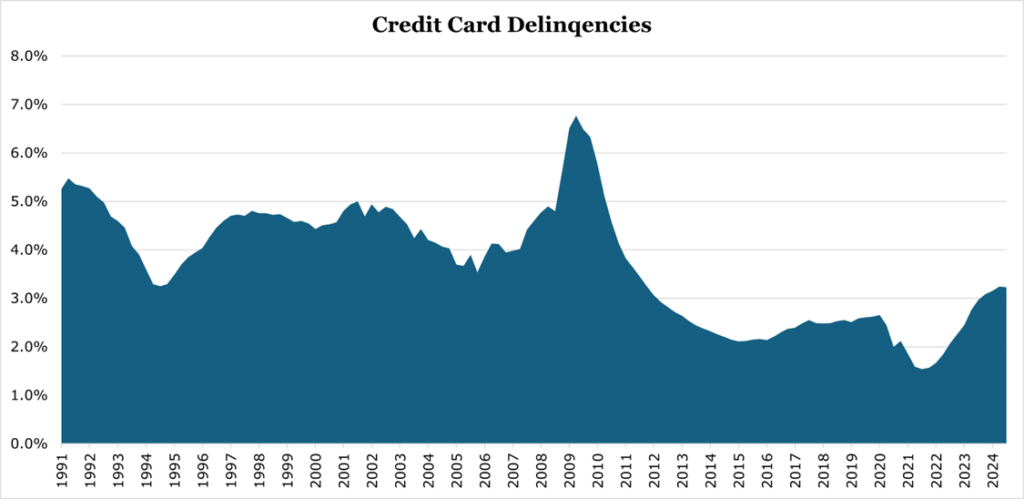

Credit card accounts are still below 2008 averages for delinquencies (more than 30 days late) but are elevated compared to before the pandemic.

More interestingly, charge-offs have recovered to their pre-pandemic and pre-financial crisis average. Of delinquent accounts for the quarter ending September 2024, 4.7% are expected to be unrecoverable.