Economic and Market Review

May 31, 2023

Overview

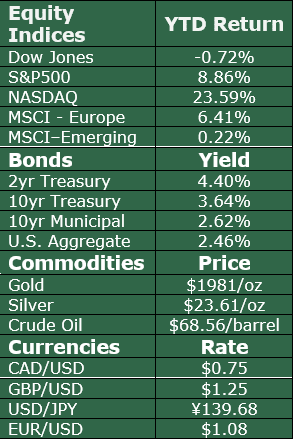

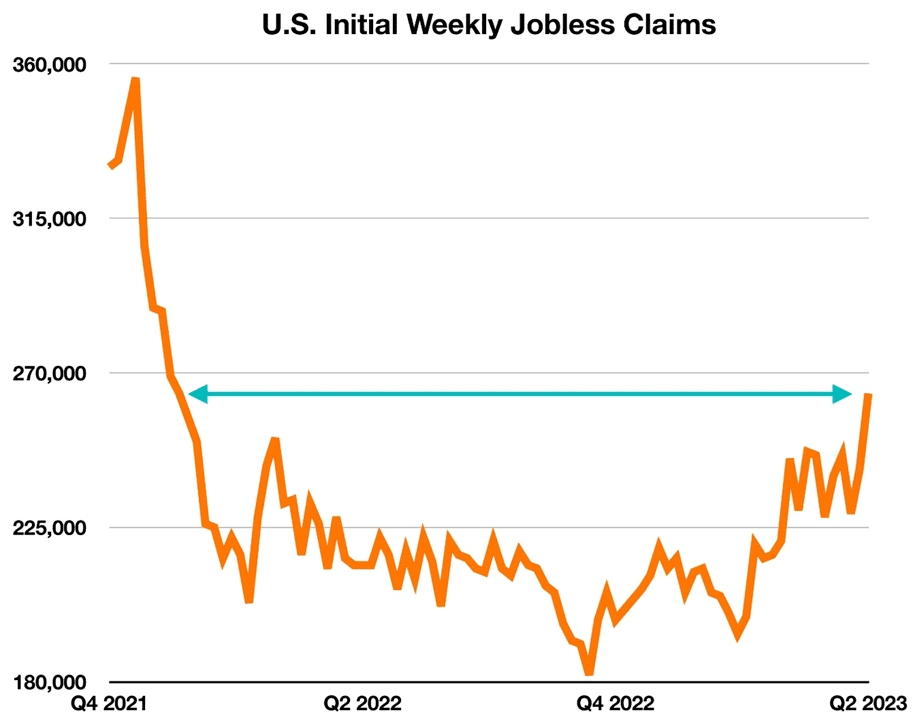

Congress passed legislation during last-minute negotiations to avert a default on the nation’s debt. The suspension on the U.S. government’s $31.4 trillion debt ceiling is temporary until lawmakers finalize legislation to fund ongoing federal obligations.

The impasse on the debt ceiling added strain to bond and equity markets in May. Treasury bond yields rose as increasing debt level concerns triggered increased trading in government bonds. Debt ceiling concerns in addition to the uncertainty surrounding regional banks’ exposure to commercial real estate contributed to a volatile environment throughout the month.

The Treasury Department plans to issue additional short-term debt to fund immediate federal expenses, with $61 billion in 6-month bills and $68 billion in three-month bills already issued as of the first of June. Treasury issuances, also known as auctions, are part of the government’s ongoing cash management process.

The 49th summit of the G7 was held in Hiroshima, Japan in late May. The G7, which includes leaders from developed countries, gathered to discuss the Russian invasion of Ukraine, the climate crisis, the pandemic, and global geopolitical tensions. The G7 also conveyed concern surrounding China’s economic coercion and its stance on Taiwan.

The Fed’s most recent Beige Book survey found that demand for domestic transportation services such as trucking and railroad has been decreasing. The survey also found that commercial construction and real estate activity has also been decreasing overall.

A Recent History of the Debt Ceiling

In the decades following World War II, the U.S. has seen its debt level steadily increase as the government has faced growing financial commitments. More recently, however, government debt has been expanding at a more significant pace since the early 2000s. Through these past two decades, there have been several political disputes regarding the debt ceiling, which is the limit of debt the government can issue. In January, the debt ceiling of $31.4 trillion was surpassed, which prompted the U.S. Treasury to implement “extraordinary measures” that will last until early summer to avoid the government defaulting on debt.

There have been several debt ceiling hurdles since the turn of the 20th century. Fortunately, the U.S. has never defaulted on its debt, which means the Treasury would be unable to pay its obligations. However, 2011 saw a point of near default, leading to credit rating agencies’ first downgrade of U.S. debt. In 2013, debates regarding the debt ceiling rose again, with the government experiencing a partial shutdown that led to the furloughing of hundreds of thousands of federal employees until the debt ceiling was suspended. More recently, another government shutdown occurred in 2018 when the debt ceiling yet again failed to be raised. Now, in 2023, the debt ceiling saw a near-default due to political gridlock and differing interests by the main political parties. The resolution to this will delay further debt negotiations until 2025, suspending the debt ceiling and keeping spending largely at its current level.

The risks of default include severe domestic and global economic repercussions, market volatility, and damage to confidence in the U.S. government’s ability to manage its finances. As political gridlock has driven another debt ceiling crisis, it is important to note that extremely similar circumstances have occurred in the past and will likely continue to occur.

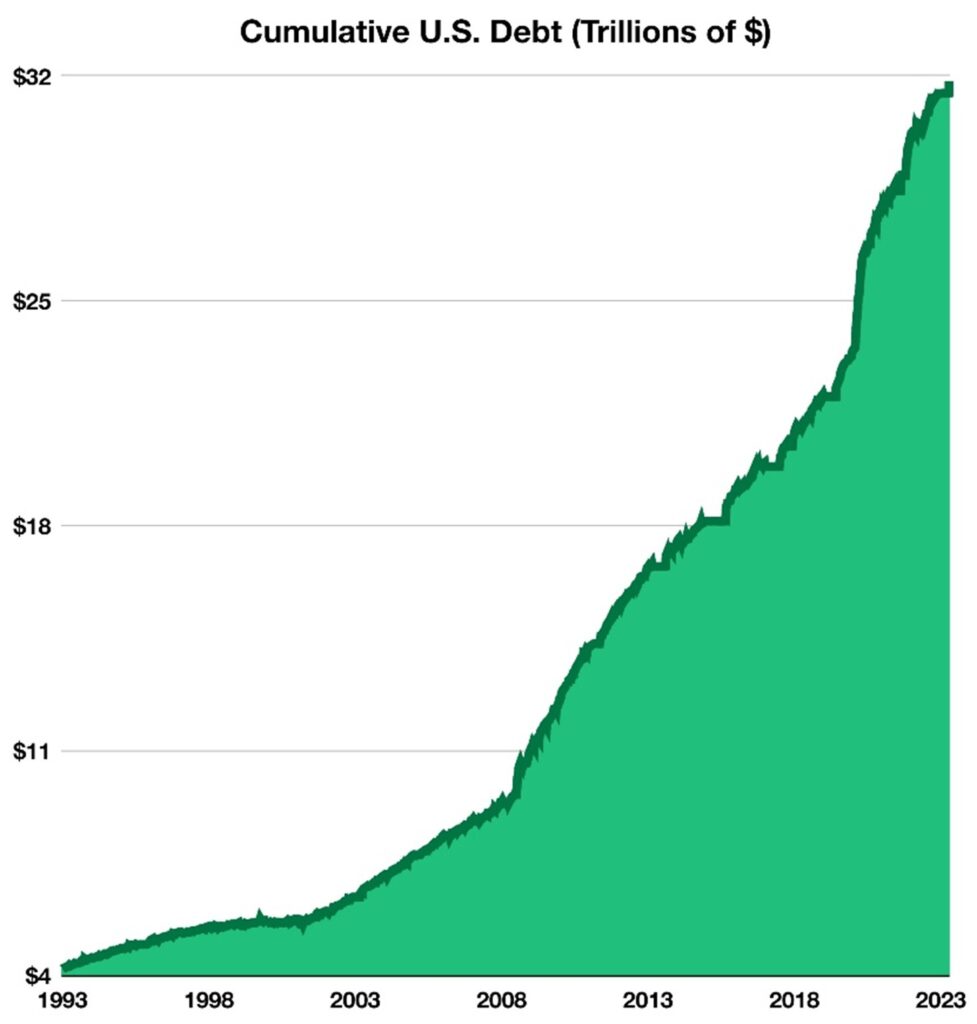

Economic Growth and Inflation Start to Cool

Following two consecutive quarters of negative Gross Domestic Production (GDP) growth starting in 2022, the year ended with two consecutive quarters of positive growth. While 2023’s first quarter also displayed positive growth, marginal growth shows a cooling GDP. GDP grew by 1.1% in the first quarter of 2023, down from 2.6% in the fourth quarter of 2022.

Also trending downward is inflation, increasing 4.9 percent from April 2022 to April 2023, the smallest 12-month increase since April 2021. A large driver behind this decline is the mellowing of more volatile factors such as electricity, gasoline, vehicles, and food. Leading this decline is the price of gasoline, which fell 17.4% in March and 12.2% in April from the year prior.

However, core inflation remains resilient. Core inflation excludes more volatile factors which significantly contributed to inflation’s historic rise in 2022. While lower than its September 2022 high of 6.6%, core inflation has remained relatively constant in the past 5 months, measuring in April at 5.5%, just 0.1% lower than in March and the same as in February.

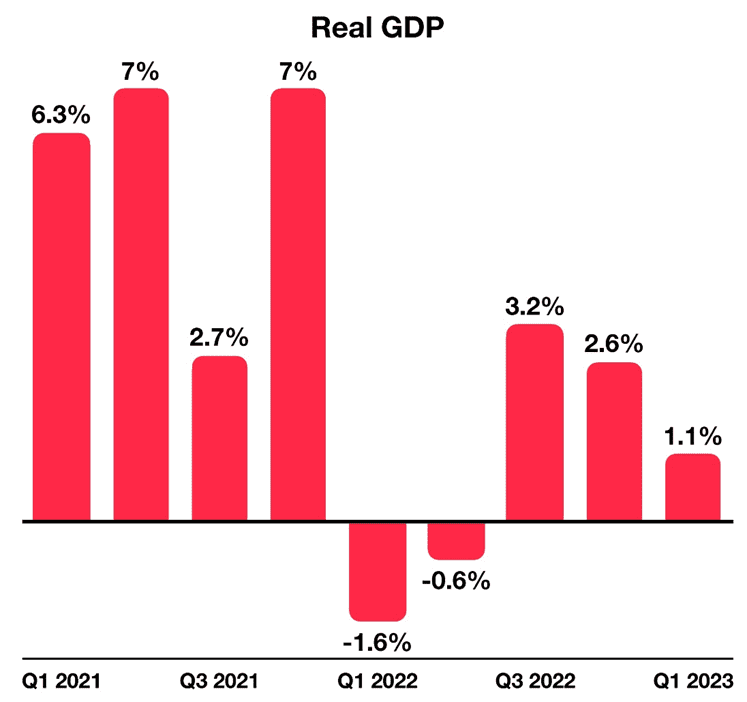

US Jobless Claims on Uptrend

Signs of a cooling economy are beginning to radiate throughout the labor market, which saw its highest level of weekly initial jobless claims since October 2021. While unemployment remains fairly low, this is an early sign of a cooled-down labor market.

In 2020, following the breakout of the pandemic, unemployment claims reached as high as 6 million claims per week. Claims have significantly died down since that historic high, reaching as low as 182,000 weekly claims in September 2022. However, claims have risen 45% since that low, with weekly claims as of May reaching 264,000.

These unemployment claims are primarily seen in white-collar sectors such as banking, finance, and technology. More specifically, a new wave of unemployment is coming from cities centered around these sectors. In this recent 18-month high in jobless claims, nearly half of all claims came from Massachusetts.

How Inflation in the US Differs from the International Community

Inflation is felt differently by consumers, businesses, and governments across the world depending on the driving factors behind inflation. Three nations that excellently reflect this include Japan, Argentina, and the United States.

First is the inflation exhibited in Japan. The Japanese government has a much more hands-on approach to inflation throughout the various fields in the nation, allowing them to better control the country’s inflation. Japan has more controlled labor costs relating to programs its government has recently established. One program helps retrain retired employees for part-time jobs while another program brings foreign workers into the country. In 2021, Japan saw annual deflation of -0.2%, and 2.5% inflation in 2022. This annual inflation rate was the highest seen since 2014, further showing how inflation has been kept under control.

In Argentina, political chaos and financial volatility tend to drive inflation. Argentina has an extremely volatile currency, and exchange rates within the nation can vary significantly. Argentina, unlike Japan, has very little control over its currency, and markets maintain a lack of confidence in the Argentinian government. Instability has manifested into inflation surpassing 109% in April, the greatest inflation since 1991.

The U.S. has unique inflation that is different from both Japan and Argentina. The U.S. has higher labor costs and imposes excise taxes on products such as batteries, cigarettes, gasoline, and tires. Even though the U.S. exhibits higher inflation, there continues to be immense trust in the American government, and the U.S. dollar, which is the currency of choice for nearly all trade globally.