Economic and Market April

April 30, 2023

Continuing Weakness in Banking Sector

Concern over additional bank failures has created ongoing uncertainty for equity and bond markets, as the collapse of First Republic Bank this past month has become the second-largest bank failure ever, with $229 billion in assets and over $100 billion in deposits.

Federal regulators stuck a deal with JPMorgan, the nation’s largest bank, to take over the failed bank and assume its loans and assets. The FDIC and JPMorgan agreed to a loss–share transaction which is projected to maximize recoveries on the assets by keeping them in the private sector. The FDIC estimates that the cost to the Deposit Insurance Fund will be about $13 billion.

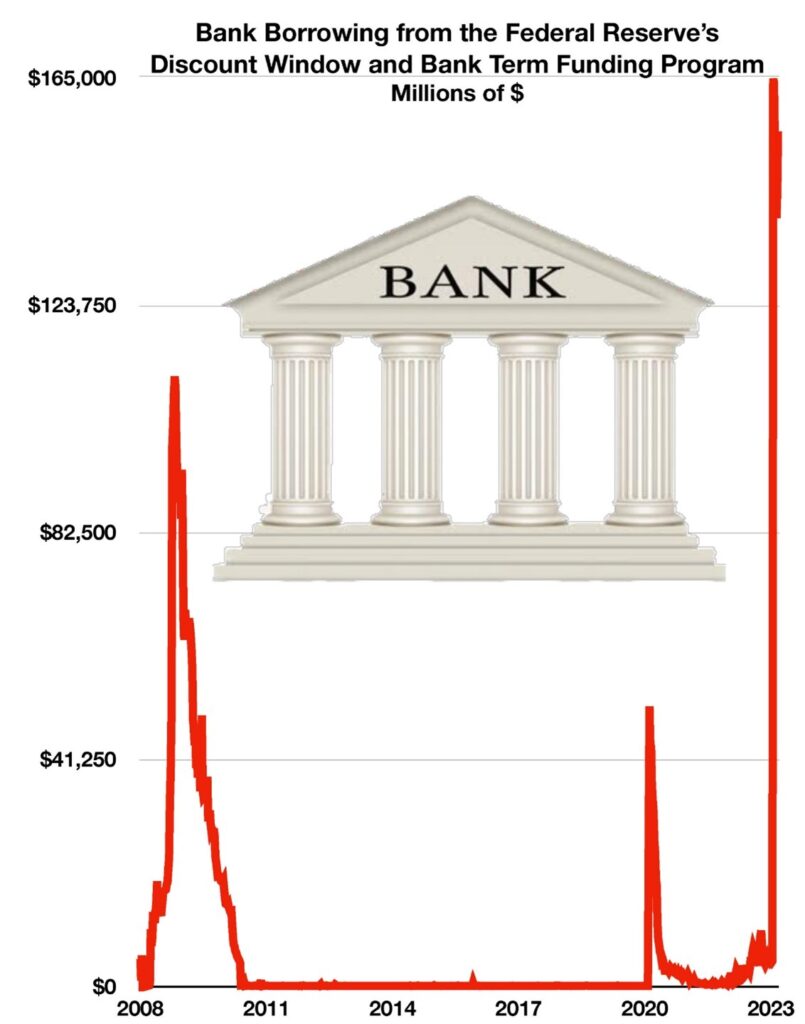

Following the failure of Silicon Valley Bank, Signature Bank, and First Republic Bank, banks across the nation have been scrambling to maintain their depositors’ trust and cover losses of depositors’ withdrawals. To acquire short-term funding, many banks have turned to the Federal Reserve’s discount window, a backstop for banks that require liquidity assistance. Banks have been borrowing funds from the Fed’s discount window at levels not seen since the 2008 banking crisis.

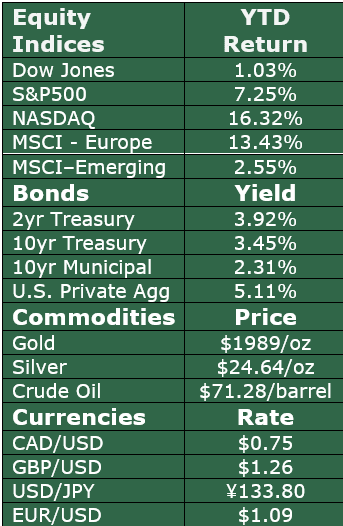

Interest rates held steady in April with shorter-term rates rising somewhat, a result of the Fed expected to make a final rate increase before altering its course. Analysts are carefully tracking economic growth and inflation data to determine what direction the Fed might take. Many believe that the recent increase in rates has already brought about a retraction in economic activity.

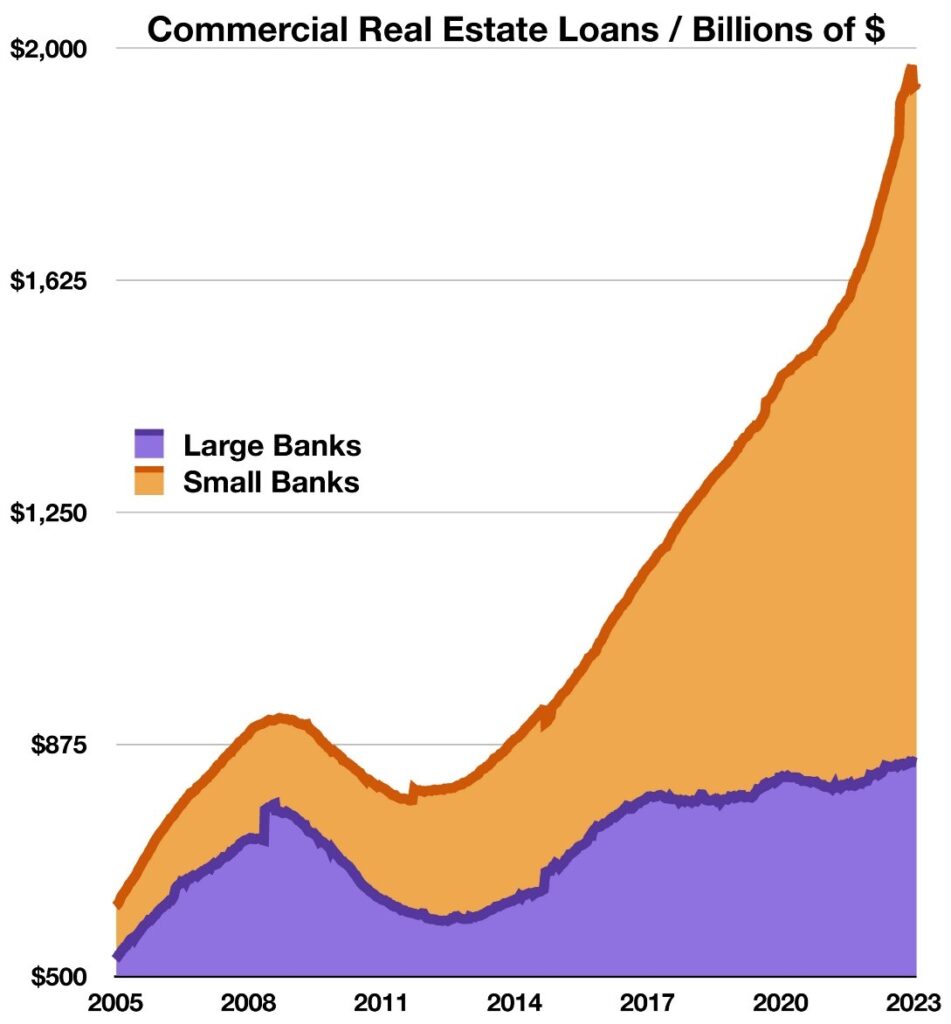

Commercial Real Estate Shows Increased “Shadow Banking” Activity

The commercial real estate market has begun to show trends of shadow banking on the rise. Shadow banks are characterized as firms that issue short-term loans and invest the proceeds into mortgage-backed securities, which were at the forefront of the 2007-2009 financial crisis. Banking regulations have become more stringent since the financial crisis, yet banks still emerged as a weak link within the financial markets due to high-interest rates and speculative investments. Internationally, the International Monetary Fund (IMF) recently communicated concerns surrounding shadow banking practices in both the U.K. and South Korea.

Over the past three years, the commercial real estate market has struggled with a critical factor that is vastly changing the security it previously held. Following the pandemic, a massive change has occurred in how people work, live, shop, and navigate their surroundings. This issue has been furthered by rising interest rates, which have increased the risks of defaults on mortgage loans and may structurally change the market.

Remote work has drastically changed how corporations view the importance of office space, and with more companies shifting toward a permanently remote form of work, office vacancies are expected to rise significantly. With $2.6 trillion of commercial mortgages expected to mature in the next four years, landlords who previously benefitted from long-term leases may begin to find it more difficult to replace their previous tenants.

As mortgages mature, the U.S. office vacancy rate is expected to rise, which some analysts expect to result in a downturn for commercial property. Additionally, since the rise of remote work appears to be cementing itself as a structural change rather than a temporary choice for employers, building values may not rebound as they have in previous downturns. This coupled with the fact that small banks greatly outpace large banks in commercial real estate lending creates a more fragile market. Historically, small banks, which are more susceptible to interest rate changes in today’s bond market, are more likely to default on mortgage loans than larger banks.

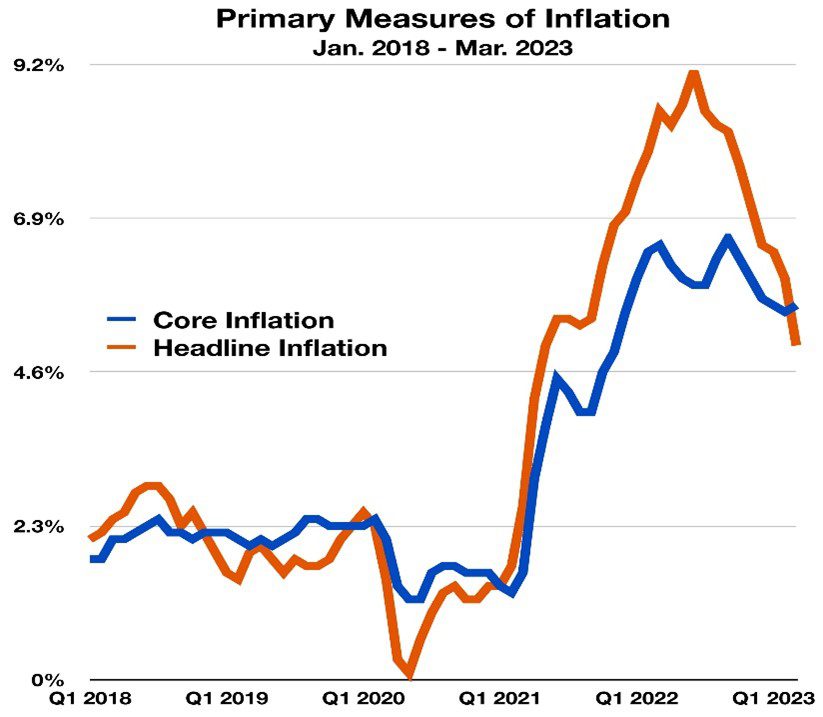

What is the Difference Between Headline Inflation and Core Inflation?

Following historically high inflation throughout 2022, we have now had nine consecutive months of decreases in the Consumer Price Index (CPI), which has driven inflation to its lowest level since May 2021. Inflation in March measured at 5.0%, 1% lower than the month prior and over 4% lower than the highs in 2022. Headline inflation is a broad measure that closely represents the basket of goods and services consumed by most households. Core inflation is the change in the costs of goods and services but does not include those from the food and energy sectors.

Across 2022, volatility in gasoline, food, and housing all played crucial roles in the costs of daily expenses. This drove inflation as high as 9.1% in 2022, a 40-year high last seen in 1981. At its current level, headline inflation is 3.2% greater than core inflation, which does not consider the effects of the more volatile food and energy costs. However, while the headline inflation rate has significantly decreased since 2022, core inflation has proven quite resilient. In March 2023, when headline inflation was 5.0%, core inflation remained at 5.6%, close to its previous highs. March 2023 was also the first occurrence of core inflation being higher than headline inflation since December 2020.

Banks Are Borrowing Money from the Fed at an Increase Pace

Widespread uncertainty and difficulties remain persistent for numerous banks, especially smaller regional banks. As investors’ trust in banks has recently fallen, depositors have withdrawn funds nationwide. The broad level of withdrawals has led many banks to tap the Federal Reserve for assistance, through the Fed Discount Window and the Fed’s new Bank Term Funding Program.

Recently released data is showing that banks have increased their access to the Federal Reserve for assistance, primarily from the Fed’s Discount Window. Requests for funds from The Federal Reserve’s discount window are widely regarded as a last-resort backstop for banks experiencing liquidity issues. To receive short-term, in some cases even overnight, cash loans through the discount window, banks pledge assets such as loans or securities. This allows banks to process a greater level of withdrawals than they normally would, yet is also a signal to investors and the market that some banks may be struggling. However, with the risks of contagion amidst high-interest rates, banks are turning to the discount window and the Fed’s new Bank Term Funding Program at levels that far eclipse the heights of the 2008 banking crisis. While just $4.5 billion was loaned out from the Discount Window in the week of March 8th, the week of March 15th saw a record-high $152.8 billion in loans. Historically, the highest level of Discount Window loans ever previously recorded was $110 billion in late 2008.

While the names of borrowers from the discount window are not disclosed until two years after the loan was administered, many banks are self-reporting that they borrowed from the backstop to show depositors that they are proactively addressing their liquidity issues. The historic level of loans through these crisis facilities has highlighted the importance of increasing public trust in banks, while also ensuring that customer withdrawals are minimized.