Taiwan Semiconductor Dominates Leading Edge

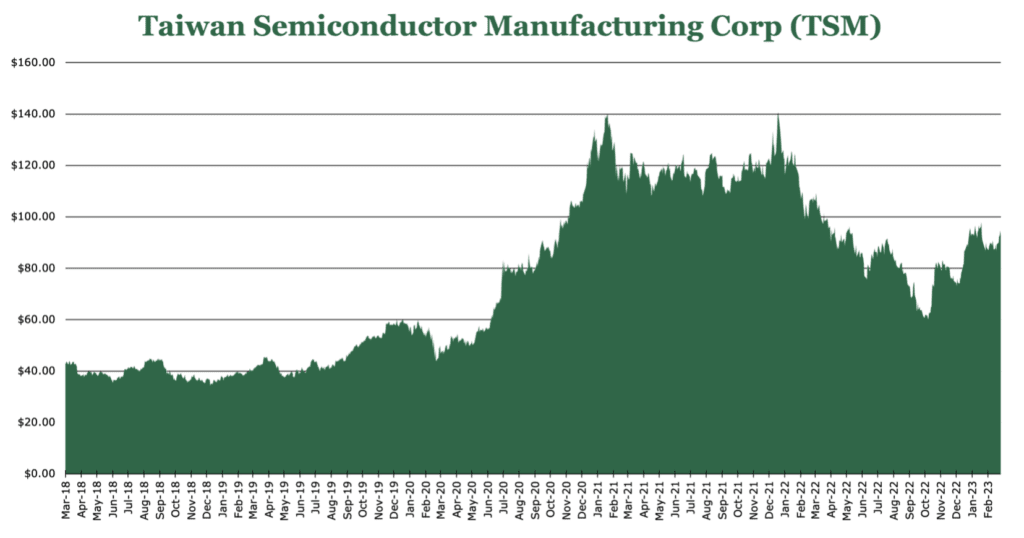

| Price $91.00 | Growth Holding | March 28, 2023 |

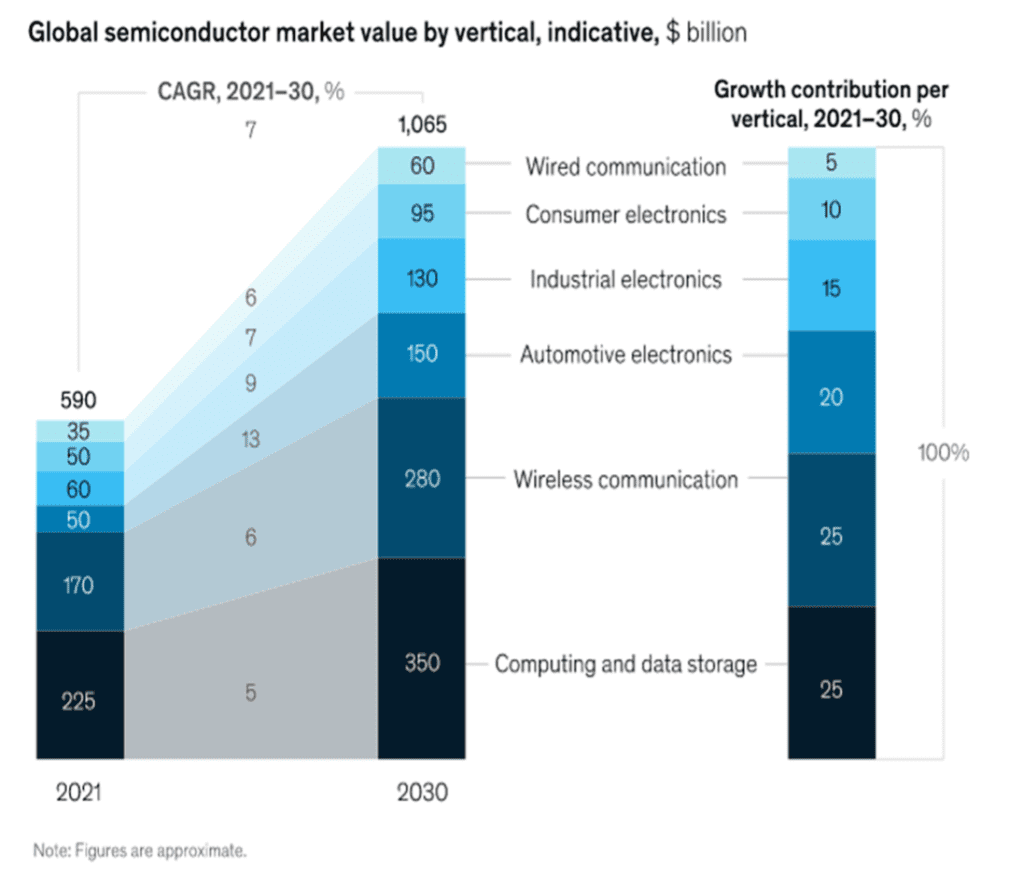

- Semiconductor market is expected to double in size by 2030. TSM (Taiwan Semiconductor Manufacturing) accounts for 26% of the world’s semiconductor output.

- Largest pure play fabricator, strength comes from long-term relationships.

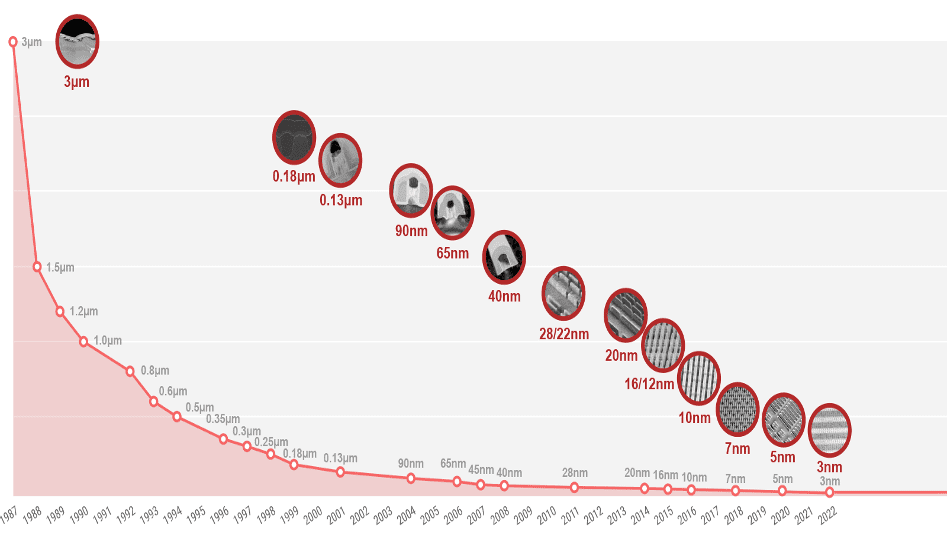

- Scale and leading-edge technology as one of the only sub 7nm wafer technology manufacturers in the world.

- International expansion slotted in Japanese and American markets driven by a $100 billion CapEx (Capital Expenditure) expansion.

- Western governments want to distance domestic technology products from China and bring manufacturing back to their countries or local allies.

- The US CHIPS and Science Act provides roughly $280 billion in new funding to boost domestic research and manufacturing of semiconductors in the United States.

TSM financial statements are reported in New Taiwan Dollars. Therefore, we have converted this to USD at a rate of USD/TWD 30.40.

Investment Thesis

Taiwan Semiconductor Manufacturing (NYSE: TSM) is a leading pure-play semiconductor fabrication firm primarily based in Taiwan. TSM accounted for 26% of the world’s semiconductor output value (excluding memory) in FY21, and as more companies switch to fabless this will likely increase. TSM manufactured 12,302 distinct products for 535 customers in FY21. Margins have expanded as demand has increased, with operating margin expanding 140bps to 52%, targeting another 100bps in FY23.

Semiconductors foundry manufacturing has high barriers of entry with massive CapEx, embedded relationships, and technological expertise. Even experienced firms like Intel have struggled at the sub 7nm wafer level. With the market expected to double, TSM is poised to participate in this growth with its dominant position.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $6.46 X 15.2 = $98.19.

FY23 is expected to have some weakness in EPS because of softness and the cyclical nature of the semiconductor business. However, we expect to see a recovery in FY24. We expect further strength once 3nm technology enters large scale production in FY26, and Japanese and American expansion projects begin output in FY24, with full capacity in FY26.

Taiwan Semiconductor Manufacturing Corp (TSM) | E2023 | E2024 | E2025 |

|---|---|---|---|

| Price-to-Sales | 31.78 | 26.48 | 23.40 |

| Price-to-Earnings | 16.57 | 13.49 | 11.44 |

The Rise of Fabless

The global semiconductor foundry market is growing quickly. In FY22 the global market for semiconductors grew 8.2% to $573 billion, with foundries growing 27% to $77.8 billion. FY23 is likely to contract, along with TSM’s revenue, about 3-5%.

However, over the decade the CAGR is expected to be 12.2% with sales surging to $1.38 trillion in market size by 2030. For reference, the last 50 years of demand for semiconductors will be added in only 10 years even by conservative estimates.

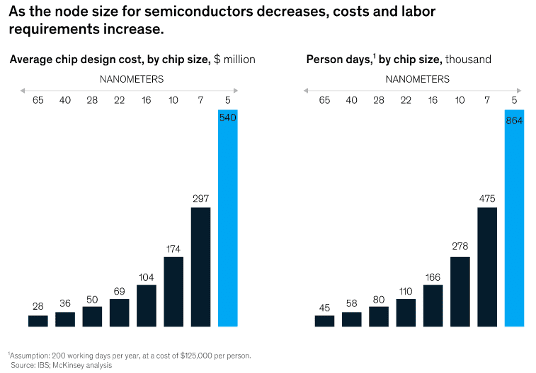

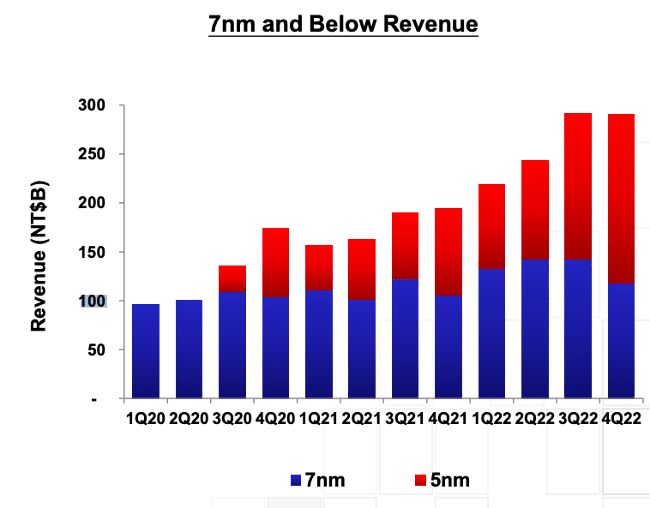

The semiconductor industry contains many complicated parts, each playing an important computing role. As the required size of wafers has decreased, capital costs for manufacturing skyrocket. Wafers over 7nm are used for industrial applications such as automobiles or machinery. Under 7nm is used for more specialized industrial equipment and consumer electronics. In 4Q22, sub 7nm accounted for 54% of revenue.

The days of internal design and then end-to-end manufacturing in a company’s own foundry are fading into history. Traditionally in computation the number of transistors on a chip has doubled every two years (called Moore’s law), but this rate has begun to slow as technological investment in manufacturing has become insurmountable except for a select few. Despite the huge expansion expected in the total addressable market over the decade, any new players will unlikely come onto the stage.

The complexity of scaling fabrication along with design almost killed AMD in the mid 2000s. Companies began to move toward fabless production as the advantages of pooled investment became more evident. Combined design and fabrication are less than the sum of their parts as enormous Capex demands high utilization to justify the investment. TSM expects this effect to be even more relevant at the sub 5nm level. Customer adoption for sub 7nm chips has been resilient even with persistent weakness in supply chains during COVID-19. At the same time, the input costs and capital expenditures required for sub 5nm design and manufacturing have continued to escalate.

The US CHIPS and Science Act

The competitors to TSM are primarily companies that can produce sub 7nm chips, including Intel, Samsung, and SMIC. To reduce American dependence on SMIC and other Chinese-controlled chip manufacturers the CHIPS act was passed in 3Q22. The CHIPS act will grant $50 billion in government incentives and $24 billion in tax credits to fabs expanding within the United States.

There is an ongoing debate on whether federal money from the CHIPS act should prioritize American-owned fabs like Intel. Intel argues that giving federal money to foreign companies could cause a flight of intellectual property. At this time, the federal government is still staying course and plans to grant the same benefits to every company that qualifies. Specific funding allocations have not yet been released. TSM has numerous American firms like Apple, Qualcomm, and AMD as key customers, with AMD being vocally supportive of TSM receiving federal funding. We do not believe that any subsequent legislation would prioritize Intel over TSM.

With that being said, the United States has historically been 4-5x more expensive for fabrication startup than a comparable plant in Taiwan. Subsidies will help but streamlining permitting and certainty of reasonable projects getting approved is mandatory for a large-scale rebirth of US semiconductor manufacturing. Japan and the US, where TSM is focusing international expansion efforts, are still developing plans to facilitate growth in the semiconductor manufacturing space. We are likely to see legislation to streamline permitting. The CHIPS act is a step in the right direction for diversified geographic manufacturing.

Risk

The top 3 suppliers for inputs make up approximately 50% of procurement. This is an inevitability as industrial suppliers like 3M, BASF, and Fuji dominate their respective inputs.

Two firms combine to make up 33% of TSM revenues, which we believe are Apple holding the top spot followed by AMD. Contract terms most likely would not permit a sudden pull of capacity, but more importantly finding a suitable competitive foundry would be difficult and costly. We expect competition to be most fierce in the older over 7nm space, but limited competition in the sub 7nm space which is now the majority of TSM sales.

TSM has warned of some softness in consumer markets during 1H23, which is in line with consensus macroeconomic predictions. However, supply chain inventories are expected to be reduced over the same period, which may cause some additional tightening. In 2H23 TSM expects inventories to be balanced by revenue declines of around 4-6 percent.

Geopolitical tensions between China and Taiwan are a significant business risk with over 90% of TSM manufacturing coming from Taiwan. It is impossible to estimate the risk of invasion with any level of certainty. Russia’s invasion of Ukraine is distracting the US and depleting weapons. The US is behind in supplying Taiwan promised weapon systems. If the worst-case scenario of direct NATO engagement with Russia happens, the possibility of a Chinese invasion increases as the US becomes further distracted in Eastern Europe.

Outlook

The split in revenue has shifted to favor sub 7nm chips in FY22. Huge increases in high-performance computing and smartphone demand drove this. High performance computing growth was estimated to be 59% year over year, with smartphones at 28% year over year growth. These demand trends are expected to soften over the 5-year horizon, especially as inventories normalize.

For over 7nm chips, IoT and Automotive platforms continue to lead industrial demand, with automotive demand increasing 74% yearly and IoT demand increasing 47%. Competition is fierce in the over 7nm area, as those are traditionally used in non-specialized industrial applications and automotive areas. Additionally, the startup costs are far lower in the over 7nm space.

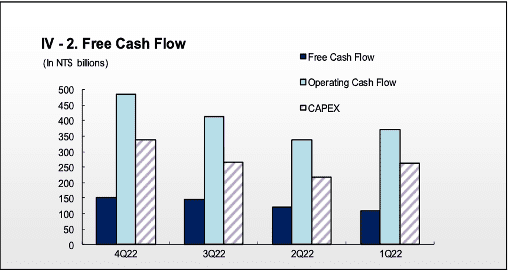

Capex is expected to be flat in FY23 compared to FY22. TSM has put $40 billion forward in two new fabs in Arizona which are expected to begin production in FY24. It has also put forward $60 billion for new fabs in Taiwan, and $20 billion in Japan. We expect capex ramps in the coming years as TSM attempts to grow its leading-edge position as the go-to fab for sub 7nm western contracts as they try to distance themselves from Chinese manufacturing.

In FY22 R&D accounted for 7.2% of net revenue, and TSM expects to increase this by 20% going into FY23. In addition, by FY26 TSM is targeting release of 3nm process which will incur another ramp in capex spending around that time.

TSM generated $17.4 billion in free cash flow in FY22, doubling FY21. We do expect revenues and EPS to decline slightly in FY23 due to normalizing semiconductor market conditions. However, as TSM expands its offerings and manufacturing base, we expect it to solid recover and a return to secular growth. Even at this level of spending, TSM expects to sustain its modest dividend which pays a 2.0% yield.

Competitive Comparisons

| Taiwan Semiconductor Manufacturing Company (TSM) | Texas Instruments (TXN) | Intel (INTC) | Micron Technology (MU) | Samsung Electronics (SSNLF) | |

|---|---|---|---|---|---|

| Price-to-Earnings (FWD) | 16.57 | 23.55 | 55.63 | Neg | Neg |

| Price-to-Sales (TTM) | 6.26 | 8.21 | 1.91 | 2.49 | 1.38 |

| Price-to-Cash Flow (TTM) | 8.80 | 18.66 | 7.87 | 5.48 | 6.69 |

| EV-to-EBITDA (FWD) | 8.56 | 17.12 | 13.51 | 14.92 | 5.99 |

| Dividend Yield | 1.96% | 2.76% | 1.70% | 0.75% | - |