Bloom Energy’s Growth Blooms with IRA

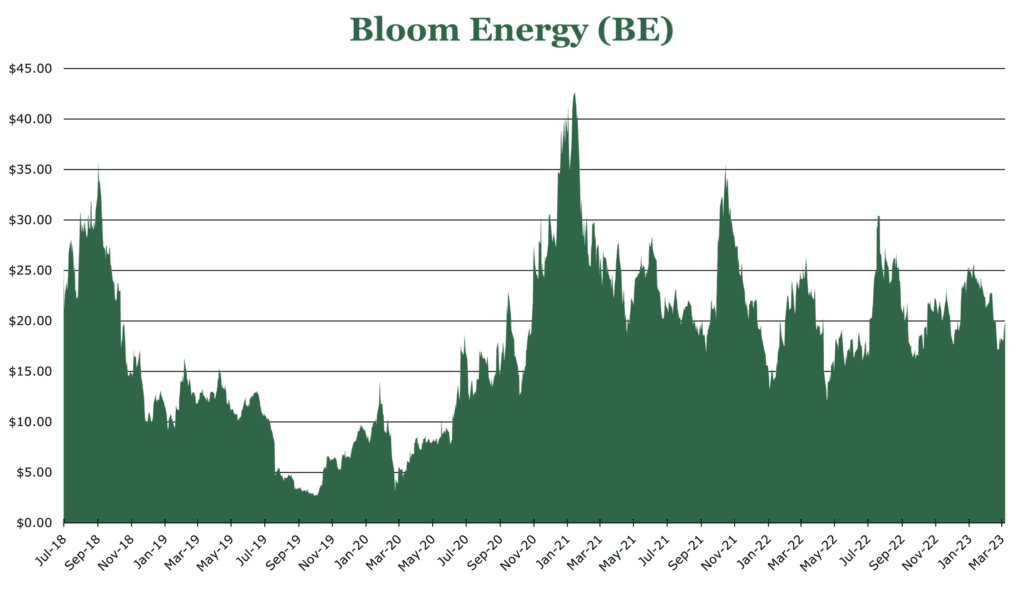

| Price $20.16 | Growth Buy | April 4, 2023 |

- IRA (Inflation Reduction Act) should accelerate growth for fuel cells.

- Hypergrowth sector, 2050 neutrality targets, and 2030 reduction targets are approaching fast.

- $10 billion in total backlog, $2.8 in new product backlog.

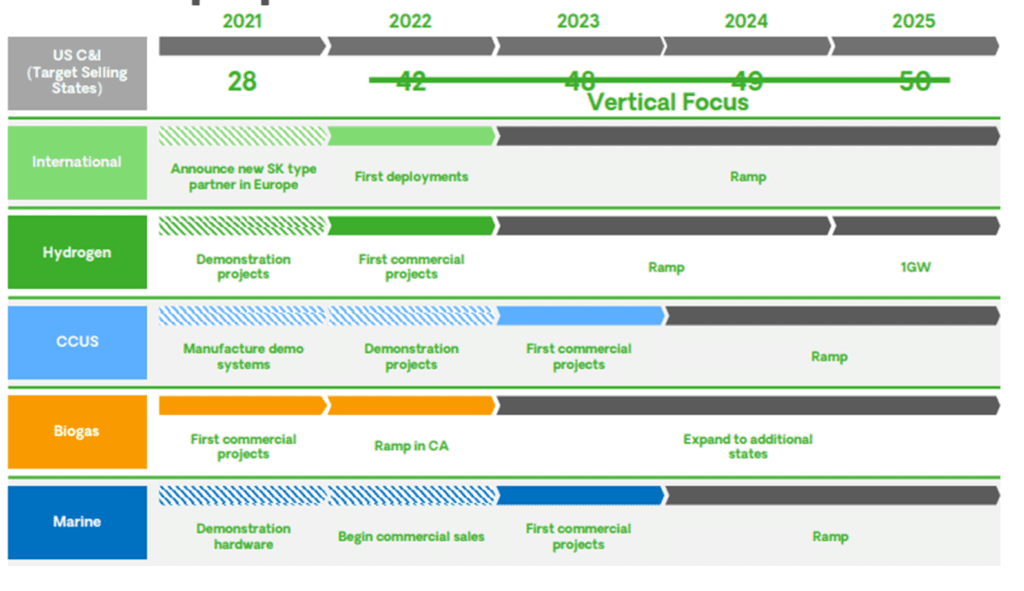

- First commercialization in carbon capture, expanding hydrogen cells and electrolyzation to Europe. Large expansion in the maritime segment, first successful deployment of a Bloom energy cell on a vessel.

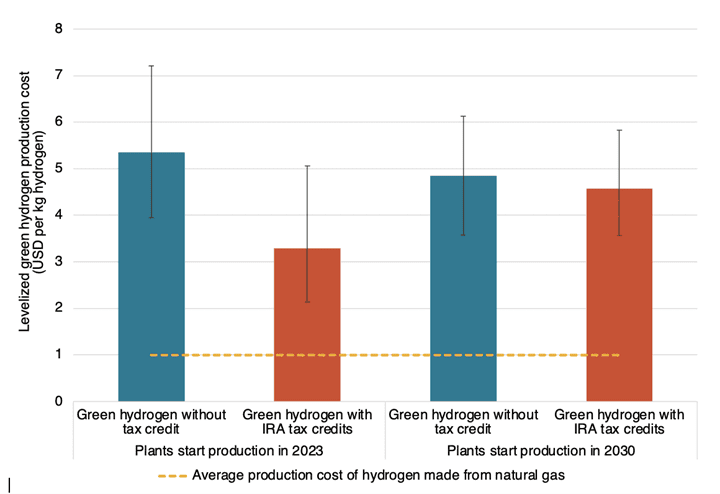

- IRA tax credits significantly incentivize new installations and expand existing modules. Offering $3/kg of hydrogen produced over the electrolyzer’s or fuel cell’s lifetime.

Investment Thesis

Bloom Energy (BE) is a vertically integrated supplier of stationary fuel cells, with 80% market share in the United States. Bloom has over 600MW of installed production, with a $10 billion backlog. Bloom has managed a 10-year trailing revenue CAGR of 28%, expanding margins to be net positive over the same time frame.

Green energy is a hypergrowth sector, and Bloom has a first-mover advantage and 80% of the US market share by installed cell capacity. The outlook for Bloom energy is excellent for FY23, with margins expanding and record-high revenue expected, growing at least 17% per Bloom. With European expansion on the horizon and new commercialized projects launching in FY23 we believe that Bloom is an attractive growth stock.

Estimated Fair Value

EFV (Estimated Fair Value) = E25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $0.65 X 40 = $26.00

Our EPS for 2025 in net of stock-based employee compensation is lower than the consensus which ignores this cost. We believe a PE in line with its growth rate is warranted given the leadership position and size of this expanding growth market.

| E2023 | E2024 | E2025 | |

|---|---|---|---|

| Price-to-Sales | Neg | Neg | 31.0 |

| Price-to-Earnings | Neg | 0.65 | 1.0 |

Primary Products

Bloom energy provides solid oxide fuel cells to produce electricity on site. The primary method for solid fuel cells is the SOFC (Solid Oxide Fuel Cell). Bloom’s cells can be hydrogen, biofuel, or natural gas run if the fuel has a hydrogen atom. Most are currently deployed with natural gas as hydrogen infrastructure is lacking globally. While not carbon free, the natural gas versions produce approximately 50% less carbon than the US grid. The smallest unit sold is usually Server sized units, shown below. However, power generation is a $1.4 trillion global market, and there is significant scalability for Bloom’s systems.

Bloom also produces and sells SOECs (Solid Oxide Electrolysis Cell) to produce hydrogen. Hydrogen is traditionally extracted using electricity to remove the non-hydrogen parts of hydrocarbons. While Bloom’s can work similarly, the value-added proposition of Bloom’s electrolyzers is their potential to operate utilizing excess heat and energy from grid-sized systems. The electrolyzer can reduce its electricity requirement by 35-45% by utilizing spare heat from industrial applications. This could be a bolt-on to power plants with excess demand during the day, like nuclear and solar, producing hydrogen when excess capacity is available. During periods of high demand, the hydrogen could be discharged to a SOFC server to add capacity.

Development Areas

One of the most understated applications for decarbonization is global ocean freight. Roughly 4% of global emissions lie within the area of ocean freight and Bloom’s energy cells represent an opportunity. While full hydrogen ships are still a long distance away, in-port emissions reduction is a priority of the International Maritime Organization. 30% of vessels laid down in FY21 were LNG-powered, providing existing infrastructure for Bloom’s cells. The cells can use the ship’s existing storage of LNGs for usage as an auxiliary unit. In a partnership with French Cruise Ship company CdA Bloom demonstrated using a 150kW solid fuel oxide battery to provide auxiliary power to the ship during a port visit. It provided a 30% reduction in carbon emissions to the existing auxiliary unit. The maritime addressable market for auxiliary power and propulsion is estimated to hold a total addressable market of $70 billion.

Carbon capture is a relatively new technology, ideally pulling carbon straight from the air. Bloom is targeting its first commercial project in FY23, but few details on method or scaling have been revealed. Carbon capture and hydrogen electrolysis is expected to be a $375 million total addressable market. In addition, there is an additional value-added proposition to carbon capture in the form of resale. Carbon dioxide is used as an input for plastics, food and beverages, oil recovery, feedstock, and many other industrial uses. Currently, the US government offers a $35/ton credit for usage of carbon dioxide and $50/ton for storage.

European expansion is next on the docket for geographic expansion. Already, Bloom has over 200 MW in orders for SOFC. With the Russian invasion of Ukraine demonstrating how fragility of energy security, Europe has renewed interest in Hydrogen.

Partnerships and Clients

The largest current partnership is with South Korean telecom giant SK. SK contracted Bloom to provide 500 MW of power through FY24 at an estimated full cost of $4.5 billion. In addition, the deal included a $500 million investment in Bloom for ownership of 15%. The contract included both hydrogen fuel cells and electrolyzers. South Korea is an important market for hydrogen energy, with $34 billion in investments toward trimming the country’s footprint by 2030. This includes the goal of 7.1% of electricity generated by hydrogen sources by 2036 and 30,000 commercial hydrogen vehicles.

Risk

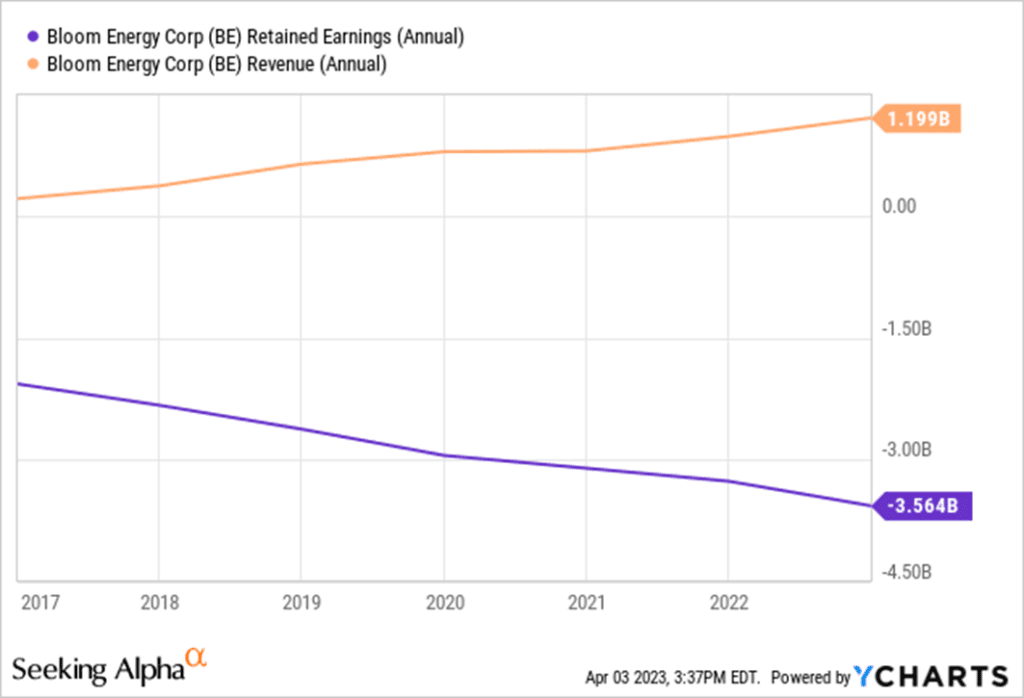

One of the premiere risks to Bloom energy is a lack of profitability. Despite massive improvements in the top line over the previous 10 years, the bottom line has not improved at the same pace. As Bloom is at the bleeding edge of hydrogen tech, we do not expect blockbusting earnings. If adoption is not as widespread as Bloom expects, their actual FY31 revenue could be just a fraction of the projected $15-20 billion.

As 2050 approaches, when most companies and governments have net zero goals set, competition will increase. While Bloom is currently at the front of the development of hydrogen tech, this position is not guaranteed. As competition increases, Bloom will have to put more money into R&D to stay ahead which could drain any gains from expanding margins.

Outlook

Technology in the area of energy cells is accelerating quickly. In just over a decade Bloom went from 5kW cells at a density of 3kW/m2 to 750kW cells at a power density of 37kW/m2. On top of efficiency and density improvements, there is a high-cost reduction opportunity. This is beginning to be realized, with the gross margin improving from a 3% loss in FY17 to 23% in FY22. By FY25, the cost savings are expected to improve gross margin by 700bps to 30%. On a per-unit basis, Bloom is already earning 31.3% margin.

Operating expenses are 37% R&D with the remaining being SG&A. As Bloom expects a 17-25% increase in revenue, there will probably be another ramp in R&D spending but revenues should outpace increased expenses providing operating leverage.

| % of revenue | Expected Cost Reduction | Avenue | |

| Product | 65% | 10-15% | Density increases and better transaction volume. |

| Installation | 15% | 10% | Partnerships with third party installers. |

| Service | 20% | 12% | Life cycle improvements, along with cheaper replacements. Refurbishment mechanism improving. |

Bloom’s own calculations put themselves at a 35% CAGR growth rate from FY21 to FY31. Power generation is expected to grow from $1 billion in revenue to $10 billion. At the same time, Bloom expects the maritime unit to grow to be $1-2 billion, with miscellaneous decarbonization fulfilling a $6-8 billion niche.

Tax credits have so far been key in adopting green energy sources in the United States. New tax breaks from the Inflation Reduction Act include hydrogen electrolyzation through either dedicated SOECs or the internal mechanism of SOFCs. As of FY22, a tax credit pays out as much as $3/kg of hydrogen produced over a 10 year window to FY33. This greatly reduces the startup costs for hydrogen projects, provided they start before FY30.

The backlog, as previously mentioned, is $10 billion, a 17% year-over-year increase. Total revenue for the year was 44% international and 56% domestic. The new product backlog expanded 16% yearly to $2.8 billion. Contract and service backlog, which generally have a term of 6-20 years represents $7.2 billion in backlog, growing 17% year over year.

Competitive Comparisons

| Bloom Energy (BE) | Ballard Power (BLDP) | FuelCell Energy (FCEL) | Plug Power (PLUG) | Blink Charging (BLNK) | |

|---|---|---|---|---|---|

| Price-to-Earnings (FY24) | 41.92 | Neg | Neg | Neg | Neg |

| Price-to-Sales (TTM) | 3.09 | 19.85 | 8.25 | 9.69 | 6.64 |

| EV to EBITDA (FWD) | 61.94 | Neg | Neg | Neg | Neg |

| Return on Total Capital | -6.92% | -7.49% | -09.34% | -7.93% | -22.11% |

| Gross Margin | 21.48% | -15.63% | -15.19% | -23.89% | 29.30% |