Market and Economy

Diligence is the mother of good luck

Benjamin Franklin

Inflation Inflection. Inflation will drive the inflection change for value to outperform growth.

• Inflation Inflection.

Inflation will drive the inflection change for Value Stocks to outperform Growth Stocks.

• Rising inflation will cause a contraction of high price to earnings and price to sales ratios.

• Growth will underperform Value as this occurs.

• Growth has gone up over 500% since September 2008 while Value is up 186%. This is a reverse of the Period before September 2008 to March 2000 where Value beat Growth.

• Growth outperformed Value from 1990 to March 2000, the peak of the internet bubble.

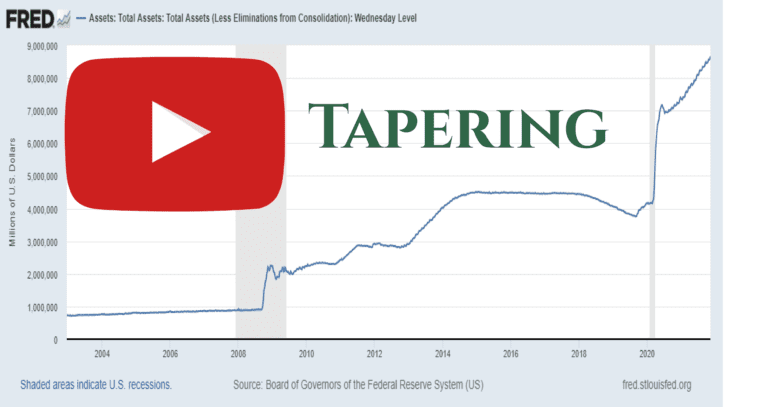

Tapering at the Hotel California

Tapering is the presumed end to Quantitative Easing (QE) which helped balloon the Fed’s balance sheet from $860 Billion to $8.6 Trillion. Yes, please 10X my balance sheet. The Fed is facing its Hotel California moment for the third time. Will it really taper this time or will the Fed let inflation run? You can check out anytime you want, but you can never leave.