Economic and Market Review

January 31, 2024

| Equity Indices | YTD Return |

| Dow Jones | 1.2% |

| S&P500 | 1.6% |

| NASDAQ | 1.0% |

| MSCI – Europe | 2.6% |

| MSCI–Emerging | -3.1% |

| Bonds | |

| 2yr Treasury | 4.31% |

| 10yr Treasury | 3.95% |

| 10yr Municipal | 2.46% |

| U.S. Corporate | 5.11% |

| Commodities | |

| Gold | $2041.48/oz |

| Silver | $22.89/oz |

| Crude Oil (WTI) | $76.36/bbl |

| Natural Gas | $2.26/MMBtu |

| Currencies | |

| CAD/USD | $0.74 |

| GBP/USD | $1.27 |

| USD/JPY | ¥146.74 |

| EUR/USD | $1.08 |

Overview

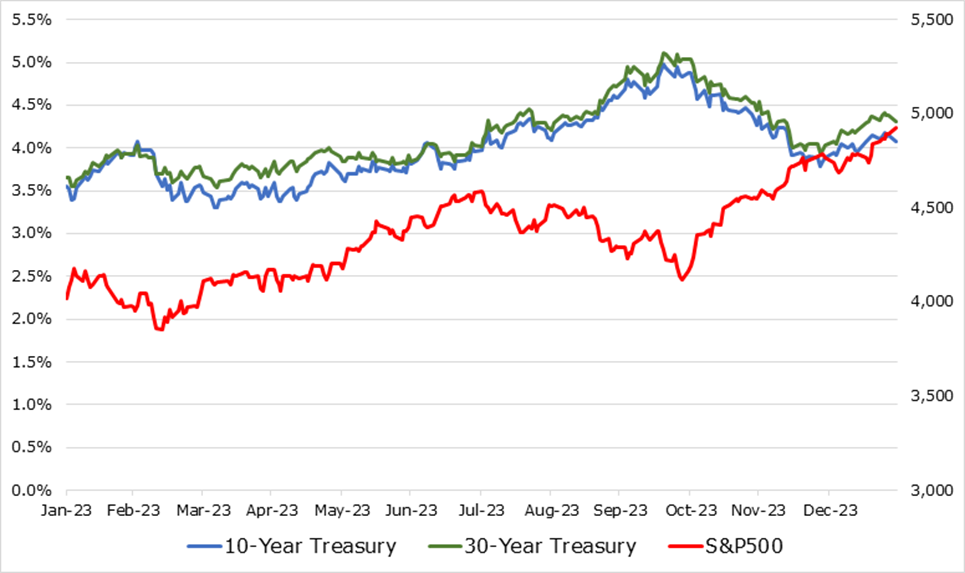

The S&P500 topped 4,900, with gains continuing to be dominated by the top 7 mega-cap stocks. With indices at all-time highs, earnings upsets could introduce volatility into the market. A survey by Deutsche Bank shows that analysts are cutting earnings targets by as much as 1.9%. This is indicative of a more pessimistic view as 2024 goes on.

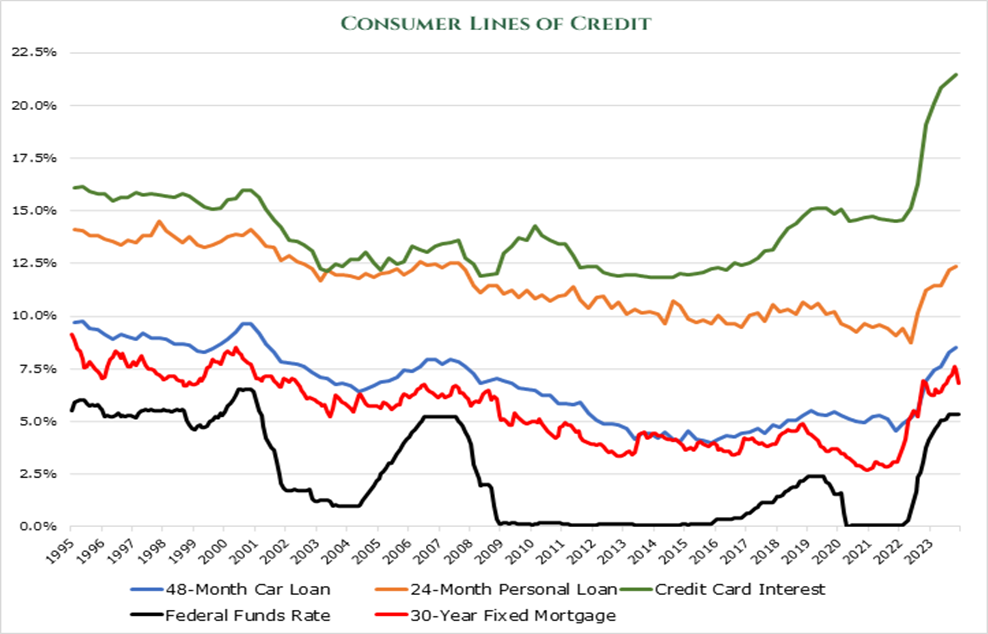

Many investors are currently pricing in an aggressive Fed rate cut by March, implying a better-than-soft-landing scenario. However, the US Economy still struggles with sticky inflation and persistently hot consumer spending.

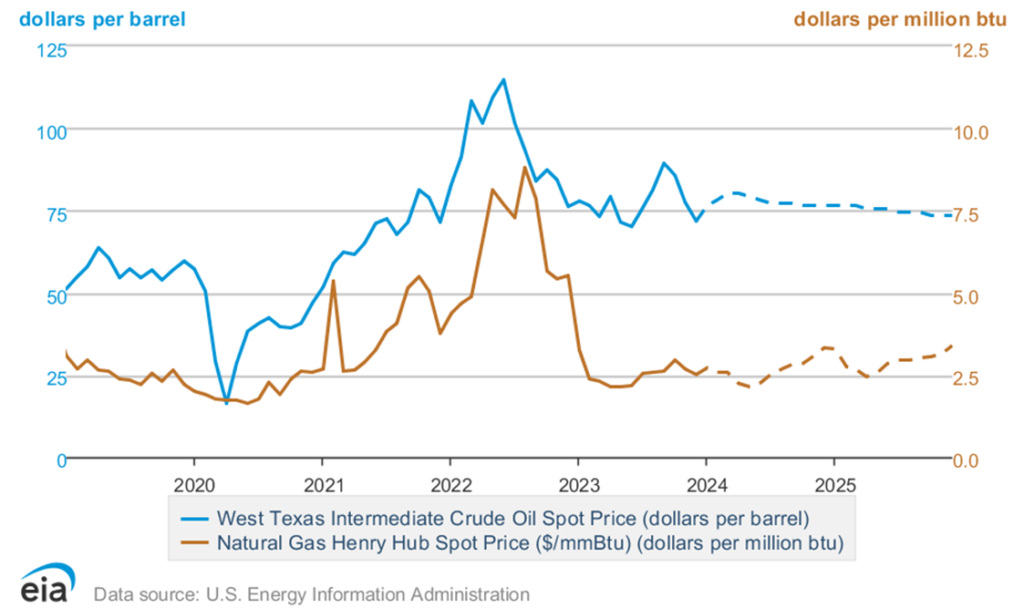

The IEA expects global natural gas demand to increase by 2.5% in 2024, compared to just 0.5% in 2023. This will be driven by expected colder normalized weather for 2024 compared to 2023 and the stabilization of the European economy.

Despite the latest OPEC+ price cuts, oil has remained depressed in the first month of 2024. Falling inventories and geopolitical uncertainties in the Middle East over the quarter ending March could provide upward pressure on prices.

The US Dollar is expected to remain strong for 2024. Despite slowing economic conditions and consumer uncertainty domestically, the rest of the world is faring equally or worse. As a result, the Dollar will remain heightened against its peers, which may have geopolitical knock-on effects which we discuss in our article here.

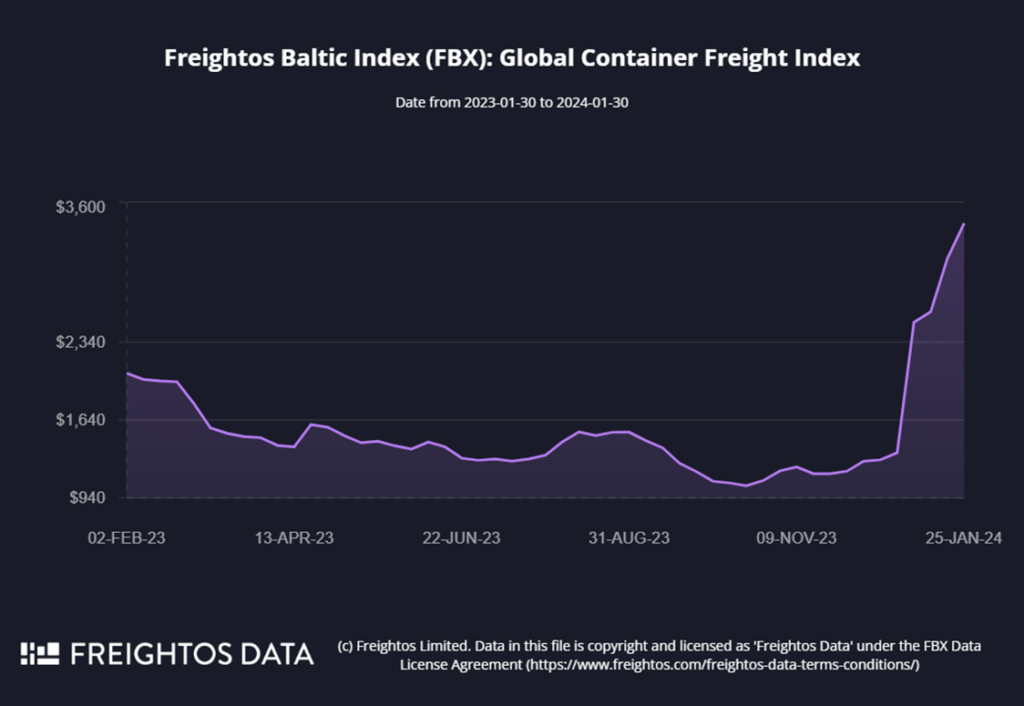

Shipping Prices See Spike as Traffic Avoids Red Sea

Attacks by Houthi Rebels in Yemen on vessels in the Red Sea have forced many to take longer routes or take on increased insurance premiums. The Freightos Baltic Index (FBX), which measures the cost of shipping a 40-foot container, has increased 153% since the last week of December. The number of transits through the Suez Canal has decreased by 42% since early December.

This will likely have trickle effects on the consumer, with 12% of oil and 30% of global container traffic moving through the Suez area. Several European retailers have warned that supply disruptions could cause a reduction in availability and an increase in prices.

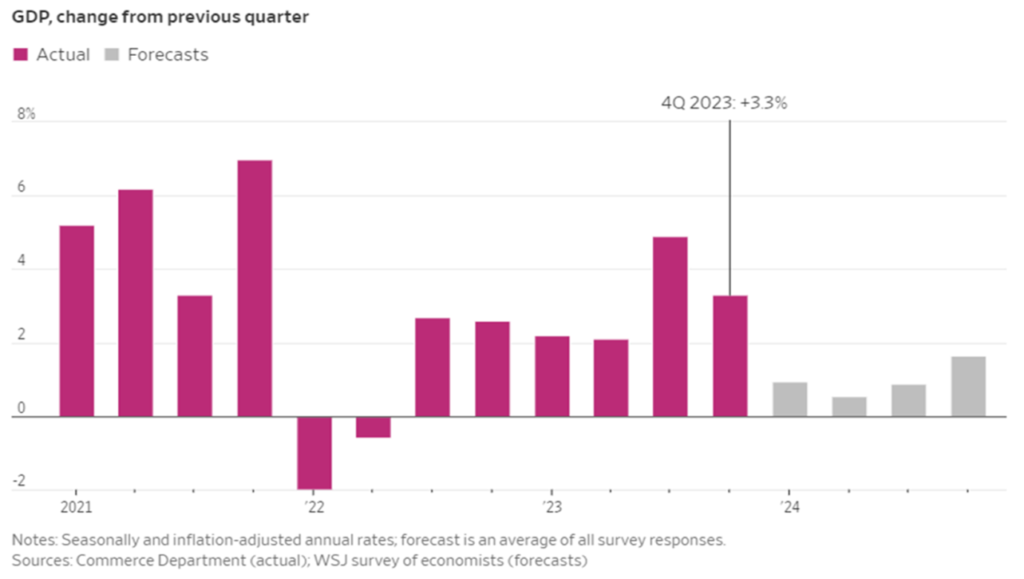

GDP Comes in Hot, but So Does Inflation

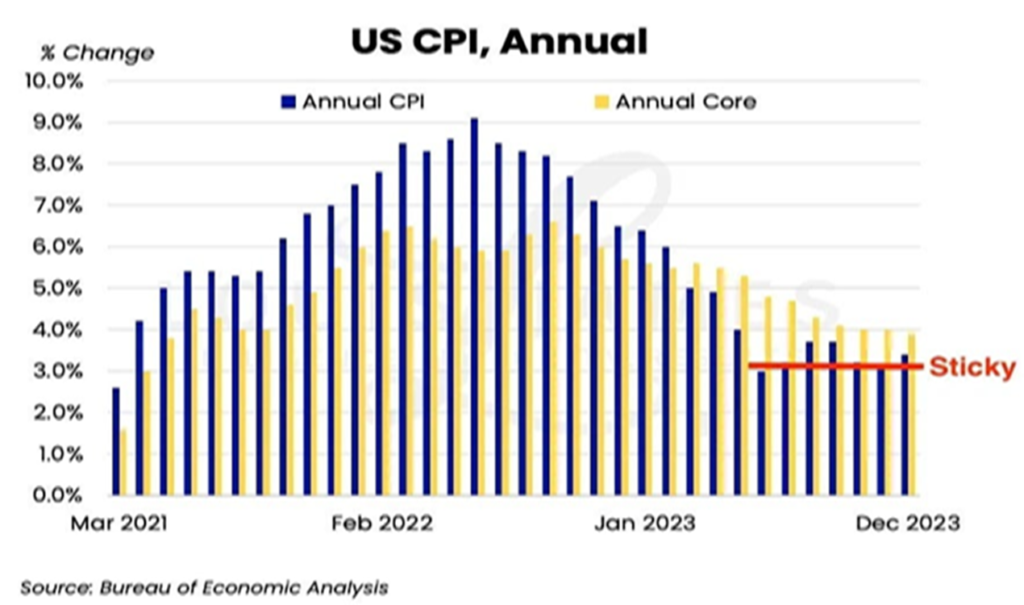

Real GDP increased at an annual rate of 3.3% in the quarter ending December 2023, above the 2.0% estimate, with the biggest contributor to growth being Government spending which is being financed by massive deficits. Future forecasts have a more pessimistic view of real economic growth as consumer spending begins to take a hit. Inflation remained sticky, with full CPI increasing 20 basis points to 3.3% and core CPI decreasing to 3.9%.

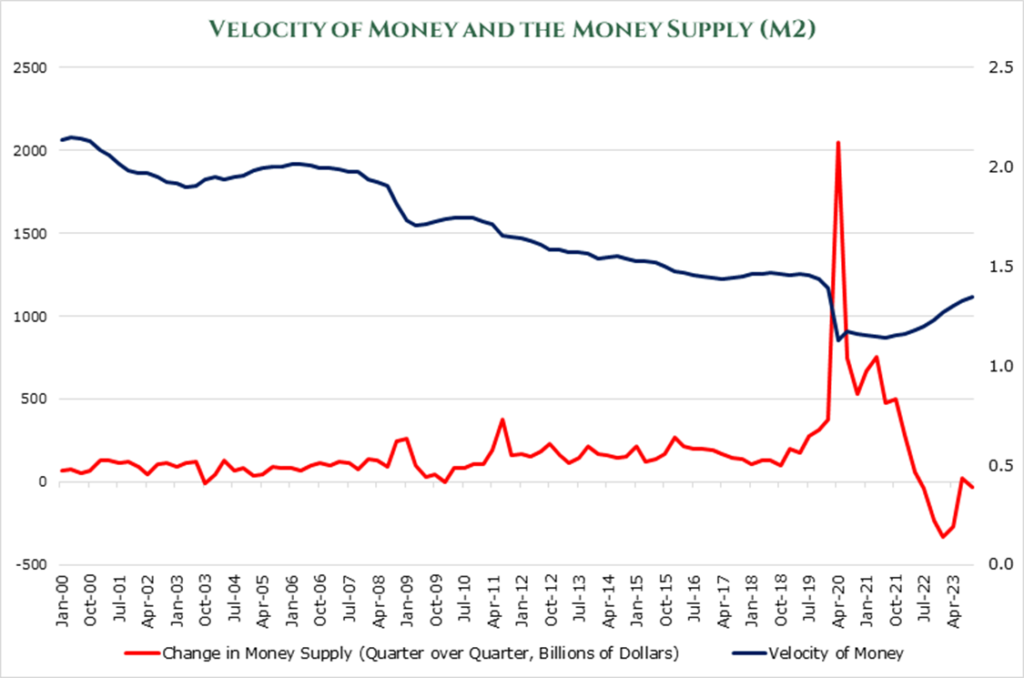

The M2 money supply – including savings, deposits of all types, and savings vehicles like CDs with under 1 year to maturity – has declined by around $700 billion since the Fed raised interest rates and began quantitative tightening. There still seems to be a long way to go, given how sticky inflation has been.

Additionally, the velocity of money – the number of times a single dollar cycle throughout the economy in a quarter – has been on the rise again. The velocity of money has not recovered to its pre-COVID level despite high inflation levels. This low velocity possibly indicates consumers’ and businesses’ reluctance to spend money or money is still in excess compared to economic activity.

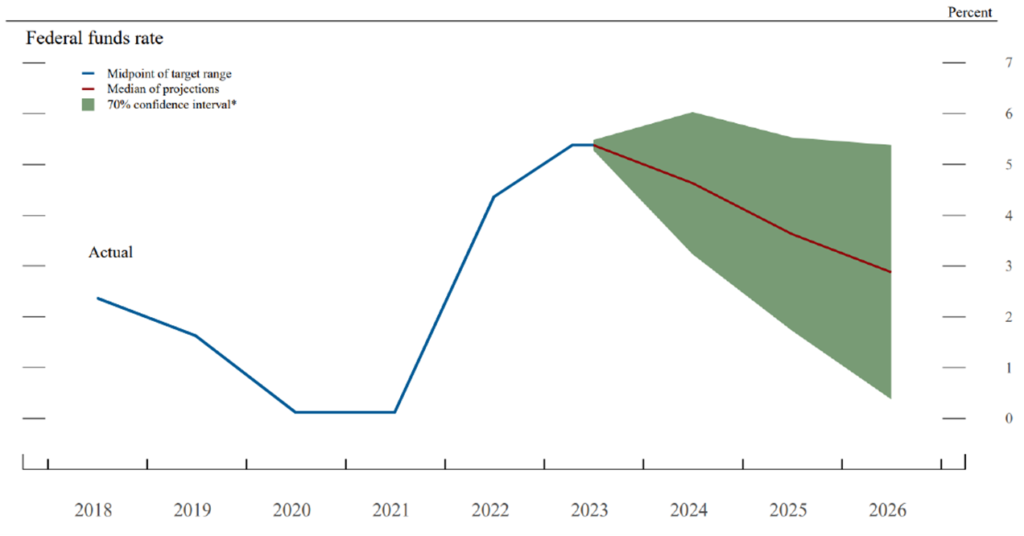

Given how sticky inflation is, it is unlikely that the Fed will cut as dramatically as the market is pricing in. The Fed ended 2023 with interest rates steady at 5.5%. The FOMC’s own members, the committee that decides monetary policy, expect interest rates to end the year at a median rate of 5.1%. This signals only a minor rate cut by the end of the year.

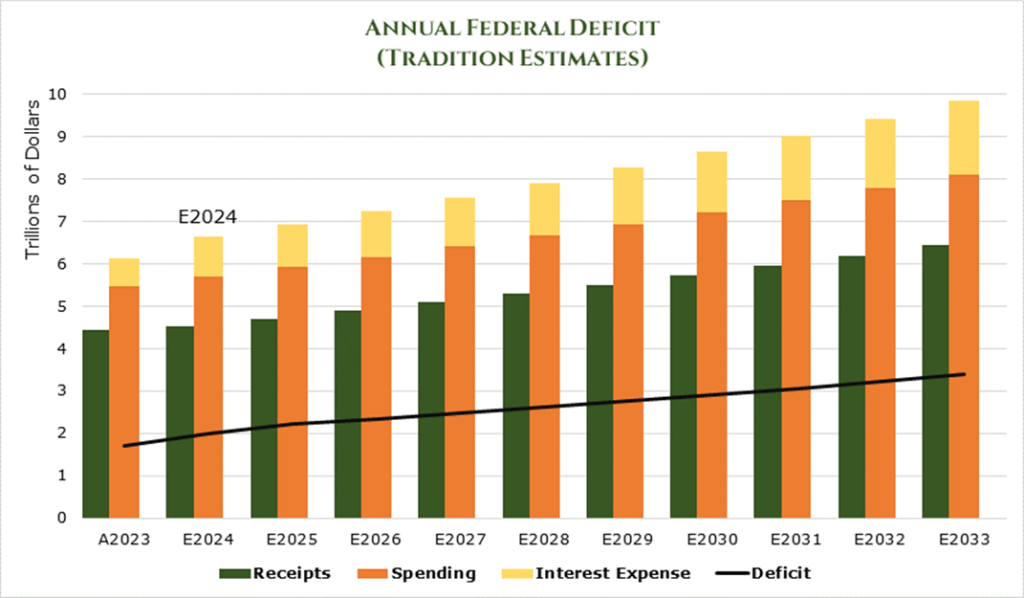

The Deficit Dilemma Continues

The Treasury Department released the first quarter borrowing plan, expecting to issue $760 billion in debt during the March quarter. This is a down revision from the initial $816 billion figure, which caused the S&P500 to jump and yields to fall.

As we discussed in our video, this $760 billion for just the first quarter is mind-boggling, with the deficit expected to end the September 2024 fiscal year at $2 Trillion. This will bring the full federal debt to $35 Trillion by the end of the September 2024 fiscal year.

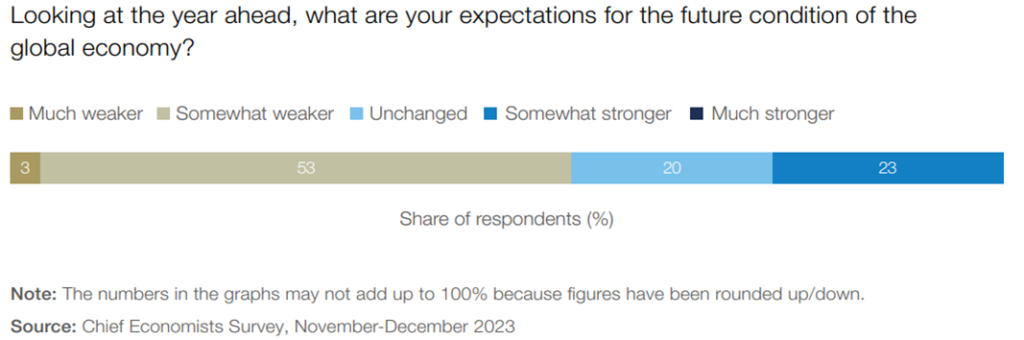

Economists Split on 2024 Outlook

Economists remain largely split on the global economic outlook. Of surveyed economists, 56% expect a weakening global economy during the year, with 43% seeing the US weaken and 77% seeing Europe weaken. More telling is that 87% of surveyed economists see volatility in the global economy in 2024.

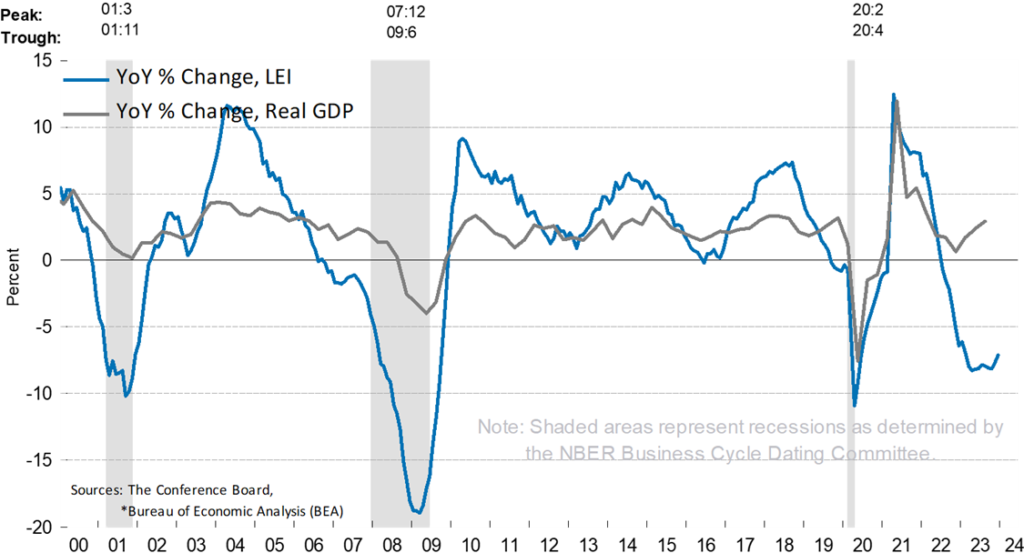

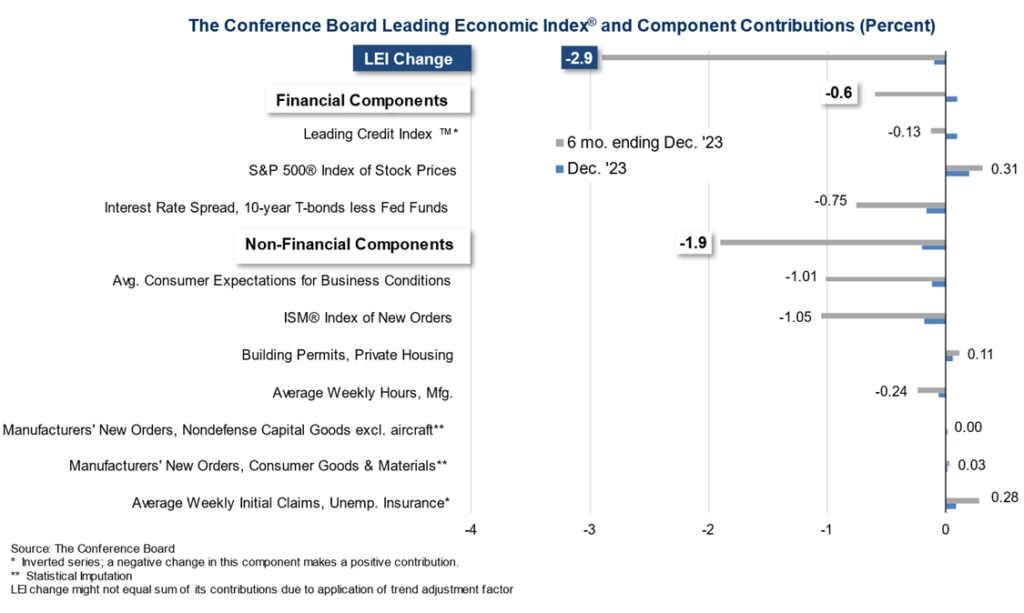

The Leading Economic Index remains depressed, indicating persistent weakness in many sectors of the economy. Prolonged negative periods are historically an indicator of recession.

While consumer confidence is recovering and equity markets remain strong, non-financial indicators paint a grim picture. Persistent weakness in private housing, a glut of retail inventories, and a decrease in manufacturing hours have significantly depressed the index.

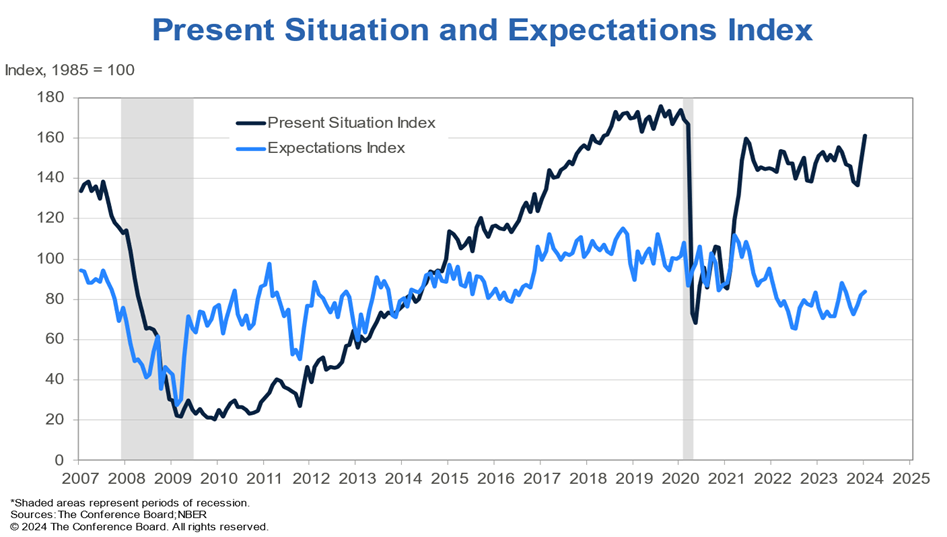

Consumer Confidence Claws Back COVID-19 Losses

The Consumer Confidence Index has hit a two-year high, indicating a reduction in consumer pessimism. The index measures the attitudes of consumers toward businesses and the broader economy and strongly correlates to consumer expenditure.

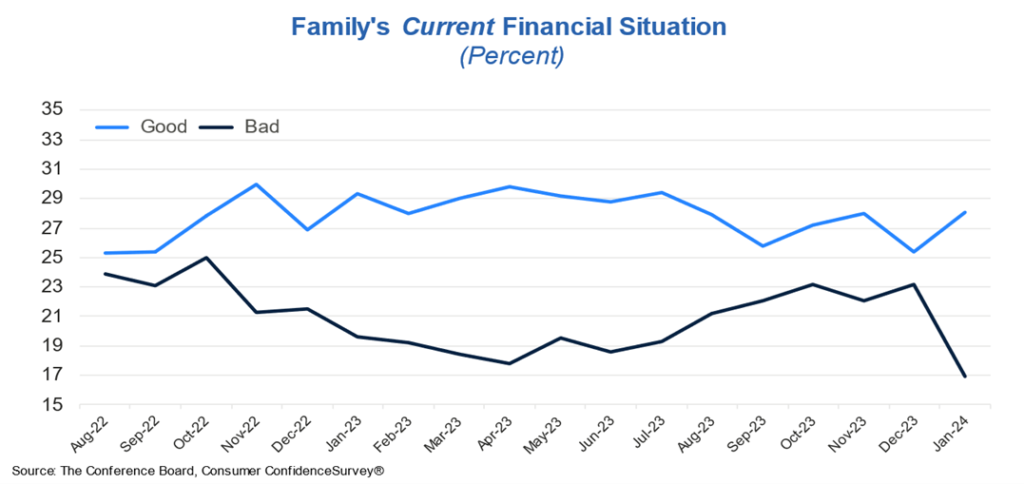

As an extension, the current financial situation survey indicates that consumer’s assessment of their family’s financial situation was far more positive in January.

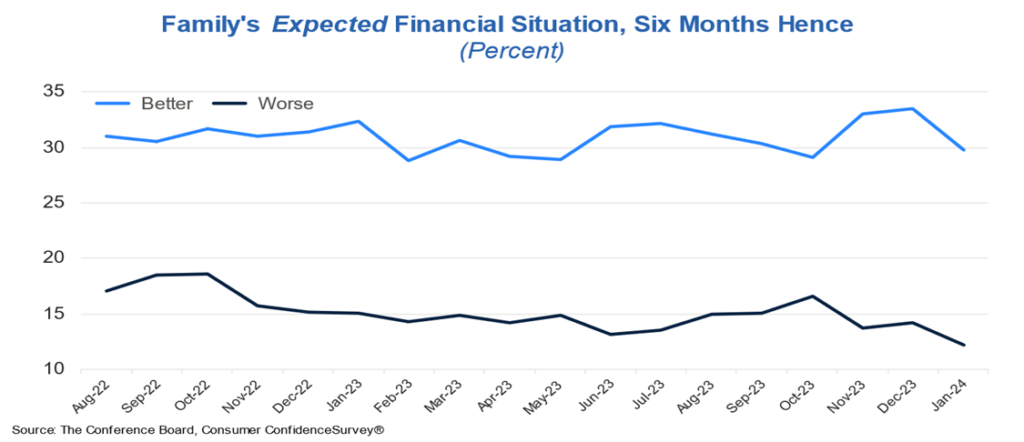

While the number of expectations of being worse off has moderated, so too has the view that things will improve in 6 months. This disparity indicates significant uncertainty on behalf of consumers.

High consumer credit rates on everything from mortgages to credit cards have put significant pressure on consumers.