Toyota Drives Up Battery EV Production Targets

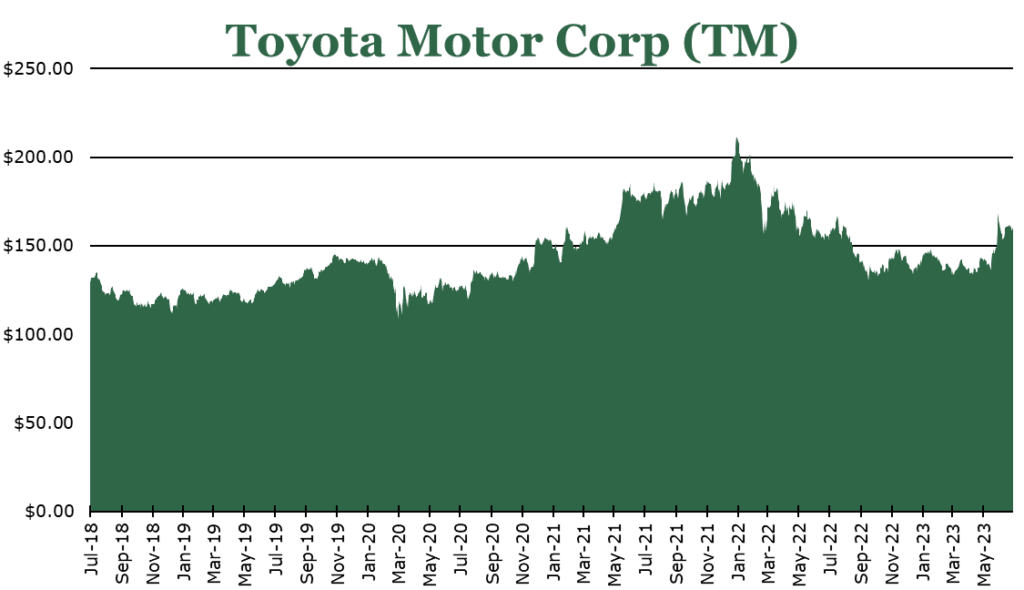

| Price $163.15 | Dividend Holding | July 19, 2023 |

- Despite the current high prices and shortages in the automotive market, Toyota expects strong unit and net income in FY24 and new expansion in North America opening by FY25.

- Pledges will expand BEV (Battery Electric Vehicle) production to reach 1.5 million by 2026 and 3.5 million by 2030.

- Announced a buyback and dividend policy change, with a $2 billion per year maximum repurchase agreement and a dividend policy reflecting cash-on-hand.

- Strong management, willing to sacrifice short-term revenue gains for long-term customer loyalty and sales volume.

- Vehicle unit sales are expected to increase 7.8% companywide. Revenue is expected to increase by 2.5-5% for FY24 depending on Forex.

- Due to a more favorable mix of EVs and alleviating supply constraints will boost operating income, growing it 9.6% year over year.

Investment Thesis

Toyota (ADR: TM) is the second-largest vehicle company in the world by revenue. Toyota has a long history of innovation, bringing the first commercially successful hybrid to market and offering the first-ever battery electric vehicles for consumer sale. Toyota was the first foreign automaker to gain a dominant market share in the United States, a history they hope to repeat with EVs.

Toyota is rapidly expanding its EV footprint with an expected $36 billion in new facilities and research to produce 3.5 million BEVs (Battery Electric Vehicles) per year by 2030. Toyota will be announcing its revolutionary solid-state battery in 2025, which could propel them into the forefront of affordable consumer EVs. Due to its history of strong management, commitment to expansion, and commitment to customer loyalty, we believe that Toyota is a good bet for the future of the global Automotive sector.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $18.25 X 13.5 = $246.38

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 0.74 | 0.72 | 0.70 |

| Price-to-Earnings | 8.86 | 8.65 | 9.12 |

Business

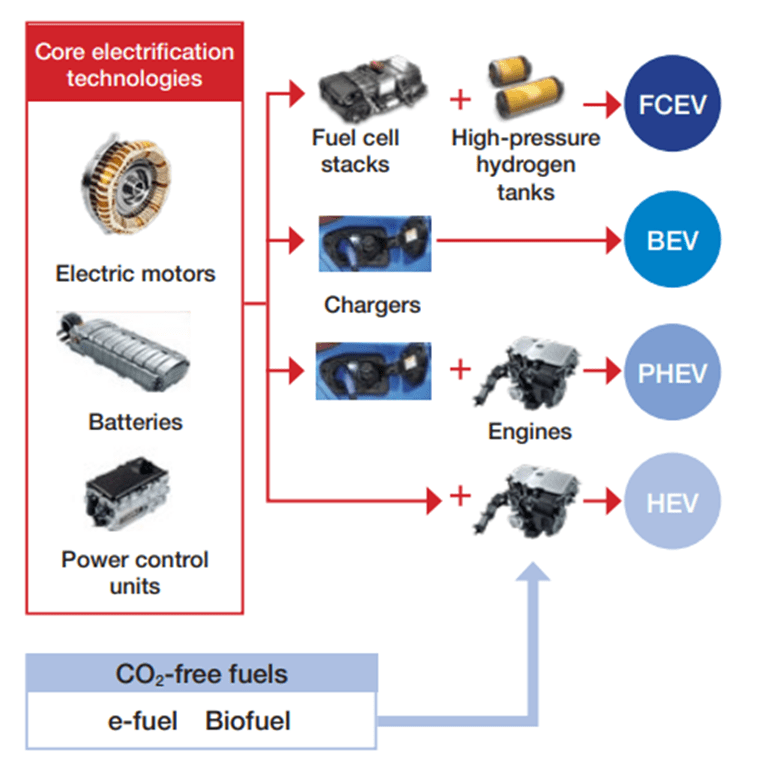

EVs are broken down into several categories, with BEVs (Battery EVs) being what most people think of when they see EV. FCEV (Hydrogen vehicles), HEV (hybrids), and PHEVs (plug-in hybrids) are all types of EVs. Toyota, in particular, has been a pioneer of PHEVs and HEVs. All of these are usually grouped together under the term EV.

EVs are going to become an increasingly important market for Toyota. Toyota Europe already has a 61% EV sales mix for new vehicles, with Japan at 42%. The rest of the world is under 30%. Cheap and accessible EVs will be key to mass adoption in these areas.

Toyota expects its global EV sales to increase by 29.7% year over year in FY24, with BEVs leading the pack at a 137% increase in sales units. Secular sales units are expected to increase by 7.8% companywide. Toyota has stated that the material cost situation has improved drastically, coupled with more high-value EVs being sold, which translates to an estimated 9.6% net income growth yearly.

EV Expansion

The automotive sector is on the edge of a breakthrough in scale and consumer demand, “not seen since the model T”. Scalability of production lines has long been a strong suit of Toyota. The Toyota Production System is the global gold standard for just-in-time production methodology. Total production units are expected to increase by 10.1% for FY24 to address vehicle shortages, and produce a small excess for potential supply price increases in the future. By 2030, Toyota pledges to produce 3.5 million more EVs per year, targeting 1.5 million by 2026.

Toyota plans to unveil its “next-generation” solid-state battery in 2025 with initial production beginning in 2027 Toyota has not released specifics, but early figures indicate these batteries are 20-40% cheaper and have a 20% range increase. Solid-state batteries represent a marked improvement from the typical liquid lithium-ion batteries used.

We believe this will mark the point at which Toyota will enter the BEV market at scale. To this effect, Toyota is building facilities in Japan and North Carolina for $2.4 billion and $3.8 billion, respectively. These gigafactories will produce 1.2 million EV batteries annually and expand production lines to accommodate an additional 1.3 million EVs annually by 2026. While production specifics of the projects are not yet released, Toyota has said that 2 out of 6 vehicle production lines will be dedicated to BEVs.

Thus far, Toyota has stuck to the PHEV and HEV market it is known for and has renewed its push for FCEVs as an alternative to BEVs. However, much of the subsidy money globally is moving toward BEVs with Toyota receiving $841 million in subsidies in Japan, and $315 million in the US for BEV facilitates. However, many commercial vehicle operators raise concerns about BEV weight and charge time.

The key to a meaningful hydrogen alternative to BEVs will lie with infrastructure. The Japanese government has pledged $50 billion to establish a hydrogen production and distribution network to make FCEVs more viable for customers. The US Inflation Reduction Act offers a hydrogen production credit of $0.6/kg to $3/kg depending on the environmental impact of the production and roughly $8 billion in facility construction subsidies.

Management and Scale

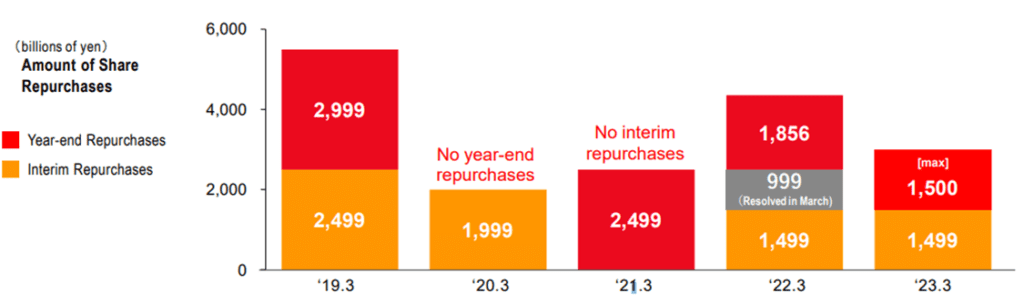

Management has revised the dividend and buyback policy for FY24 and beyond. The new purchase policy is more static. The share repurchase agreement is approximately $1.1 billion on a year-end basis and $1.1 billion throughout the year. The dividend strategy has also shifted from a 30% payout ratio target to a more flexible cash-on-hand model.

Risk

Toyota has been particularly affected by increased materials pricing and logistics costs in FY23. For FY24, this is expected to alleviate significantly, with materials prices expected to fall by 50% by 2H24. Additionally, a more favorable mix with more high-value EVs expected to be sold in FY24 will also offset the losses related to increased logistics and material costs.

Toyota has been reluctant to enter into partnerships with battery manufacturers. It has a joint venture with Panasonic in Japan, but has kept R&D in-house for its next-gen batteries. While this may pay off in the long run, it could equally lead to Toyota being behind if the solid-state battery they have developed does not work as planned and lags competition.

Car purchases are almost always in line with economic conditions. Consumers purchase fewer vehicles when economic conditions are not good. Consumer confidence is still not back to where it was pre-COVID.

Competitive Comparisons